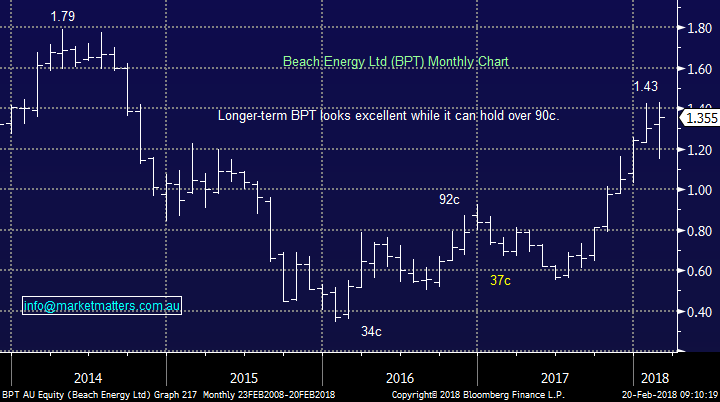

Looking at 4 big movers from Australian reporting season (IVC, BXB, BPT, SGR)

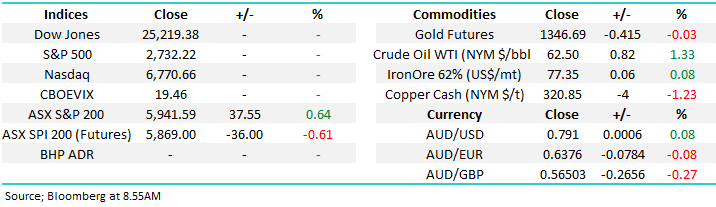

The US markets were closed overnight for President's Day but unfortunately it looks like the local ASX200 is going to initially follow European markets lower with our March SPI futures implying a drop of around 25-points early this morning. However, yesterday was very encouraging for local stocks following an average open with strong gains across most of the market – we danced the strong Asia tune for a nice change.

In the medium-term MM believes the ASX200 looks on track for further gains over coming months but for this week we anticipate further consolidation around the 5900-5950 region. If this does unfold we believe it will provide the perfect platform for an assault above the psychological 6000-area into March / April.

Our view at the start of 2018 remains intact and will remain the core to our investment decisions until further notice:

1. Stocks would have a” warning style” correction for a short-term buying opportunity in early 2018 – this has occurred and we bought aggressively.

2. Many global indices will make fresh all-time highs between now and April before its time to get off the stock market bus!

Remember we are happy to slowly increase our cash positions prior to ideal targets just in case we are wrong as we believe over 2018/9 the next ~20% move for stocks is down.

Today’s report will focus on 4 stocks who have recently traded ex-dividend.

Share Price Index 60-mins Chart

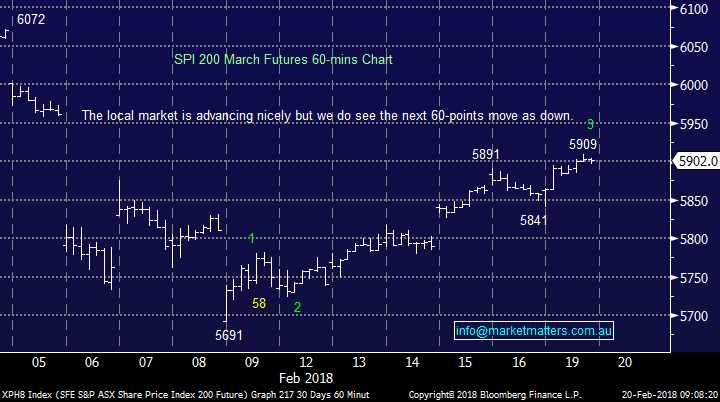

1 Brambles (BXB) $9.74

Initially BXB was sold off following its profit report when revenue came in at $2.7bn compared to the expected $2.8bn, however the company provided some reasonable commentary which helped the stock recovery. While BXB is not very exciting at current levels we do like its $US earnings moving forward.

From a purely technical short term standpoint, the stocks could bounce up to 10% but this would still have it ~12% below its 2016 high i.e. the medium-term trend is down.

Brambles (BXB) Weekly Chart

2 Invocare (IVC) $14.30

The funeral provider has been a wonderful performer over the years but competition has weighed on its performance since the end of 2017 with the stock now 21% below its all-time high.

In yesterday’s report IVC downgraded guidance and while they have performed a solid job of increasing margins it has come at the expense of market share. While population growth clearly helps IVC competition is our perceived major risk as is a shorter term reduction in likely deaths over the next year or so (touch wood) plus the stock trading on ~25x estimated 2018 earnings is not in the cheap basket.

Yesterday we were considering the stock seriously for our Growth Portfolio but considering our view for the market sitting on our hands feels the best option – technically we can actually see a test of ~$11 in the years ahead which coincides with our bigger picture market outlook moving forward.

