| Can inflation propel gold & interest rates higher?

Gold is a strange commodity with the quantity of gold stored above ground dwarfing the yellow metals annual demand. Unlike other commodities the gold price is generally affected by sentiment and the direction of other assets as opposed to supply and demand.

"Gold gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head.” - Warren Buffet.

On a long-term basis, gold has kept up with inflation rallying ~ 8% pa over the last 45 years BUT in a VERY volatile manner. The precious metal has however underperformed stocks, over the same period, who have rallied closer to ~10%pa in a less volatile manner (relatively speaking).

It is generally acknowledged that the price of gold is closely related to interest rates. As interest rates rise the tendency is for the gold price to fall, and as interest rates dip, for the gold price to rise - this makes simple sense as gold produces no income and costs money to store e.g. Last Friday night the US jobs data was strong increasing the possibility of an increase in rates for the US which resulted in gold being smacked ~$US25/oz.

In simple terms, the link to interest rates comes down to inflation and the central banks actions to manage inflationary/deflationary pressures. Historically if begins to tick up central banks main ‘go-to’ has been to raise interest rates in an attempt to slow down economic growth, reduce spending and upside pressure on prices. Clearly, it's been a long time since we witnessed this!

When considering this, today's record low interest rate environment should be perfect for gold but we have witnessed an over 25% correction in the gold price since August 2011, even as central banks drove interest rates lower.

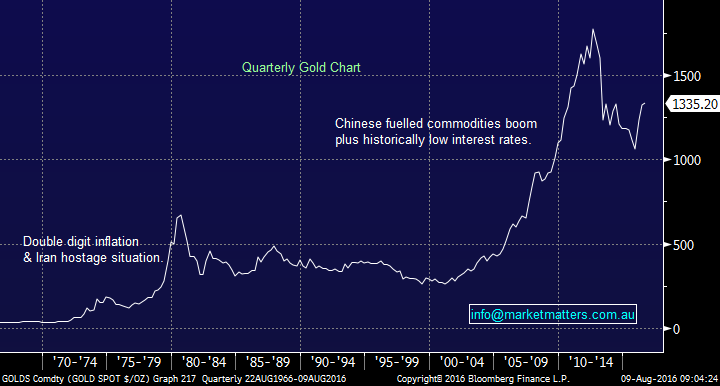

Gold began trading actively in 1970's after it became a "free" commodity and not pegged to currencies, below illustrates the two standout gold bull markets over this period:

Gold Quarterly Chart

Gold’s reputation for being a good hedge against inflation doesn’t necessarily hold up to the bright light of data. In nominal terms, gold spiked to more than $650 an ounce in 1980 and then to an all-time high of $1,921.17 in 2011, but it hasn’t seen the same performance in real terms when adjusted for inflation.

In those terms, investors buying gold in 1980 for $650 would never have recouped their initial investment, even at gold’s nominal peak in 2011. Gold needs panic style circumstances to get the safety bid and hence outperformance.

What fears may cause gold to rise in the future?

1. Fears of an aggressive breakout in inflation.

2. Fears that governments like Greece, Portugal, Iceland, etc. cannot pay their debts.

3. Fears that the EU will disband after BREXIT.

4. Fears of a significant correction for global stock / housing markets.

5. Fears of terrorism.

6. Fears of a corporate / banking collapses.

We are sure that most readers can see some very real possibilities over coming years from this list – and of course, there will likely be some ‘left field events’ that could also come into play, however, the main takeout is gold loves rallying on fear!

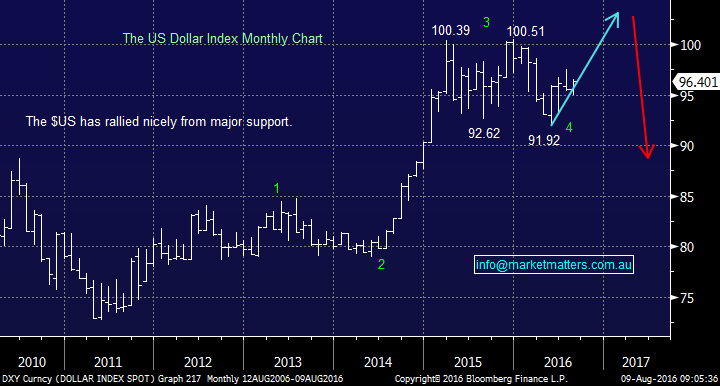

The gold price also has a strong inverse correlation the $US which again makes sense as this is the currency it is denominated in. All things being equal, as the $US rallies the gold price falls e.g. the $US rallied ~25% in 2014-15 when the gold price experienced a 25% correction.

Importantly our current view is the $US makes fresh recent highs ~10-% higher before falling over 20%...sound similar to our view for the US share market!

$US Monthly Chart

Another bullish factor for gold has been extremely strong demand coming from China - the Chinee simply love property and gold as investments. Combining this passion with the apparent inevitability of an ongoing depreciation in the Chinese Yuan makes this appetite for gold likely to continue.

