Market Matters Morning Report Monday 22nd August 2016

Subscribers questions - as the ASX200 tracks sideways

We are loving the feedback around our Monday morning "Q & A" report format and continue to urge readers to keep the questions coming - please do not take offence if yours is not covered, as we are receiving a great response to this segment. Hopefully, the below 5 questions / answers prove useful to all.

Question 1: "Hi MM, Can you give me an outline of your thoughts on Health Sector Stocks, including Ramsay Healthcare, ResMed, and Sonic." - Thanks, John D.

Answer: Hi John, A very topical question after some volatile swings within the sector. The Healthcare Sector has enjoyed an excellent 8-year advance, but this leads to stocks trading on hefty valuations. Hence, when they report only average to good, the stocks often come under pressure.

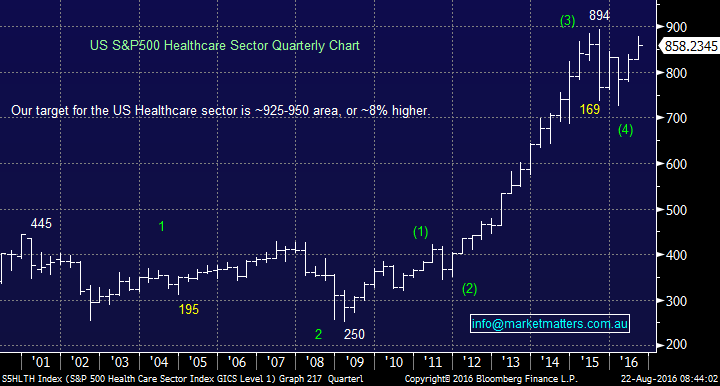

The US Healthcare Index is one of the clearest to us at present, pointing a further 7-8 % gain, before a decent correction. With this, we remain short-term comfortable the local Healthcare Sector overall - there is a historically strong correlation between the Australian and US health stocks.

US S&P500 Healthcare Sector Quarterly Chart

Now moving onto the 3 specific stocks mentioned:

1. Ramsay Healthcare (RHC) $74.92 - After reassessing RHC this morning, we are now cautious the stock and would run stops under $73. In the bigger picture, we do eventually see the stock back under $60. The main variable for RHC (and other hospital operators) stems from pricing pressure coming from the health insurers. Medibank reported last week (and was hit hard on weak guidance) while NIB has just dropped with their results (and reported a relatively good number), however, policyholder growth is the weakest in a decade at ~1%, and participation rates are falling as affordability issues become more evident. Participation rates across the industry have fallen around 0.5% - which makes life tough for the insurers and will, in turn, will put pricing pressure on the healthcare providers like RHC.

2. Resmed (RMD) $9.10 - Short-term, the stock looks technically bullish targeting over $10; we would run stops under $8.40. They reported Q416 results earlier this month which showed a strong finish to FY16 and management are positive of the near-term growth prospects, guiding to high single digits and a strategy to take further market share on top. It’s expensive trading on 26 times forward and relative to single digit growth, best to stay close to the door in our view.

3. Sonic Healthcare (SHL) $23.19 - SHL remains technically bullish, targeting $25. We would run stops under $22. The reported recently and the result was well ahead of expectations however it was supported by acquisitions and positive currency translation – therefore, the underlying ‘beat’ was of poor quality – but a beat non-the-less. The biggest risk in this stock (and the stocks above for that matter) is around changing regulation. For instance, changes to Medicare in the US will take 20% of SHL revenues in CY18…

Question 2: "Your Weekend Report often talks about an "ABC" target which I do not understand what it is? Can you tell me more about it." Thanks, Donald K.

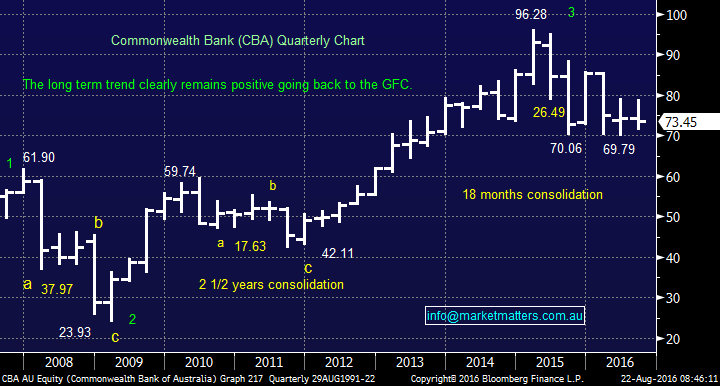

Answer: We use "ABC" retracement targets as a method to gain good risk / reward entry into a market or stock. As we often mention, market characteristics often repeat themselves both on a statistical and visual pattern level. An "ABC" retracement is a pattern pullback within a trend, the below quarterly chart for CBA gives 2 great examples that we will use to clarify the method:

1. CBA corrected from $61.90 in 2007 to $36.82, a $25.08 fall. It then bounced $37.97 before falling for a second time this time to $23.93, a $22.56 fall. These two falls are within ~10% of each other creating visual symmetry. Some investors would then buy CBA when it rallies back up through the "a" point; we tend to start "fishing" around a projected "c" point assuming we like the stock close i.e. an equal $ fall in the stock for the second time.