Invocare (IVC) Quarterly Chart

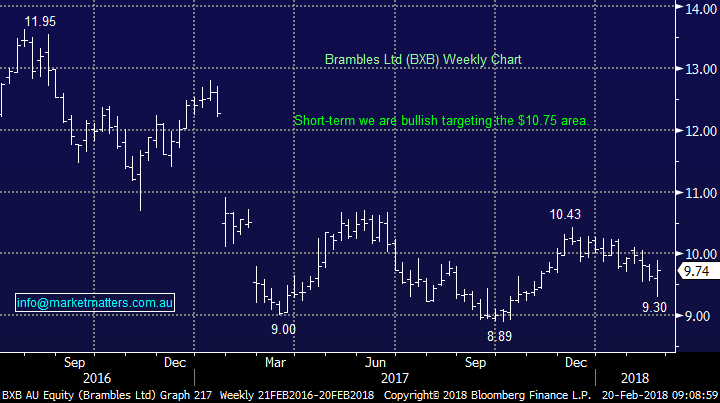

3 Beach Energy (BPT) $1.35

A very frustrating day for MM as Woodside (WPL) that we hold fell almost -8% courtesy of its Rights Issue while BPT rallied by over +7%. However, our view is that BPT has completed a chapter in its evolution and WPL is better value at current prices.

Technically the stock looks a sell around the $1.50 region.

Beach Energy (BPT) Monthly Chart

4 Star Entertainment (SGR) $5.45

Shares in SGR have been smacked -11% in the last 5-days following the company’s recent result with most of its issues occurring in their Sydney casino. In simple terms the casino’s “skim” came in well under the expected margin i.e. for VIP’s only 1.06% compared to over 1.6% previously. The problem for the stock was compounded by the strong run from the shares into its result leaving it looking expensive.

This is a stock we have made money from last year but for now we are bearish SGR with a sub-$5 target.

Star Entertainment (SGR) Weekly Chart

Conclusion (s)

No major change, at this stage we are comfortable with our short-term bullish call targeting new all-time highs from a number of global indices in the next few months.

MM found no opportunities for ‘now’ from the 4 stocks we looked at today.

Global Indices

US Stocks

Closed overnight.

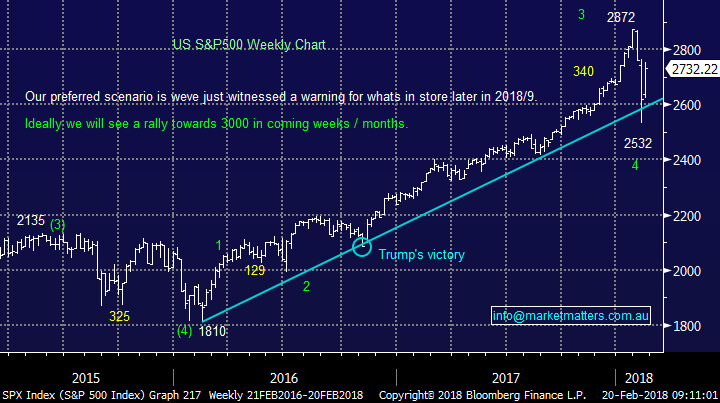

Our target area for the recent aggressive weakness by US stocks was reached and to-date has been rejected strongly. Assuming over the next few days / weeks the S&P500 can trade around current levels in a calmer fashion a test of all-time highs looks a strong possibility.

US S&P500 Weekly Chart

European Stocks

No major change we are now targeting around the 14,000-area for the German DAX before we will turn bearish i.e. a rally from here of ~10%! However, at this stage European equities have not embraced the global “bounce” by stocks.

German DAX Weekly Chart

Asian Stocks

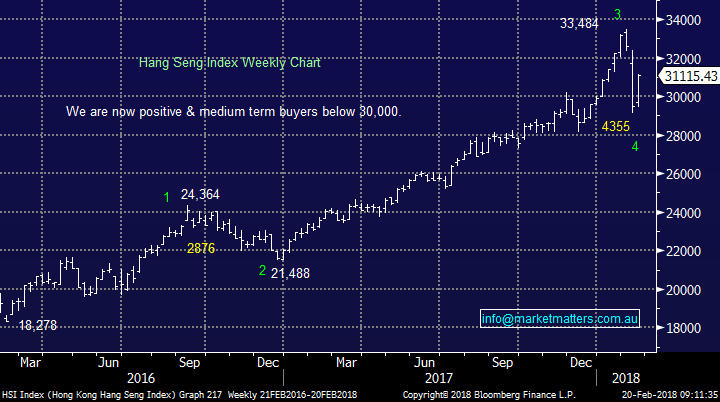

Similarly, to western global indices the Hang Seng has corrected over 10% and was looking good from a risk / reward perspective under 30,000, already a lofty 3% away.

The Emerging Markets index, which is highly correlated to our resources sector, looks very bullish ideally targeting a ~8% advance in coming weeks / months.

Hang Seng Weekly Chart

Emerging Markets ETF (EEM) Weekly Chart

Overnight Market Matters Wrap

· A quiet yet weak session overnight with China, Hong Kong and the US closed for holidays, however the European region had failed to follow Asia Pacific’s strength, with the FTSE off 0.64% and the EuroStoxx of 0.55% led by the consumer staples and consumer discretionary sector.

· On the commodities front, Dr. Copper was weaker, whilst crude oil rallied over the US$62 handle and should benefit the energy sector today.

· Companies reporting today are ACX, APO, BAP, BHP (after market), CQR, FXL, GOZ, GPT, GXL, IOF, MND, OSH, SUL, SWM, SXY, VOC and VRT.

· The March SPI Futures indicating the ASX 200 to follow Europe’s lead to the downside, down 33 points towards the 5910 region this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 20/02/2018. 8.13AM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here