Market Matters 2018 Outlook including 10 major forecasts for the year ahead.

I hope the entire Market Matters community enjoyed a well-earned break over Christmas, recharged the batteries and refocussed for a big year ahead – I know I certainly did. We typically have Christmas at home then head North on Boxing Day for a week or so camping, water skiing, sailing and the like with a big group of family and friends. Simply a sensational time and a chance to ‘reset’ from year to year. Last year was our 10th in a row.

Below you’ll find the Market Matters 2018 Outlook outlining our overarching views for the year ahead. These are our bigger picture predications that will influence the management of our portfolios. Since our last note on the 20th December we have made some amendments to the Growth Portfolio with alerts sent to subscribers at the time of the changes. To recap, we increased cash by taking profits in Fortescue (FMG), Independence Group (IGO), Oz Minerals (OZL) and reduced our weighting towards Westpac (WBC) by half (we now hold 5%). To view the current growth portfolio CLICK HERE, to see the current income portfolio CLICK HERE or to see recent activity CLICK HERE.

Wishing you all a safe & successful 2018

James & the Market Matters team

Market Matters 2018 Outlook including 10 major forecasts for the year ahead.

As we commence an exciting new year for investors, it’s imperative to consider what’s on the horizon after an extraordinary 2017; the year when US stocks just kept on rallying and Donald Trump could do no wrong for markets. The Dow Jones gained an amazing 25% while locally the ASX 200 put on a late flurry to advance 7% - pre-dividends.

Within the ASX200 there were some noticeable winners and losers, again illustrating our mantra of remaining open-minded as being an important quality for successful investing, Dominoes (DMP) was just one example of a major loser in 2017 after soaring in 2015 and 2016.

Winners: CYBG (CYB) +20%, Aristocrat (ALL) +53%, Challenger (CGF) +25%, Origin Energy (ORG) +43% and CSL Ltd (CSL) +44%.

Losers: ANZ Bank (ANZ) -5.5%, Domino’s Pizza (DMP) -29%, Coca-Cola (CCL) -16%, Fortescue (FMG) -17% and Telstra (TLS) -29%.

Firstly, let’s quickly glance at some of the highlights from the previous 4 Market Matters annual outlook pieces, there’s been some real gems in there emphasizing why today’s report should be considered very carefully.

2017 – We targeted over 6000 for the ASX200 and 2400 for the S&P which was reasonably accurate in hindsight, although we did underestimate the US slightly with the S&P 500 closing out 2017 at 2673!

For the first time since the 1980's, we felt interest rates were headed higher globally which has played out and this is a theme that will again dominate 2018. We also felt Australian house prices and particularly apartment prices would plateau / decline in 2017, and importantly would not ‘crash’, and this has started to unfold over the last 3-6 months.

Gold traded higher throughout the year as we expected, while the banks gave us an opportunity to reduce our exposures in Q2 before suffering a weaker second part of the year.

We called a deeper correction to play out at some point in 2017 which failed to materialise, however it remains at the forefront of our thinking, and this call has simply been pushed back into our 2018 forecast.

2016 – We suggested this was the year to reconsider resources after they had an awful 2015, an accurate call with heavyweight BHP rallying 40%. Overall 25 of our 35 alerts were profitable in a year when the ASX200 rallied 7%.

2015 – Our favourite 3 stocks were RRL at $2.32 which rallied over 80%, Challenger at $8.05 which rallied 75% and Telstra (TLS) at $5 which then rallied 17% - a nice trifecta.

2014 - We were unpopular but correct when we called BHP down to $20 when it was at $34 and Woolworths (WOW) to $25 when it was close to $34.

All this means very little unless we actually make money from our views, and in 2017, 37 of our 46 closed alerts were profitable, while 9 were unprofitable.

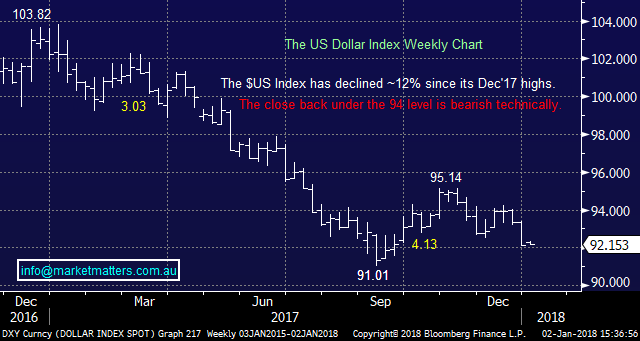

Last year was fascinating with the 10% fall in the $US reaffirming our belief that running with the crowd can be a dangerous past-time. If you cast your mind back to the start of 2017, the No. 1 consensus call for 2017 was for the US currency to trade up throughout the year as rates tracked higher – the issue with that trade was clearly that everyone was already positioned for it!