2. We had a similar "ABC" style correction in 2010 from $59.74, the first leg down to "a" being $12.90 and leg "b-c" being $13.42. Only a 4% difference in the magnitude of the two retracement legs!

Commonwealth Bank (CBA) Quarterly Chart

Question 3: "Curious on your thoughts for SPO which is trading at a discount to DCF before it reports next week" Peter W.

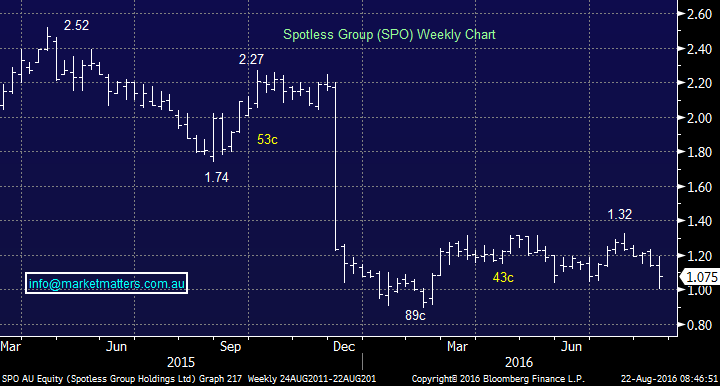

Answer: Sorry Peter that we did not answer your question before their report, which obviously was taken poorly by the market. Short-term, the stock is tricky, but there remains the feeling of inevitability that the stock will test new recent lows in the 80c region.

Looking at Spotless Group (SPO) fundamentally, the metrics look reasonable. Low PE (9), high return on equity (19%), good forecast dividend yield (7.9%), however, it’s a low margin business (EBIT margin of 4.9%). It locks itself into contracts that can turn out to be duds – and continue to hamper performance for many years to come. SPO have a few of these at the moment. SPO is currently priced for further earnings disappointments, unfortunately, however, there is a silver lining. Markets often get too bearish on stocks and another test of that 89c region (and preferably a drop below) could get us interested in this.

Spotless Group (SPO) Weekly Chart

Question 4: "Do you guys have an opinion on Scentre Group (SCG), another newsletter, has it as a buy?" Colin B.

Answer: Morning Colin, Scentre Group (SCG) is not a stock we look at often, so thanks for the nudge. Firstly SCG $5.04 is a property stock that has enjoyed strong share price appreciation over the past few years as a combination of low-interest rates, and reasonable earnings growth have combined. As we’ve written numerous times recently, we don’t like property stocks at this juncture given the impact of higher (eventual) interest rates.

Technically, as the stock was only formed in 2014 (post the spin out from Westfield), there is limited technical indicators to work from. Fresh highs towards $5.50 would not surprise, but we would be taking profits there, stops should be run under $4.80.

Question 5: "What is MM current opinion regarding Redflow (RFX)" Nathan VD.

Answer: Hi Nathan, RFX 40c is another stock we do not follow closely, but it's clearly comfortable moving 15% per week. Hence, one for the traders. Unfortunately, we see no technical risk / reward opportunities in the stock after the recent 40% decline and would be looking elsewhere for excitement.

Overnight Market Matters Wrap

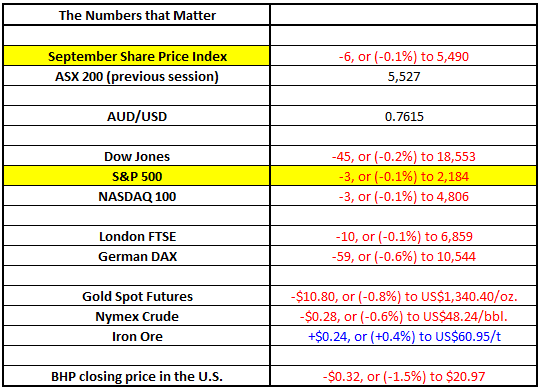

- The US share market closed marginally lower last Friday, as investors revaluate their interest rate bets, and see a rise likely to be in December.

- The Dow closed 45 points lower (-0.2%) at 18,553, while the broader S&P 500 closed 3 points lower (-0.1%) at 2,184.

- Gold futures ended lower, down 0.8% to US$1,340.40/oz. while Oil had a breather, down 0.6% lower to US$48.24/bbl.

- Domestically, focus remains on corporate earnings, with Bluescope Steel (BSL), Fortescue Metals (FMG), GBST Holdings (GBT), GWA, Japara Healthcare (JHC), NIB Holdings (NHF), Northern Star (NST), Seek (SEK) and UGL.

- The ASX 200 is expected to open with little change this morning, testing the 5,530 level as indicated by the September SPI Futures this morning.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 22/08/2016. 9:00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here