Market Matters Morning Report Thursday 8th September 2016

Why US interest rates remain the key to stocks

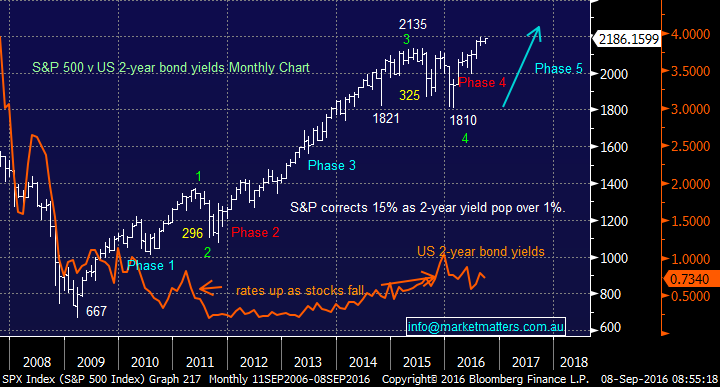

While we continue to believe US stocks will grind higher into at least early 2017 we are watching very closely the week to week movements of US / global interest rates. The correlation between asset prices and interest rates is very pronounced and should not be ignored by investors who want to avoid being caught in the next significant correction in stocks.

The bull market in the S&P500 began back in early 2009 and has seen an appreciation in stocks of over 300%, with a significant portion of this rally generally acknowledged to have been fuelled by cheap money i.e. all-time low-interest rates.

Within this 7-year impressive rally, there have been 2 meaningful corrections of 21% and 15% respectively. In both of these occurrences, US bond rates rallied prior to the fall in stocks and peaked before equities bottomed i.e. they were a leading indicator. Hence caution at the very least should be adopted when US rates again turn higher which they obviously will at some point.

US S&P500 v 2-year bond yields Monthly Chart

Recent US economic data has been average leading to a short-term tick lower in both US rates and the $US. This move has yet again aided US stocks to challenge their all-time highs.

However, we believe some of the core fundamental economic indicators are very strong and cannot be ignored. The number of people looking at each job in the US has plummeted from almost 7 to 1.3, noticeably under the GFC levels. To us, this illustrates that the US does not have an unemployment issue and the Fed will move to start normalising rates sooner rather than later.

Note: while there is a big difference between normalising and raising them up significantly it is still likely to send shudders through stock markets that have been bid up to above average valuations by artificially low-interest rates.

Number of people looking per Job opening - Monthly Chart

When we look internationally the Japanese JGB's already look to have formed a clear low in rates as central banks acknowledge that negative interest rates are not working. Low rates are a headwind to banks and for an economy to recover it needs healthy / banks who want to lend.

Japanese 5 year JGB yield Monthly Chart

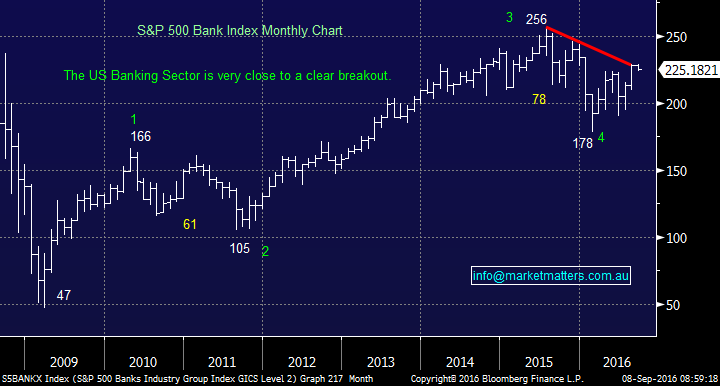

Our main short-term sector call at the moment remains being overweight banks which is supported by our view that rates are set to rise. The banking sector is a clear beneficiary from the normalising of interest rates as their margins improve. The US Banking sector has broken out technically and is targeting over 15% gains from current levels.

We believe we are ahead of the pack with this bullish banking view as very few are talking about buying banks today!

S&P500 Banking Index Monthly Chart

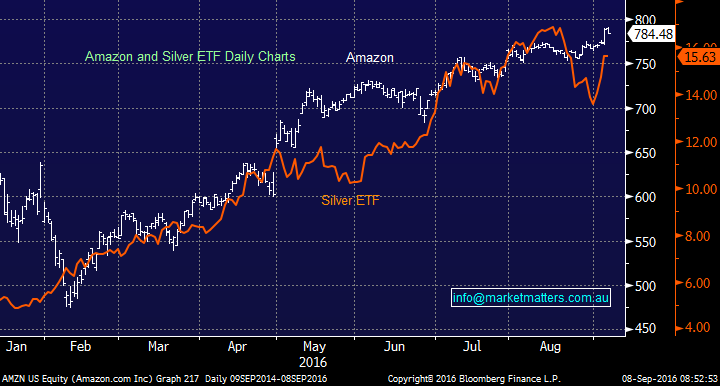

An insightful chart we saw on Bloomberg today illustrates the remarkably tight correlation between the Amazon share price and the iShares global Silver Miners ETF. The two respective assets have nothing fundamentally in common however they move almost totally in step. This tight correlation is yet another demonstration of the vast majority of global assets steadily becoming inflated by free money - it's not just Sydney housing that we read about almost daily.

Amazon shares v iShares Silver ETF Daily Chart

Summary

We remain comfortably overweight equities at present but will be looking to reduce into strength. US rates will be the primary indicator we use to reduce our holdings significantly.

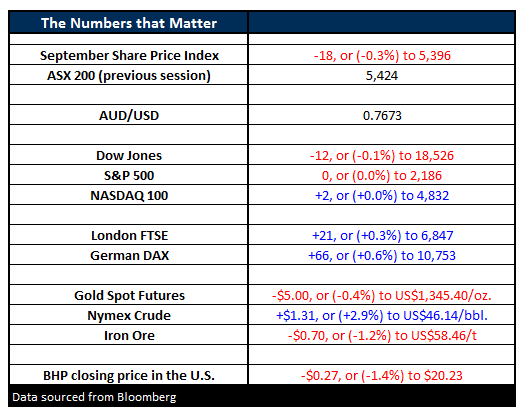

Overnight Market Matters Wrap

- The US markets closed slightly lower, with the Dow finishing down just 12 points to 18,526 and the S&P500 slightly below square, to 2,186.

- Oil picked up last night on the belief that the world’s top producers could agree on a production freeze. Crude finished up US$1.31 (+2.9%) to US$46.14/bbl. The oil inventories report is a day late this week following on from public holiday in the US on Monday.

- Gold dropped on profit taking, after it soared the most in two months yesterday. The precious metal fell US$5.00 (-0.4%) to US$1,345.40/oz.

- Iron Ore settled marginally lower, down by 70c (-1.2%) to US$58.46/t. BHP is expected to underperform this morning, after closing an equivalent of -1.4% in the US, to $20.23 from Australia’s previous close.

- The ASX 200 is expected to open lower this morning by 26 points, again, testing the 5,400 resistance level, as indicated by the September SPI Futures this morning.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 8/09/2016. 9:00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.

To unsubscribe. Click Here