Market Matters Morning Report Tuesday 4th October 2016

Mergers & acquisitions are back in vogue

News has been extremely quiet on the M & A front in Australia for some time even with the world awash with "free money". Then suddenly on the Labour Day public holiday, we have two big deals across the news wires after the low volume trading day with most states enjoying the spring weather.

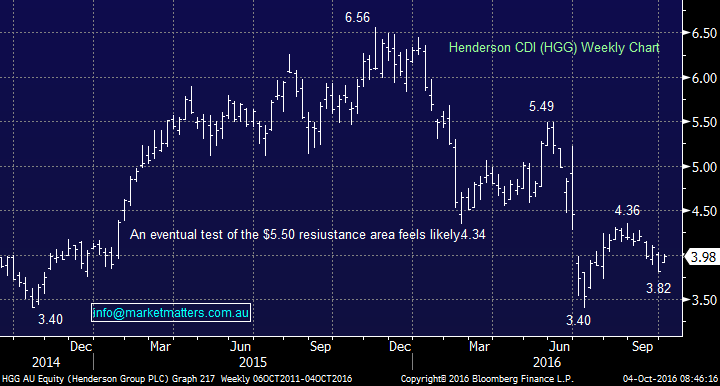

Firstly Henderson Group (HGG) announced a merger with Janus Capital Group creating "Janus Henderson Global Investors plc" which will be dual traded in Australia and London. This is great deal for HGG shareholders and we take our hat off to the HGG board. The new company will become a leading global active asset manager with over $320bn under management and have a combined market cap. of ~$6bn. We see very attractive growth potential and cost synergies, expect the stock to open up 15-20% today.

Henderson Group (HGG) Weekly Chart

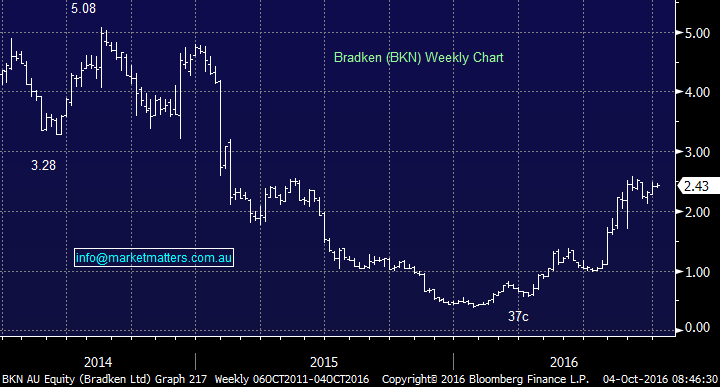

Also, Japanese company Hitachi Construction Machinery Co. has made a $3.25 cash takeover offer for Bradken (BKN) which the board have unanimously supported. The bid is a 33.7% premium to BKN's last trade and an enormous premium to the sub 40c area reached earlier this year. We believe investors should regard this bid as a windfall and sell the stock when it recommences trading at 11am this morning – assuming it’s near the bid price.

Bradken (BKN) Weekly Chart

The sudden pick up in M & A makes sense when we consider the simple obstacles facing businesses moving forward.

1. Companies have been slashing costs to increase profitability since the GFC, there simply cannot be much fat left on the bones after the many years of cuts.

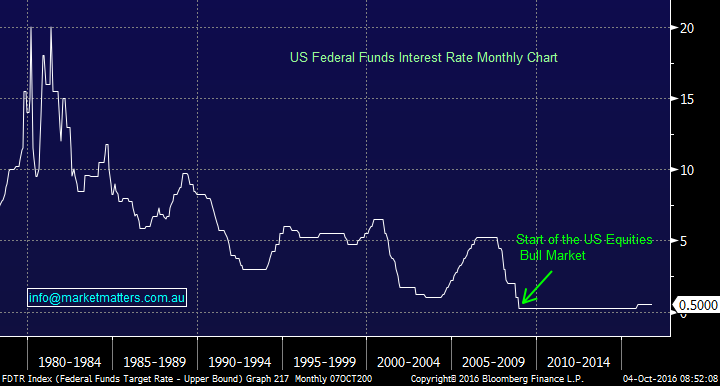

2. US companies in particular have embarked on enormous buybacks to boost earnings per share, which made some sense in such a low-interest-rate environment - The Fed funds rate is 0.5% today compared to 20% in the early 1980's. After many years again this is likely to have run its course.

