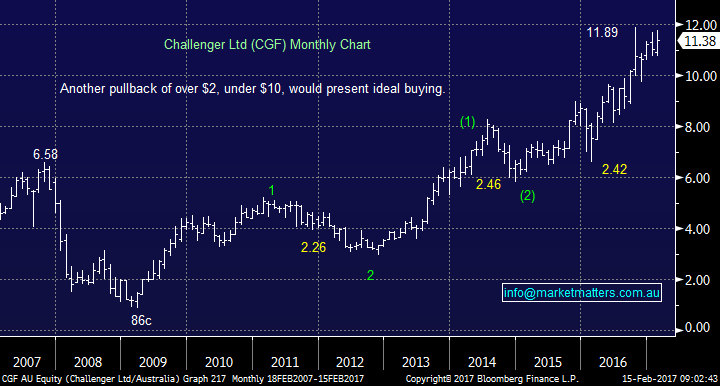

Looking for opportunities during reporting season – Part 1

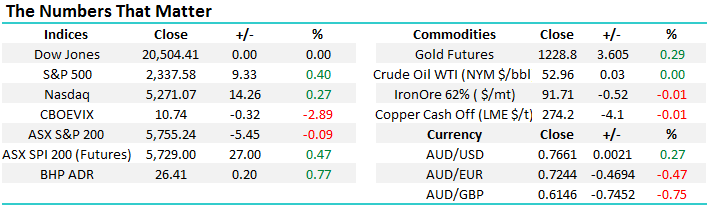

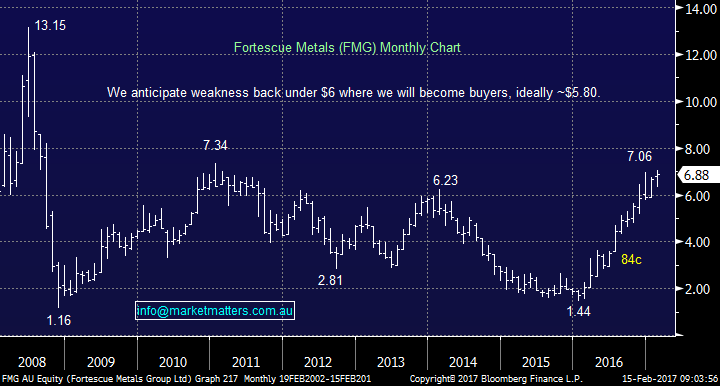

The local market showed signs of exhaustion yesterday after its rapid rise of 212-points (3.8%) in only 6 strong trading days. A few days consolidation, potentially back towards 5725 would not surprise but on balance we do eventually expect the ASX200 to attempt a break over the 2017 high of 5827. We saw some relatively small weakness from both our banking and healthcare sectors, plus the recently impressive resources were soft, including heavyweight BHP closing down 0.9% and Fortescue Metals (FMG) closing unchanged even though iron ore made fresh multi-year highs last night, rallying an impressive 6.5% to $US92.2/tonne.

ASX200 Daily Chart

We shorted FMG as a trade in the morning, following our thoughts in the previous Morning Report, the options trade is explained at the end of today's report. With US stocks continuing to make fresh all-time highs overnight the local market looks set to regain around half of yesterday's intra-day's losses but sentiment is likely to be dictated by reporting season which really kicks into gear today.

Today we will see some big Australian names report to the market including, Boral, Computershare, CBA, Sonic Health, Dominos, CSL, and Wesfarmers - there's likely to be some significant volatility at individual stock level today – we will cover these results in coming reports.

In terms of Commonwealth Bank, the results are a small beat to consensus expectations.

Cash profit of $4,907m (Exp 4821m) , EPS of $2.77 (Exp $2.74) and an interim dividend of $1.99 (ex 22nd Feb) versus Exp $1.98 . Margins down 4 bps but inline with expectations at 2.11%, bad debts lower than forecasts but costs slightly higher. Capital was strong with CET 1. of 9.9% v 9.6% Exp. The Result includes a one off gain of $397m offset by one off-cost increase $393m due to software write off. All up a good result

Commonwealth Bank (CBA) Monthly Chart

Today we have looked at 4 stocks who have recently reported that we are monitoring closely, plus one interesting takeover scenario that we already own, but do we want more?

1. Ansell (ANN) $21.42

We took a nice profit in MM back in December above $25 and the recent weakness ~17% correction has us considering re-entering the medical gloves and condoms manufacturer. ANN's report this week was mildly below expectations but guidance was fine - they said "“The second half is expected to see continued progress against the company's strategic goals. Organic growth should benefit from continued momentum of new product sales in Industrial, while Medical should make further progress as it emerges from the capacity constraints of last year and improves operational productivity.”

