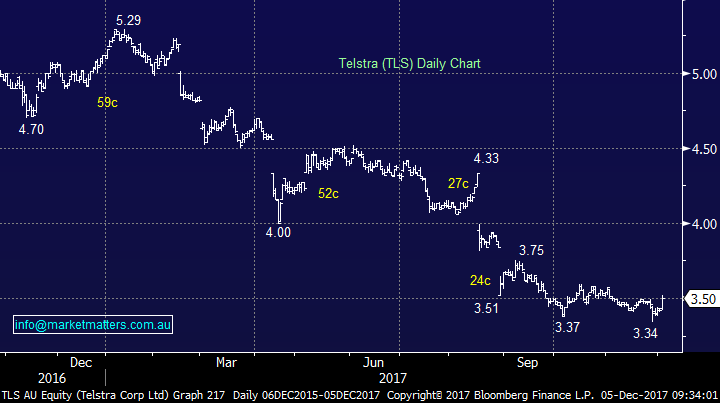

Keeping our finger on the pulse (A2M, JHG, CBA, TLS, NCM, NAN)

At MM we believe that it’s not yet time to throw in the towel in on this major bull market but we do feel that the greater likelihood is stocks will be lower over the next 3-6 months, the question we are asking ourselves is – “will we get a classic Christmas / window dressing rally for some optimum selling?”.

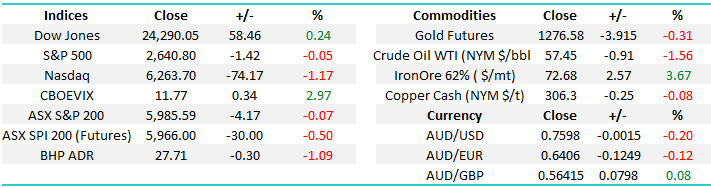

It feels day to day like the ASX200 has experienced a tough time recently but its only 1.1% below the years high however to make a decent break through 6000 we are probably going to need the heavyweight banking sector to cast off the shackles of the royal banking commission and come back into favour – just half of the gains recently shown by the US banks would be enough!

Volatility continues to slowly raise its head and although most major stock indices appear relatively quiet on the surface there’s a lot happening “under the hood” i.e. this morning the Dow is up +58-points (0.2%) but the NASDAQ is down -74-points (1.2%).

We often say the NASDAQ is the leading US index but this morning an index of the largest US tech shares has slumped to a 5-week low primarily as they won’t be the major beneficiaries of Donald Trump’s Tax Plan – not a major sell signal but a warning light.

ASX200 Daily Chart

Today is a perfect example of the difference you get with MM i.e. because we have real money in the market we cannot simply generate 3 “buy ideas” weekly as we have a finite amount of funds available hence today there are a matching volume of potential sells to buys as we search for the optimum portfolio mix of stocks / cash.

MM’s 3 most likely sells

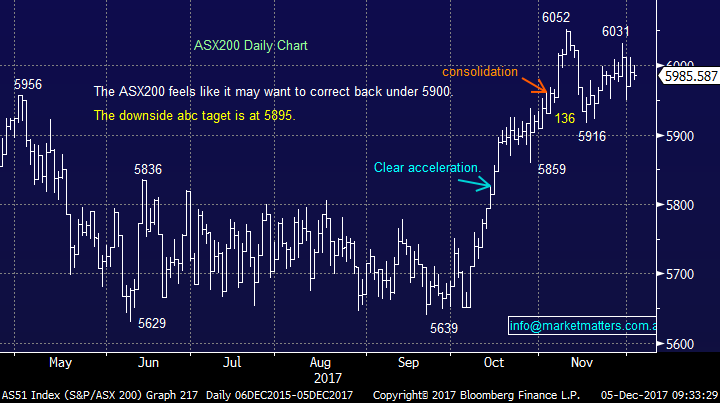

1 Nanosonics (NAN) $2.61

We have discussed NAN a number of times over the last week – if NAN cannot hold around this $2.60 area we will exit alternatively we are currently sellers ~$2.70. Watch for alerts

