Market Matters Morning Report 1st September 2016

Is this the beginning of the end for Australian stocks?

After an aggressive last few days selling, August has managed to live up to its reputation as a weak month for stocks, with the ASX200 falling 2.3% for the month while the S&P500 was down only 0.1%. Today will be interesting to see if our market can produce its characteristic strong start to the month. On the 1st of August the market rallied almost 50-points early in the day, to create the top that was never breached at 5611 - remember the "DOT Theory".

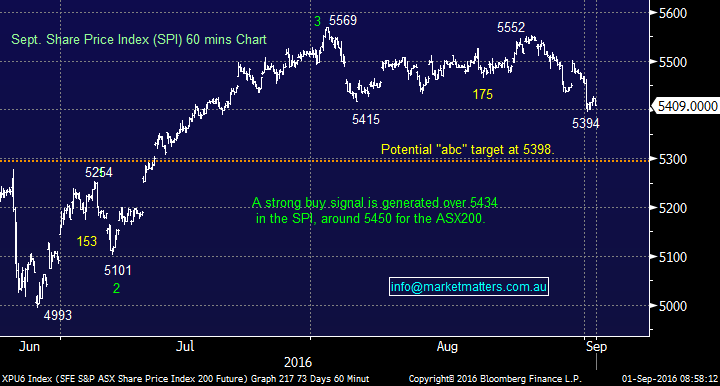

In last Monday’s Morning Report we said that we would be watching the "ABC retracement target" very closely - that time has now arrived with the SPI likely to be just under that level this morning. We get a strong bullish signal if the SPI can break back over 5435 which is where we were trading ~10.20am yesterday - we use the SPI on shorter timeframe analysis as it discounts for dividends.

Importantly for our short-term bullish view the ASX200 needs to hold the 5400 area.

September Share Price Index (SPI) 60-minute Chart

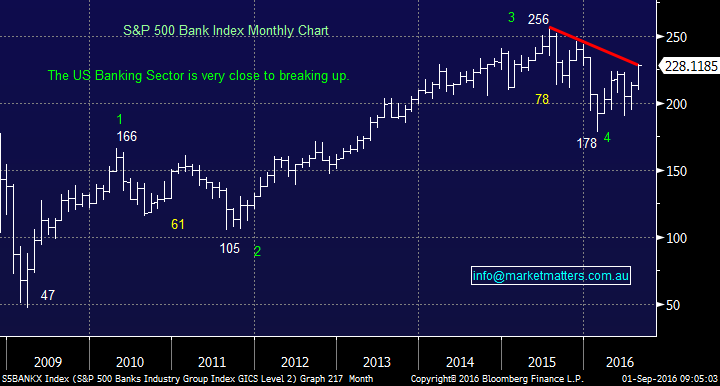

Overnight even though the major US indices all closed in the red their Banking Index again managed to make small gains to close up a very impressive 7% for the month. Unfortunately, the Australian equivalent only managed to rally 0.3% for the month which is still not a bad effort in an overall weak market (~ 2% outperformance)

The banking sector remains our favourite place to be at present.

US S&P500 Banking Index Monthly Chart

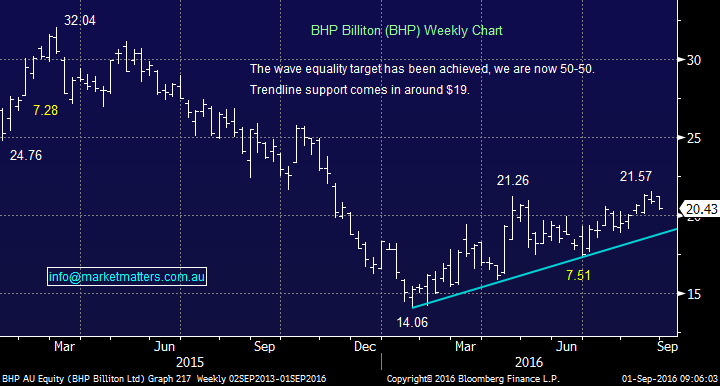

Yesterday we mentioned BHP as one of the 5 stocks that we did not want to own at current prices - today it looks set to open under $20, a rapid $1.10 (5%) decline. This week investors have taken the hammer to resource / gold stocks after comments from Jackson Hole last weekend implied interest rates may rise sooner rather than later in the US. This selling pressure makes sense but the Australian market seems yet again to be the worst performer on any good, or bad, news e.g. The Canadian market closed marginally higher last month and the $US Index is only up 0.47% for the week.

