Market Matters Morning Report Wednesday 21st September 2016

When to catch the falling knife

Over the next two days, we receive the policy updates from the US Fed and The Bank of Japan (BOJ), plus more importantly we get to see how the markets interpret the news. Below are our simple thoughts on what will unfold from these two important meetings and their likely market implications.

US Fed - We do not believe the Fed will hike rates tomorrow which is not a big call. The market is pricing that as a 20% probability and it's been many years since a Fed hiked against market expectations – simply put, at this stage of the recovery we doubt that Ms Yellen & Co. would want the likely market fallout of a surprise move.

Our view remains that we will get an increase in December, assuming Hilary Clinton wins the race to the Whitehouse. A Trump victory would destabilise the status quo and likely prompt a ‘wait and see approach’ from the Fed. Markets are currently factoring in 3 hikes by the end of 2018, which implies an economy with only moderate growth. Clarity is what markets want from the Fed and we believe this will be the key to how markets interpret the Fed's decision tomorrow. When looking at the release, the clarity will be provided in the ‘dot plot’ which shows where different Fed members see rates at a particular point in the future. They’ll likely be a cluster of dots for rates at 0.75% by December 2016 in our view.

BOJ - The Bank Of Japan is harder to predict and potentially more important. The update will come at no set time today, but usually in the early afternoon. Clearly the current stimulatory measures in Japan are struggling to gain traction, however, we doubt they’ll admit this today. Instead, they’ll elect to stick with the current QE program, but not increase it.

We believe lowering short-term interest rates further into negative territory is counterproductive. It seems to us that fiscal expansion is what is required for Japan and this is likely in the short-term, but unlikely today. Maintaining short-term rates at extremely low levels, while allowing longer dated rates to slowly climb (steepening of the yield curve) should continue to aid the banking sector.

Turning to our market, while the local ASX200 is up almost 5% over the last year, some high profile stocks have been hammered at different times and obviously for varying reasons. Many investors simply sell stocks that have fallen, say 10% and would not consider purchasing stocks that are falling sharply. This approach means they never get caught in horrific stories like ABC Learning and Slater & Gordon, but sometimes they do miss excellent opportunities.

If you have done your technical / fundamental research and identified a level you want to purchase a stock, assuming the "goal posts" have not been moved materially, buy the weakness and follow your plan. Catching the falling knife can work when carefully considered.

Today we will look at 3 stocks that have suffered significant pullbacks recently to evaluate if we believe a buying opportunity is looking.

TPG Telecom (TPM)

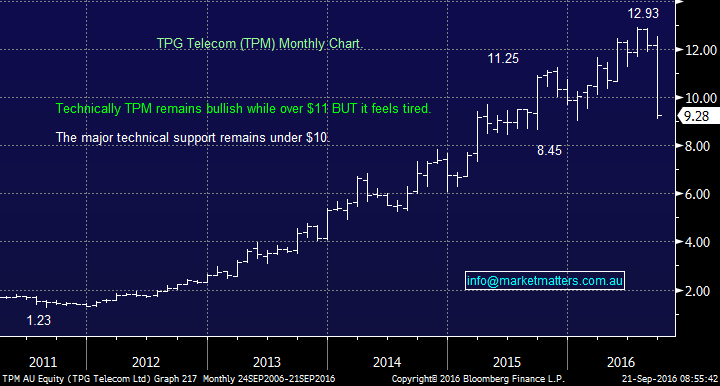

TPG was hammered 21.4% yesterday, to be down over 25% for the month and 11.5% for the year. We have deliberately left the weekend's comments on the TPM chart, because we expressed concern that the stock was feeling tired. Yesterday, TPM downgraded their earnings forecast for 2017 and the stock was sold aggressively.

The company is facing the reality of reduced margins under the NBN world. Unlike Vocus (VOC), TPG was earning higher ‘infrastructure’ type margins for their broadband services (around 40% while VOC uses Telstra’s broadband network and earns 18% margins on their retail broadband offering). This reduction from 40% margins to nearer 20% under the NBN world is a concern for TPG. Even after yesterday's decline the stock still trades on a P/E of ~ 20 x which is still not cheap. Investors have loved this Telco over the years and are likely still "long." We believe further weakness is likely and there is no hurry to be a buyer.

