Market Matters Morning Report Friday 7th October 2016

Market Matters Morning Report Friday 7th October 2016

Gold or oil moving forward?

So far 2016 has been the year of the resource sector with stocks surging from an aggressively oversold position e.g. BHP +29%, RIO +17%, NCM +61% and Santos +8.7%. However there has been some enormous volatility within the various sub components of the broader resource arena that these stats do not do justice. This morning we await the US employment data tonight which will almost definitely determine the short-term direction for the $US, which is highly correlated to commodity prices. Hence we thought it was an ideal time to update our overall view of resources with stocks around 9-months into their recovery from an aggressive 2-year sell off.

Please note we remain of the belief that the resources sector is a short-term investing / trading vehicle due to the dependency on the underlying commodity prices to determine profitability e.g. we recently enjoyed a +40% return from an option position in RIO over a few days.

Gold v Oil

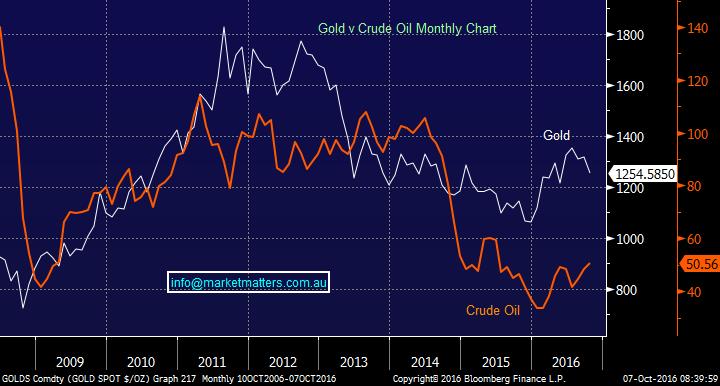

Different commodities often have a high correlation given they’re all priced in $US with oil and gold often tracking each other very closely. Since 2015 this correlation has become very stretched and it's our opinion that over the next year this gap will close i.e. buy oil and sell gold.

Gold v Crude Oil Monthly Chart

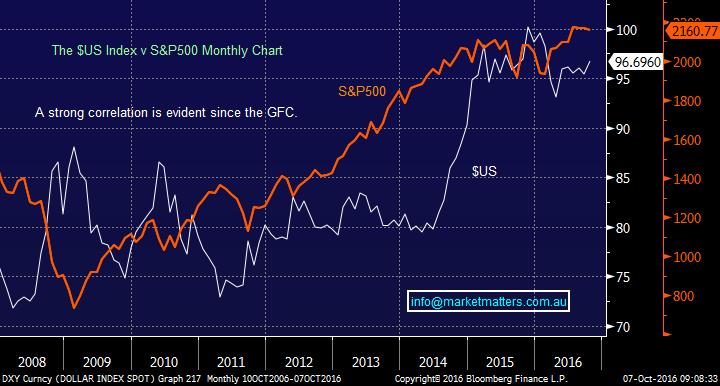

The $US

In many ways the $US is the key to commodity prices, and hence resource stocks moving forward. If we have more strong US economic data and rate rises for the US become more accepted by investors the $US should rally putting some pressurce on commodity prices. Conversely a weak number tonight and gold could easily jump $US40/oz!

Our view is the $US is headed to fresh recent highs ~6% higher prior to a significant decline. If we are correct this will put pressure on commodity prices and our resource stocks in the short term, hence our call recently to sell BHP and look for a lower entry in the weeks / months ahead.

$US Index Monthly Chart

What is also interesting is the recent strong correlation between the $US Index and the S&P500. If we are correct that the $US rises ~6% it implies that US stocks will also remain firm which is our short-term view.

$US Index v S&P500 Monthly Chart

Crude Oil

Crude Oil looks extremely strong after recent developments around Saudi Arabia as well as lower than forcast inventories. We remain bullish crude oil targeting ~$US60/barrel.

This is another great example of stocks getting ahead of themselves in both directions e.g. Crude Oil is now only 2% below its high of 2016 but stocks like Santos and Origin are ~20% and 10% respectively below their highs earlier in the year. The lesson is do not be afraid to take profit when everbody else is buying and vice versa.

