Market about to shut the door on a weak May

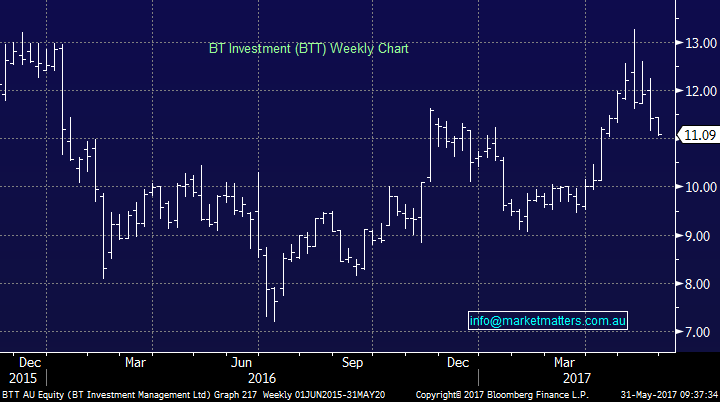

A reasonable session on the ASX yesterday with the market shaking off early weakness to close back up in the black by 10 points and importantly, the 5700 region continues to hold. Today marks the end of a tough month for the ASX with big underperformance versus the US and other global markets. The S&P 500 is up +1.20% for May while the ASX languishes down –3.48%. The banks obviously the major drag with the index off -11.98% for the period – ANZ the weakest link down by 14.84%, although it did trade ex-dividend in the period. We’ve continued to use weakness in the banking space as a buying opportunity.

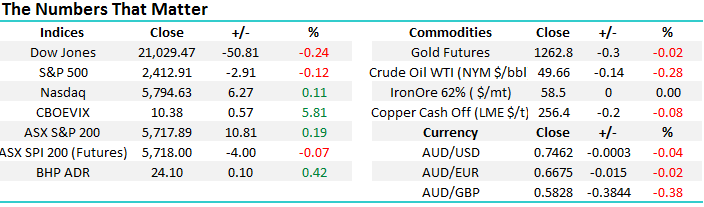

In terms of the ASX 200, there was some small signs of a more robust underbelly yesterday with the market once again bouncing from 5700 as it’s done on three previous occasions. Clearly this becomes the tipping point for any short term view on the market and given the seasonal weakness that still lingers in June, a break of the 5700 level should see 5600 come into play in short order.

ASX 200 Daily Chart

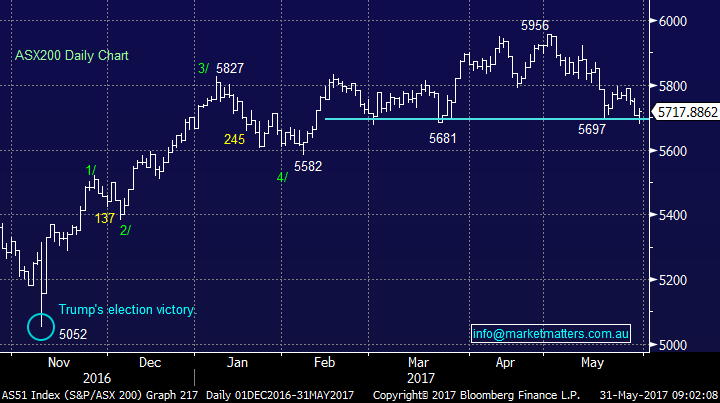

Yesterday we ‘tweaked’ the Market Matters portfolio by reducing our holding in Henderson Group by 3%, leaving us with 5% of the portfolio in the stock which we continue to like. We bought BT Investment Management allocating 5% of the portfolio. This increases our exposure to European facing managers by 2% overall which is a theme we see further upside in.

BT Investment Management (BTT) Weekly Chart

Last night we hosted Market Matters Live in Sydney, with over 400 people in attendance - an event designed to present different, original and wide ranging views on the market. Martin Crabb, Chief Investment Officer at Shaw and Partners set the scene with a top level look at global economies with a specific focus on China. Jason Huljich gave an update on commercial property markets in Australia sighting Brisbane as a city that looks good in terms of office assets. Charlie Aitken from AIM gave a very well received spiel on why we should be investing in Europe over and above the US and made some pretty compelling points around active versus passive management – with the conclusion that now more than ever is the time to be active – sound familiar! While James Gerrish expanded on the trends we see historically in terms of bull and bear markets, why we are likely to track higher in the medium term before a correction plays out for global equities.

A great night and thanks to all those who attended.

Conclusion(s)

No real change today, with the MM portfolio now sitting in 19.5% cash following yesterday’s portfolio moves.

We continue to think the bulk of the banks downside move has now played out

Overnight Market Matters Wrap

· Amazon shares traded above $US1000 for the first time as a rise in tech stocks offset losses in banking and energy stocks.

· US personal spending and core inflation was in line with expectations while consumer confidence fell to 117.9 in May, below consensus of 119.5.

· Oil fell, base metals were mixed and iron ore was flat.

· The June SPI Futures is indicating the ASX 200 to open marginally lower this morning from the previous close of 5,715.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 31/05/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here