Market Matters Morning Report Friday 19th August 2016

Looking at 6 of the big movers from yesterday’s results

A distinct lack any fresh and interesting macro news crossing our screens as US equities continue to tread water albeit at record levels. One encouraging statistic from last night, for both our Origin and Woodside positions, was crude oil officially entering a bull market having rallied over 20% during the last 3 weeks - it was only earlier this month that people were talking about crude oil re-entering a bear market highlighting the volatility in this market.

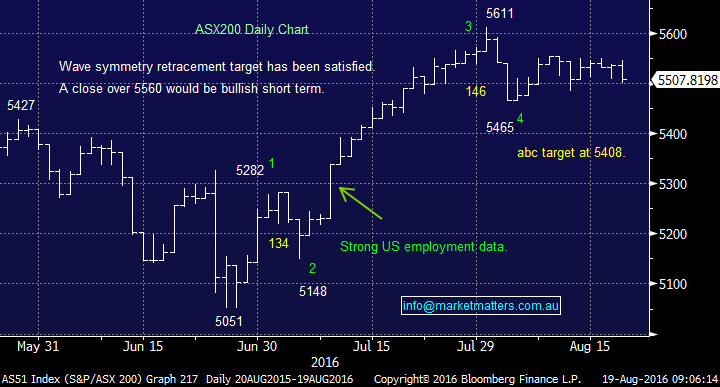

Yesterday’s disappointing 0.5% fall from the ASX200 has led us to tweak our short-term forecast for local equities but we do want to point out that the day-day noise in the market is generally the toughest to interpret. Our preferred scenario is the ASX200 will correct back towards 5400 support prior to further strength, but a close back over 5560 will immediately again turn us bullish. - one for the traders.

ASX200 Daily Chart

While the overall index has felt dormant over recent times there has been some extreme volatility within the market itself as investors are reacting aggressively, in both directions, to news during this reporting season, yesterday was no exception:

Winners - IRESS Ltd (IRE) +9.7%, Treasury Wine (TWE) +11.5% and WebJet (WEB) +20%,

Losers - AMP -4.7%, Origin (ORG) -1.2% and ASX Ltd (ASX) -0.8%

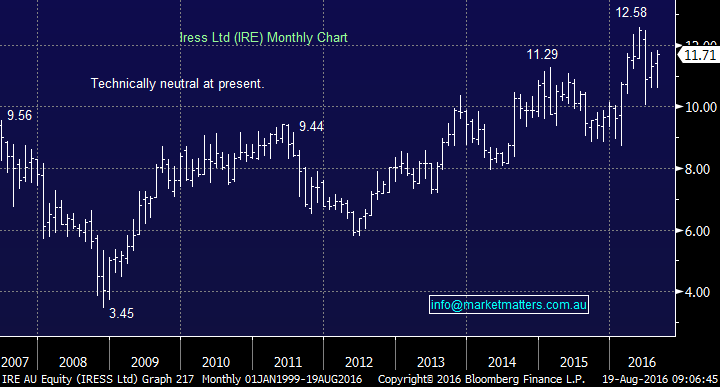

IRESS (IRE) $11.71

IRE rallied strongly after the financial services software provider generated a larger than expected 15% jump in first-half profits. The underlying profit rose to $41.89 million, and they announced a part franked 16c dividend. IRE is benefitting from a change in strategy from GBST (GBT) who are focussing more on international growth. This is clearly a positive for IRE.

Certainly a great result and solid outlook, however overall we are neutral IRE at current levels.

IRESS( IRE) Monthly Chart

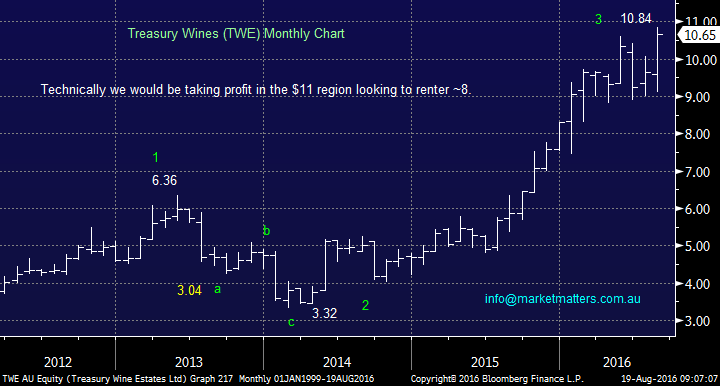

Treasury Wine (TWE) $10.65

Another cracking result for TWE following the successful acquisition of a wine distribution business and strong demand from export markets. Under relatively new CEO Michael Clarke they’ve continued to re-focus attention in the premium market, trimmed down the number of brands they operate under to about 83 to from over 140 (Penfolds, Wolf Blass, Lindaman’s are their key brands) and made some fairly strong comments during the conference call about working hard to strip out costs from the business, and redirect funds into growth. The market liked it and the stock ran hard again.

We think a lot of this positivity is now priced in and this rally provides an excellent opportunity to start taking profits in TWE with a view to buy back in around the $8-9 region.

Treasury Wines (TWE) Monthly Chart

WebJet (WEB) $9.70

WEB shares were the standout of the day surging higher after announcing a $22 million net profit and importantly a strategic partnership with Thomas Cook - now that's directors adding value! This has prompted a string of upgrades from analysts’, and the market is in the process of re-rating WEB because of the growth it is delivering and the potential for that to continue over an extended number of years.