Nanosonics (NAN) Monthly Chart

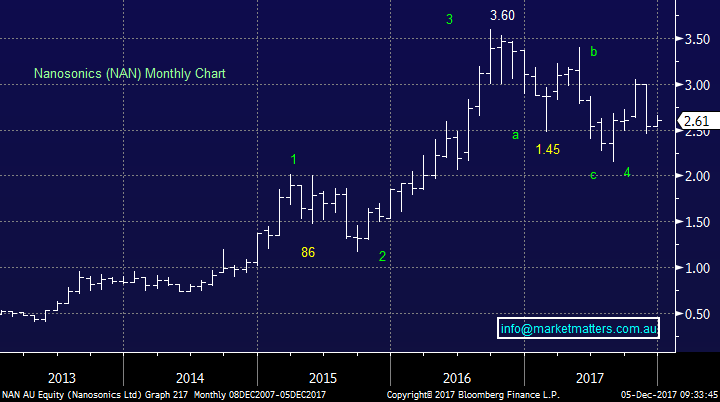

2 Telstra (TLS) $3.50

We are comfortable holding TLS around current levels but the 10% weighting in the Growth Portfolio feels too rich and we are considering trimming this back around the $3.60 area to match the 5% weighting in the Income Portfolio. TLS owes us $3.56 in the Growth Portfolio and $3.48 in the Income Portfolio.

Telstra (TLS) Daily Chart

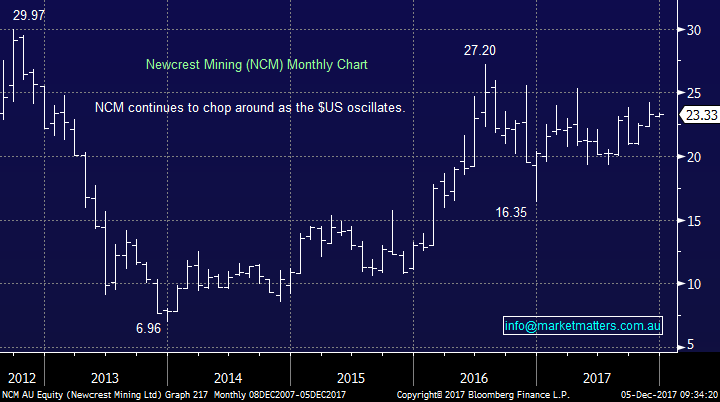

3 Newcrest Mining (NCM) $23.33

We are watching NCM very closely as our long-term view of rising interest rates is at odds with this holding. For now, we can see the $US making one final low in 2017 which should help gold and its respective stocks hence we will remain patient exiting for now, however this is a position that is firmly ‘on the block’.

Newcrest Mining (NCM) Monthly Chart

MM’s 3 most likely buys

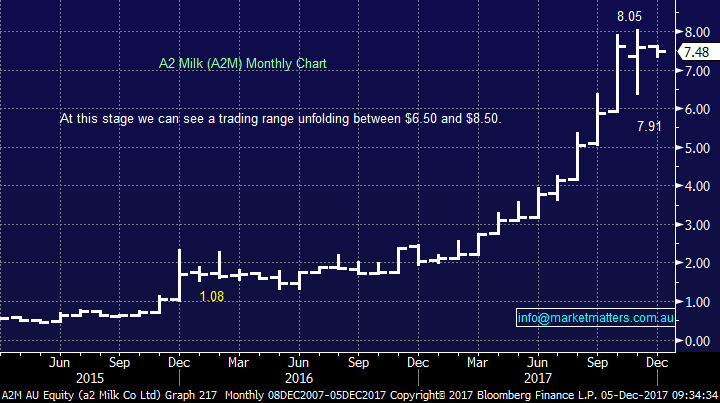

1 a2 Milk (A2M) $7.48

For now, we will observe but any weakness back under $6.50 is likely to see MM again accumulating A2M. This may seem a large move but A2M can be a very volatile stock.

A2 Milk (A2M) Monthly Chart

2 Commonwealth Bank (CBA) $78.92

No change here, we are looking to add to our CBA holding around $77.50 with one eye on next February’s attractive dividend.

