Market Matters Morning Report Monday 5th September 2016

Subscribers questions for today

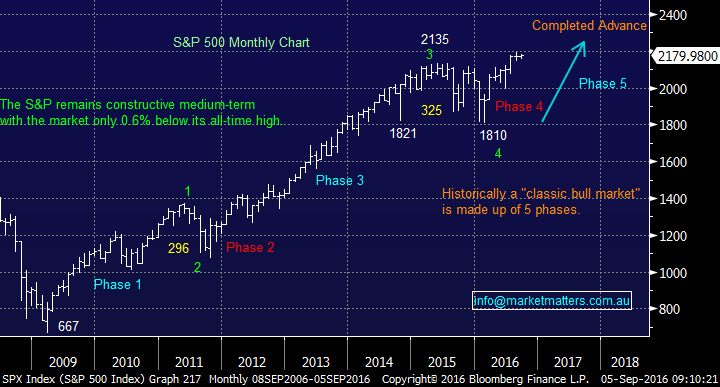

This week’s volume of questions has been simply awesome, very much appreciated those that made the effort - please keep them coming! As we have reiterated numerous times, it’s our opinion that global stock markets are completing a 7-year advance and will soon be entering the correction phase which is fraught with pitfalls hence it's important to have a solid understanding of all potential scenarios going forward.

Recently we have improved the afternoon report and introduced the question format for Mondays on the back of subscriber feedback. As always, we’re here to provide a valuable service to our subscribers and we’ll always take on board your ‘constructive’ comments. So, if you have any further suggestions, things you’d like to see, we will certainly consider them – please send them through.

Question 1

"Hi, I'm wondering you can explain a bit more about short stocks that you described below. If I understand correctly traders sell stocks they don't own therefore shorting the stock hoping that the stock will fall In price therefore buying this back at a profit. By shorting it will cause more selling pressure so shorting have the self-fulfilling result of lowering the stock price. However shorted stocks are usually weaker companies otherwise if the prices rise instead traders would be at a loss. Am I right? So that's why as you said Bellamy's is a mystery. So Myers having risen from significant and with 16% short is vulnerable. So if you own this stock what should you do?" Thanks Kenneth

Morning Kenneth, a great question.

As a concept, the thought of selling something you do not own often confuses investors. These "shorters" actually borrow stock from large institutions, for which they pay a few percent interest, to enable them to sell the stock into the market - it's all real stock that's changing hands. Professional investors generally make money otherwise they would not exist but it's when they make mistakes that fireworks can occur as they scramble to buy their positions back.

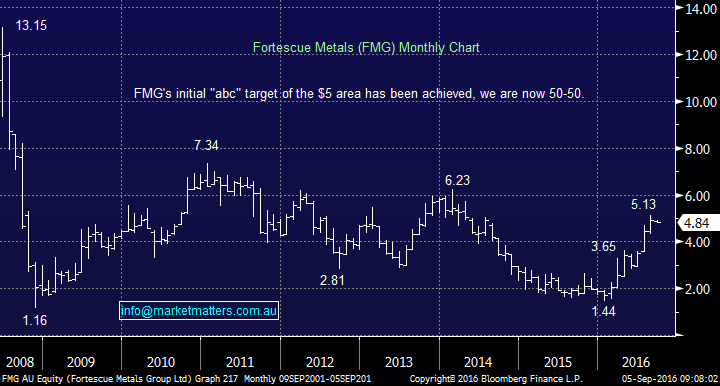

Your insights above are relatively close, however, there are 2-sides to a coin. Short selling may depress a stock's price over a period but when these shorts are bought back it will have the opposite impact amplifying the buying of a stock. For instance, there are natural buyers of the stock plus those that are buying back stock to cover their shorts. Remember how fast FMG recovered this year, it had a huge short position coming into 2016 due to debt concerns but management addressed them exceptionally well leading to "pain" for shorts that were late to the party.

Professional investors / traders short sell stocks for a number of different reasons e.g.

1. They may believe the company is in trouble and hence is going down.

2. The stock has run too fast, becoming over-valued and a pullback appears likely

3. It's the weakest stock in the sector, for example, they may buy Wesfarmers and sell Woolworths searching for relative performance.

NB Bellamys (BAL) that you mentioned has corrected over 47% at one stage this year which sounds like point 2.

We like to be aware of increasing / decreasing short positions for all the reasons mentioned above as a large short position can skew the size of a potential move when it starts to unravel, however, the level of shorts in isolation will not have a huge influence on whether we buy / sell a stock, it’s simply another piece of the puzzle we like to monitor.

Fortescue Metals (FMG) Monthly Chart

Question 2

"On Monday, could you please give some more detail / data on why you prefer Newcrest as the GOLD punt. " thanks Doug

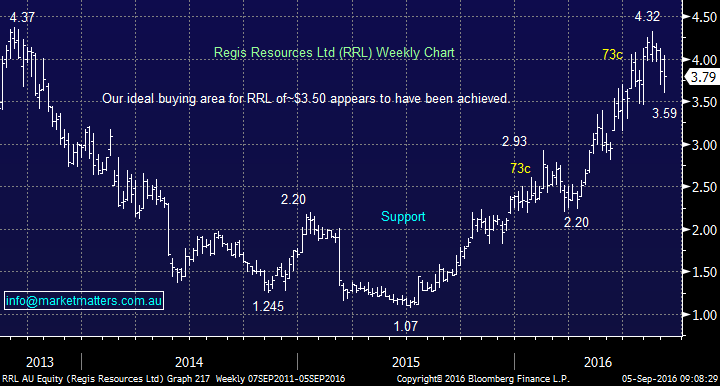

Hi Doug, the simple answer is we don't. We’ve preferred to be active in Regis Resources (RRL) stock over recent times as in general terms, we think it’s a quality mid-cap gold company that trades on a reasonable valuation (relative to future production/earnings). In terms of their ‘relativeappeal’ both stocks have had a big run-up in price.

