Market Matters Morning Report Friday 16th September 2016

Remain open-minded during times of worry

The US Tech stocks led the strong gains overnight with the NASDAQ advancing over 1.5%, which itself was led by APPLE. We have often voiced our opinion that the NASDAQ leads the US stock market and if this again proves to be correct, the current mass "Doom & Gloom" stock market commentators may be wrong, or at least premature. Amazingly, the NASDAQ is now only 0.37% below its all-time high - this index doesn't currently sound too bearish. We remain bullish the NASDAQ, initially targeting the 5000-5200 region ~ 6% higher - we turn bearish under 4620, which is now 4% away.

In Wednesday's report, we discussed the high levels of cash being held by many investors. We have to question whether markets roll over when everyone's talking about a fall, plus actually sitting on cash hoping for it. Perhaps we are going to experience a "sell on rumour, buy on fact" market reaction to the Fed and BOJ meetings next week. Markets may only be factoring in a 22% chance of a rate rise by the Fed, but the uncertainty is usually the larger concern.

We think that US indices may be throwing out a warning of what is around the corner, as opposed to the event actually unwinding before our eyes e.g. The Dow fell 10.5% in mid-87, before rallying to make fresh highs, then collapsing 41% later in the year.

NASDAQ Monthly Chart

Unfortunately, the NASDAQ is not a particularly great indicator for our own ASX200, which is down 1% in 2016 compared to the NASDAQ being 4.9% higher over the same period. The main comfort we can take at this stage is it’s unlikely that the local market will accelerate lower if US stocks remain firm, or actually make fresh all-time highs.

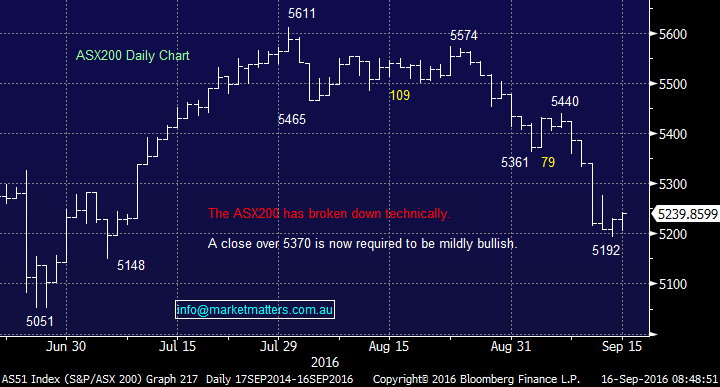

We stick with our opinion that the ASX200 has formed a major top at 5611 and we will be looking to increase our own cash position into strength, ideally over 5275 basis the ASX200. On a technical level, this negative view requires a break of 5375 to switch us to a neutral stance.

ASX200 Daily Chart

The standout in our local market yesterday was our pet at the moment - the banking sector. The local banking sector is currently performing very well on a relative basis e.g. the ASX200 is down 5.3% over the last month, but NAB is down 0.96% and Westpac 1.3%. Not surprisingly, CBA and Bendigo have corrected further, but they have both recently paid significant dividends.

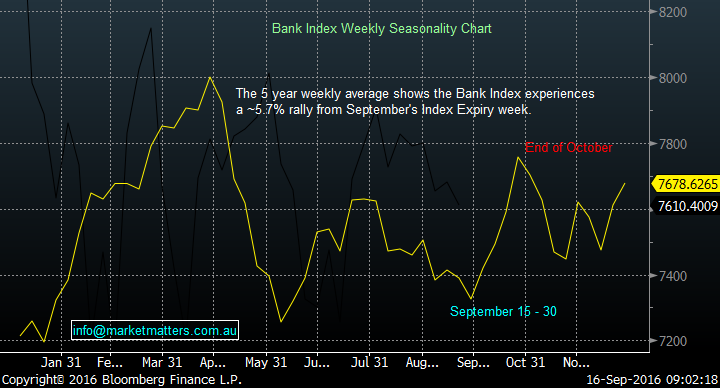

Seasonally, we are entering an extremely strong period for the local banking sector, which makes sense with ANZ, NAB and WBC paying large dividends in November and then the "Christmas Rally" just around the corner. The banking sector is not the area where we anticipate reducing our market exposure.

Australian Banks Seasonal Weekly Chart

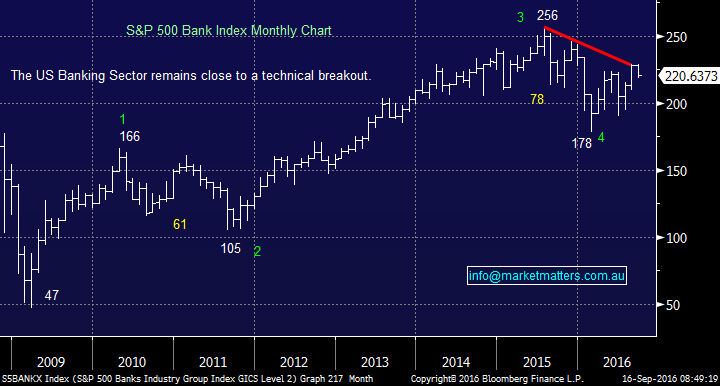

Also, the US Banking Index remains positive on a technical basis, but it needs to follow the NASDAQ towards fresh September highs to become exciting i.e. over 3% higher. Fundamentally, higher interest rates are good for banks profitability.

US S&P500 Banking Index Monthly Chart

Summary

- We intend reducing our market exposure into strength around the 5275 area, but it's unlikely the banks will be in sell sights.

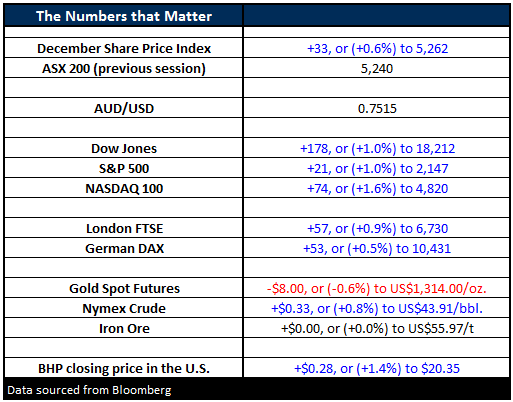

Overnight Market Matters Wrap

- The US share market rallied from its recent lows overnight, with the strength of Crude Oil being one of the culprits for the broad rally, along with Apple shares pushing the NASDAQ to outperform the broader market.

- The Dow closed 178 points higher (+1%) at 18,212, while the S&P 500 ended 21 points higher (+1%) to 2,147.

- Oil advanced little from the bottom of its snakes and ladders game, up 0.8% to US$43.91/bbl., after a restart of a pipeline to New York Harbor was delayed.

- BHP looks to outperform the broader market today, after ending its session up an equivalent of 1.4% to $20.35 in the US.

- The December SPI Futures is indicating the ASX 200 to open 40 points higher, around the 5,280 level this morning.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 16/09/2016. 9:00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence.

To unsubscribe.Click Here