Market Matters Morning Report Wednesday 14th September 2016

Keeping our finger on the pulse

Volatility has taken a dramatic change in direction over the last 3-days with US stocks registering three consecutive +1% swings following the most protracted period of inactivity in history. As you know the bond market / interest rates have been the trigger for this uncertainty which is a risk we’ve written at length about in recent times.

That said, it's been a tough few weeks our side given we’re almost fully invested in stocks as this pullback has played out. Our original view was to increase cash by selling into strength ~5650butregrettably markets yet again showed us they are not always that easy.

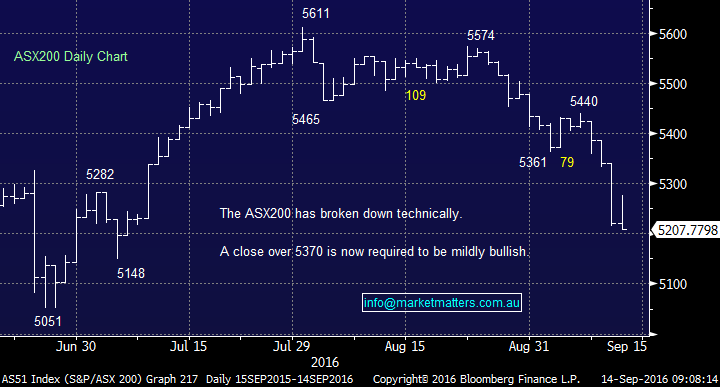

We understand subscribers current frustrations as we can see / feel the red ink within our own portfolio, but unfortunately, that is the nature of the market – at times, it can be a fickle beast. In hindsight, the crack under 5400 that we had been monitoring has been dramatic and we should have sold on the 8th (last Thursday) when the ASX200 closed at 5385. The main reason for not doing so was the prevailing strength in the US market prompting us to give the local index ‘more room’.

The US market remains only 3% below their all-time high whereas our local losses have been over double that. Put simply, we did not pick this major degree of local underperformance. Firstly, it’s important that we acknowledge the tough period we and our subscribers have experienced over the past few weeks – it’s been frustrating, to say the least and our calls have been below the high standards we set for ourselves. We make no excuse for this, however, it’s important to note that we’ve been in similar positions before. Our approach has weathered these difficult periods and continued to outperform over time.

Ideally, we’d like to be closer to 20% in cash during this current weakness but remain relatively comfortable with our stock / sector selections.

Technically we have no specific change to our current outlook for the ASX200 which is negative unless the market can close over 5370. We will look to lighten our market exposure into an 80-100 point bounce which now looks likely only to reach the 5275 area which was tested yesterday.

ASX200 Daily Chart

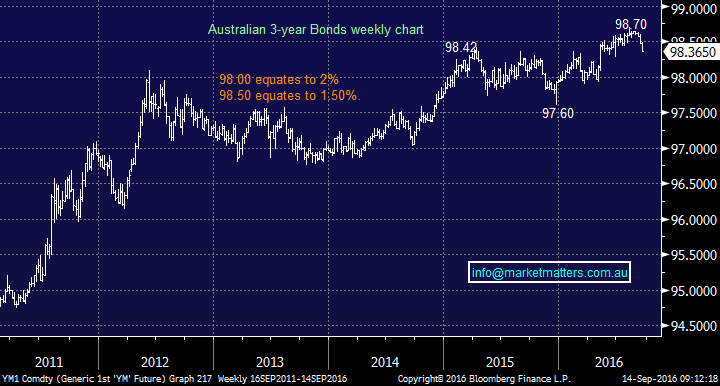

The big question remains, is this a mini "taper" tantrum as investors digest the inevitable increase for US interest rates or do we have a total / dramatic change in trend for rates? Our local 3-year bonds are moving lower in tandem with the local ASX200 exhibiting an uncanny correlation, far more so than US stocks.

Three important points;

1. Both 3-year bonds and the ASX200toped within 24-hours of each other at the start of August.

2. The 3-year bonds accelerated lower from the 8th of August which coincided with the aggressive leg lower in the ASX200 from the 5440 area.