Commonwealth Bank (CBA) Daily Chart

3 Janus Henderson (JHG) $48.96

We are very keen on JHG’s offshore earnings and todays hiccup in the BREXIT negotiations might cause some weakness short-term – we are potential buyers around $47, or 4% lower.

Janus Henderson (JHG) Weekly Chart

Global Indices

US Stocks

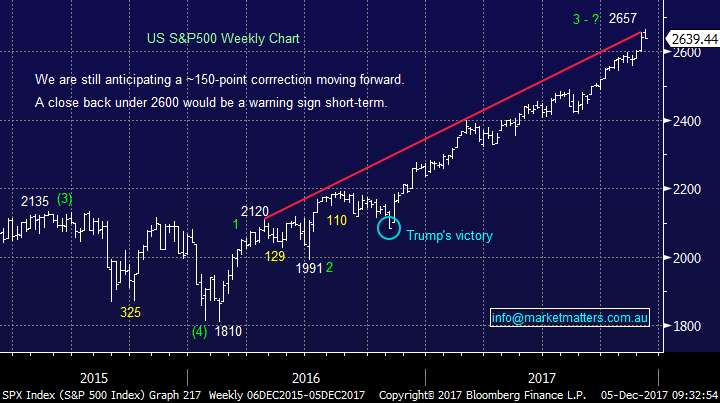

US equities are following our recent thoughts where the selling of any new all-time highs if / when they occur has paid dividends at least for 24-48 hours as the market looks for a top.

Overall there is no change to our short-term outlook for US stocks, where we would advocate patience ideally targeting a ~5% correction for the broad market to provide a decent risk / reward buying opportunity.

US S&P500 Weekly Chart

European Stocks

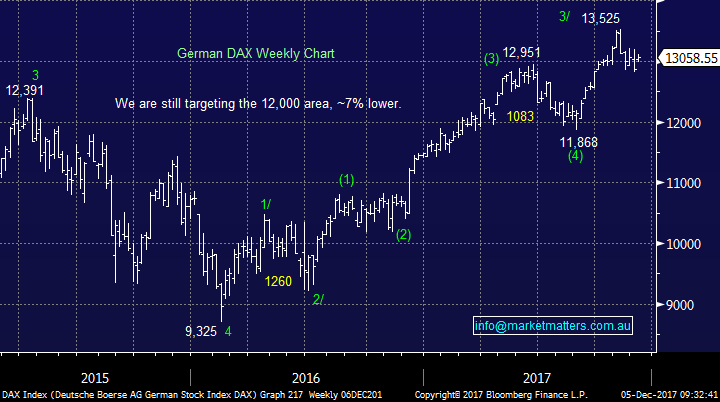

No major change with our preferred scenario for the German DAX a 7% correction back towards the 12,000 region.

German DAX Weekly Chart

Conclusion (s)

We are considering buying CBA, A2M and JHG for the MM Growth Portfolio while TLS, NCM and NAN are the most likely stocks to make way for any fresh purchases. To view both portfolios, click here.

Overnight Market Matters Wrap

· A mixed session overnight, with the US equity markets giving back majority of its early gains and the NASDAQ 100 underperforming out of the bigger indices as investors see less benefit in this sector following the tax cut bill being passed.

· The Sterling dipped overnight as negotiations broke down in BREXIT talks and an agreement was not made.

· Gold lost its lustre as the ‘safe haven’ asset was switched primarily to the US financial sector as investors saw better risk / reward, while Iron Ore continues to bounce, up 3.67% as it has entered in bull market territory.

· Oil however slid 1.56% to US$57.45/bbl, dampening any strengths in diversified miner, BHP which closed in the US down an equivalent of -1.09% to $27.71 from Australia’s previous close. We expect Fortescue Metals (FMG) to outperform this sector and the broader market today, a stock MM currently holds.

· The RBA meets this afternoon where we anticipate rates to remain unchanged at 1.50% for December.

· The ASX 200 is expected to give back some gains early in the session, down 24 points towards the 5960 level as indicated by the December SPI Futures this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 05/12/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here