Market Matters Morning Report Friday 30th September 2016

The ECB need to step up now

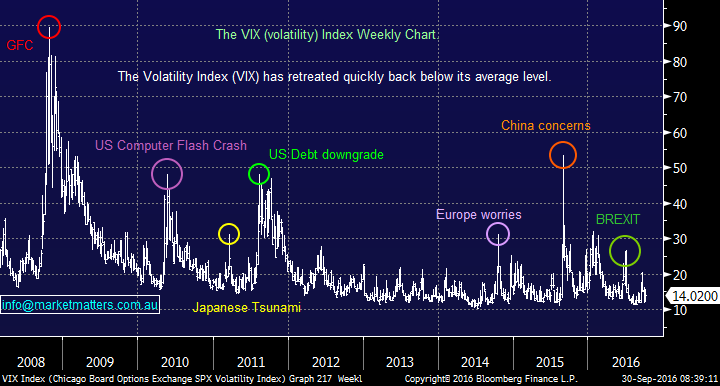

Last night, stocks tumbled 1% in the US on further concerns around Deutsche Bank after rallying strongly in the previous session on the OPEC decision to reduce production. Stock markets are commonly driven by one main theme for a period of time before moving onto the next topic to focus on and often worry about. The VIX (volatility Index) is an excellent way to identify these increased periods of uncertainty for stocks, we have experienced 3 events that pushed the VIX over 20% in 2016 - China/oil concerns in January, BREXIT and the recent 400-point plunge by the Dow on concerns around US interest rates. On the horizon, we have elections in the US and Italy.

While the day to day volatility currently feels high the VIX spending the most of this week around 14% implies strongly investors are currently comfortable with the overall risks for equities.

The VIX (volatility) Weekly Chart

Since the GFC, the European Central Bank (ECB) has driven down interest rates in Europe to unprecedented levels with huge amounts of debt in the region, actually paying a negative yield e.g. German 10-year yields have nose-dived from over 4.5% at the start of the GFC to -0.1168% today. The ECB are now aggressively buying bonds in an attempt to drive down interest rates and stimulate economic growth.

Most investors have enjoyed the fruits of this low- interest rate environment, as assets have increased dramatically in price due to the "free money" phenomenon e.g. Property and shares.

German 10-year Govt. yield Monthly Chart

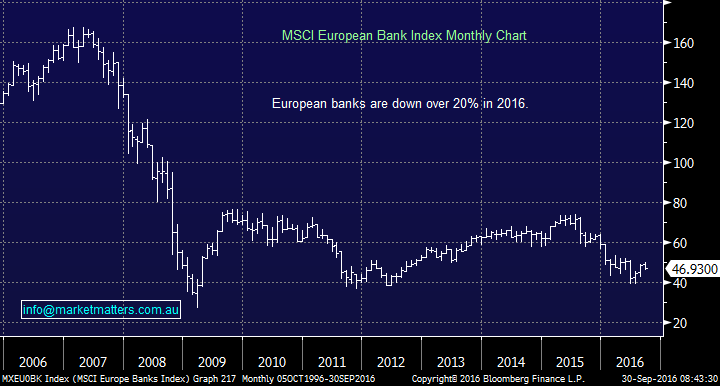

The problem is the path taken by the ECB has been very negative for the earnings of European banks, the MSCI banking index is down over 20% in 2016 alone. Banks can generate higher margins, when interest rates are high – the complete opposite from today. Obviously if rates get too high, bad debts can occur and this has a negative impact on banks profitability. Banks simply borrow short and lend long, which means they benefit as the gap between short and long term rates widen i.e. If I can borrow at 1.2% and lend at 2% I make 0.80%.

However, the ECB are buying bonds of varying maturities, hence also driving down longer-dated interest rates e.g. German 10-yeields are negative!

The core business of banks is to lend money to the corporate, BUT the ECB are basically now performing this function by buying both corporate and government bonds, clearly bad news for banks. However for economies to flourish, we need bank lending on all levels and when banks struggle as they are currently, lending gets tighter. The ECB are harming the one sector it desperately needs to be active to generate the much dreamed about economic growth.

We do not believe the ECB wants to continue buying bonds indefinitely and when they eventually stop / reduce their activities, it will be positive for bank earnings.

MSCI European Banking Index Monthly Chart

When we move onto the hot topic of the morning - Deutsche Bank, all the previous comments apply and probably in a magnified manner. Deutsche Bank's share price has fallen over 50% in 2016 and after a quiet session in Europe, they plunged ~7% in US trade as talks emerged of investors transferring their positions away from the struggling bank.

The goliath German bank is being hit on 3 fronts:

1. The US are looking to impose huge a multi-billion dollar fine over the selling of mortgage backed securities

2. Actions of the ECB are encroaching on its core corporate lending business.

3. Low-interest rates are making the bank less profitable hence making it harder / slower to recover from points 1 & 2.

Our view is the US fine will end up being much lower than the initial demand of $US14bn and the ECB does not want to buy debt indefinitely, which will eventually help all European banks.

Importantly while supporting banks is a political hot potato, if Germany let Deutsche Bank fail, all the hard / expensive work of the ECB since the GFC would be totally wasted.

Deutsche Bank Monthly Chart

Summary

European banks feel very similar today as say BHP did at the start of 2016 - BHP has rallied almost 60% from its lows in January.

We believe European banks as a sector will be much stronger in 12-months’ time.

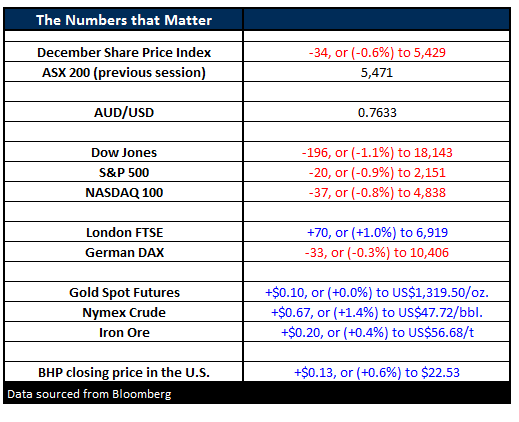

Overnight Market Matters Wrap

- The US markets were sold down last night on concerns regarding Deutsche Bank, as itsUS listed shares went to all-time lows. The Dow closed down 196 points (-1.1%) to 18,143, and the S&P 500 shed 20 points (-0.9%) to 2,151.

- Deutsche Bank shares hit a low of US$11.19 (-9%) and closed at US$11.48,

after Bloomberg reported that 10 Hedge Funds were reducing their exposure to the bank. - Better news for our markets, however, with Base Metals all up in London, Iron Ore managing to keep in the positive at US$56.68/t and Crude continuing to improve, up 67c (+1.4%) to US$47.72/bbl.

- The ASX 200 is expected to open weaker this morning, around the 5,448 level, as indicated by the December SPI Futures.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 30/09/2016. 9:00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.

To unsubscribe.Click Here