Market Matters Morning Report Tuesday 16th August 2016

US stocks make record highs, 3 local stocks surge 10%, but everyone remains ‘tactically underweight’ stocks!

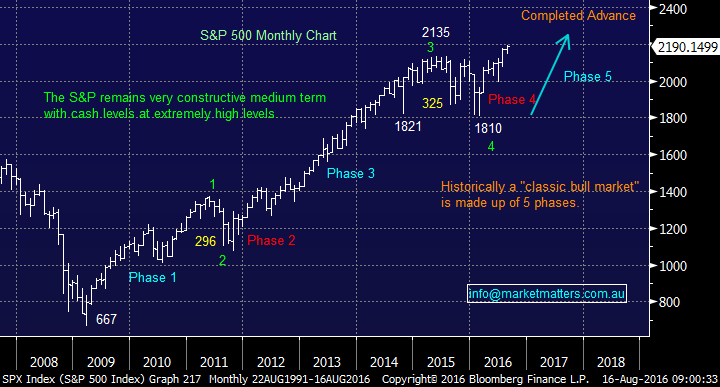

Experts around the world are generallywary of bearish stocks at present, but they keep grinding higher, even Peter Switzer a perennial bull was negative on his show recently. We think people are missing the simple factor that in the short term - central banks want asset prices higher. As subscribers know we do expect a +20% correction medium term from equities but short term we remain comfortable with bullish target of ~6% further gains in the US.

Looking at 3 simple but powerful facts that support this short-term positive view:

1. The Bank of Japan (BOJ) is becoming the whale of the Nikkei hoovering up local stocks. The BOJ has recently bought 2% of the Nikkei's market Cap. And will be the largest shareholder in 51 companies by the end of 2017.

2. Earnings revisions drive markets, and the market is so conservative / negative that "surprises" are occurring more often to aid the Bulls. An okay report is being taken positively. We will look at the 3 local stocks that soared ~10% yesterday later in this report.

3. European equities are the cheapest in history versus interest rates. There is a saying in the market that has proven very accurate since the GFC - "don't fight the Fed" but we think it should say "don't fight the coordinated central banks"...not as catchy but arguably more powerful.

While central banks want to create a happy wealth effect by increasing asset prices, it remains a tough game to fight their weight of money. Our view is this asset inflation will provide some excellent selling opportunities going forward.

Investors are in a tough position chasing high quality stocks inexpensive territory, but history shows us that distorted valuations can persist over sustained periods of time.

US S&P500 Monthly Chart

Yesterday Ansell (ANN) announced a 15.1% fall in full-year net profit to $US159.1 million, and the stock surged 17.7%! The market embraced the news that they were looking to sell their sexual wellness division.

Simply better than the markets fears and the champagne cork flew. Technically the $25 level is the next resistance, however, a lot of the move yesterday was likely ‘short covering’ so it will be interesting how it travels today.

Ansell Ltd (ANN) Monthly Chart $23.16

Yesterday packaging company Orora (ORA) jumped 9.8% after announcing a whopping 28.3% increase in profits to $168.6 million and a final dividend of 5c. The result was ahead of market expectations by about 4% - driven largely by a good mix of organic growth, cost out, and some contributions from recent acquisitions.

Technically the stock is positive with stops under $2.40. Analyst upgrades to filter through today.

Orora (ORA) Weekly Chart $3.03

JB Hi-Fi (JBH) closed at a record high yesterday after an impressive 11.5% increase in its full-year profit to $152.2 million, with sales up 8.3%. We discussed the bullish position of the retail sector in the weekend report, but this result was at the top end of our thoughts.

Technically JBH is clearly bullish with an eventual target ~$40 not out of the question.

JB Hi-Fi Ltd (JBH) Monthly Chart $30.09

Summary

- We remain bullish stocks short term but continue to believe that the best returns over the next 3-6 months will be generated by a more active approach.

- Expect Market Matters alerts to become more frequent as we look to tweak our portfolio.

Overnight Market Matters Wrap

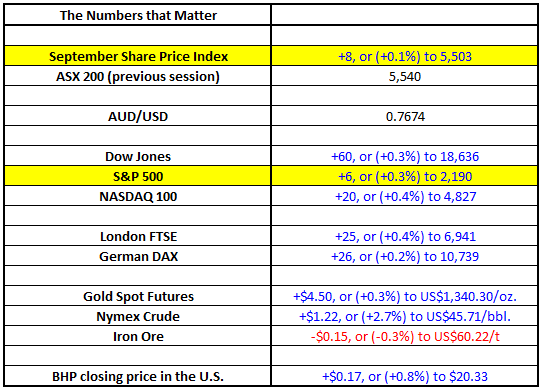

- The US share markets closed on new highs overnight on the back of a decent move in the commodity markets.

- The Dow closed 60 points higher (+0.3%) at 18,636, the broader S&P 500 up 6 points (+0.3%) to 2,190 and the Nasdaq 100 up 20 points (+0.4%) to 4,827.

- Crude Oil was the main driver up 2.7% to US$45.71/bbl and testing the US$46 resistance.

- Domestically, investors will focus on the RBA minutes, while we continue to digest corporate earnings. i.e. James Hardie (JHX), Challenger (CGF), InvoCare (IVC), BHP Billiton (BHP), Mirvac Group (MGR), Scentre Group (SCG) and Domino's Pizza (DMP).

- The ASX 200 is expected to open 16 points higher, near the 5,560 level as indicated by the September SPI Futures this morning.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 16/08/2016. 9:00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here