Maintain a plan as everywhere you turn volatility is increasing! (ALL, NAN, CBA, JHG)

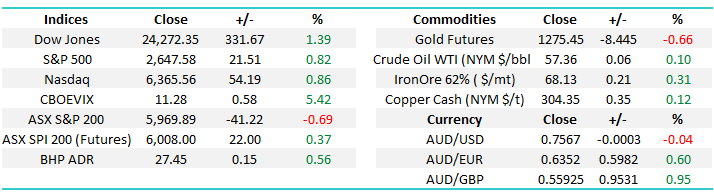

The ASX200 was smacked 41-points / 0.7% yesterday as news of the banking royal commission unsettled investors who were already anticipating loses by stocks led by a struggling resources sector. This morning I’ve started writing this report with the Dow up over 300-points, the US Fear Index (VIX) is up over 4% yet European stocks fell – strange but fascinating markets. MM’s activity in the market yesterday clearly demonstrates the increasing volatility within the markets:

- Aristocrat (ALL) $21.99 – As flagged we sold ALL at $24.15 locking in a ~18% profit however 30 minutes later the stock had plunged 12% and I’m sure a number of subscribers missed the sale, we will outline our current thoughts on ALL later in the report.

- Nanosonics (NAN) $2.54 – As planned we attempted to sell NAN around $2.60, the stock plunged with the market down to $2.45 in a flash. As mentioned in yesterday’s pm report we did not sell NAN but still intend to be sellers, however we are amending our level to be around $2.70 if the opportunity arises today.

- Commonwealth Bank (CBA) – Again as planned we added to our CBA position, into weakness, at $79 as the bank plunged close to 3% on the royal commission news. We will look to add to this holding towards $77.50 occurs.

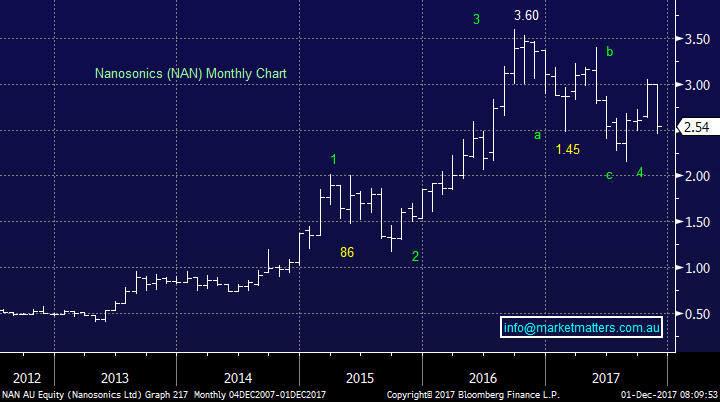

When I read the Financial Review on Wednesday the amount of bearish commentary was amazing stating scary stuff like – “the S&P500 is in its longest winning streak since 2007” and “equity valuations are at record highs” we believe this negativity is leading to huge rallies in US stocks, as we saw in the Dow last night, with persistent bears / short sellers get stopped out after 1-2 days of looking good. Markets rarely roll over when everyone’s bearish.

At MM we believe it’s not yet time to get off the stock market train but are happy to increase cash levels into strength.

Today we are going to look at 2 stocks we are looking to both sell and buy - it’s all about keeping our fingers on the pulse with both Christmas and 2018 approaching fast.

ASX200 Daily Chart

The VIX has rallied 15% from last week’s lows which is unusual as US stocks continue to make fresh all-time highs i.e. investors want to buy some downside protection if they are buying / holding stocks at these levels. Or in other words, buyers are being forced into the market, but nerves are increasing.

US VIX (Fear Index) Weekly Chart

Two potential sells in the MM Growth Portfolio

We have not mentioned Telstra (TLS) and Newcrest Mining (NCM) as subscribers are hopefully clear on our plans with these 2 holdings.

1 Aristocrat (ALL) $21.99

If we had missed selling ALL yesterday at $24, we would amend our sell level to $23, however please note we are likely to become buyers again if the stock drops under $20. The announcement yesterday was good in our view, with the acquisition of Big Fish increasing its online gaming revenue, which is clearly a growth area for ALL. That acquisition will be earnings accretive in the first full year of operation, and to us it makes sense. Some saying the markets issue yesterday was around gearing post acquisition given ALL will debt fund the purchase and that increases the need to maintain strong earnings. I think more accurately it was simply a case of one big seller getting out of the stock.