Hence when forecasting the gold price we consider the following:

1. Potential fear factors.

2. The likely path of the $US

3. Inflation.

4. Ongoing demand from China.

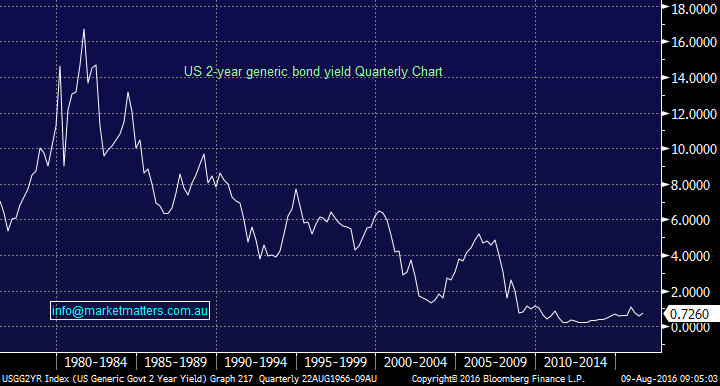

We believe the market is beginning to get interest rates wrong, and we are likely at / close to an inflection point for global interest rates. Central banks are already quietly admitting that negative interest rates are not working. These now unpopular negative interest rates in Germany (Europe) and Japan has created a gravitational pull lower on interest rates worldwide, but we believe the end of this phenomenon is very close.

In the US wages growth is starting to become obvious with the growth rate moving from 2% to 2.6% over the past 12 months. In time, this should flow through to an increase in inflation. As we said previously, we do not believe bond markets are pricing in the strong possibility of higher US interest rates in 2016.

Our view is the entire 35-year bull market for bonds / bear market for interest rates is coming to an end...... In short, the next major move for interest rates will be up.

When we look at US 2-year interest rates that have fallen from 16% to well under 1% since the 80's, it's easy to envisage rates bouncing back towards 4-5%, BUT this would dramatically change today's economic landscape. This view supports our current dislike of companies that are acting like a quasi-bond e.g. Sydney Airports/Transurban/APA Group etc. plus the real estate space. All of which will be negatively impacted by

higher interest rates.

US 2-year bond interest rate Quarterly Chart

Funds have been net buyers of $US for the last five weeks, increasing their overall net long position to the highest in six months, potentially a negative short term for gold. Gold stocks have run hard this year withRegisResources for example trading almost 30% above analysts' consensus of fair value.

While we are not big believers in analysts' forecasts, it is easy to imagine a decent correction from the sector if markets sniff higher interest rates for the US, as we do. Our ideal buy levels for the 3 main gold stocks we look at are:

1. Regis Resources (RRL) ~ $3.50,

2. Northern Star Resources (NST) ~$4.20

3. Newcrest Mining (NCM) ~$21 - all around 10-15% lower

Summary - We like gold medium term due to inflation, a weakening $US and fear factors but believe better entry levels are a strong possibility given the scenario we outlined above

- We do not like stocks that are trading at elevated levels due to low-interest rates; this feels like an accident waiting to happen.

Overnight Market Matters Wrap

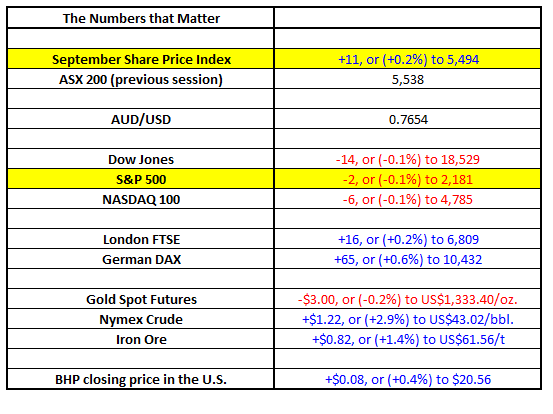

- The US markets took a slightly backward step on the close after a strong rally last week. The Dow finished down 14 points to 18,529, and the S&P500 closed down just 2 points to 2,181.

- The market appears to be now waiting for further US data, with US retail sales (due Friday evening, our time) for some confirmation of the strengthening economy, after the strong jobs report last Friday.

- Gold continued to weaken slightly, following its significant plunge on Friday, after a reported strong jobs number and a strengthening US$. Gold fell US$3.00 (-0.2%) to US$1,333.50/oz.

- Oil enjoyed a better night after it was reported in the Wall Street Journal that OPEC countries such asVenezuela, Ecuador and Kuwait are trying to get more cooperation between the OPEC countries. A forlorn hope I fear. Crude finished up US$1.22 (+2.9%) to US$43.02/bbl.

- Iron Ore was stronger last night, rising 82c (+1.4%) to US$61.56/t.

- ANZ announced its trading update for the 9 months to June 2016, with a net profit of $4.3b and flat margins – looks a little light on however it is only a trading update. CBA the main game tomorrow

- The ASX 200 is expected to open higher this morning with the September SPI Futures indicating an open of 16 points higher, around the 5,553 level.

Regards,

The Market Matters Team

Level 12 28-34 O'Connell St

Sydney NSW 2000

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 9/08/2016. 9:00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not berealised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here

|