Market Matters Morning Report Thursday 15th September 2016

Reviewing 3 stocks we've been negative

Investing successfully is about both picking winners and avoiding bad losers. Obviously, not all of our current portfolio is currently unfolding as desired, but it's been a tough few weeks for many - even Warren Buffett lost $US1.4bn in one day this week, with bank Wells Fargo. However, we have been negative a number of stocks / sectors, which have fallen aggressively over recent weeks. Hence, we felt revisiting 3 of these stocks to assess whether remaining bearish at current levels would give a strong indication as to whether the overall market is likely to fall further medium-term.

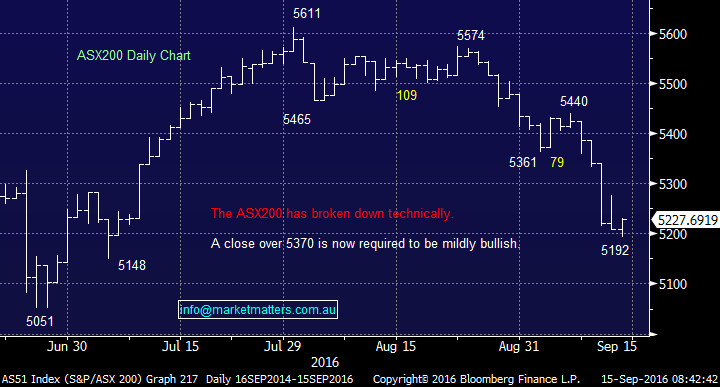

Technically, the ASX200 looks to have found some initial support just under 5200 and a few days consolidation up towards 5275 would be our preferred short-term scenario, followed by further weakness. If this minor recovery unfolds, we are likely to increase our cash position.

ASX200 Daily Chart

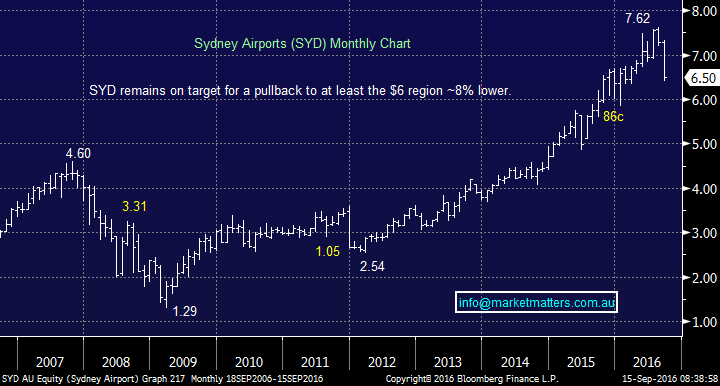

We have been negative quasi-bond like stocks that investors have flocked to over recent times, in the hunt for yield with interest rates falling to historic low levels. Sydney Airports (SYD) fits this description, perfectly being considered by investors as a stable dividend paying stock - current yield 4.3% unfranked. However, the stock has tripled since 2011, as investors became very comfortable with the style of investment - it feels very similar to the complacency with the banks in 2015.

Overall, the business is growing steadily with earnings up by 9.7% in 1H16 – which largely reflects a full six months of ownership of Terminal 3 (previously owned by QANTAS), and strong growth in international passenger numbers (+9.4% for the period). We believe that trend will continue as tourism looks set to improve for Australia as the $A weakens and the Chinese continue to travel overseas. The question is as always, at what price does the stock represent good value?

Even though SYD has fallen 16% to-date, our target for the correction remains ~ $6 level or 7-8% lower.

Sydney Airports (SYD) Monthly Chart

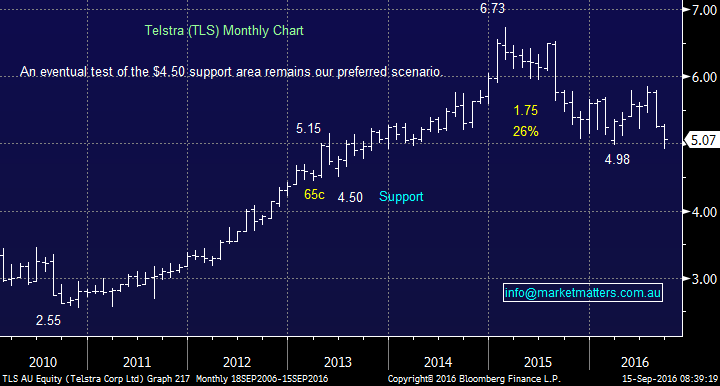

Telstra (TLS) has been the big go-to for many retail investors over recent years, but the stock has been a huge value trap. The business is simply performing poorly on most levels – with earnings being artificially inflated by one-off NBN payments. Although the BIG one off payments seem impressive, it will come down to Telstra’s ability to reinvest those payments, given they lose $2bn-$3bn of re-occurring earnings over the next 3-3.5 years. The dividend is clearly still attractive with the stock yielding 6.11% fully franked – however, dividends are useless if capital is being eroded.