3. Conversely, the S&P500 did not move lower until last Friday.

We will continue to comment on the Australian 3-year bonds until further notice to get a direction on the overall ASX200. The bonds are very close to 98.30 major support implying some consolidation in local equities is very close at hand.

A break under the 98.30 (1.7%) area will be extremely bearish targeting around 97.60 (2.4%), a significant a dangerous kick higher in interest rates.

Australian 3-year bonds Weekly Chart

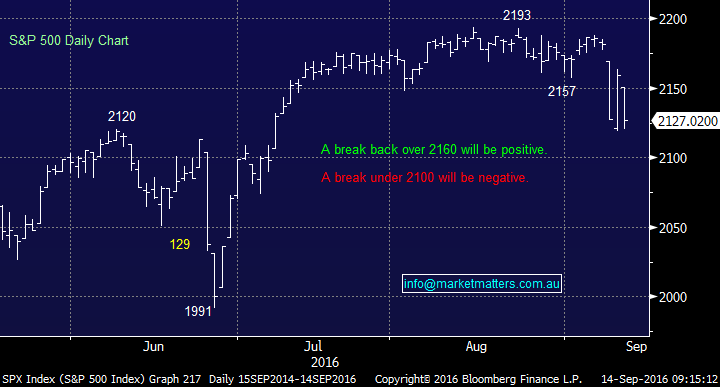

The S&P500 remains short term neutral. A break under 2100 would be bearish and a close over 2160 bullish. We are very conscious that fund managers cash levels for September are at 5.5%, the highest we have seen previously was 5.8%. At some stage this money will have to be put back to work and big sell-offs do not usually occur when investors are happily in cash waiting for it to unfold.

We have two large central bank events looming on the horizon next week. 1. the Fed's decision on whether to raise rates and 2. The Bank of Japans policy update which may actually be more important this time around. We all know markets hate uncertainty hence it's unlikely that stocks can show any positive signals until some clarity emerges from these two events.

NB Markets are factoring in less than a 30% chance of a rate rise by the Fed in September.

US S&P500 Daily Chart

Summary

We continue to believe it’s prudent to reduce equity exposure into any 80-100 point bounce, ideally now around the 5275 area.

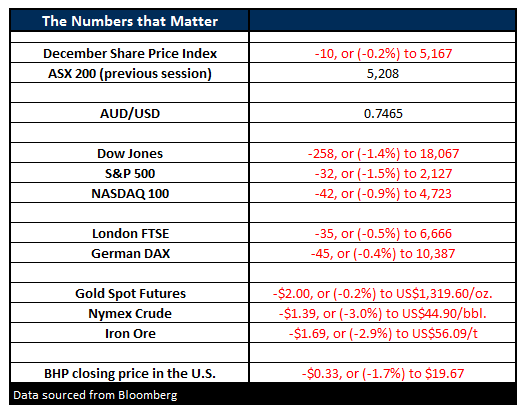

Overnight Market Matters Wrap

- The US markets fell last night, with fears still mounting that the Fed will raise rates next week. The Dow fell 258 points (-1.4%) to 18,067 whilst the S&P500 closed down 32 points to 2,127.

- Oil continued to add to the weakness generally after the International Energy Agency advised that a continuing slowdown in demand, together with ballooning inventories and rising supply will be with us until at least half way through 2017. Crude Oil fell US$1.39 (-3.00%) to US$44.90/bbl.

- Gold remained steady, albeit slightly weaker on the back of a stronger US$ as traders were unsure which way to go leading up to the FOMC meeting next Thursday 22nd Sept. Gold fell US$2.00 (-0.2%) to US$1,319.60/oz.

- BHP is expected to underperform the broader market today, after finishing its session down an equivalent of - 1.7% to $19.67 in the US market.

- The ASX 200 is expected to open down 25 points this morning, with the September SPI Futures, indicating a test of the 5185 level.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 14/09/2016. 9:00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.

To unsubscribe.Click Here