Market Matters Morning Report Thursday 6th October 2016

Should we be scared of Donald Trump?

The US election is looming on Tuesday 8th November, personally I would rather vote on a Saturday like we do. Currently, the polls have Hillary Clinton marginally ahead, but we all saw with BREXIT that there can be a huge margin for error within polls, especially when the race for the Whitehouse is this close. Most market pundits are scared of a Trump victory, with some even predicting a market crash if he wins. We feel a short-term negative knee-jerk reaction is almost guaranteed, but our view at this stage is that Hillary Clinton will win. We place an obvious caveat on this opinion with plenty more chapters of this circus to play out.

CBA recently published some comprehensive research on the ramifications of a Trump victory, the main points were:

1. Trump looks positive for US economic growth and inflation would lift.

2. The global ramifications look negative, there are no winners from trade wars.

3. The net impact for the Australian economy is mildly negative, China is now more important to the health of our local economy.

The largest likely impact of a Trump victory would be the Fed accelerating the "normalising" of interest rates i.e. US interest rates lifting faster under a Trump administration, compared to a Clinton one.

This basically tells us that the theme which is currently unwinding aggressively will accelerate if Trump wins as the market focuses on higher rates. Last night US economic data continued to show a strengthening economy, resulting in a 1.5% rally in financial stocks, but falls of 1.9% in Real Estate, 1.8% in Telco's and 0.3% in Utilities. US banks rallied 2%, outstripping even energy stocks which were up 1.4%, following crude oil’s 2.1% gain.

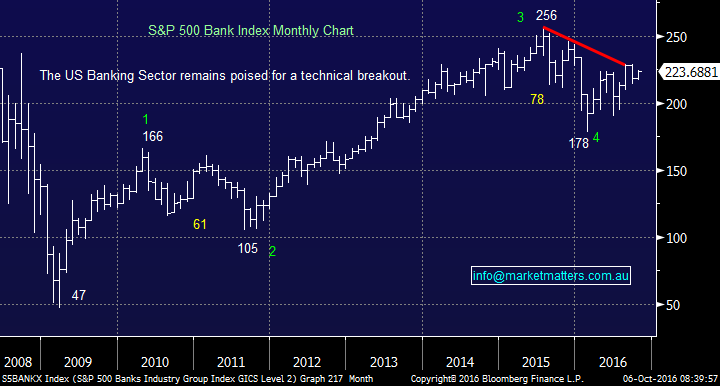

US S&P500 Banking Sector Monthly Chart

Markets have spent a long time chasing the perceived safety "yield play" and selling banks. Our belief is this strategic change in market opinion which we have pushed for weeks, has only just commenced.

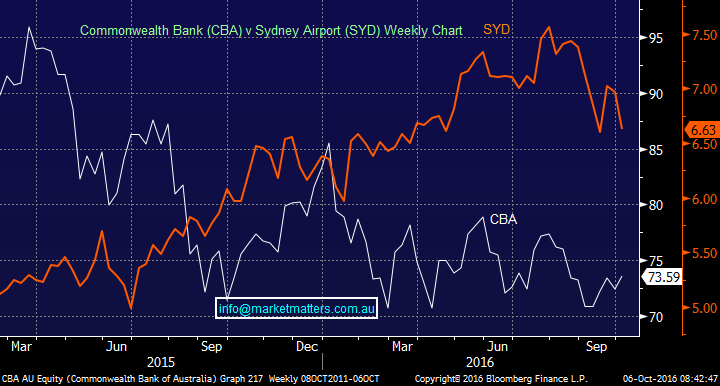

Since the first quarter of 2015, CBA has fallen 23% while Sydney Airport (SYD) has rallied 27%, even after the recent fall in SYD. If the two stocks just go back the differential at the start of this year, CBA looks set to outperform SYD by over 20%.

Commonwealth Bank (CBA) v Sydney Airport (SYD) Weekly Chart

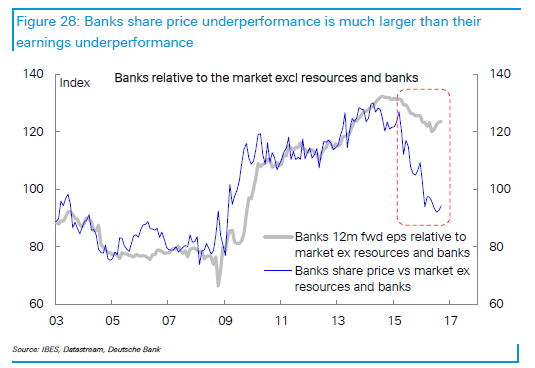

Deutsche Bank put out an interesting chart this morning highlighting the weakness in banks over and above weakness in their earnings.Clearly banks have been out of favour however as we’ve been writing of late, if you think interest rates will start to increase globally, banks should be supported.

Let’s now take a look at the statistics for both this time of year and around a very close US election:

1. Over the last5-years CBA has rallied on average 6.6% in the month of October.

2. Over the last20-years the ASX200 has gained 0.8% in October, 0.4% in November and 1.8% in December with positive outcomes 70%, 60% and 75% of the times - a good outcome for November with 3 of our big 4 banks trading ex-dividend.

3. In a close US election, not surprisingly the market trades sideways into the vote, but then rallies strongly ~4% in November, whoever wins!

While we acknowledge that Donald Trump is definitely an extreme candidate, if he were to win the above statistics do bode well for equities into Christmas, and more so if we see a Clinton victory. We do not believe the market is currently positioned for a 4-5% rally into Christmas increasing the possibility of this outcome.

Summary

- We remain comfortably overweight banks within our portfolio, which is almost fully exposed to stocks.

- We have no interest buying stocks / sectors which will be negatively influenced by higher US interest rates.

Overnight Market Matters Wrap

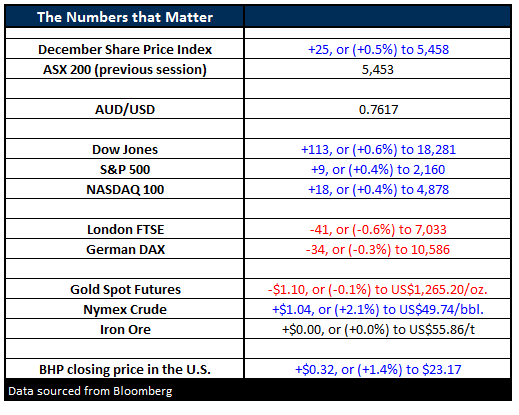

- The Dow was higher last night, powered along by rising oil prices. The index closed up 110 points (+0.6%) to 18,281, whilst the S&P500 closed up 9 points (+0.4%) to 2,160.

- Oil rose to its highest levels since June after it was reported that there was another drawdown in inventories. There was a cut of 3 million barrels reported, which was the fifth weekly drop. Analysts had reported earlier that they expected a rise of 2.6m barrels.

- Gold remained steady after a dramatic fall in the previous session. The price fell US$1.10 (-0.01%) to US$1,265.20.

- Traders are now waiting for the non-farm payrolls due Friday night, our time. Expectations are for 171,000 jobs to be added, and for the rate of unemployment to remain at 4.9%

- Domestically, investors will look further into our economy, with the Trade Balance to be announced at 11.30AM. The consensus is a deficit of $2.3b.

- The ASX 200 is expected to open higher this morning, around the 5,479 level (up 27 points), as indicated by the December SPI Futures.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 6/10/2016. 9:00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.

To unsubscribe.Click Here