Market Matters Morning Report Friday 26th August 2016

The "Bears" are back on the front pages

Normality should return to the stock market next week, as both Janet Yellen's speech at Jackson Hole and the local reporting season will be behind us. Market players are poised to scrutinise the speech when Fed Chair Janet Yellen takes the stage for any clues to the future timing of US rate rises, with the title of her talk "The Federal Reserve's Monetary Toolkit". Currently, markets are pricing in ~50% probability of another rate increase by Christmas - yes, the festive time is again slowly approaching.

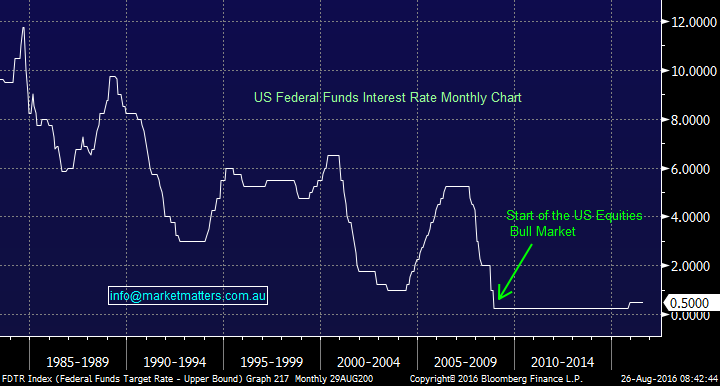

The US Fed raised interest rates for the first time since 2006 by 0.25% last December, taking the new target rate to 0.25-0.5% - they use a target band. Historically, a tightening cycle for US rates comprises of over 20 increases, implying strongly that this is just the beginning. Medium-term investors in equities should not ignore the correlation with the bull market and global interest rates falling to almost zero.

Our view, like many market participants is that Central Banks have reached, or are very close to the end of their monetary policy actions, in an attempt to generate growth and fiscal moves will follow. Simply, the end of super low-interest rates is close and governments may, for example, lower taxes to stimulate spending.

US Fed Funds Rate Monthly Chart

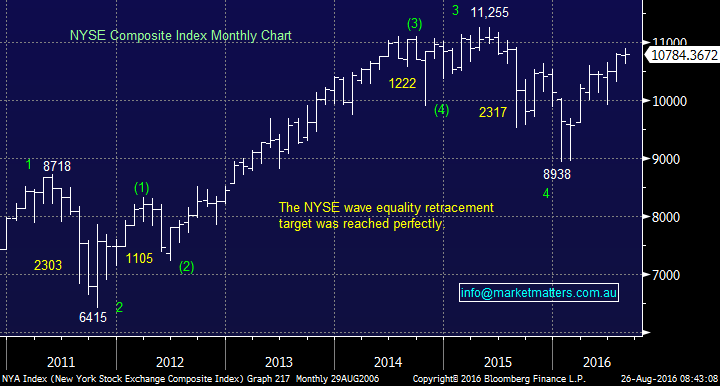

Prominent billionaires, George Soros and Paul Tudor Jones, have gained a lot of press recently due to their large "bearish bets" on stocks, from buying S&P500 put options with a face of over $3bn. Our view remains their view is correct, but they are off in the timing with further upside, likely before a major correction for equities. Fortunately, both of these famous investors have recently been relatively "cold", helping us feel comfortable to have a different skew on our opinion.

NYSE Composite Index Monthly Chart

Yesterday, Woolworths (WOW) announced a $1.2bn loss, but the stock rallied 4% on growth optimism. Overall, the results were ~1% below most analysts’ forecasts, but some green shoots were perceived to be emerging - on a valuation basis, the stock is not cheap. Human nature leads to investors wanting to buy perceived "cheap" stocks, hence after this bounce, we have received numerous emails wondering if WOW is a buy as it still languishes over 35% below its 2014 highs.

Unfortunately, we believe the stock is currently in "no man's land”, with an enormous amount of work required on the ground floor level. Actually, our "gut feel" is the +25% correction in WOW from close to $20, may prove to be a better short-term selling opportunity as opposed to a buying one.

Woolworths (WOW) Weekly Chart

Rival Wesfarmers (WES) also reported this week and again, they matched market expectations. The stock arguably still represents better value than WOW, looking at expectations for 2017.

Technically, we remain mildly bullish WES targeting fresh highs towards the $47 area.

Wesfarmers (WES) Weekly Chart

Summary

Remain patient, we still believe equities have further upside before we press the abandon ship button. Interest rates may well be the key on many levels, but this weekend's comments by Janet Yellen are so highly anticipated, the likelihood is they will be a fizzer!

We remain on the sidelines when it comes to WOW and at current levels, would prefer WES, but currently are happy not to be in either.

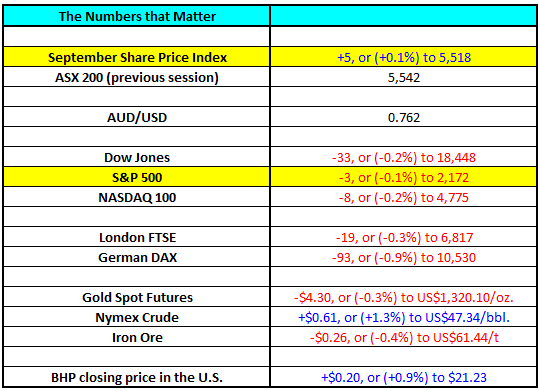

Overnight Market Matters Wrap

- In the US, the Dow finished barely changed, down 33 points (-0.2%) to 18,448 and the S&P500 closed down 3 points at 2,172. The NASDAQ however, which has been powering along, had its first 2-day loss in two months, closing down just 8 points to 4,775.

- A quick summary of last night can be put down to the upcoming speech by Janet Yellen of the Federal Reserve and her speech on the economy due tonight our time. It seems everybody is holding back to see which way

- Oil reversed weakness of Wednesday and rose 61c (+1.3%) to US$47.38/bbl. Traders took the view that the US$ will weaken following the Yellen speech.

- Gold, however, ended towards four-week lows, again traders not willing to commit. The yellow metal closed down US$4.30 (-0.3%) to US$1,320.1/oz.

- The following corporate earnings are due today: APN News & Media (APN) 1H, Coca-Cola Amatil (CCL) 1H, Regis Healthcare (REG) FY, The Star (SGR) FY, Super Retail (SUL) FY

- The ASX 200 is expected to open with little change this morning, around the 5,543 level as indicated by the September SPI Futures this morning.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 26/08/2016. 9:00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here