Market Matters Morning Report Thursday 22nd September 2016

Reviewing our views & positions after the Fed / BOJ.

Firstly, let's summarize the events of the last 24 hours and our interpretation of the central banks respective actions.

Fed - The Fed left interest rates unchanged as expected by both ourselves and the market. However, the Fed appears to be revving the engines for the future with 14 of 17 board members targeting an increase in 2016 i.e. The December hike that we targeted yesterday. Importantly the Chair, Janet Yellen, suggested the lack of hike was not due to a lack of confidence in the economy, they are closely monitoring financial developments and asset valuations are not out of line with historical valuations.

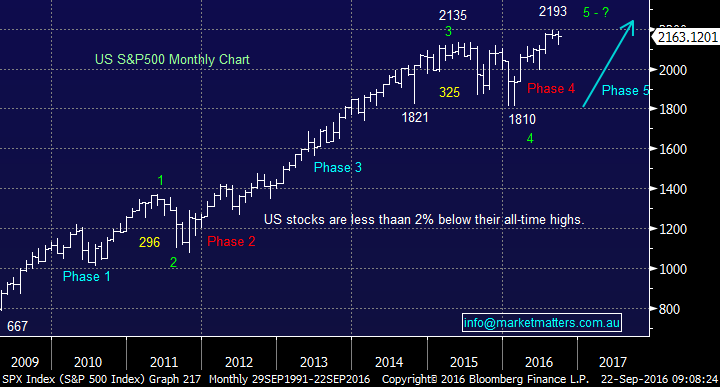

Our major interpretation from this morning is from the rhetoric – recall the phrase "Don't fight the Fed", if the Fed are saying asset prices are ok strongly implies they do not want the stock market falling from current levels. The USS&P500 is only 1.4% below its all-time high and our 2400 target area remains intact.Unfortunately, a strong US equity market has not been a good indicator the ASX200.

US S&P500 Monthly Chart

BOJ - The BOJ simply tweaked their monitory policy to enable them to massage the yield curve,lifting longer-term rates, which as we have been flagging is bullish for banks. Bank shares surged in Japan and were solid here with ANZ +1.7% and BEN +1.3%.

The combination of the actions by the Fed / BOJ and the clarity / content of their future intentions is short-term bullish for equities.

The ASX200 has been extremely choppy of late and much harder to forecast than its global counterparts. The strength from overseas markets enabled us not to panic and sell aggressively our large exposure to the Australian market. The best approach at present is to look at things on a stock sector basis as opposed to the overall index.

ASX200 Weekly Chart

The Banks

We are holding a fairly aggressive 40% of our portfolio in the banks, especially when combined with 12% weighting in the correlated Suncorp. After the central banks actions, we remain very comfortable with this position with large bank dividends on the horizon in November plus we are entering a very strong seasonal period for the banks. The statistic we quoted on the 1st of September: if over the last 5-years you had bought CBA on the open of the 1st trading day of October and sold on the close of the last day the average return was +6.6% with all 5-years registering a positive return, the lowest 3.4% in 2012 and the highest an impressive 10.5% in 2011.

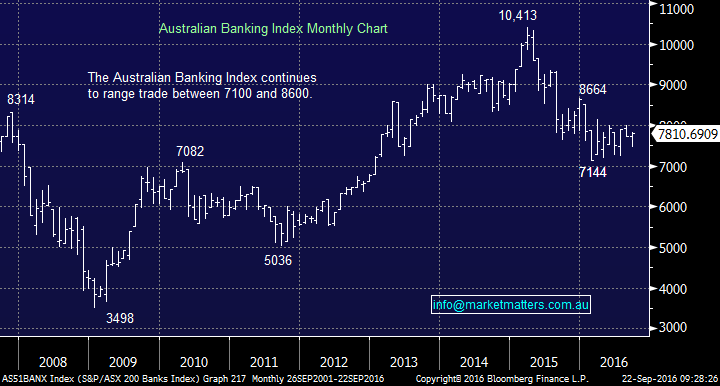

The Australian Banking Index has had an awful 1 1/2 years but a bounce back towards the 8500 resistance level seems a strong possibility i.e. 9% higher.

Australian Banking Index Monthly Chart

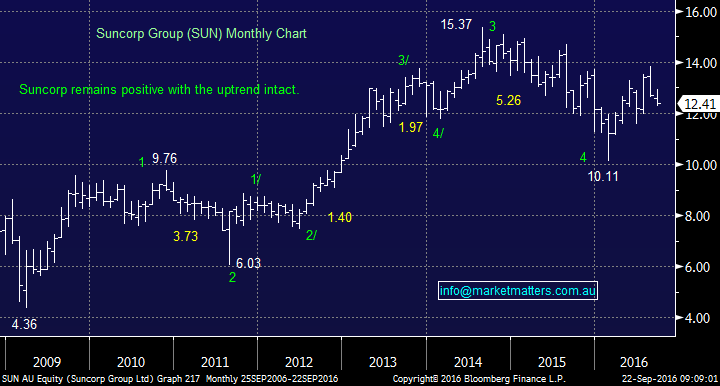

Suncorp (SUN) $12.41

We remain comfortable with our 12% holding of SUN in our portfolio. We remain bullish eventually targeting a test of $15.50.

