Market Matters Morning Report Monday 26th September 2016

Subscribers questions for today.

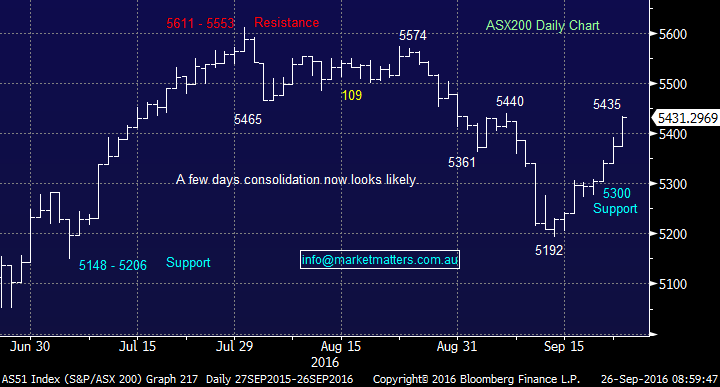

After a strong week it will be interesting to see if the local market can hold firm after a 0.7% pullback by the Dow on Friday night. Our view is the ASX200 will spend a few days consolidating its recent gains around / above the pivotal 5400 area prior to continuing with its current advance.

With the major central bank news now a memory and the US election / Italian referendums a few weeks away markets are likely to go back to good old-fashioned supply and demand. Who will be the more dominant force - the underweight / negative fund managers trying to top up holdings or investors using this current 200-point rally to sell positions that were scary only a few days ago?

ASX200 Daily Chart

Question 1

"Your overweight banks call has been playing out well over recent weeks but what is your plan from here and which bank, or banks, are you likely to sell first?" - Steve.

The banks are the single largest factor why we are positive equities over the short-term. Statistically, October is an excellent month for our banking sector. For example, the worst performance over the last 5-years from CBA, our largest bank / stock was +3.4%. If the banking sector is going to rally over 3% in October the ASX200 should enjoy a decent time.

We are holding : ANZ, BEN, CBA and WBC for a substantial 40% portfolio weighting. If we include Suncorp (SUN), this ticks up to 52%. Clearly this is an aggressive stance, however, we’re high conviction in our approach and we back our views accordingly.

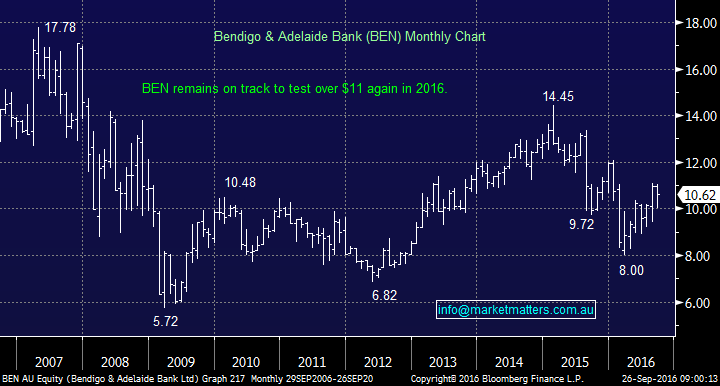

The two holdings we are most likely to trim at this point in time are Bendigo and / or Westpac - please note we have not yet held BEN for 45 days so there are ramifications around franking credits from the recent dividend which must be taken into consideration.

Our current targets are BEN ~$11.25 and WBC ~$32.20.

Bendigo Bank (BEN) Monthly Chart

Westpac Bank (WBC) Weekly Chart

Question 2

"Could you update your view on oil with the upcoming meeting this week, the volatility feels scary to me" - Peter.

Morning Peter, The news flow around the oil price feels to be consistently flowing - excuse the pun and this is typical in Oil. There are so many economic, geo-political, military occurrences that impact Oil in the short term, that we feel it’s better to look at price action (technical indicators) with this one rather than understand / decipher the generally self-interest rhetoric that dominates the news.

This week's informal meetings in Algiers may produce some clear development around production but in our view this is unlikely. Importantly analysts are currently forecasting an average oil price of $46.84 for Q3 2016 and $55.88 in 2017, significant movements with these numbers (guesses!) will have an impact on energy stocks.

Technically crude looks poised for a strong rally if it can break over last week's high, at this point in time we are neutral / bullish but our "gut feel" is bullish oil.

Crude Oil Weekly Chart

Question 3

"Re CAPILANO HONEY : I am not sure if you are aware of the potential issues/problems facing Capilano Honey. I strongly recommend you read the article I have attached to this email...together with the references within the article to Capilano Honey which will more fully explain the situation being faced by that company. After reading these articles you may wish to change your attitude towards Capilano if only as the sweet taste in your mouth would have soured.