While most assets performed solidly who would have thought the best global share market would be the Ukraine while the best currency was that of Mozambique and the strongest major bond market Greece, plus of course we had the Bitcoin explosion. Performance often comes from where its least expected.

Let’s take a look at 3 major market consensus calls for 2018:

1 Bearish $US – The market has now become bearish the $US – we think that call will prove correct early in 2018 with the US dollar index making fresh 3-year lows but by year end, the dollar index will actually close up for the year.

2 Australian stocks higher – The market is bullish stocks with many ‘upbeat’ calls for the ASX in 2018. Bear in mind that often those penning an outlook price are doing so for marketing purposes and optimism / bullishness tends to sell! At MM we believe it will be a choppy year with a negative bias overall, and having ones finger on the pulse will be more important than ever.

3 Bullish commodities – Co-ordinated global growth + a lack of new meaningful production in many commodities so we tend to agree with this view but we firmly believe resources will have a choppy advance and weakness, not strength, should be bought.

Over 2018 we will continue to remain flexible and fluid with our investment ideas, intending to move into significant cash holdings and / or initiate bearish market positions when we believe market risk warrants it.

In the last week of 2017 we increased our cash position close to 30% in the Growth Portfolio while in the Income Portfolio we have ~40% held in more defensive assets like hybrids, fixed income and cash, in anticipation of a pullback.

Read on to find out our outlook for the coming year and discover our favourite sectors / stocks and themes for 2018!

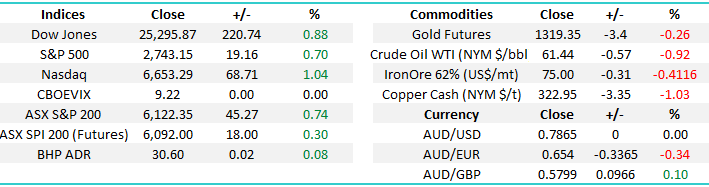

1. The “warning pullback” appears imminent but a decent downturn for stocks may easily be 6-months away.

We’ve been talking about a major correction for stocks for a while but have essentially remained fully invested given the lack of any meaningful warning signs.

• We now feel the time for a classic “warning style pullback” is due, with our best guess ~6% in the coming months. .

US stocks have advanced over 50% since early 2016 so our correction scenario is far from aggressive, but it will provide opportunities. With US interest rates rising and mid-term elections in November with President Trump likely to lose a degree of control we certainly anticipate increased volatility in 2018 in financial markets.

Russell 3000 Index Quarterly Chart

At this stage following a relatively small pullback we envisage another, and final, rally to fresh all-time highs, followed by a deeper correction similar to what occurred in 2011 and 2015.

US S&P500 Index Quarterly Chart

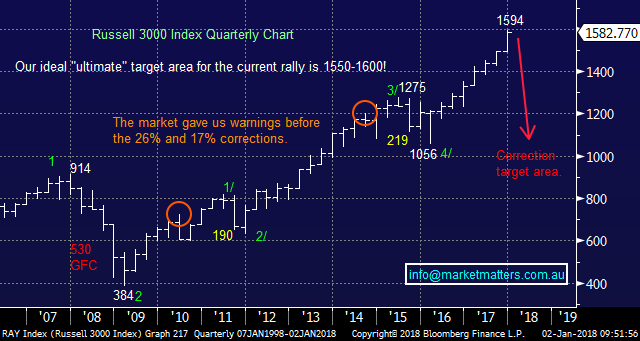

2. Resources will have another choppy year tracking underlying commodity prices. Buy weakness, sell strength will yet again be the mantra for resource stocks in 2018.

Local Resource stocks enjoyed a solid 2017 with RIO a good example rallying over 26%. Over the course of the year the stocks in the sector not surprisingly followed the underlying base metal prices providing excellent buying opportunities in the first half of the year and also early December, both of which MM took advantage of generating some very healthy returns.

• Short-term we are square the resources sector looking to buy a correction back towards the lows of late 2017.

We are wary the bullish market view / positioning which can easily lead to sharp corrections.

