Market Matters Morning Report Tuesday 20th September 2016

Updating the Chinese growth story

Back on August 25th, we looked at the "increasing risks for the Chinese growth stocks" after they had suffered some significant declines. Investors who had entered the larger names, Blackmore's and Bellamy's earlier in the year, were losing money compared to the ASX200, which was mildly ahead. Chasing easy fast money has always been dangerous when people lose sight of valuations and this sector felt like a lot of "Fear of Missing Out" (FOMO) was at play.

Today with global markets very quiet ahead of both the US and Japan's central banks updates, we thought it would be an ideal time to review this growth area where many retail investors have put their money to work.

With rising interest rates on the horizon, the growth story becomes far more compelling than chasing yield. We are firm believers that the expansion of the Chinese middle class is in its early stages, so this is an area we want to keep a very close eye on.

Our conclusion last month was:

Blackmore's (BKL) $129.50 - Buy under $120 as an aggressive play, looking for a 20% bounce.

Bellamy's (BAL) $14.99 - BAL remains constructive and we could buy with stops under $13.50, targeting fresh highs over $16.50.

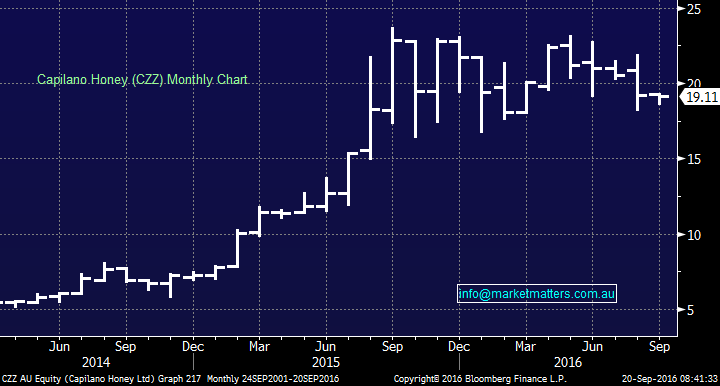

Capilano Honey (CZZ) $19.68 - We like CZZ as a small cap. holding and would accumulate in the $18-19 region.

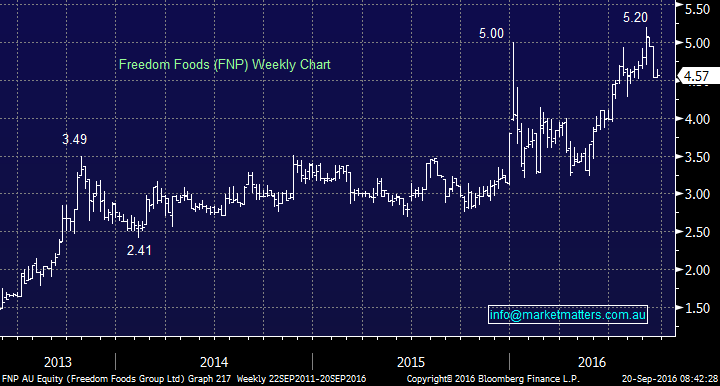

Freedom Foods (FNP) $4.78 - We would be comfortable accumulators of FNP in the $4 region.

https://www.marketmatters.com.au/blog/post/market-matters-morning-report-thursday-25th-august-2016/