The stock is clearly bullish, but good risk / reward entry is tough with stops currently required around $6.

WebJet (WEB) Monthly Chart

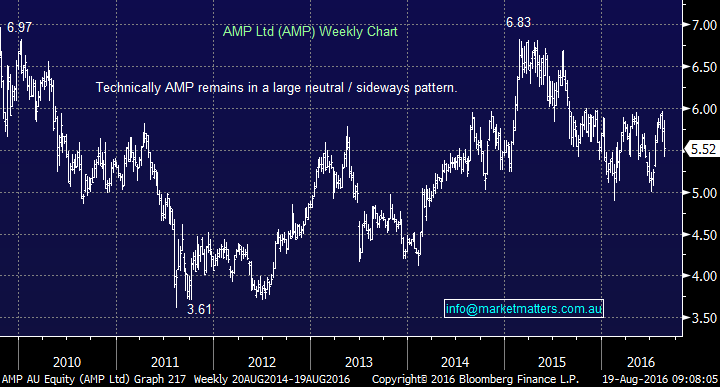

AMP Ltd $5.52

AMP shares fell after its first-half underlying profit fell on higher claims and $$ outflows. The AFR led with a pretty damning headline -AMP becomes the "if only" stock. AMP’s one the cheapest stocks in the financial sector, but it continues to disappoint in a similar manner to QBE.

Although the stock trade at valuation discount to its peers we have no interest in being the lone hero at this stage and buying when Suncorp remains far more attractive - a simple leave alone.

AMP Ltd Weekly Chart

Origin Energy (ORG) $5.77

Yesterday ORG announced a $589 million loss, after large write-down's and scraped its dividend for the second half of 2016 - no major surprise here. The stock fell to $5.62 before quickly regaining most of its losses although it did close negative in a sector that was up for the day. When valuing ORG we look at each individual part of the business and come up with a sum of the parts valuation of around $7.40 at current Oil prices.

We remain bullish ORG targeting ~$6.20 - we do hold the stock.

Origin Energy (ORG) Monthly Chart

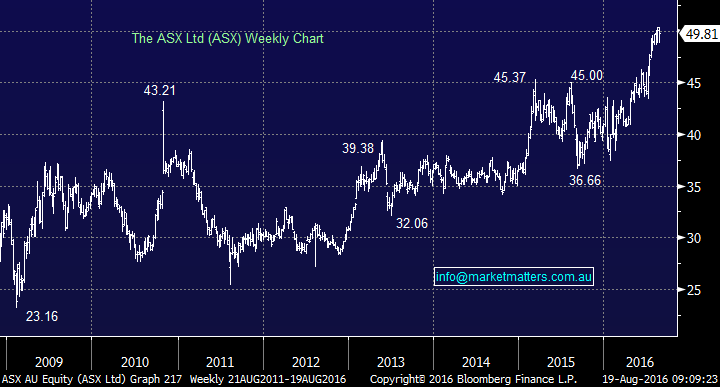

ASX Ltd (ASX) $49.81

ASX was sold off aggressively in early trade yesterday before bouncing $1 (2%) to close almost unchanged. The result was in-line with consensus and no real surprises however they do have a large number of projects on the go, and this is seeing costs creep up. In a low growth environment, where it’s hard to grow the top line, the market is fixated on cost management – and ASX fell short regarding this. The trend here will be important.

We are neutral / positive the ASX at present and would currently run stops at $46.

ASX Ltd (ASX) Weekly Chart

Summary

The simple view from the 6 stocks looked at today:

Sell - TWE.

Buy - ORG and WEB.

Neutral - AMP, ASX, and IRE.

N+B We need further trading activity to identify a good risk reward opportunity buy level in WEB.

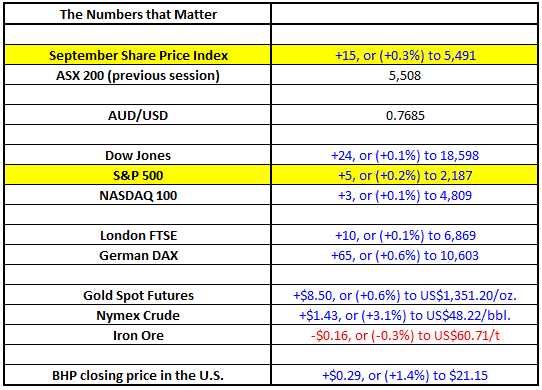

Overnight Market Matters Wrap

- The US markets continued higher overnight with oil keeping the sentiment levels up. The Dow finished up 24 points (+0.1%) to 18,598 whilst the S&P rose 5 points (+0.2%) to 2,187.

- The Black Gold continued to gush, with Crude ending the session up US$1.42 (+3%) to US$48.22/bbl. Crude has now risen 20% since the beginning of August and last night, there were fresh thoughts that major producers meeting in Algeria next month will push to freeze output levels. Prices weren’t hurt either, by the short traders covering their positions.

- Gold also pushed higher on a weaker US$ following the Fed minutes, with traders believing there was still enough uncertainty whether there will be a rate rise in the short term. Gold jumped US$8.50 (+0.6%) to US$ $1,351.20/t, with targets of US$1,357 being the next resistance area technically.

- The ASX 200 is expected to open 21 points higher this morning, testing the 5,530 level as indicated by the September SPI Futures this morning.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 19/08/2016. 9:00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here