Equity markets see red – is this time to buy, or time to jump from a sinking ship?

On Wednesday, MM increased its cash position in the Growth Portfolio to 15% by realising small profits in both our BetaShares Bear ASX200 ETF (BEAR) and US Dollar ETF’s. While we could see these positions going marginally further we wanted to concentrate on the further opportunities within the Australian market which have now arrived, a touch faster than expected.

Do we think there’s more to come or is this the ideal buying we’ve been targeting over recent weeks / months opportunity.

Overseas Indices

When we look at US indices 2 things catch our eye:

1 The Dow has unfolded as we have been forecasting in our Chart Pack, assuming of course it doesn’t follow through to the downside.

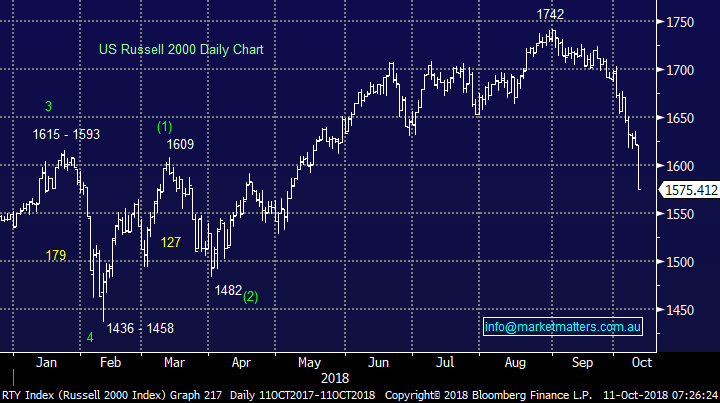

2 The Russell 2000 has now generated a sell signal eventually targeting another ~5% downside.

When we looked at APPLE Wednesday we were keen buyers into weakness and its reached our initial buy zone yesterday morning whereas the likes of Amazon has exceeded it. We are bullish APPLE around $US215 targeting ~15% upside, plus we would average if weakness persists to around $US200.

Dow Jones Chart