3. This leaves M & A as an obvious option for directors to investigate, again using the very cheap money currently available, especially as interest rate hikes are on the horizon in the US.

US Fed Funds Rate Monthly Chart

Buying stocks in anticipation of a takeover is a dangerous game but if its potential cream on the cake of a stock we like anyway it's a very different matter e.g. when we were fortunately long iiNet when TPG Telecom bid for the company.

The obvious sector where value remains to us is in the energy sector which has had two significant attempted takeovers fail:

1. Santos (STO) rejected a $6.88 a share bid from Scepter Partners only to then raise capital leaving the stock languishing well under $4 after hitting a low of $2.46.

2. Woodside (WPL) made a scrip bid for Oil Search equivalent to $7.65. It appeared that the PNG government were looking for a cash bid over $8.20, which was its entry price. It all got too hard for WPL who subsequently cancelled their bid and walked away.

The dramatic change in attitude from Saudi Arabia around production last week may reignite activity in the sector. Another attempt at OSH from WPL is a possibility, most of the work has been done while the stock remains close to $7 hence a bid just over $8.20 may be successful.

Technically OSH has traded sideways for many months but as we like the sector we could be a speculative buyer with stops under $6.50.

Oil Search Ltd (OSH) Weekly Chart

There has already been a flurry of deals (and proposed deals) in the mining services sector over the past 12 months or so and the move on Bradken (BKN) late yesterday suggests they’ll likely be more.

In June this year, ALS Limited (ALQ) received a joint bid from two private equity firms at $5.30 a share. The bid was rejected and shares are now trading at $6.06 – so a good decision by the board. A deal in some form for the business still makes sense. The food science division of ALS is driving earnings, however, the resources division is starting to improve (from a low base). A suitor could break up the two areas and probably find buyers for each at higher multiples.

Technically ALQ has traded up from a low of $3 and could be bought here as a speculative investment with stops under $5.60. Obvious resistance sits around $6.60

ALS Ltd (ALQ) Weekly Chart

Summary

- We envisage more M & A into 2017 with the energy sector & mining services two obvious targets.

- We could buy OSH with stops under $6.50.

- We could buy ALQ with stop under $5.60

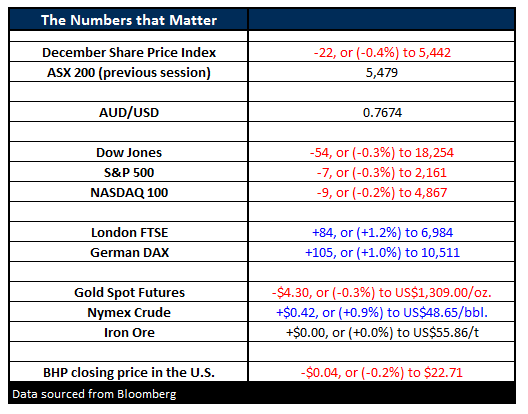

Overnight Market Matters Wrap

- The US markets started the first quarter and month on the negative note last night, with the Dow closing down 54 points (0.3%) to 18,254, while the S&P500 finished down 7 points (0.3%) to 2,161.

- Oil managed to rally after comments from Iran’s President Nicolas Maduro said other oil producers need to join OPEC in supporting the oil market. Crude finished up 42 cents (+0.9%) to US$48.65/bbl.

- Gold lost ground on the news that Britain will start to unveil its plans to leave Europe in the first quarter 2017. Gold finished down US$4.30 (-0.3%) to US$1,309/oz.

- Domestically, investors will focus on M&A activity after two companies had significant announcements after market yesterday:

- Henderson Group (HGG) recommending a merger of equals with Janus Capital Group. HGG last traded $3.98.

- Bradken Ltd (BKN) – the board unanimously recommends cash takeover from Tokyo Stock Exchange listed, Hitachi Construction Machinery Co. Ltd at $3.25 a share. BKN last traded at $2.43.

- The ASX 200 is expected to open weaker this morning, around the 5,462 level, as indicated by the December SPI Futures

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 4/10/2016. 9:00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.

To unsubscribe.Click Here