Market Matters Morning Report Thursday 25th August 2016

The increasing risks for Chinese growth stocks

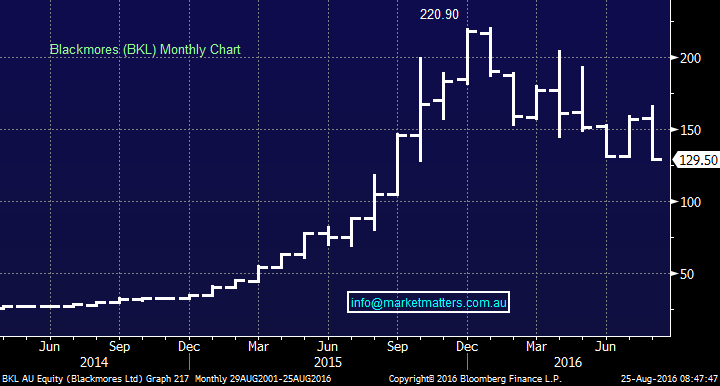

Yesterday, one of the markets favourite stocks of the last 18 months, Blackmore's (BKL) literally fell off a cliff, collapsing almost 20% in the one day. In this reporting season, we have witnessed a few examples of "growth stocks" that are trading on very expensive valuations, being hammered when their profit results reports do not live up to market expectations - when a stock is priced for perfection the risks are not surprisingly heightened on the downside.

In the case of BKL, the marginal growth over the recent four quarters clearly did not warrant a stock to trade on a P/E of 30x i.e. Net Profit After Tax (NPAT) in Q1 $22.6m to Q4 of $24.5m. By way of comparison, CBA trades on a P/E of 13.7x and Seek 15.8x.

Arguably, this year's most hyped investment theme has been to gain exposure to the rapidly increasing number of Chinese shoppers. In simple terms, the average worker in China is getting richer and spending more money. This trend we believe is still in its infancy considering that less than 10% of the Chinese population has a passport.

There are many obvious risks when investing in this theme. How much positivity / success is already built into the share price, is the controlling Chinese government likely to "move the goal posts" or change the regulatory environment, barriers of entry for new competitors, do companies have local expertise and access…and the list could continue on. Today, we will give our current view on 4 local stocks with exposure to the growing volume of Chinese consumers.

BKL is now trading on a P/E multiple of 22x after yesterday’s hammering and the overall 42% decline from the highs earlier in the year. Not surprisingly, we feel BKL has become an aggressive investment.

Technically we could buy BKL in the $110-120 area, targeting a ~20% bounce, but this is aggressive and volatile stuff and capital allocation should be set low accordingly.

Blackmore's Ltd (BKL) Monthly Chart

We made a nice profit of around 9% from Bellamy’s (BAL) in the middle of this year and it’s only over recent weeks that the stock has again commenced to rally above the $12 region. Yesterday, it felt like the stock was receiving some of the money coming out of BKL – in other words, investors sold the stock, not the theme.

While BAL is trading on a very elevated valuation of over 37x, technically BAL remains constructive and we could buy with stops under $13.50 targeting fresh highs over $16.50.

Bellamy's (BAL) Weekly Chart

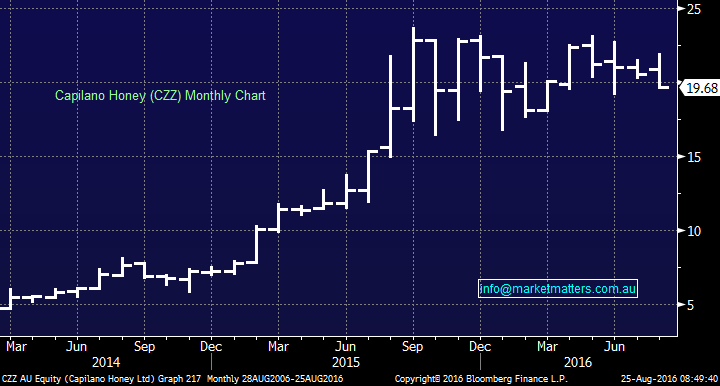

Capilano Honey (CZZ) has enjoyed a huge rally since 2015, but the stock remains on a relatively low valuation compared to expected double-digit earnings growth over the next few years. The company has been very successful in the Australian market – has a proven track record of earnings accretive acquisitions, had new products in the pipeline, and importantly has only recently targeted overseas opportunities – including China – with only ~20% of sales are currently coming from overseas.

Technically, the stock looks bullish, plus we like the fundamental story, a good small cap for a portfolio.

Capilano Honey (CZZ) Monthly Chart

Freedom Foods (FNP) has a range of health food options, while it's also a milk producer under the name of Australia's own. The company has been investing heavily in the milk business, which should bear fruit in the Chinese market, with a refreshingly long-term objective.

The stock, not surprisingly, is trading on an elevated P/E of 31x, increasing the risks for investors, however, we do like the company and its outlook and would currently look to accumulate around the $4 region.

Freedom Foods (FNP) Weekly Chart

Summary

The China theme is clearly very volatile, as the 41% plummet in BKL's share price this year clearly illustrates. Picking the winners from the growing volume of Chinese consumers is clearly an exciting concept, but the elevated valuations brings with it clear dangers. Our conclusion on the 4 stocks covered today is:

1. Blackmore's (BKL) - Buy under $120 as an aggressive play, looking for a 20% bounce.

2. Bellamys (BAL) - BAL remains constructive and we could buy with stops under $13.50, targeting fresh highs over $16.50.

3. Capilano Honey (CZZ) - We like CZZ as a small cap. holding and would accumulate in the $18-19 region.

4. Freedom Foods (FNP) - We would be comfortable accumulators of FNP in the $4 region.

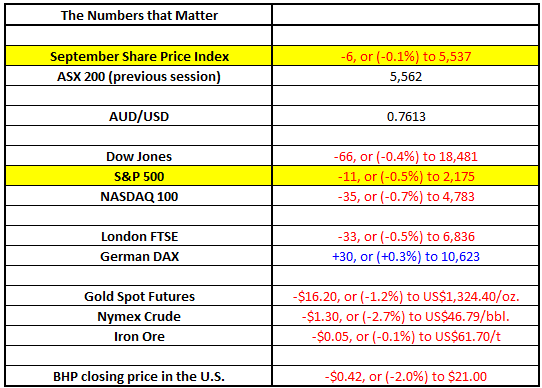

Overnight Market Matters Wrap

- The US share markets finished weaker, with the Dow down 66 points (-0.35%) to 18,481, while the broader S&P500 closed down 11 points (-0.5%) to 2,175.

- The Healthcare sector fell 1.5%, dragging the markets weaker, again on very low volume.

- Oil dropped, falling US$1.30 (-2.7%) to US$46.80/bbl., after it was reported that US stockpile increased in the week to 19th Aug, rising 523m barrels, when the market was expecting a drop of 455m barrels.

- Gold dropped US$1.30 (-2.7%) to US$1,324.40oz, as investors took a position in the US$, ahead of the speech by Janet Yellen.

- There are a few companies reporting today - AWE (AWE), Billabong (BBG), Breville (BRG), Event Hospitality & Entertainment (EVT), Flight Centre (FLT), Iluka (ILU), Perpetual (PPT), Platinum Asset Management (PTM), RCG Corp. (RCG), South32 (S32) Village Roadshow (VRL) and Woolworths (WOW).

- The ASX 200 is expected to open with little change, testing the 5,560 as indicated by the September SPI Futures this morning. Note some volatility to be expected as it is Equity Options expiry this afternoon.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 25/08/2016. 9:00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here