The aggressive selling we've experienced implies strongly that investors have simply been caught long in the crowded resource trade.

BHP Billiton (BHP) Weekly Chart

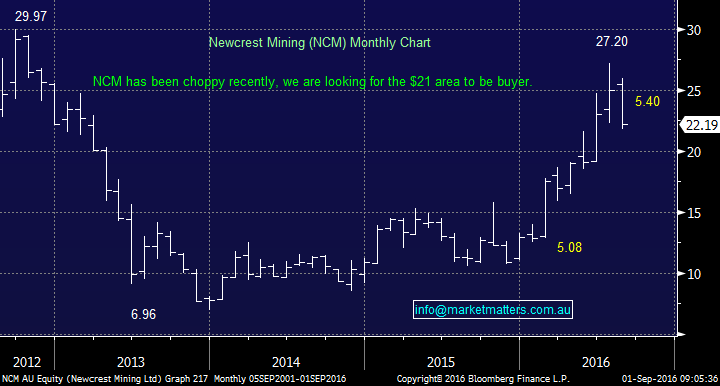

Gold has fallen around 5% from its highs in July but the gold stocks have been savaged e.g. Newcrest (NCM) -19.9% and Regis Resources (RRL) -14.4%.

This is clearly another illustration that investors / traders were long the gold sector and are suffering some pain. We identified buy levels for NCM at $21.20 and RRL at $3.50, these are approaching fast hence we may consider switching another holding to these stock (s) at identified levels.

**Watch for alerts**

Newcrest Mining (NCM) Monthly Chart

Yesterday's large volume was a major concern to the health of our overall market. The recent reporting season was average and Estia Health's (EHE) debacle was enough to put people off stocks for life; shouldn't age care be a growing exciting space? Today's price action will be very interesting but it’s hard at present to see where any major support will come from, with exception hopefully of the banks.

Summary

- We remain short-term positive local equities but the 5400 area needs to hold for this view to be maintained.

- We maintain our buy targets for NCM and RRL, these are ~4-5% lower.

Overnight Market Matters Wrap

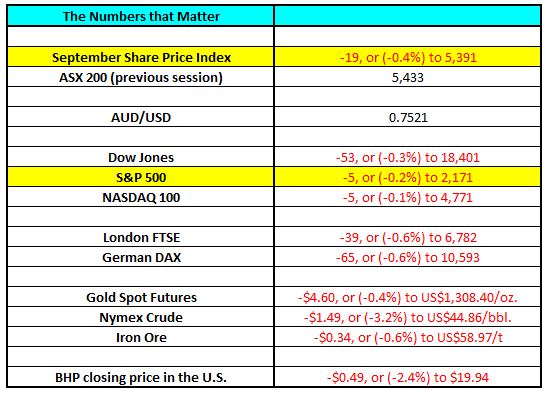

- The US share markets were weaker last night, dragged down by falling oil prices and investors waiting for Friday’s job numbers. The Dow closed down 53 points (-0.3%) at 18,401, whilst the broader S&P500 finished down 5 points (-0.2%) to 2,171.

- For the month of August, the Dow finished down 31 points (-0.2%) and the S&P500 finished down just 3 points (-0.1%).

- Oil had a trifecta of bearish news, with stockpiles of crude reported to have increased by an unexpected 2.3m barrels – analysts expected 921k barrels. Distillate (diesel and heating oil) increased by 1.5m and gasoline, although it decreased by 690K barrels, it was only half of the expected number. Crude finished down US$1.49 (-3.2%) to US$44.86/bbl.

- Gold fell on an expectation that the jobs number would be better than expected, closing on a two-month low at US$1,308/oz, down US$4.60 (-3.2%).

- The ASX 200 is expected to open weaker this morning, testing the 5,400 level as indicated by the September SPI Futures this morning.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 1/09/2016. 9:00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself or if you require a personal recommendation, you can seek the assistance of a financial adviser. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here