Market Matters Morning Report Tuesday 13th September 2016

The question remains - should we panic?

Obviously yesterday, many investors felt like a Kangaroo caught in the spotlights of a car, but this morning things clearly feel a lot better. Overnight US equities have recovered over 60% of Friday night’s plunge and amazingly, the S&P500 is now only 1.6% below its all-time high. Locally, the ASX200 looks set to open up ~60-points, similarly regaining around 1/2 of yesterday's losses.

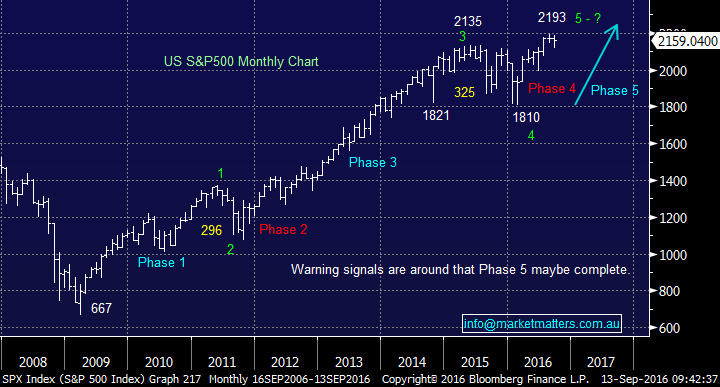

On Friday, large turnover implied fund managers were sellers of US stocks, raising money for the usual September seasonal weakness, which is an unpleasant reading for equity investors. Historically, September is the weakest month of the year for the US stock market, but it usually creates an excellent buying opportunity in November. Over the last 50-years, the S&P500 has fallen ~1.3% in September, but it should be remembered over this 1/2 century, the market has rallied significantly - importantly the S&P500 is down only 0.05% this September! The path of most pain maybe fresh all-time highs for US stocks, followed by a sell-off later in the month.

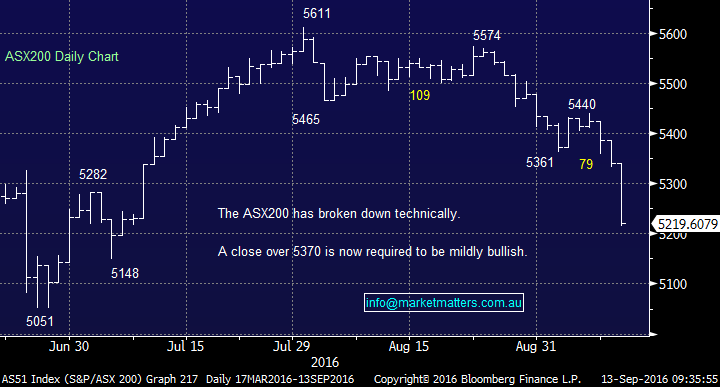

Locally, the picture is far bleaker with the ASX200 closing almost 7% below its 2016 high, while the US remains in striking distance of its all-time high. We unfortunately now believe we have peaked at 5611, unless the market can close over 5470. Hence, we are looking to reduce our equity exposure into strength and a test of 5300 would potentially be an ideal opportunity.

ASX200 Daily Chart

Last night, we had 3 more Fed speeches with the most important from Governor Lael Brainard and she called for prudence in the central banks approach to raising interest rates. Overall, we believe there’s no real change over the last few days, interest rates are going to rise in the US with the only question being the speed.

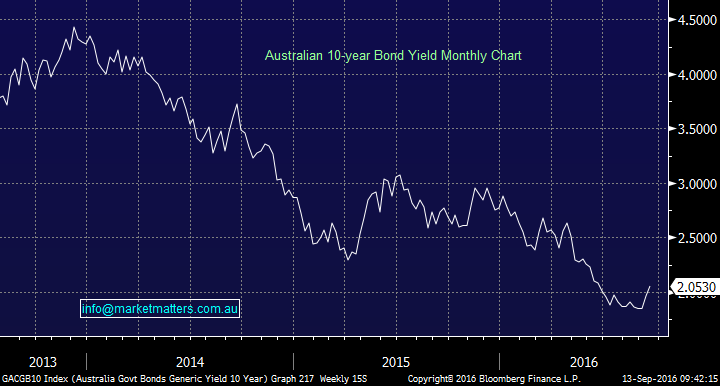

The local Australian 10-year bonds have seen yields rally over 0.2% very quickly and we remain with our view that the "yield trade" has topped out and quasi-bond like stocks are a sell.

Australian 10-year Bond yield Weekly Chart

We believe the main job of central banks over coming years is to raise interest rates in a controlled manor and hence, avoid a bond bubble explosion. If they are successful in this extremely tough task, some of the masses of monies that has hidden in bonds over recent years is likely to find its way back to stocks and potentially push the S&P500 to our long term ~2400 target.

US S&P500 Monthly Chart

Buy-write on Banks

We have mentioned previously that we currently like the buy-write investment strategy on the banks for sophisticated investors and this morning we have outlined the logic and mechanics of the trade.