Newcrest, for instance, is up almost 70% over the last 12 months while Regis has put on around 75%. Newcrest however still trades at a large discount to its book value while Regis is less so – but still a discount (about 0.75. of book). Newcrest is your large cap liquid gold play on the ASX so attracts more of the ‘big money’ that floats in an out of the gold trade. For this reason, NCM typically outperforms the gold price when the gold price is rallying, and underperforms when the gold price is falling. In the most recent pullback, Newcrest dropped around 12% while Regis was down 9% versus Gold which declined around 5%.

We’re active investors / traders, and we think Gold is an asset class that needs this approach. Currently we have low cash levels, hence would need to sell something to buy RRL – instead – we prefer at this juncture to consider an option position in Newcrest given the option market is more liquid for NCM than RRL.

That said, if we were purely buying stock our likely choice would be Regis Resources (RRL).

Regis Resources Weekly Chart

Question 3

"Hi guys, Just a quick question for you. I am sitting on 30% cash levels going into September (have been for two months) and trying to determine when and if to deploy the extra cash for any growth. Noting the particular position of the market (post reporting) and the high valuation of the US and potential interest rate arising would you be investing more if you had increased cash levels or just waiting?" Thanks Peter

Hi Peter, We cannot give personal advice but the risk / reward the market is currently offering does not seem overly compelling. As you may know, the Market Matters portfolio is 96.5% invested which felt too high last week. As we’ve been suggesting for some time, we are in overall sell mode, and will be keen to go towards higher cash levels – something around 25% - into meaningful strength. In generalterms we like your current position until we see more constructive price action for the Australian market – and better risk / reward prevails.

US S&P500 Monthly Chart

Question 4

"Hi, What is Market Matters' current view on Lithium stocks particularly ORE, PLS & GXY?" Regards, Wayne.

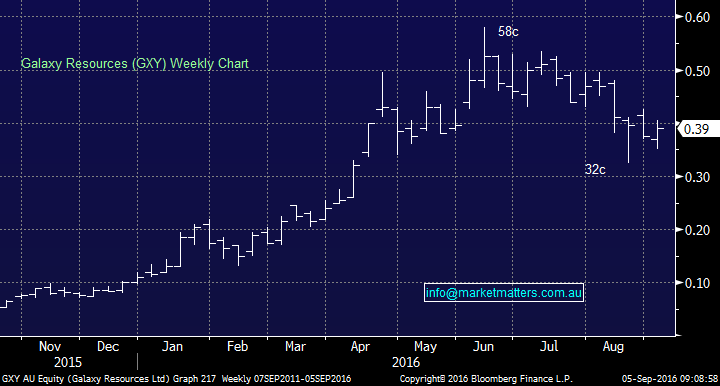

Hi Wayne, We have not invested in this space and the fundamental picture right now is fairly complex, but we’re happy to give you a snapshot of our technical view on these 3 stocks.

1. Orocobre Ltd (ORE) $3.73 - The stock is correcting from the $5 resistance area, we could be buyers ~$3.50 with stops under $3.

2. Pilbara Minerals (PLS) 56c - We are neutral with no opinion.

3. Galaxy Resources (GXY) 39c - A small stock but good risk reward buying here with stops at 34c which should be raised if the stock broke over 45c.

Galaxy Resources (GXY) Weekly Chart

Overnight Market Matters Wrap

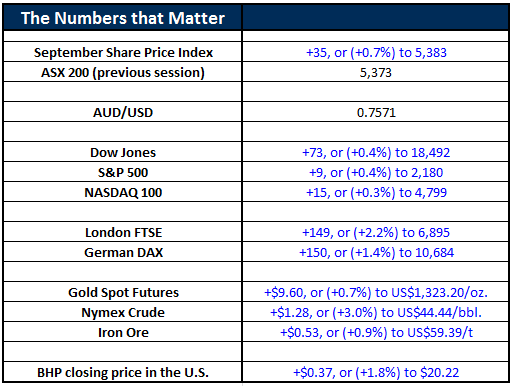

- The US share market rallied slightly last Friday, as investors saw the job numbers less than expected and ‘book squaring’ ahead of their long weekend, in celebration for Labor Day.

- The Dow closed 73 points higher (0.4%) at 18 491, while the broader S&P 500 closed 9 points higher (+0.4%) at 4,798.

- The volatility index dropped 11% to settle at 11.98 after the job data, while commodities gained, particularly oil, rallying 3% to US$44.44/bbl.

- The strength of both Oil and Iron Ore last Friday, had BHP in the US, rally an equivalent of 1.8% higher to $20.22 from Australia’s previous close.

- The ASX 200 is expected to open down this morning just 9 points, testing the 5,407 level as indicated by the September SPI Futures this morning.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 5/09/2016. 9:00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.

To unsubscribe. Click Here