Seriously....I cannot see how you can continue to believe Capilano is a potential buy." - Cheers

David.

https://kangaroocourtofaustralia.com/2016/09/25/channel-seven-capilano-honey-and-addisons-lawyers-involved-in-judicial-favours-scam/

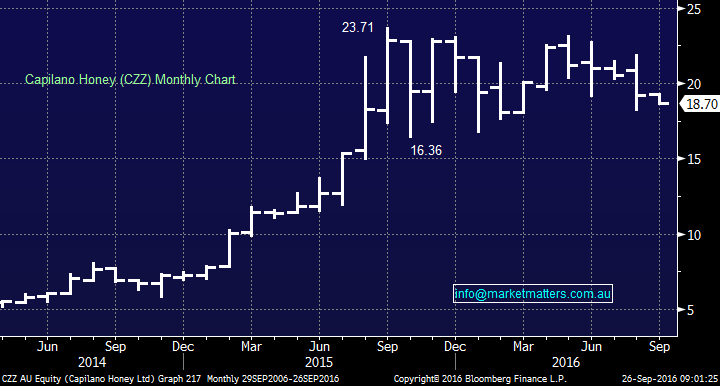

Morning David, an interesting read and obviously investors never like to see stocks they like / own involved with legal situations - there are rarely many winners. In this instance, the claims made in the article are fairly severe and it’s not surprising to see them aggressively defended by the company. At this point in time it’s very difficult to get a gauge on whether or not the claims have merit, however that’s usually beside the point. The company and its 18% shareholder (Seven Group) should defend these claims given their potential for damage.

Our view has been to accumulate CZZ between $18-19 which has only just been possible over recent weeks given recent weakness in the share price. On Friday the stocks had an 18.70 close 0 which is up from the recent low of $18.15 - investors are probably ahead at this juncture.

If we were a holder we could see a strong case to walk away from this stock as any legal news / uncertainty is generally a negative or alternatively lower the buying area to under $17 in case news does become "soured" leading to a 10% fall. CZZ does still have a good footprint into China which was our reason to look at the stock.

Capilano Honey (CZZ) Monthly Chart

Question 4

"Any informed thoughts on (this might be a useful inclusion in a Monday morning subscriber questions review) Nanosonics (NAN) and Naos Emerging Opportunities (NCC)" - Robert.

Hi Robert, these are not stocks we follow closely but some quick thoughts are below:

Simply put, Nanosonics (NAN) is involved in developing technology for infection control, and in their last set of result (August) they reported very strong sales growth – particularly from their North American operation and announced their maiden full year profit – which was $122k. Small however it beats a loss of -$5.5m from the previous year and gives us confidence that NAN has gone from a capital intensive hopeful to the real deal. Furthermore, success in North America and positive regulatory developments in Europe should open up new markets for their ‘trophon technology’. This is a very good mid cap company ($1bn mkt cap) with a strong platform for future growth.

Technically NAN looks excellent, buy the next 50c pullback.

Nanosonics (NAN) Monthly Chart

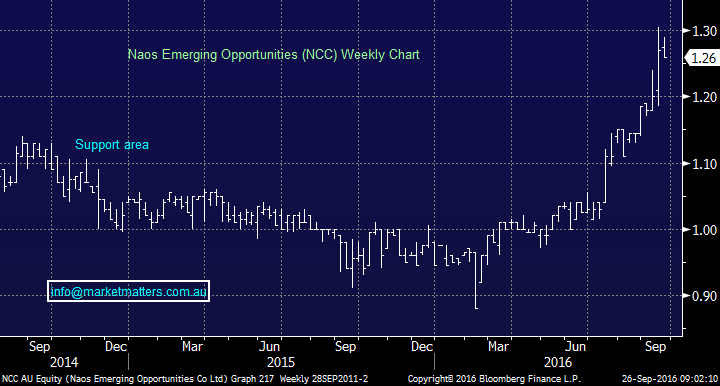

NCC is an emerging opportunities fund within Australia looking at companies outside of the top 100. A good idea for people that are time / expertise poor.

The stock trades at $1.26 with a post tax NTA of $1.28. NTA = Net Tangible Assets or in other words, the value of their holdings. When buying a fund like this, try to BUY at a discount to their asset base – which makes sense. Right now, NCC trades at a very slight discount so represents reasonable entry price.

Technically the stock looks solid with stops under $1.10. For entry, use NTA as a guide.

Naos Emerging Opportunities (NCC) Weekly Chart

Overnight Market Matters Wrap

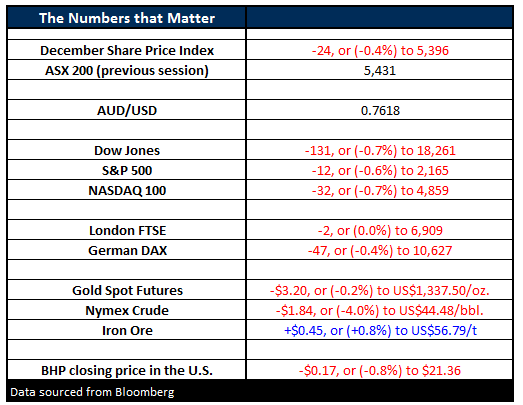

- The US markets finished Friday’s session down on the day, with the Dow down 131 points (-0.7%) to 18,261, whilst the S&P500 finished down slightly better, down 12 points (-0.6%) to 2,165. For the week however, the Dow managed a healthy 137 point gain or (+0.76%) and the S&P500 up an impressive 25 points (+1.2%).

- Once again energy stocks were the major cause, with the talks between OPEC members due on Monday in Algeria unlikely to see any agreement on cutting or capping in production. Crude finished down US$1.84 (-4%) to US$44.48/bbl. For the week oil managed a gain of 86c or +2%.

- Iron Ore managed a gain on the day and for the week, rising 45c on Friday (+0.8%) and for the week 80c +1.4% to close at US$56.79/t.

- The December SPI Futures is indicating the ASX 200 will open down 16 points to test the 5,415 area this morning.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 26/09/2016. 9:00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.

To unsubscribe.Click Here