Market Matters Morning Report Tuesday 27th September 2016

Is Deutsche Bank the next Lehman’s?

Overnight stocks came under pressure, particularly in Europe with Germany’s biggest lender, Deutsche Bank (DB) down another 7% on the session – closing at the lowest level since the 1980’s. This put pressure on the broader financial space, with German Chancellor, Angela Merkel standing firm that a bailout was not on the table.

The main issues for DB stem from their investment banking division, which is undercapitalised, versus the exposures they have and the huge fine they have hanging over their heads from the US Department of Justice. They were fined $14bn for their role in selling mortgage-backed securities pre-GFC.

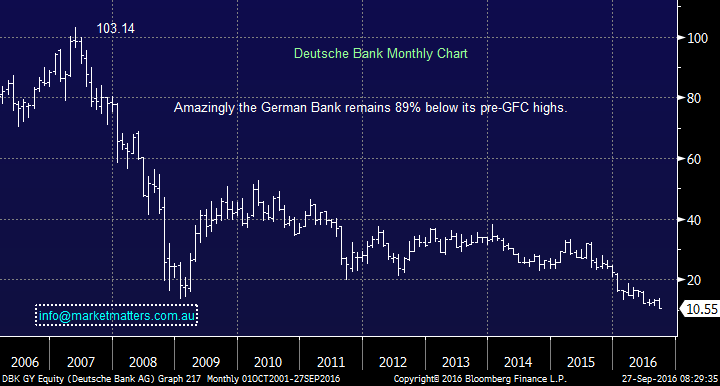

To give some context about the size of this fine, DBs market capitalisation is now just $16bn and they’re hugely undercapitalised. Shares in DB have fallen from a pre-GFC high of €103.14 to just €10.55

Deutsche Bank Monthly Chart

Unsurprisingly, we’re starting to see a lot of comparisons to Lehman’s Brothers which went to the wall just over 8 years ago, causing a major market meltdown.

Three main points here;

1. DB needs more capital; they can either raise it by selling more shares, however, shares are so low that it would provide massive dilution. For instance, DB trade on just 0.3% of their book value compared to Commonwealth Bank (CBA) which trades on 2.1 times book value.

2. They can raise equity by selling assets, however, that reduces future earnings and the ability to generate capital which is critical for their longer term survival.

3. They can go cap in hand to the Government and ask for money

Right now, looking at the 5 year Credit Default Swap market tells an interesting story. It’s more expensive now to insure against a default, than it was during the GFC which goes a long way to highlight their current predicament.

Deutsche Bank 5 Year CDS Weekly Chart

Importantly, this is a political situation as much as an economic one. Let the bank fail and deal with the consequences which could be large for Germany and the rest of Europe, or inject a few more billion and keep the bank alive. A bailout is politically unpopular, so ruling it out is a good political move, but this thing will gain momentum. Confidence is very important in banking, and when counterparties lose confidence, they simply stop dealing with DB which will cripple them.

We think it’s very unlikely that Merkel and Co will stick to such a hard line stance, given the massive ramifications that we saw from Lehman’s collapse. It seems that at the moment, the market is taking this stance and we’re only seeing some light selling rather than anything aggressive in the broader market.

The obvious question for us is whether or not we should be concerned about our overweight banking exposure? The simple answer is no.

Banks are struggling from record low-interest rates - it’s a theme we’ve written about recently and it’s forming the basis for much of the discussion in Europe and the US. It’s ironic, but banks are now saying low-interest rates and stimulus is impacting them in a negative way, even though the measures probably saved them during the GFC.

Putting the irony aside, they’re right. Low-interest rates hurt bank earnings and if we see higher interest rates, banks earnings will improve. We didn’t see a rate cut in the US last week and financials underperformed, however, markets start to price things 6-12 months ahead. Clearly, interest rates are going higher which will support bank earnings and we think the market will come around to this way of thinking. We also touched on capital levels in yesterday afternoon’s report which is another supporting factor here.

The stat we’ve quoted in the last few days / weeks, is around seasonality. Banks perform extremely well in October, so any weakness in the next few days would likely provide a good entry into that theme. Remember, this remains a market to buy weakness, sell strength.

Summary

Deutsche Bank is clearly an issue that could cause uncertainty in the near term, however, there has been so much put behind the recovery from the GFC particularly in Europe that it would be economic suicide to not to prop them up.

The concept of too big to fail probably applies to Deutsche Bank – they’re huge. It would be almost impossible to contain the contagion spreading to other banks if they let them go to the wall. The German Government can prop them up if they decide to. They don’t want to, but they’ll be forced to one way or another.

If our banks fall in the next few days, this could provide a good entry into the sector for strong seasonal performance in October.

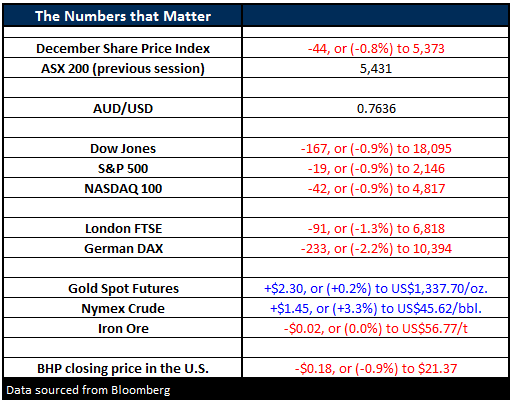

Overnight Market Matters Wrap

- Deutsche Bank traded to a record low overnight, as investors saw grave concerns over its balance sheet, ahead of its settlement with the US Justice Department and believe a capital raising is necessary to keep the bank afloat.

- Volatility jumped 18% higher overnight on the back of these concerns, testing the ‘complacency’ level.

- The commodities markets were better than the equities, with Crude Oil settling 3.3% higher to US$45.62/bbl.

- Domestically, we expected the ASX200 to follow suit, with the financial sector to underperform the broader market.

- The ASX 200 is expected to trade below the 5,400 level, towards 5,390 as indicated by the December SPI Futures.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 27/09/2016. 9:00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.

To unsubscribe.Click Here