Base Metals Spot Index Weekly Chart

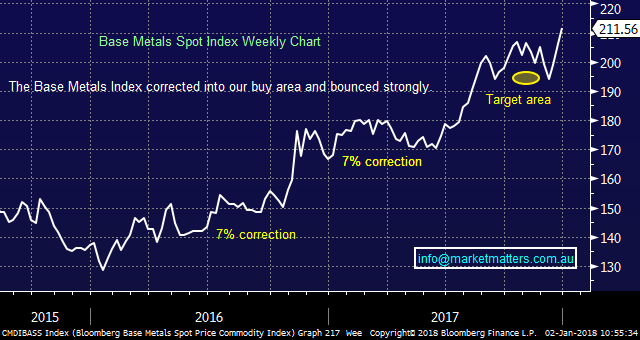

3. Crude Oil looks destined for $US70/barrel.

There’s no doubt that crude oil has been on a wild ride since the GFC but volatility has diminished since 2016. In 2017 we expected Crude to range trade between $US40/60bbl which played out nicely.

• We are bullish the energy sector into 2017 targeting a 15% advance for crude oil.

Crude Oil Monthly Chart

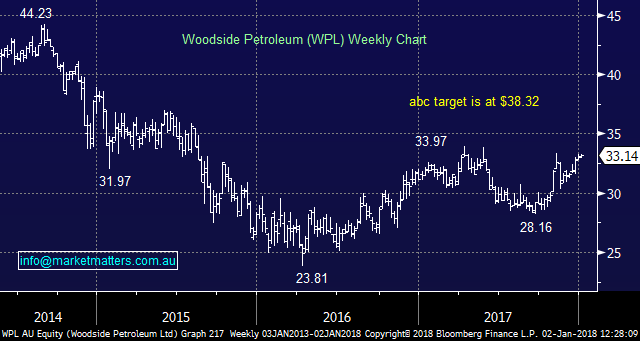

Hence we are long Woodside Petroleum targeting over $35.

Woodside Petroleum (WPL) Weekly Chart

4. Interest rates have bottomed, the question is how fast do they rise?

For all of 2017 the RBA cash rate remained at its all-time low of 1.5%, arguably a crazily accommodative level considering our economy remains solid. The wild card locally is property prices, while unemployment is also important.

Property prices are expected to drift lower this year, however the speed of ‘drift’ will be the main point of contention for the RBA. If they roll over too fast the RBA will be reticent to increase rates.

• Our best guess is still a hike to 1.75% on Melbourne Cup Day 2018.

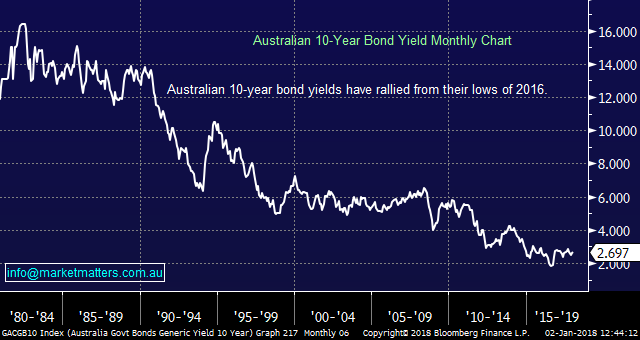

We remain committed to our view that global interest rates have bottomed although central banks still appear somewhat concerned about slowing the current gradual economic pick-up.

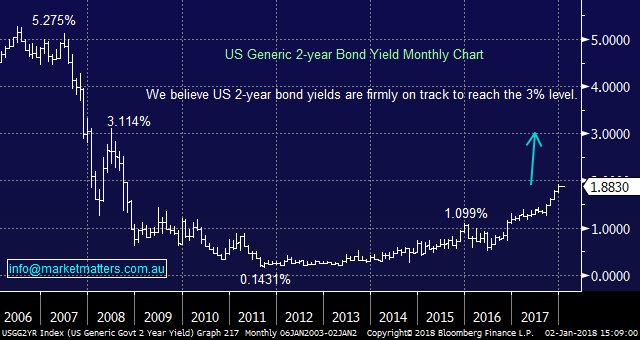

In the US we saw the Fed raise interest rates 3-times as their economy remained strong. However, inflation remains muted which explains why their 10-year bond yields actually fell but in contrast US 2-year bond yields rallied very strongly.

• We expect another 3 hikes in 2018 by the US Fed which should eventually support the struggling $US.