We still hold ORG with a target ~15% higher

Crude Oil Monthly Chart

Gold

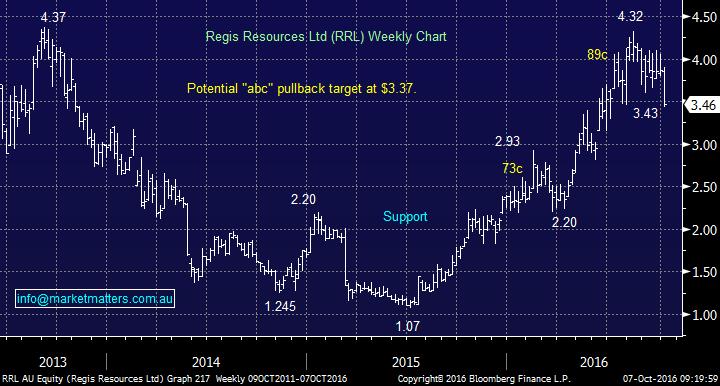

Local gold stocks have enjoyed a strong 2016 as we mentioned NCM is up over 60% for the year but it has also fallen 24% since its July high. Our concern for the gold sector over coming months is our bullish view on the $US.

Regis Resources (RRL) is our preferred stock in the sector and it has currently corrected ~20% from its 2016 high. For the gold bulls out there we could buy RRL under $3.40 with stops under $2.90 - we will not take this trade due to our view on the $US.

We are long IGO which has significant gold exposure but it also has significant nickel production coming on line and nickel is enjoying a great 2016 - we still may cut this IGO position early.

Regis Resources (RRL) Weekly Chart

Iron Ore

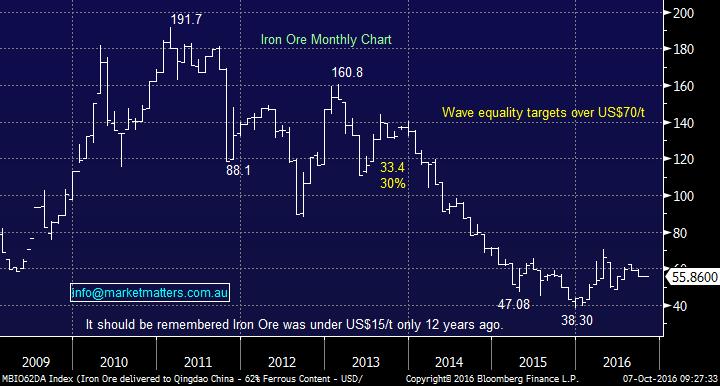

We remain neutral to negative iron ore moving forward.

Iron Ore Monthly Chart

Summary

We are wary the resources sector, except energy, moving forward due to our bullish $US view, specifically:

1. We are bullish crude oil targeting ~$US60/barrel.

2. While we are 50-50 gold right here there are no buy signals.

3. We remain neutral - negative iron ore.

Overnight Market Matters Wrap

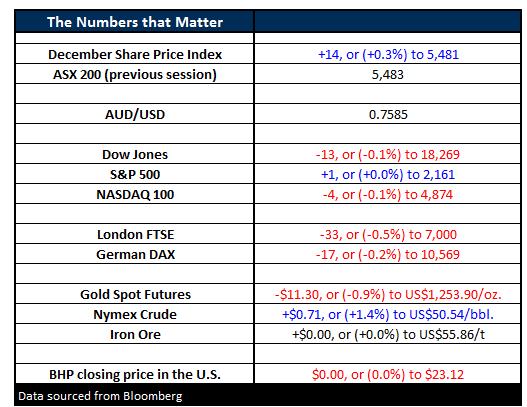

- The US markets finished flat last night, with the looming US jobs number due tonight our time. The Dow closed down 13 points at 18,268, while the S&P500 finished up just 1 point to 2,161.

- As mentioned, the all-important Non-Farm Payrolls number is due tonight before the US market opens. A Reuters conducted poll of economists predicts an increase of 171,000 new jobs to be added.

- On the energy front, Crude finished above the US$50.00 level for the first time since June to US$50.54/bbl, which was up 71c (+1.4%) on the day.

- Iron Ore remains closed in Asia due to a holiday, with BHP expected to open with little change this morning, with a positive bias.

- The December SPI Futures is indicating the ASX 200 to open marginally higher this morning, testing the 5,500 area.