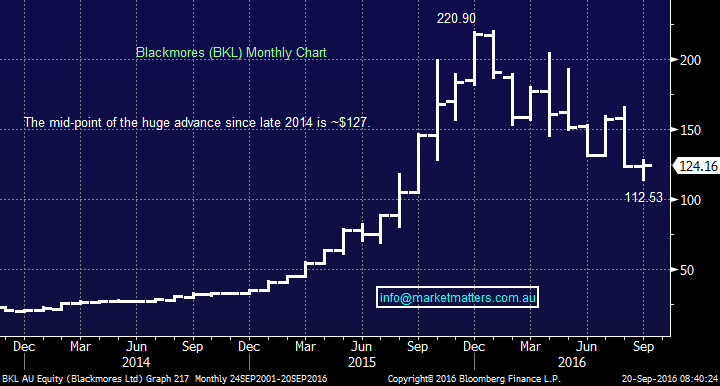

BKL fell another +10% as anticipated, providing the opportunity to buy under $120 with the stock reaching a shorter term low of $112.53 on the 6th Sep. The BKL –re-rate has been fairly dramatic after they announced earnings that came in below of expectations. The real concern was around growth, and the trajectory of that growth over the past four quarters. A growth company that was failing to grow earnings gets hit on two metrics. Lower earnings and a PE re-rate to a lower multiple should lead to a big fall in share price – which we’ve seen. BKL however now looks reasonable value, and some semblance of price support is now playing out. Clearly, BKL is a very volatile stock, so we would recommend investing size should be small accordingly, ideally around half normal size.

We would now look to buy BKL around $110, still targeting a 15-20% return.

Blackmore's Ltd (BKL) Monthly Chart

BAL has corrected 17% and is now trading under $13. The overall picture has become more neutral, as sellers clearly entered the market in force above both $15 and $14. We met with Bellamy’s management recently and it remains clear there is little sign yet of an equilibrium of demand and supply – the risk remains meeting that demand whilst maintaining quality. Great management, a great product, however, our main concern remains that it is well owned within Australia.

We can buy BAL around the current $12.75 level with stops under $11.80.

Bellamy's (BAL) Weekly Chart

No change, we still like CZZ, but ideally would be buyers into some further weakness, when the stock was closer to $17.

Capilano Honey (CZZ) Monthly Chart

FNP rallied to fresh highs over $5, as opposed to giving us a buying opportunity around $4 that we were targeting. We are now currently neutral, awaiting company news / technical price action.

Freedom Foods (FNP) Weekly Chart

Summary

The China theme remains both volatile and exciting, the almost 50% fall in BKL's share price clearly illustrates the pitfalls in chasing "expensive" stocks. Picking the winners from the growing volume of Chinese consumers remains an exciting concept, but the elevated valuations brings with it clear dangers. Our updated conclusion on the 4 stocks revisited today is:

Blackmore's (BKL) - Buy around $110 as an aggressive play, looking for a 20% bounce.

Bellamy's (BAL) - BAL remains constructive and we could buy around current prices with stops under $10.80

Capilano Honey (CZZ) - We still like CZZ as a small cap holding however we would accumulate in the $17-18 region.

Freedom Foods (FNP) - We remain neutral FNP for now

Importantly, if we were allocating say 15% of a portfolio to this sector / area, we would be looking at 5% allocation into each of BKL, BAL and CZZ to spread the stocks specific risk.

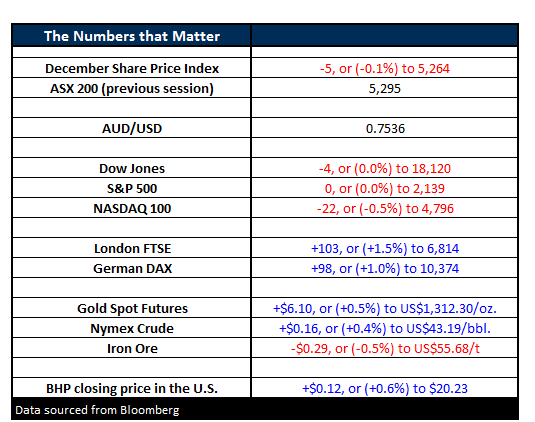

Overnight Market Matters Wrap

- The US markets finished virtually flat overnight, as investors are waiting yet again for a direction from the Fed this week, with the FOMC statement being released at 4am Thursday morning.

- The Dow finished down just 4 points to 18,120, after rising 100 points earlier in the day, whilst the S&P500 finished square on the day at 2,139.12.

- Oil was stronger last night, rising just 16c (+0.4%) to US$43.19/bbl. The volatile session saw gains earlier in the day of over 2%, after Venezuela hinted that OPEC and other major producers could agree to a market support deal.

- Gold picked up on a weaker US$, but were capped ahead of the Fed statement. The precious metal finished up $6.10 (+0.5%) to US$1,312.30/oz

- The ASX 200 is expected to open down 11 points this morning, testing the 5,285 level, as indicated by the December SPI Futures this morning.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 20/09/2016. 9:00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.

To unsubscribe.Click Here