Suncorp (SUN) Monthly Chart

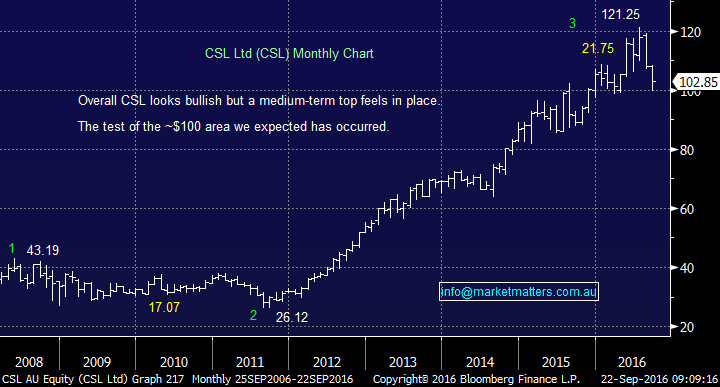

CSL Ltd (CSL) $102.85

CSL is down only 4.5% for the month and it has retreated almost 18% from its high in July. The stock has been sold for investing in the future but more importantly because its valuation simply got ahead of itself. While the stock is still trading on a P/E of ~28x this is not expensive for the Healthcare sector. We believe that CSL is likely to trade sideways now for decent period of time so this excellent company could almost become a trading stock i.e. sell over $110 and buy under $100.

We topped up our holding a little early but believe we still can realise a small profit from the position and then re-enter at better price moving forward as outlined above.

CSL Ltd (CSL) Monthly Chart

Independence Group (IGO) $3.89

We hold 7% of our portfolio in diversified miner IGO. Yesterday's close over $3.85 combined with strong commodities overnight, on the back of a weaker $US, maintains our positive outlook for IGO targeting over $4.50.

Independence Group (IGO) Weekly Chart

Origin (ORG) $4.87

Origin has been a very frustrating story within our portfolio having been close to our profit target prior to a significant decline after an average report and falls in the underlying oil price. Recently we altered our technical picture to a 50-50 scenario, with very different implications, putting our position on clear "watch". Last nights strong rally in the oil price looks bullish and we are comfortable to give our ORG a little "more room".

Origin Energy (ORG) Weekly Chart

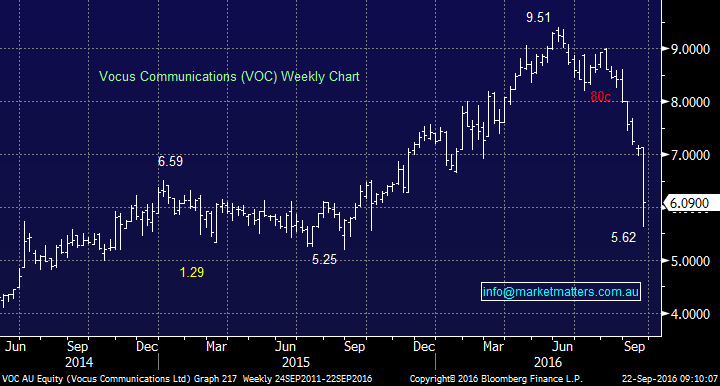

Vocus (VOC) $6.09

Clearly a problem position in our portfolio with a fairly savage decline in share price. The stock was dragged significantly lower on Tuesday by the poor future guidance from TPG Telecom (TPM) and yesterday it was hit hard on the news that the CFO had resigned. VOC does not suffer like TPG to the NBN pricing issues but the CFO resignation requires some quick explanation from the company which is not yet forthcoming.

We suspect there has been some form of conflict between M2 and Vocus management during the merging process, and we now see the bulk of M2 management in key rolls. CFO Rick Correll was from the VOC side and his abrupt departure has the market asking questions. Importantly, he will stay with the company for the next few months whilst a replacement is found – implying that relations remain amicable.

If we stand back and look at the facts here, Vocus (VOC) reported their FY16 result only a month ago – was better than market expectations and management provided a positive update. Therefore, it’s highly unlikely that recent turmoil is earnings / performance related. The main issue has come from TPG’s guidance, which is being impacted by lower margins post NBN roll out. That downward trend in margins will simply not happen to Vocus given their margins are already at a lower level. If VOC can meet current earnings expectations, the stock is trading on 11.5 times and offers earnings growth of 22% for the next three years.

This morning, VOC announced that the ACCC will not oppose the acquisition of Nextgen Networks which is a slight positive.

Right now, we think the market has overreacted, however, price action is always important, and we are very conscious of the high volume of selling that has been thrown at the stock over the last few days / weeks. The market clearly thinks that where there is smoke there is fire. Our position is on high alert and a loss appears inevitable, managing the best exit is the goal for us now.

Vocus Communications (VOC) Weekly Chart

Summary

We are currently happy with all our portfolio at present with the exception of VOC which we look to exit in coming days / weeks.

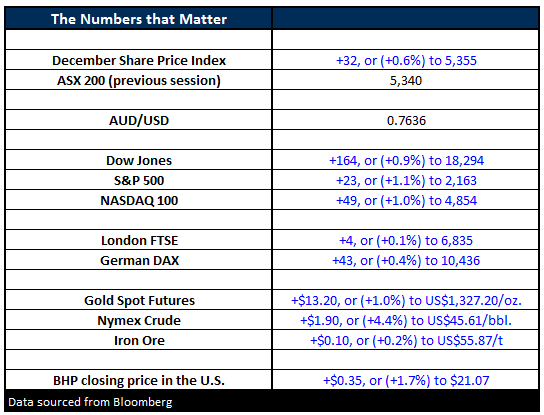

Overnight Market Matters Wrap

- As expected, the US Federal Reserve left its interest rates on hold, leading the US Share markets to rally overnight.

- The Dow closed 164 points higher (+0.9%) at 18,294, while the S&P 500 rallied 23 points (+1.1%) to 2,163.

- This morning, the Reserve Bank of New Zealand had also left its key interest rate unchanged at 2, however reiterating further easing will be required.

- Domestically, we expect the ASX 200 to follow suite of the US performance overnight, with the December SPI Futures indicating the ASX 200 to open 34 points higher this morning.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 22/09/2016. 9:00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.

To unsubscribe.Click Here