Market goes quiet as James jumps on his postie bike (CBA, BBOZ)

A brief Morning Report today as James and Harry are about to embark on their tough ride through the Flinders Ranges, here’s a quick YouTube clip of a past event for subscribers who haven’t yet had time to watch it : Click Here

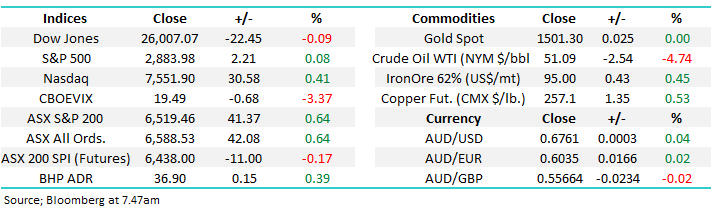

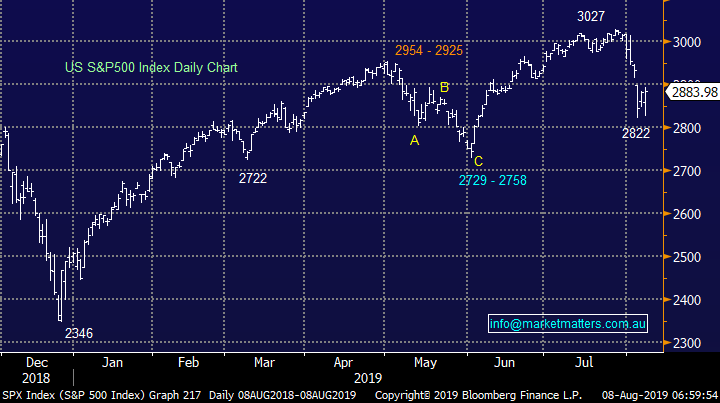

The ASX200 bounced well yesterday gaining 41-points, but as the chart below illustrates, it didn’t make much of a dent in the falls of the last few sessions. Unfortunately we still believe the market has evolved since the dizzy heights of July and we still prefer “selling strength" until further notice. Around lunchtime, the market was flirting with negative territory until we were rescued by New Zealand!

1 – The Reserve Bank of New Zealand cut its key interest rate by 0.50% to 1.00%, more than expected in an attempt to revive inflation. The move reverberated through both our own and NZ markets, across the ditch, equities soared finally closing up +1.88%, about 3 times more than our own.

2 – Australian bond yields plunged to record lows with our 3-years falling under 0.655%, a great indication that the markets now expecting two further RBA rate cuts to 0.50%.

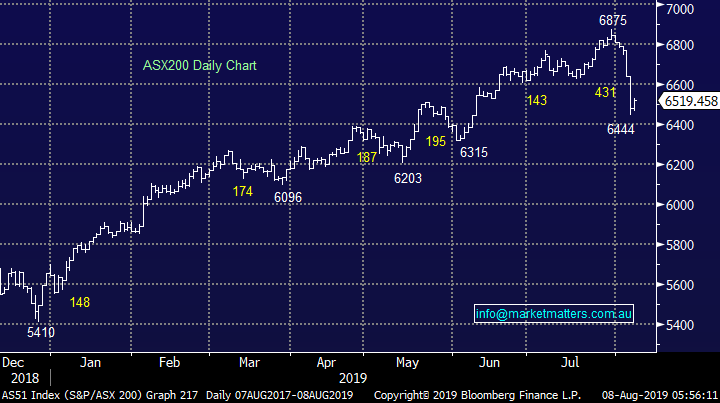

3 – Trans Tasman currencies were smacked with the $A breaching US67c for the first time in 10-years.

MM remains comfortable adopting a more conservative stance than we did for the first half of 2019, but we do anticipate being active this month.

Overnight US stocks closed the session basically unchanged and the SPI is indicating a quiet start to the day, James will be happy!

We continue to believe markets will swing between optimism around interest rates and pessimism around the looming recession - it will be interesting to see how long yesterday’s positive tone can last. Plus of course, let’s not forget the US-China trade war, unfortunately that’s 2 negatives vs. one positive. Below is a link to the upcoming company reports, yesterday threw out no hand grenades and fingers crossed we have a new theme:

https://www.marketmatters.com.au/reporting-season-2019/

** AMP have this morning reported an underlying profit of $309m, along with a whopping non-cash impairment of $2.35bn(post-tax) and a $650m capital raising at a floor price of $1.50/share as the recently appointed CEO restructures the business.**

ASX200 Chart

Yesterday the $A dipped below US67c, but it bounced almost 1c overnight, a good sign its “looking for a low”. The Kiwi didn’t fare as well closing around the US64.5c area.

