Market Matters Morning Report Thursday 29th September 2016

OPEC looks set to rally stocks into 2017

Last night, OPEC shocked markets by agreeing to a preliminary deal to cut oil production for the first time in 8-years. Nobody was expecting Iran and Saudi Arabia to resolve their differences so quickly. In the US oil surged over 5.5% taking with it the energy stocks which rallied 4.3% as a sector.

This is a significant policy switch by the Saudi's from 2-years ago, when they turned on the pumps to flood the market with oil in an attempt to defeat the shale gas threat primarily coming from the US. We are now witnessing OPEC reducing production to manage the oil price which should lead the price of Crude move higher.

This is a massive policy change by Saudi Arabia, born out of necessity as their economy comes under increasing pressure with a ballooning budget deficit.

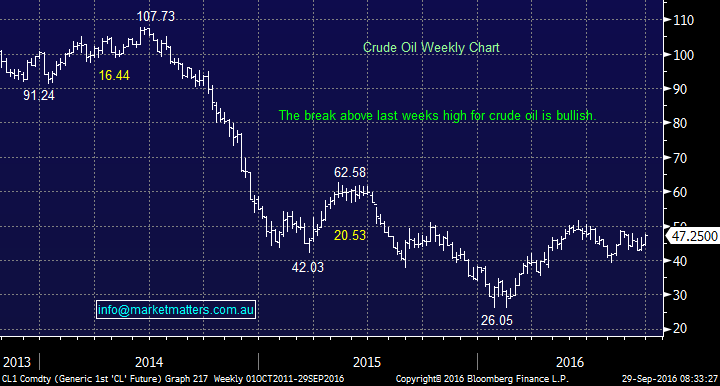

Last night's strong rally by Crude Oil reaffirms our bullish outlook targeting the low $US60 region i.e. around 30% higher.

Crude Oil Weekly Chart

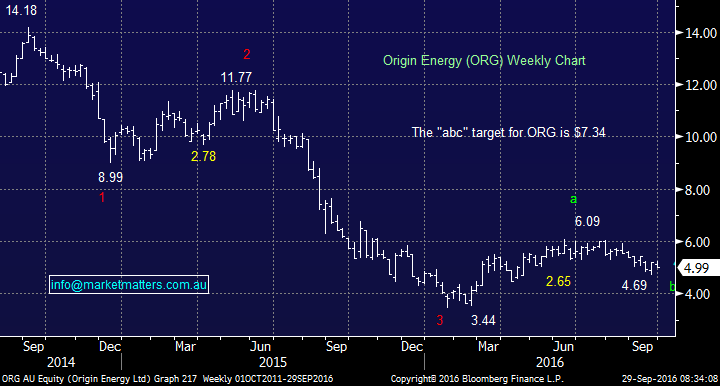

We currently hold 10% of our portfolio via the leveraged play, Origin Energy (ORG). Our initial target is $6.25, with a strong possibility of a rally over $7 - assuming oil unfolds as we are forecasting.

Origin Energy (ORG) Weekly Chart

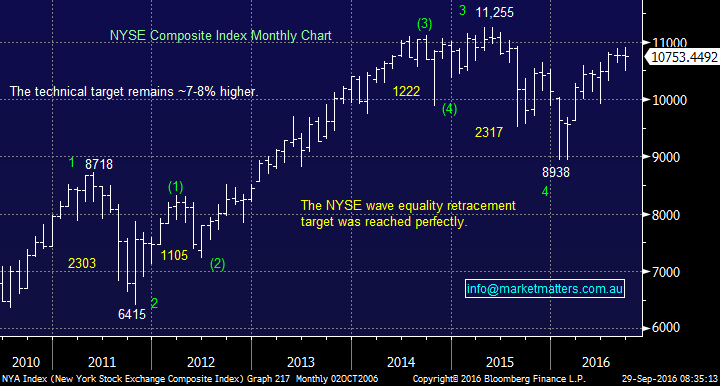

The rally from the energy stocks helped the US market rally for a second night, leaving the S&P500 only 1% below its all-time high - not a great outcome for the many bears out there. Pinpointing tops in markets is extremely hard and definitely part guess work, but our preferred scenario remains a further 7-8% gain from US stocks before the major alarm bells start ringing.

NYSE Composite Index Monthly Chart

Recently we looked at the $A and saw a pattern that was similar to that in 2014 prior to big fall by the $A. We have not taken a 360-degree change of view short-term and are looking for an ongoing "ABC" correction over 80c.

Since the major top in the ASX200 (just under 6000) in 2015, the Australian stock market has followed the $A very closely. There is no reason to believe this strong correlation will not continue, hence we remain positive the ASX200, like US equities with a potential target of the 5700 area.

ASX200 v $A Weekly Chart

Summary

1. We remain bullish oil and the sector while December Crude can trade over $US45/barrel.

2. We remain bullish US equities, targeting further 7-8% gains.

3. We remain positive the ASX200 with a top likely when the $A reaches ~80-81c.

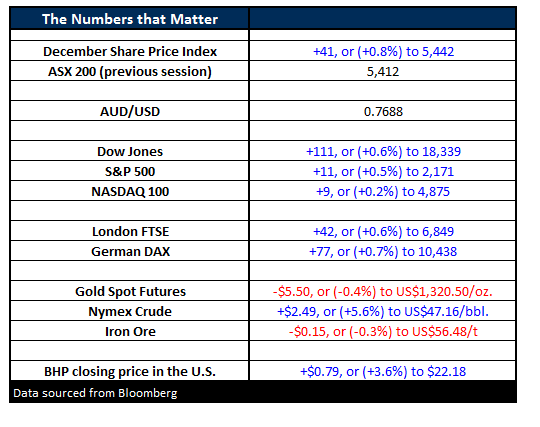

Overnight Market Matters Wrap

- The US markets rallied on a report that agreement had been reached between OPEC members to cut production of oil. The Dow rose 111 points (+0.6%) to 18,338 whilst the S&P500 finished up 11 points (+0.5%) to 2,171.

- Oil was again the focus of the night with reports from Reuters saying that the group members of OPEC has struck a deal to limit crude output at its next policy meeting in November, which is its first cut since the market crashed two years ago. Crude finished up US$2.49 (+5.6%) to US$47.16/bbl.

- The ASX 200 is expected to open stronger this morning, around the 5,462 level, as indicated by the December SPI Futures.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 29/09/2016. 9:00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.

To unsubscribe.Click Here