Although TLS has already fallen over 26% from its 2015 highs, our target remains the $4.50 area, or ~10% lower.

Telstra (TLS) Monthly Chart

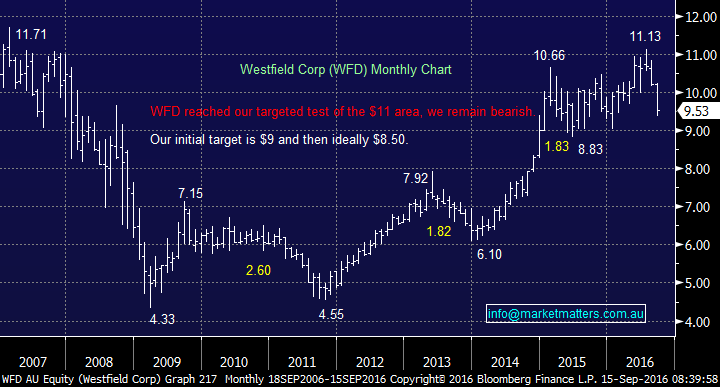

The threat of higher interest rates is traditionally bad news for the REIT's sector and while our belief has been that this is on the horizon, the market has suddenly become fixated on it over the last week. Westfield Group (WFD) is a major player in the REIT space and it generated major sell signals, which we flagged in a number of reports back in July.

WFD has fallen 15.8% in a few weeks but our target remains at least 5% lower.

Westfield Group (WFD) Monthly Chart

Summary

Although all 3 stocks that we have been negative have fallen significantly, they remain bearish implying strongly that the ASX200 has topped out and lower prices lie ahead...

Overnight Market Matters Wrap

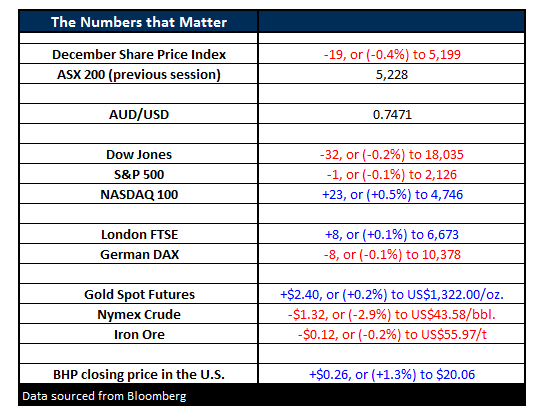

- The Dow finished the day in the red after trading as much as 96 points higher, with oil weighing on the markets. The Dow closed down 32 points (-0.2%) at 18,034, whilst the S&P500 was virtually unchanged at 2,126, after trading as high as 2,141.

- As mentioned, the energy prices continue to be the major catalyst, even though the news that large weekly builds of petroleum were offset by a surprising draw down in crude supplies. The US Energy Information Administration reported that crude inventories fell 559,000 barrels when analysts were expecting an increase of 3.8m barrels. Disappointingly, though, were the distillates, with inventories increasing by 4.6m barrels vs experts’ anticipation an increase of only 1.5m barrels. Crude oil finished down US$1.32 (-3%) to US$43.58/bbl.

- Iron Ore settled down last night, after a weak night the previous session. The metal closed down just $0.12 (-0.2%) to US$55.97/t. BHP had a better session in the US with the stock closing at an equivalent $20.05 – 1.3% higher from Australia’s previous close.

- The ASX 200 is expected to open slightly weaker by 9 points this morning, with the December SPI Futures, indicating a test of the 5220 level. *NOTE THAT THE SEPTEMBER INDEX OPTIONS EXPIRY THIS MORNING, VOLATILITY IS EXPECTED*

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 15/09/2016. 9:00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.

To unsubscribe.Click Here