Yesterday’s sell off from early highs started with a big line of stock being crossed at 10.15am – about $38m transacted at $24. To highlight how quickly ALL fell, the next line happened at $21.65 at 10.47am for around $11m. A few other big lines were transacted in ALL yesterday with it pretty clear that someone big was exiting the stock. Volume was massive, about 6 times the daily average, with $96m – or about 4.2m shares of the day’s trade being done in big lines (crossed) – that’s about twice the normal daily average that was crossed. It’s simply another example of how stocks which have run hard can tumble when everybody tries to take profit at once, obviously the best time to sell is when demand is high – remember a2 Milk fell over 10% in just a few days after we took profit.

Aristocrat (ALL) Weekly Chart

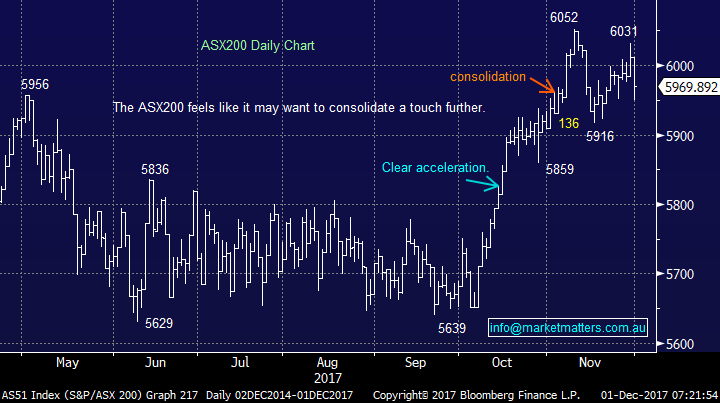

2 Nanosonics (NAN) $2.54

As mentioned earlier we were looking to sell NAN around $2.60, however the short-term picture looks reasonably for a bounce towards $2.70 (given the decent buying from yesterday’s low) so we are not panicking just yet! We are therefore amending our SELL level for now to be around $2.70,

Nanosonics (NAN) Monthly Chart

Two potential buys for the MM Growth Portfolio

1 Janus Henderson (JHG) $48.42

JHG is one of our favourite financial stocks at current levels with three big ticks against the business:

- With BREXIT looking to be unfolding cleanly JHG looks capable of reaching its pre-vote $55 area.

- The integration of Janus and Henderson is evolving well.

- We love JHG’s overseas earnings.

Janus Henderson (JHG) Weekly Chart

2 Australian Banks

As touched on earlier we are accumulators of banks into weakness. The banking royal commission may just provide this opportunity. At this stage the 2 standouts to MM are:

- Commonwealth Bank (CBA) around $77.50.

- National Australia Bank (NAB) around $28.

Commonwealth Bank (CBA) Weekly Chart

Global markets

US Stocks

The US continues to make fresh all-time highs and although we still need a ~5% correction to provide a decent risk / reward buying opportunity, no sell signals have been generated to-date.

The current strong rally since Donald Trump’s election adds to our confidence with buying a decent ~5% pullback.

US S&P500 Weekly Chart

European Stocks

European stocks look to be failing after their recent break out to fresh 2017 highs, we are now neutral / negative Europe over the next few weeks.

German DAX Weekly Chart

Conclusion (s)

1 - We are sellers of NAN ~$2.69 and if we still held ALL, we would look to lower our sell target to ~$23.

2 – We are buyers of banks into weakness and potentially JHG at current levels.

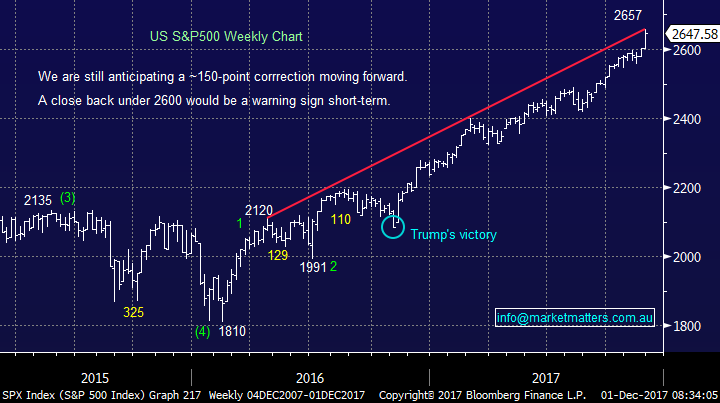

Overnight Market Matters Wrap

· The US equity markets rallied overnight, as the tax cuts reform continues to gain momentum, a positive for US companies.

· Nickel fell 3.5% on the LME, gold continues to drift lower with oil and iron ore slightly better.

· The December SPI Futures is indicating the ASX 200 to open 30 points higher, testing the critical 6000 level this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 01/12/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here