Where’s the next elastic band?

Where's the next elastic band?

Today we are going to deviate away from our usual Monday morning question / answer format, as virtually all the questions we have been receiving have been around Mr Trump’s victory - hopefully these have been answered in the Weekend Report.

In recent times we have witnessed some major sentiment changes in different sectors of the ASX200, as investors become too optimistic / pessimistic around specific sectors of our local market. Below are some standouts using big stocks within the respective sectors to illustrate some amazing sectors gyrations:

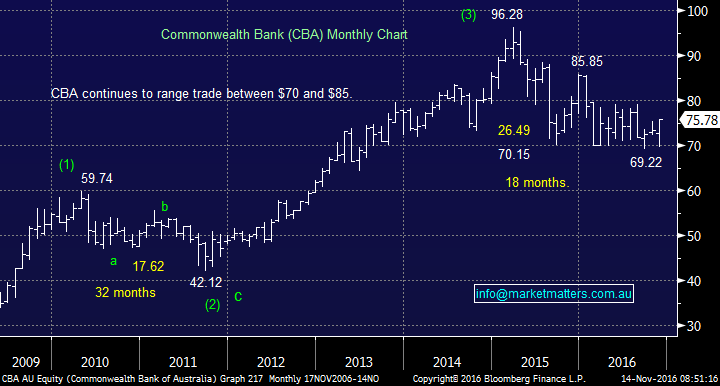

1. Banks fall from grace - CBA declined 28% from its early 2015 highs and has only managed to regain a quarter of these losses to-date.

2. The fall & rise of resources - BHP plummeted 56% from its 2015 high into early 2016, as nobody wanted to know the world's largest miner. So far in 2016 the stock has rallied 77%, managing to recover over 60% of its losses last year.

3. Real Estate stocks fall out of favour - Westfield (WFD) rallied over 80% from 2014 to July this year, but has now plunged 26% in just 5 months.

4. The "yield play" is unwinding - Everybody wanted Sydney Airports (SYD), driving the stock to all-time highs this August before everything changed and the stock has fallen 24% in just 4-months.

5. Has gold's lustre vanished? - Newcrest (NCM) rallied 150% over the last 18-months, but has snapped back falling ~25% in the last 5-months.

We could have made the list longer, but this is enough to make our point. Importantly like with everything in life, it’s vital to learn from ones experiences and mistakes. We are firm believers in the 10,000 hours concept - the amount of time that it takes to master something.

Over the last 2 years, we were very much involved in all 5 of the above:

1. We went negative CBA above $90, but started accumulating too early ~$80.

2.We bought BHP once too early ~$20 and then had a number of winning trades in BHP, RIO and FMG, however we have missed the last few months of gains.

3/4. We went negative Real Estate and the "yield play" around 5-months ago avoiding some potentially bad losses.

5. We made some excellent trades in the gold sector over the last 18-months, but missed the last part of the rally. However, we have not been caught by the recent falls.

The standout from the above is sectors / stocks are following through much further than many anticipate.

Now let's apply this simple thought to our current favourite two sectors.

CBA and the banks only appear to have come back into favour since last week's shock election victory by Mr Trump. As we have said previously it takes many weeks / months for fund manages to readjust their portfolio's, not days. CBA has recovered around 25% of its fall since 2015, a normal technical bounce is closer to 40% which takes CBA back to the top of its recent $70-$80 trading range.

We remain bullish banks over the coming months.

We already hold Westpac (WBC) and CBA, our preferred addition to this duo is Macquarie Bank (MQG).

Commonwealth Bank (CBA) Monthly Chart

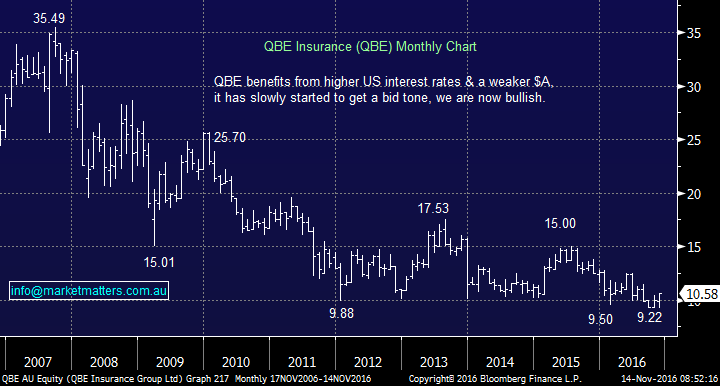

Our favourite theme over the last month has been that global interest rates, led by the US, are going higher. This view has come very much into vogue since Donald Trump's victory. Most of us know QBE has endured an awful time since the GFC through a combination of falling US interest rates and awful corporate performance. After ~8 years of battling, the board is due to turn this ship around plus they benefit significantly from rising US interest rates.

Technically QBE looks excellent targeting the $15 area.

QBE Insurance (QBE) Monthly Chart

Summary.

- We remain bullish banks and insurance stocks - especially QBE and MQG.

- These are our 2 elastic bands for the next few months as we expect them to snap back.

*Watch for alerts today*

Overnight Market Matters Wrap

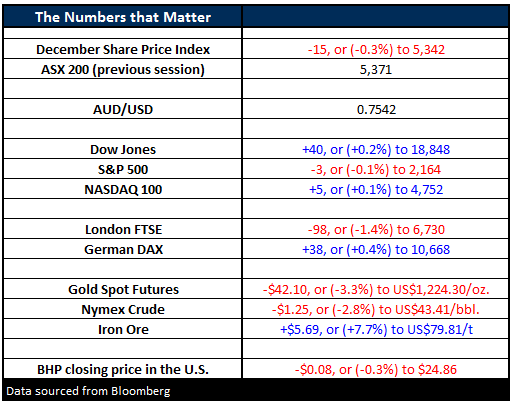

- The US markets finished the week strong, despite ending Friday mixed with the Dow up 40 points (+0.2%) to 18,848 and the S&P 500 down 3 points (-0.1) to 2,164.

- The Volatility index remains to dive back below complacency, down 3.9% last Friday.

- Iron Ore rallied 7.7%, however BHP is expected to open slightly lower, down 0.3% to $24.86 from the previous close as indicated by its performance in the US.

- Oil slipped 2.8% lower to US$43.41/bbl. after OPEC mentioned another record output in production.

- The ASX 200 is expected to open 22 points lower, towards the 5350 level as indicated by the December SPI futures this morning. We expect to see some short term weakness in the insurance sector, such as IAG after news of a powerful earthquake hitting New Zealand this morning, unfortunately killing at least 2 people

Westpac + ANZ trade ex-dividend this morning

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 14/11/2016. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here