Looking at 5 big movers yesterday (A2M, CSR, AMC, HVN, IGO)

The local market started November with a bang rallying 0.5% to challenge multi-year highs – historically the first day of the month is very often strong for the local market as fund managers allocate some of their cash inflows into the market, commonly via SPI futures before settling on specific company allocations moving forward. Following strong leads from the global resources overnight the ASX200 looks set to make fresh highs for 2017 this morning as the psychological 6000 area becomes closer by the day.

- We remain bullish the ASX200 into 2018 targeting a solid break over 6000.

- We would need a break back under 5800 to lose this short-term bullish outlook.

On a stock level the market was actually pretty mixed yesterday as the sector / stock rotation continues, we noticed the below:

- Regional banks continued to struggle following Bendigo’s (BEN) poor result, Bank of Queensland (BOQ) which we own trades ex-dividend today 46c fully franked.

- Remember on average Commonwealth Bank (CBA) corrects over 6% at one stage in November.

- The energy sector remains very strong as crude rallies away from $US50/barrel – we are bullish but unfortunately with no exposure at present.

- Healthcare was weak even with its underlying strong $US earnings – we are avoiding these stocks at present.

- Large cap miners have come back into favour over the last few days as iron ore’s rapid decent appears to be having a rest.

ASX200 Monthly Chart

5 of the big movers yesterday.

Today we have taken a snapshot look at 5 stocks who had large moves yesterday, importantly stating our view and potential action if appropriate.

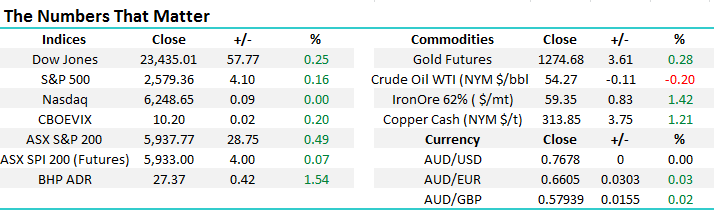

1 A2 Milk Co (A2M) $7.16

A2M finally closed down -6% yesterday after tumbling far more in early trade. The only news was that Colonial First State, a huge supporter of the stock, had trimmed its holding from 6.4% to 5.4% - why not after such an amazing rally!

We are trading buyers of A2M into weakness, ideally start accumulating ~$6.50.

A2 Milk Co (A2M) Monthly Chart

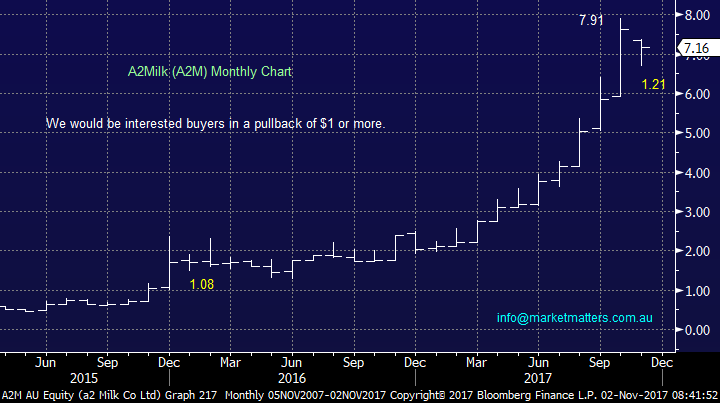

2 CSR Ltd (CSR) $4.48

CSR fell -5.5% yesterday as rising power costs and worries around the future for housing construction took centre stage ahead of its 4% profit growth.

We are neutral CSR.

CSR Ltd (CSR) Weekly Chart

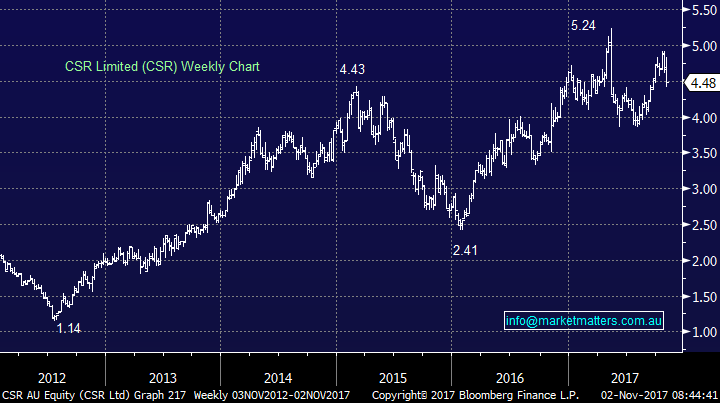

3 Amcor Ltd (AMC) $15.30

Amcor fell -3.4% following comments by the company that trading conditions were “difficult”.

We are not keen on AMC at present, even with its overseas earnings.

