Market Matters Morning Report Thursday 18th August 2016

Banks or insurance for the rest of 2016?

The local share market had fallen in love with insurance stocks during 2016 prior to yesterday's plunge by serial market disappointed, QBE. The performance from our big insurance companies so far in 2016 has been stunning compared to the margin pressured banks:

Insurance Sector - MPL +39%, NIB +34%, SUN +8%, IAG +8% and QBE -18%.

Banking Sector - ANZ -4%, CBA -13%, NAB - 6% and WBC -10%.

Noticeably the insurance stocks are now trading well above their average long-term PE ratios, which unsurprisingly is a very different story to our local banks.

As an index the insurance sector remains in a range going back to 2009 and the strength this year has simply taken it towards the top area of this range.

ASX200 Insurance Sector Monthly Chart

Firstly we will look at two stocks within the insurance sector, the best performer Medibank Private (MPL) and Suncorp (SUN) which has just traded ex-dividend – and of course we own it.

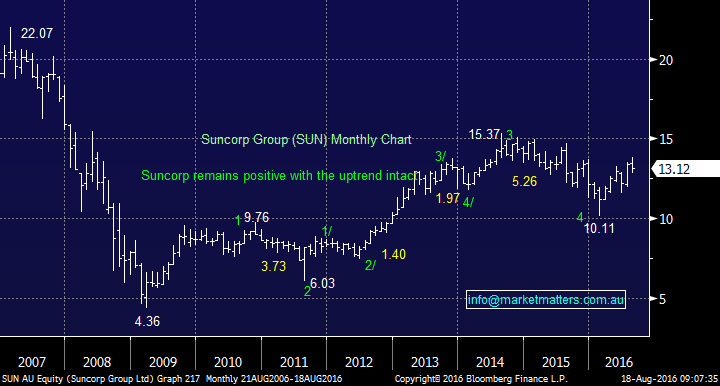

MPL is trading on an estimated PE for 2017 of 20x while SUN is only on 14x. Clearly, SUN's valuation is being dragged lower by its banking component, but also competitive pressures in their general insurance business, and falling commercial premium rates as shown in QBE’s result yesterday. Despite these forces, we remain bullish SUN targeting ~18% further gains but only see a potential ~10% further gain from MPL.

SUN is our preferred stock within the Insurance Sector and importantly we see less downside risk after its recent earnings report and reasonable valuation.

Medibank Private (MPL) Weekly Chart

Suncorp (SUN) Monthly Chart

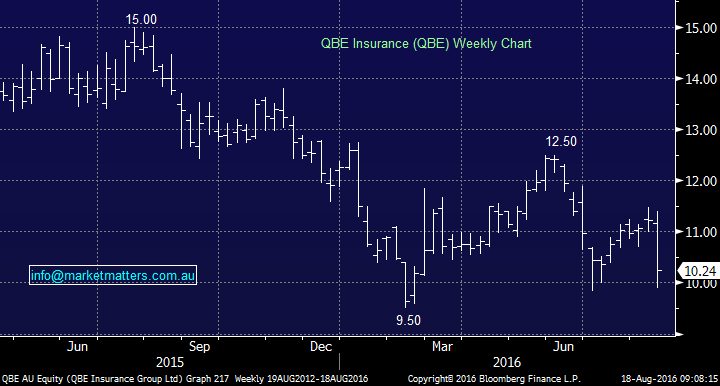

QBE Insurance (QBE) unfortunately appears to have the ability to find bad news under every rock and yesterday it was disappointing insurance margins plus lowered forward guidance that led to the 8% plunge in the stock.

We will consider the stock if it trades under the recent $9.50 low as eventually interest rates will pick up and this will be a significant assistance to QBE's profitability.

QBE Insurance (QBE) Weekly Chart

Now let's move onto the banking sector where the PE's are much lower as the market has lost some confidence in the sector. Valuations are around par relative to history but cheap compared to the overall market e.g. CBA is trading on an estimated PE of 13x for 2017 while yielding 5.7% fully franked.

Yesterday a technical buy signal was generated by Westpac targeting at least ~ 5% further gains.

Westpac (WBC) Daily Chart

The potentially most exciting chart comes from the US Banking Sector which is very close to breaking higher technically with a target of ~20% further gains. This sounds a large rally but just consider the gains which the local resources sector has enjoyed this year when it played catch up.

S&P500 Banking Sector Monthly Chart

Summary

Two clear take outs from today's report:

1. SUN is preferred stock in the insurance sector.

2. We prefer banks to insurance companies at current levels.

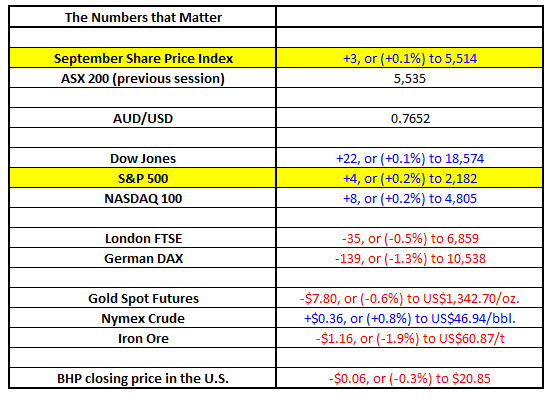

Overnight Market Matters Wrap

- The US markets finished marginally higher with the Dow up 22 points (+0.1%) to 18,574, whilst the S&P500 closed up 4 points (+0.2%) at 2,182.

- The market had time to digest the last Fed meeting minutes, which was released. Some voting members seem to think that an increase in rates will happen soon, but they still need further economic updates to confirm. At present, the probability for a rate rise in the next 2 months is only 22%.

- Oil continued to push higher, with Crude finishing up 36c (+0.8%) to US46.94/bbl. Some reports were quoted as saying that they feared that Saudi Arabia could continue to ramp up production, even though there were reports late last week that they were working towards fixing production outputs. The weekly release of domestic supply helped the positive sentiment with an unexpected decrease of inventories last week. Supply dropped by 2.5m barrels, much better than the expected increase of 522m/bbl.

- Iron Ore took a breather last night with the price dropping US$1.16 (-1.9%) to US$60.87/t.

- The ASX 200 is expected to open 17 points higher this morning, near the 5,552 level as indicated by the September SPI Futures this morning. Note it is August Index Options expiry this morning, so expect volatility this morning.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 18/08/2016. 9:00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here