History tells us that stocks that report in a manner that disappoints the market generally take a while to recover hence investors can be fussy with purchases - we are buyers of ANN under $21.

Ansell (ANN) Monthly Chart

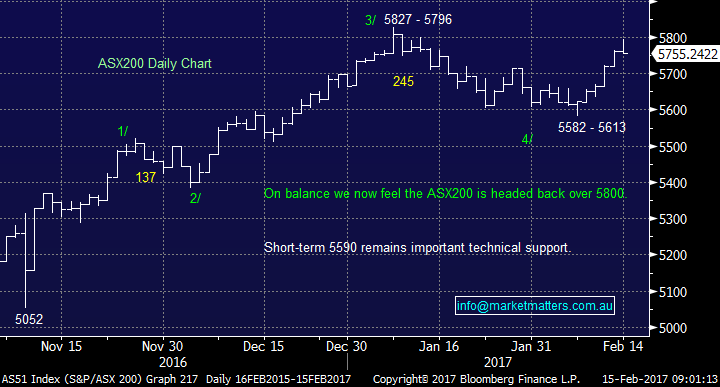

2. Cochlear (COH) $128.95

Cochlear is a stock we have touched on over recent months, we like the company but are looking for a better entry. Yesterday COH produced a good result but the stock fell 3.6% showing that investors had got a little too optimistic around their full year's profit. They reaffirmed full year guidance for $210 to $225 however the market consensus sits at $223m for the full year – which is the top of the guided range implying that there is some risk around consensus and we might see some ‘trimming’ by analysts as a result. Top line revenue was up 4% but 8% in constant currency terms which highlights the impact of the higher Australian dollar. All divisions were performing well however as we continually say, when everyone is positive a stock and there is even a hint/smell of less good news then profit taking is only natural and in this type of market, deep pullbacks can eventuate. As we said in yesterday afternoon's report "We like COH but will be patient here for some more pain to play out."

We are buyers of COH around $124, or another 4% lower.

Cochlear (COH) Monthly Chart

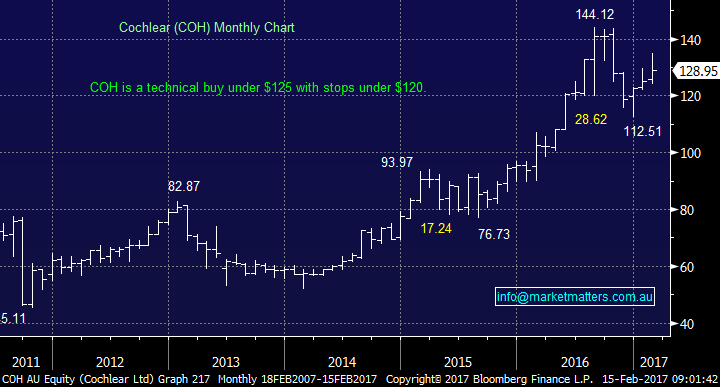

3 Challenger (CGF) $11.38

CGF had an excellent result yesterday - annuities are the hot place to be at present as our population ages and people want certainty of income into their twilight years. Annuity sales over $1bn for the third consecutive QTR and the outlook remains good. The issue here, and the reason why the stock fell off it’s perch today is around capital.When CGF writes an annuity they need to hold capital against it – a lot more than banks would for a housing loan for instance. They said today they have PCA of 1.39x however their target range is 1.3x-1.6x – so they may need to issue new capital which will likely be in the form of a Hybrid security then probably an equity raise at some point. This is simply part of their growing pains and will always be an issue for CGF as the business expands, basically it's a good problem to have but is likely to cause pullbacks in the company's share price.

We are buyers of CGF but not until the stock is closer to $10 - not outrageously optimistic with this volatile stock.