Australian 10-year bond yields Monthly Chart

US 2-year bond yields Monthly Chart

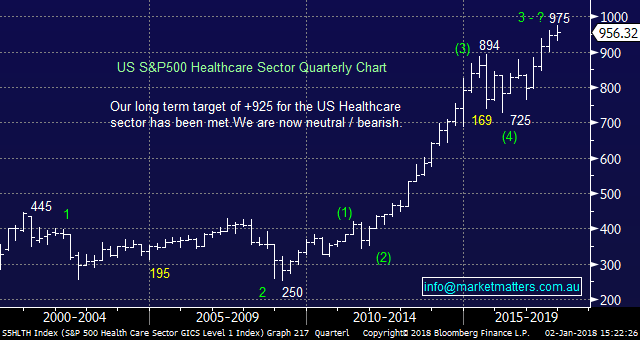

5. Healthcare looks ready for some underperformance.

The healthcare sector has been a ‘go to’ place for investors both locally and in the US since the GFC however as interest rates rise putting pressure on the expensive areas of the market, we believe it’s time for a change of fortune for these much loved names.

We are certainly well aware of the dynamics driving the sector – aging populations, more private involvement in healthcare services, new technologies and the like, however these are ‘known knowns’ and the market we think over owns these stocks.

The likes of CSL and Cochlear have been market stalwarts for many years but so had Ramsay Healthcare prior to its 27% correction. We believe that the majority of the healthcare sector are simply excellent companies but we can see their elevated valuations getting smacked in 2018/9, leading to far better buying levels.

US S&P500 Healthcare Quarterly Chart

6. Gold and the $US.

The $US is the tail that wags the gold dog – simply as the $US falls gold rallies with excellent correlation. We believe the $US will fall towards the 90 area in Q1 of this year before spending most of 2018 recovering some of last year’s losses as the Fed raises rates.

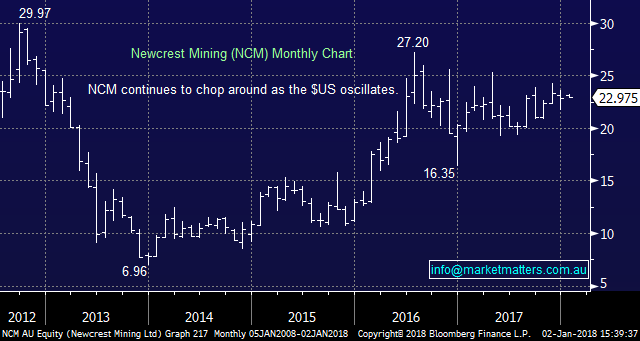

• We are targeting a high for gold and its respective stocks in the coming few months prior to a tough year.

The $US Index weekly Chart

Newcrest Mining Monthly Chart

7. The ‘yield play’ will underperform the market over the next few years.

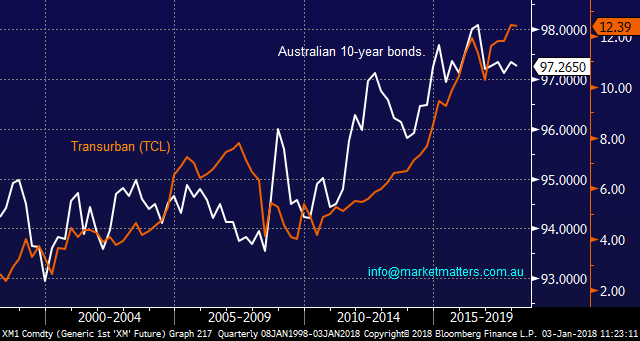

If we think interest rates are going higher globally, the sectors that have benefited the most from low rates will clearly feel the pain in a relative sense as interest rates track to more normal levels. This is not a difficult call to make given the high degree of correlation ‘yield stocks’ typically have to bond prices. Bond yields increase when bond prices decline. When inflation becomes more obvious we think 10-year bond yields will move higher which will put major pressure on the 'yield trade'.

• We held this negative view on the “yield play” stocks last year and when looking at it collectively, it failed to unfold as we expected however we still believe it will pan out.

When we look at stocks like Transurban (TCL) even though they are excellent businesses their share price correlation to bond prices / interest rates is very pronounced.

10-year bonds v TCL Quarterly Chart

8. Is Telstra the best lemon for 2018?

There are a number of investors who look closely at the previous year’s lemons to search for bargains. In the ASX200 the seven ugly ducklings for 2017 lemons were:

Brambles (BXB) -21%, Domino’s Pizza (DMP) -30%, Coca-Cola (CCL) -17%, Fortescue (FMG) -17%, Harvey Norman (HVN) -18%, Telstra (TLS) -29% and Vocus (VOC) -23%.