Unfortunately, the whole sector was hit yesterday, including our holding in Vocus (VOC). VOC is trading on a lower valuation than TPM, but unfortunately is unlikely to rally until TPM has bottomed.

TPM is a good company with good management and for a medium term investment, we could happily be a buyer ~$8.50 - another 8% lower.

TPG Telecom (TPM) Monthly Chart

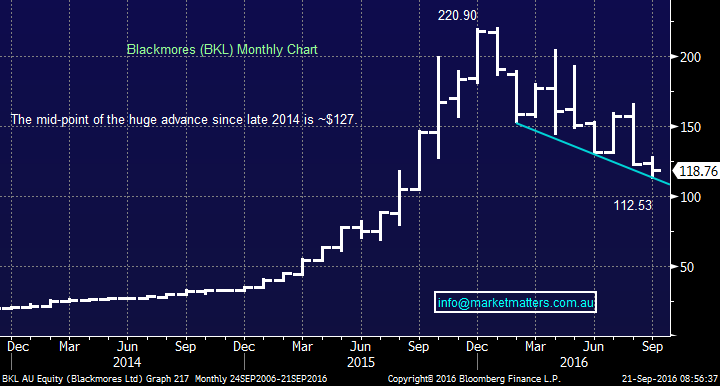

Following on from yesterday’s update on Blackmores (BKL), the stock fell another 4.3%, to be down 28% for the month and 46% from its highs.

We continue to like BKL around $110, targeting a 15-20% minimum rally, but we would remain fussy on entry i.e. 7-8% lower.

Blackmore's (BKL) Monthly Chart

CSL is down only 5% for the month, but it has retreated almost 18% from its high in July. The stock has been sold for investing in the future, but more importantly because its valuation simply got ahead of itself - while the stock is still trading on a P/E of ~28x, this is not expensive for the Healthcare sector. We believe that CSL is likely to trade sideways now for decent period of time, so this great company could almost become a trading stock i.e. sell over $110 and buy under $100.

We toped up our holding a little early, but believe we still can realise a small profit from the position and then re-enter at better price moving forward as outlined above.

We like CSL around $100 and would now be happy buyers of any weakness.

CSL Ltd (CSL) Monthly Chart

Summary

- We are happy to buy stocks that are being hammered, but the reasons and risk/reward must be fully evaluated first.

- We do not like BKL and TPM until they have corrected around another 8%.

- Conversely, we do like CSL around $100, but believe it will be a while before it can make a meaningful advance back over $110.

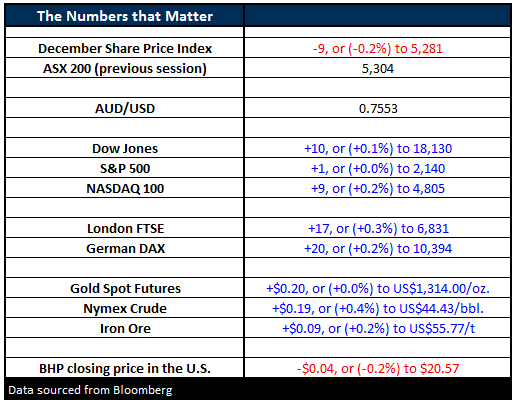

Overnight Market Matters Wrap

- A quiet market was experienced overnight in the US, as investors sit on the sideline waiting for the key interest rate decision in both the US and Japan.

- The Dow closed 10 points higher (+0.1%) at 18,130, while the broader S&P 500 ended 1 point higher to 2,140.

- Domestically, we expect the ASX 200 to be quiet, up until the Bank of Japan’s Monetary Policy is released after midday, with the December SPI Futures indicating the ASX 200 to open with little change this morning, testing the 5,300 level.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 21/09/2016. 9:00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.

To unsubscribe.Click Here