Amcor (AMC) Monthly Chart

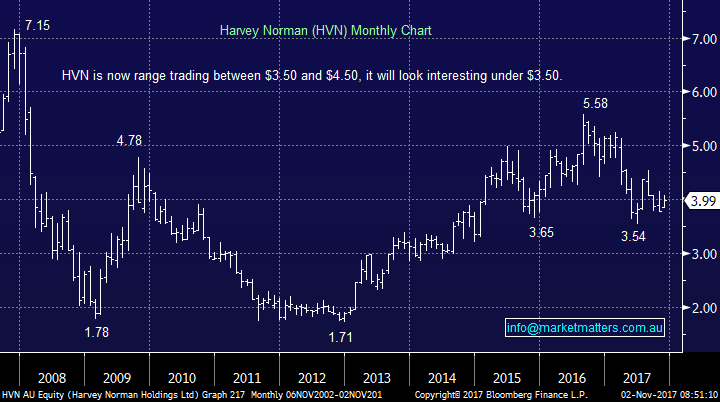

4 Harvey Norman (HVN) $3.99

HVN shares soared +5.6% yesterday following a positive tick by ASIC around its accounting practices.

We own HVN in the Income Portfolio and remain comfortable with our 4% weighting, and would only look to increase into any prevailing weakness, $3.50.

Harvey Norman (HVN) Monthly Chart

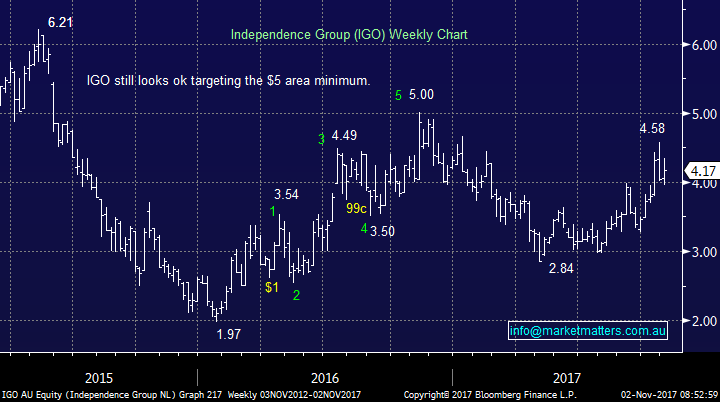

5 Independence Group (IGO) $4.17

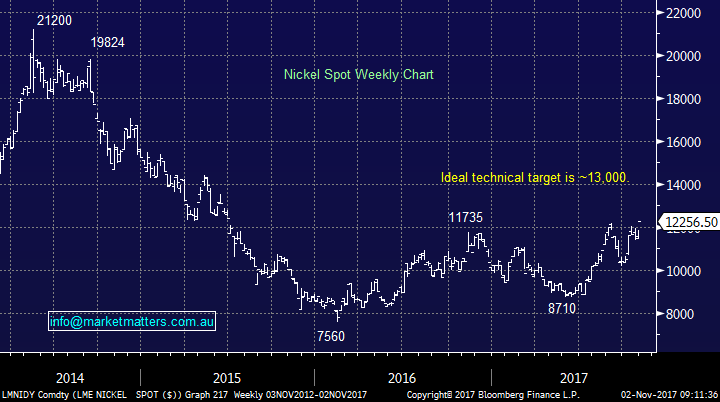

The Nickel and Gold miner IGO who we own rallied 4% yesterday as the nickel price surged to fresh multi-year highs.

We remain bullish but may be tempted to take profit around $5 if / when this occurs for this volatile stock.

Independence Group (IGO) Weekly Chart

Nickel Spot Weekly Chart

Global markets

US Stocks

The US continues to oscillate around all-time highs and although we need a ~5% correction to provide a decent risk / reward buying opportunity no sell signals have been generated to-date.

US S&P500 Index Weekly Chart

Russell 2000 Index Monthly Chart

European Stocks

European stocks have broken out to fresh 2017 highs and are now bullish technically while the 3600 area holds i.e. ~2.7% lower.

Euro Stoxx 50 Weekly Chart

Conclusion (s)

Of the 5 stocks looked at today we like a2milk (A2M) ~$6.50 as a trading BUY

Also no change on the below 4-points from yesterday:

- Australian stocks with offshore earnings remain well positioned, especially as the $A looks very weak.

- Be selective towards the Australian consumer and interest rate sensitive stocks until further notice.

- We still believe the ASX200 will trade well over 6000 in 2017/8.

- If / when we get a ~5% correction in global equites remember the above 3 points with your decision making.

Overnight Market Matters Wrap

· The US equity markets closed marginally higher overnight, as the US Fed left rates unchanged, however solid growth and labour markets point to a rate rise in December.

· All metals on the LME rallied overnight – nickel was the standout up 4%, while oil fell and iron ore made a small gain.

· The December SPI Futures is indicating the ASX 200 to open 18 points higher towards the 5955 area this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 02/11/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here