We have selected Westpac (WBC), because it has a dividend approaching on the horizon in November.

The trade at yesterday's close:

1. Buy WBC shares at $29.03.

2. Sell WBC September $29.30 calls for 41c.

3. Potentially look to pick up 3 dividends in WBC over the next 15 months ~$2.80 fully franked.

4. If the stock rallies over $29.30 by the 22nd of September, we can "lose" our stock and realise a 2.46% return in 12 days. Alternatively, we can cover the sold calls and resell / roll into October.

5. The 3 dividends plus initial option premium gives a $3.21 buffer to the stock purchase price if WBC falls from here i.e. 11% cover.

6. The intention would be to have written / sold calls in place every month for the next 15-months, hence picking up some decent premium to increase the return and protect against the potential fall in the share price.

The ASX website has some excellent background reading on the subject.

NB The above numbers do not take into account brokerage. Investors are likely to need to invest ~$300k, or more, for the returns to be attractive after costs. If you have any specific / further questions please do not hesitate to drop us a line as we understand this is a brief explanation.

Westpac Bank (WBC) Weekly Chart

2 recent topical questions

We dealt with a general flood of questions around the same subject yesterday, so today we have picked out 3 specific questions that have a similar undertone but are a touch more specific.

Question 1

"With a potential change of direction in the market and your call for a 25% move down, rather than sell everything what is the best way to capture some of this move. Do we buy a put on the index, buy a put on some specific stocks or buy into a fund that mostly short sells?" Regards Michael

Hi Michael, a great group of questions that have a different answer, depending on the degree of sophistication of the investor.

We have listed a few points below that hopefully cover most bases:

1. Investing in a short selling fund is a simple concept that most investors can understand, but do not have to be concerned about the day-day mechanics.

2. Options can be used in a number of ways from selling calls to buying puts, but importantly market timing / understanding is critical.

3. Simply reducing market exposure and sitting back waiting for future opportunities is the most relaxed idea that will probably suit the majority of investors.

NB We are still uncertain that US stocks have topped but with all of the above scenarios consultation with a broker is highly recommended.

Question 2

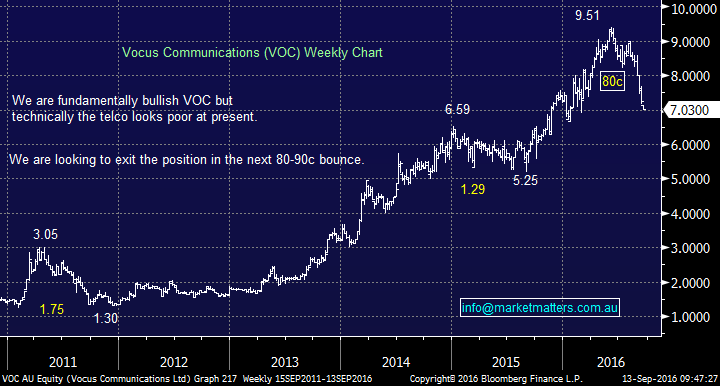

"Vocus (VOC), getting smashed. $7.25 close. You said pile in at 7.80, now what?" Thanks Hugh

Hi Hugh, Vocus has been a thorn in our side in a major way for the last few weeks. While we like the company fundamentally, we are not keen on the sector which is clearly underperforming the market.

Simply, we are now looking to exit our position in VOC, we anticipate at a relatively minor loss into the next countertrend bounce ~80c.

Vocus Communications (VOC) Weekly Chart

Overnight Market Matters Wrap

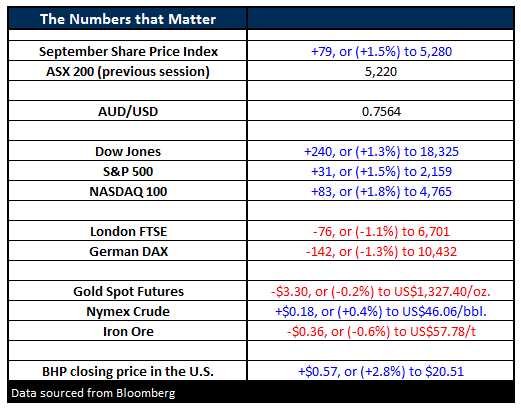

- The US markets rallied last night, recovering close to half of the loss from last Friday. The Dow put on 240 points (+1.3%) to 18,325 whilst the S&P500 rose 31 points (+1.5%) to 2,159.

- A voting member of the Federal Reserve (Lael Brainard) made dovish noises to the market, saying that it would be wise to keep monetary policy loose, even though economic progress continues.

- Oil was marginally stronger, rising 18c (+0.4%) to US$46.06/bbl, on news that energy monitoring service Genscape estimated a draw of 330,661 barrels in the six days to September 12, but countered by news that drilling activity in the US has increased.

- The ASX 200 is expected to follow suit from the US and recover some of yesterday’s losses this morning, with the September SPI Futures indicating a 60 points rise, testing the 5,280 level this morning.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 13/09/2016. 9:00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.

To unsubscribe.Click Here