MM believes the time to average our long $A in our ETF Portfolio is close at hand.

The Australian Dollar ($A) Chart

History tells us that when Australian 3-year bond yields trade in a meaningful way below the RBA Cash Rate the Reserve Bank are highly likely to cut interest rates – just as they are today, which is illustrated by the chart below.

MM, like the market, believes the RBA Cash Rate will fall to 0.5% in the next 6-12 months.

Important Australian Interest rates Chart

Following an ok result by CBA, in a very tough low interest rate environment for banks, CBA slipped by -1.38% - in hindsight we went long a day early.

This is a relative yield play, CBA is yielding 5.5% full franked and for those who go long today and hold for 13-months its closer to 8%, very attractive compared to fixed interest, especially if the bank can deliver on its cost cutting goals in this zero growth environment.

MM likes CBA at current levels.

Commonwealth Bank (CBA) Chart

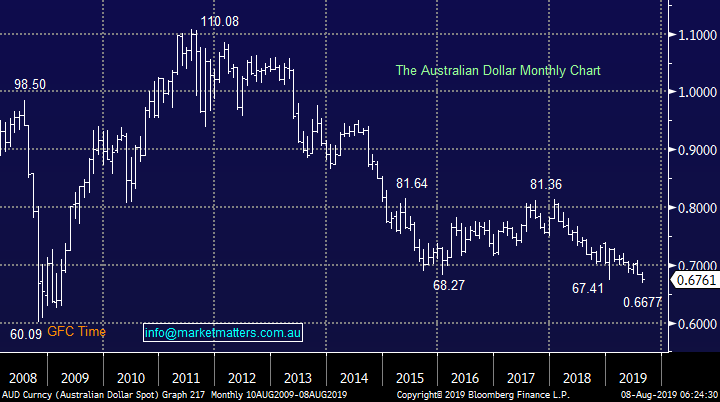

MM remains bearish US stocks, initially targeting the 2750 area for the S&P500 - almost 5% lower, hence we are in “sell the rallies as opposed to buy the dips” mode.

MM remains bearish US stocks.

US S&P500 Chart

MM’s plan for the days / weeks ahead

1 – We are looking to increase our cash position in the MM Growth Portfolio, 16% feels too light at present.

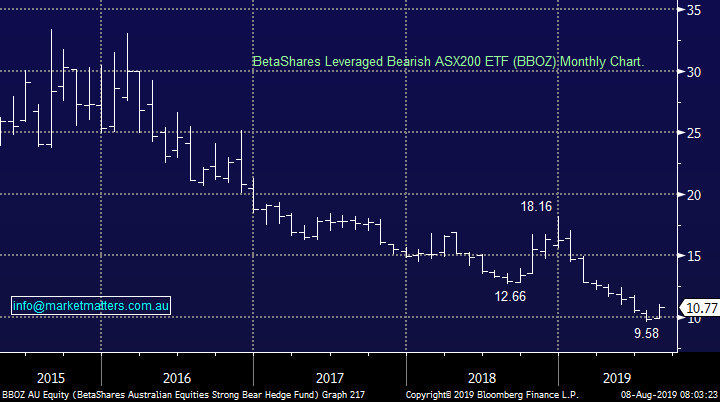

2 – We are looking to buy the Bearish ASX200 ETF (BBOZ) into strength moving forward to hedge a decent part of our portfolio.

BetaShares Leveraged Bearish ASX200 ETF (BBOZ) Chart

Overnight Market Matters Wrap

· US equities pared back its early losses overnight, with investors positioning themselves on the current outlook for global growth as they anticipate the central bank to ease its monetary policy, following New Zealand cutting its key interest rate by 0.5% yesterday.

· Crude Oil extended its losses, currently off 4.74% - hitting fresh 7-month lows and in bear market territory.

· BHP is expected to outperform the broader market after ending its US session up and equivalent of 0.39% to $39.60 from Australia’s previous close.

· The September SPI Futures is indicating the ASX 200 to open marginally lower, testing the 6510 level this morning.

Have a great day!

Alex & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 08/08/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.