Market sentiment is a powerful beast and when “bottom picking” unloved stocks it usually pays to be fussy as the trend is clearly down. We like 2 of last years unloved stocks but at lower prices:

1 We believe Telstra’s 50% fall over the last 3-years has almost run its course. Our view for 2018 is TLS will rotate between $3 and $4, hence we are buyers under last years $3.34 low however we will not hesitate to sell nearer $4

2 We think that HVN may come under renewed pressure as interest rates rise at a time of elevated house hold debt. The stock is ‘cheap’ now however if it was to get cheaper, we would be buyers under last years $3.54 low.

Telstra weekly chart

9. Australian Banks

2017 was a relatively disappointing one for the Australian banking sector which fell -3.4%, while their global counterparts rallied an enormous +52% - pre-dividends. This comparison illustrates perfectly why the ASX200 market had a pretty average year on a global level.

Australian banks have become a proxy bet against the Australian market, assuming we are correct and there is no crash in property, local banks should perform better in aggregate this year than last.

• We continue to believe the Australian banks can be bought into any pullbacks.

Commonwealth Bank (CBA) Monthly Chart

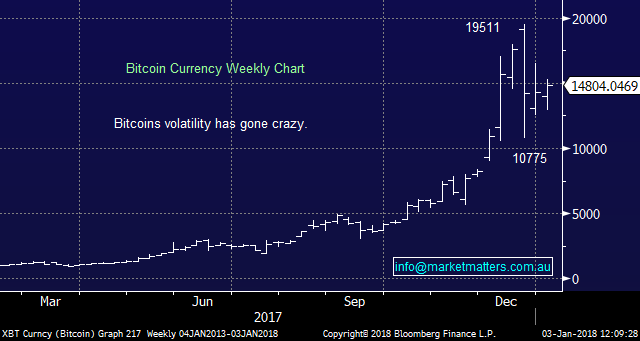

10. Bitcoin just had to be mentioned!

Bitcoin had an amazing 2017 rallying 2500% before tumbling 45% from its December highs.

• We think Bitcoin currently sits between a high risk punt and a night at the casino but definitely not an investment.

The obvious question is why have we not embraced the crypto currency? Our answer is simply statistical. If the crypto currency space eventually becomes main stream we may not yet have heard of the currency that you and I will end up using day to day. Remember when cars were invented a long time ago many tried and failed before Karl Benz got it right in1885!

In short, Blockchain technology has a great future but when you think about a currency being exchangeable for goods and a store of value, Bitcoin simply does not tick these boxes (yet!)

Bitcoin Weekly Chart

Conclusion; At MM we think that markets are currently under-pricing risk and we’re overdue for a correction, the first of which will be a ‘shot across the bow’ before the market powers higher yet again, pre-empting a more painful pullback later in the year.

2018 will be an exciting year for the informed, with increased market volatility presenting more opportunities than we saw in 2017. A stock pickers market for sure, where true active managers will earn their stripes!

We’ll continue to remain active in our portfolios, increasing cash when prudent while we also expect to have some ‘short exposure’ at times throughout the year given the increasing maturity of this bull market.

We hope you found our thoughts and predictions thought provoking for the year ahead. As always, we’ll continue to pen our daily notes to subscribers, manage our portfolios of shares and importantly, present our views in the usual straight talking Market Matters way.

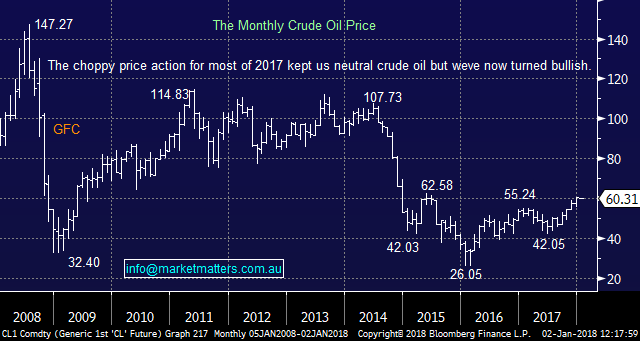

Overnight Market Matters Wrap

• A strong start for 2018, with the US equity markets closed higher last Friday, with the Nasdaq 100 outperforming the major indices.

• Dr Copper, a usual indicator of global growth was 1.03% lower last Friday, and down 1.95% for the week.

• The December SPI Futures is indicating the ASX 200 to open 20 points higher towards the 6142 area this morning.

Happy investing for 2018 and beyond!

James & The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 08/01/2018. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here