Challenger (CGF) Monthly Chart

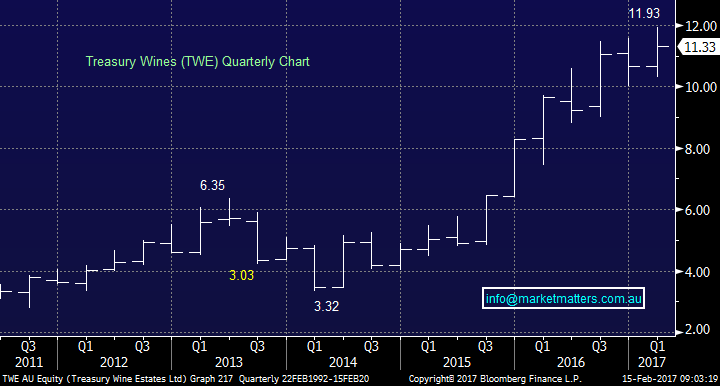

4 Treasury Wines (TWE) $11.33

TWE has been a market darling with many TV pundits describing the Australian-based global winemaking and distribution business as one of its top investment ideas for 2017. TWE delivered some good numbers yesterday but their guidance for the second half which suggested slowing growth seemed to be the catalyst for some selling, fund managers love this stock and the market is very long here. A similar story was JBH this week where the numbers were very strong, above consensus overall however when the stock is very well owned there is simply not enough new buyers to soak up the profit takers and the stock drops. In this case TWE ended the day down 4.71% at $11.33 – down from the high of $11.91

We are negative TWE and will not consider the stock until under $10.

Treasury Wines (TWE) Quarterly Chart

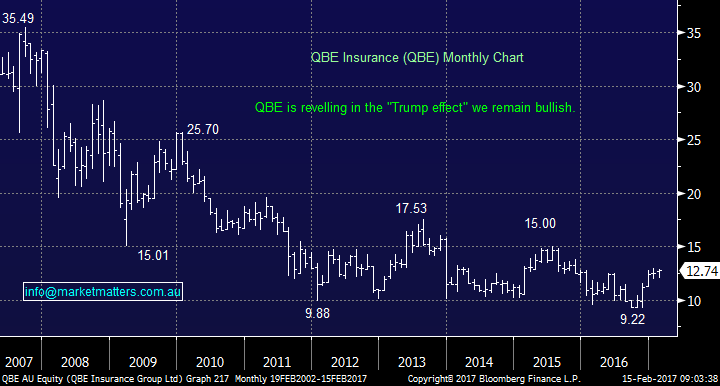

5 QBE Insurance (QBE) $12.74

With the takeover activity around Hunter Hall intensifying it feels that companies are feeling that there opportunity to use to cheap money for takeovers maybe running out of time. The papers are full of rumours around German insurer Allianz considering a bid for QBE Insurance, who is relatively small compared to the German giant. QBE is indeed taking this threat seriously recently appointing Morgan Stanley as defence advisor. From a shorter term perspective, shareholders may be keen for some takeover action given the positive impact on the share price, however if we think less selfishly, a takeover of QBE would remove one of the great ‘macro’ plays listed on the ASX, which would be an overall negative for the diversity of our market. That said, we can see why Allianz is keen to buy things at the low point in the cycle. This would be an opportunistic bid and the fact this has started to leak to the media, may expedite the timeline of a move.

Ultimately, we believe there is good possibility of this takeover bid and will look at option positions as a trading opportunity, while continuing to hold our stock position.

QBE Insurance Monthly Chart

Fortescue Metals (FMG) has enjoyed an amazing rally since the early 2016 panic lows, which made us some handsome profits along the way but we did underestimate exactly how far the stock could rally. Yesterday we went the other way implementing a "trading short" targeting a pullback towards, and probably under $6. We chose to buy a May put spread to have at least one month's exposure to the historically weak "sell in May and go away" period for equity markets.

We bought the May $7 - $5.75 put spread for 50c. The maximum profit potential is 75c with the maximum loss the 50c paid. However if we are correct and FMG retreats back under $6.50 in the coming few weeks we are likely to take a quick profit of +30%, conversely if the stock powers over $7 in coming weeks we are wrong and will take the loss - if subscribers want further explanation of this position please let us know.

Please see yesterday’s Morning Report for an explanation of our fundamental thoughts behind the bearish position.

Fortescue Metals (FMG) Monthly Chart

Summary

- Reporting season is creating volatility and with volatility comes opportunity

- We are keen on the stocks listed above but at lower levels

- We believe the QBE takeover remains in play, and will look to increase our exposure through an options position

Overnight Market Matters Wrap

- The US share markets continued its strength and hit another record high, led by the Financial sector.

- The Dow is up 92 points (+0.45%), the S&P 500 up 9 points (+0.4%) and the NASDAQ 100 up 14 points (+0.27%).

- Janet Yellen in her Senate testimony suggested waiting too long for higher rates may be disruptive to markets and US 10’s added another 5 basis points to now yield 2.47%.

- The ASX 200 is expected to continue yesterday’s strength and rally ~30 points higher this morning, towards the 5,785 level as indicated by the March SPI Futures this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 15/02/2017. 9.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here