Keeping our finger on the pulse

The local stock market has finally gained some of the strong positive sentiment that has been flowing in the US since the Donald Trump victory, over the last 2 days the ASX200 has rallied 137-points (2.5%). Yesterday’s buying was unrelenting sending the market higher throughout the day - see Wednesday's MM Afternoon Report. The move felt like fund managers were being forced to increase their exposure to a rising market, a phenomenon that we have discussed and been expecting to eventually emerge. This buying coupled by a dearth of sellers because the very same institutions are underweight stocks can be explosive.

Seasonally the local market is moving into a fascinating period that can deliver some nice Christmas cheer! Stocks usually rally into early December, they pull back for 7-10 days before exploding into the end of the month from around the 14th. This ties in nicely with our current interpretation of the local market:

MM expects the current strong rally to continue to well over 5500 prior to a 100-point pullback in early/mid December, a 2016 high well over the August 5611 high feels a strong possibility. We are now going to look at some sectors / stocks where we have an active interest with our large commitment to the local market, bearing in mind we are now in "sell mode" looking for the time to lock in some nice profits.

ASX200 Daily Chart

The ASX200 Banking Index remains on track to test the 8600 area, around 4-5% higher than yesterday's close. Considering this and our positive outlook for the overall index for the end of 2016 we will remain patient selling all / part of our CBA, WBC and MQG holdings.

ASX200 Banking Index Monthly Chart

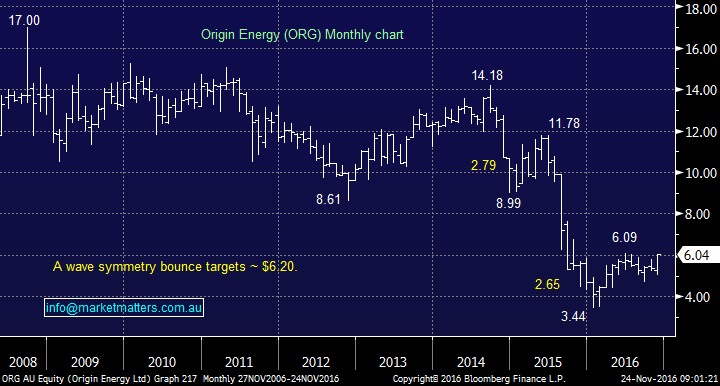

We have remained bullish crude oil targeting the $US60/barrel region, hence our 10% holding in Origin Energy (ORG). We have an initial target for ORG of $6.20 with potential upside towards $7. Importantly OPEC have a critical meeting on the 30th November, which will dictate the short-term direction of oil. History tells us it's hard to get the likes of Iraq and Iran to agree but when push comes to shove + the intent is there for higher prices, a deal seems likely in this instance.

The market is showing optimism at present and ORG is challenging its $6.09 2016 high, a pop up towards the $6.20 level feels likely. Last night on a quiet night for US stocks the energy sector gained close to 0.5% so the move may even be this week.

We are likely to take a 12-13% profit on half of our position ahead of the OPEC meeting, on a push over $6.09, putting ourselves in a nice win-win situation.

*Watch for alerts around this holding*

Origin Energy (ORG) Monthly Chart

Our most recent purchases have been in the out of favour Transurban (TCL) and Westfield (WFD). As we have mentioned previously these are shorter term plays as we do believe US rates are set to rally under a Trump administration. Both positions are showing some nice initial gains, the question is where to lock some in. Currently we are think TCL ~$10.80 and WFD ~$9.70.

Ansell (ANN) has only been in the MM portfoio since October and the position is playing out as expected. We remain bullish the beneficiary of US earnings targeting the $25 region.

Healthscope (HSO) is a stock we like medium term as we are big believers in the private health business model moving forward. This is one of the few stocks on our buy radar but we want weakness down towards $2.10 to increase our holding.

Healthscope (HSO) Weekly Chart

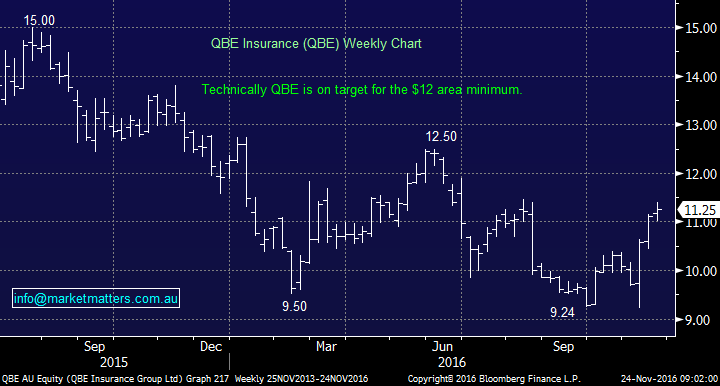

QBE is arguably our favourite holding at present with our initial $12 target looming fast. However remember medium term we can see this large beneficiary of both a higher $US and US interest rates potentially challenging the $15 area.

QBE Insurance (QBE) Weekly Chart

The battered Telco sector has recently shown signs of life gaining 3.8% over the last 5 days. We are looking to exit our tough position in VOC over $6 and our trading position in TPG ~$8.

Mantra Group (MTR) continues to frustrate failing to reach our initial $3.70 target. We remain positive Australian tourism, liked what we heard at their recent AGM so patience may be warranted with this holding.

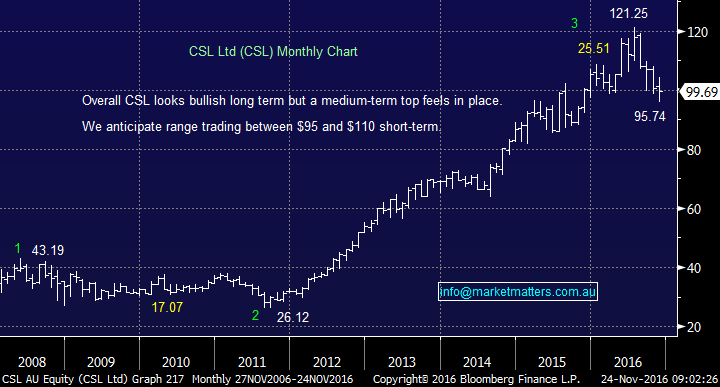

CSL has had a bad 6-months falling further than we expected breaking well below $100. However we still believe the stock will correct back to $108-$110 where we plan to take a small loss on the holding.

CSL Ltd (CSL) Monthly Chart

Summary.

- We are bullish stocks into early 2017 and will be looking to reduce our large equity exposure into strength - we are wearing our "sellers hat".

Overnight Market Matters Wrap

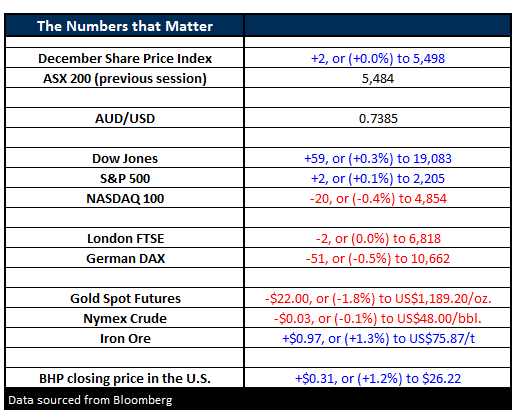

- The US share markets seemed to consolidate closed mixed overnight, ahead of Thanks Giving Holiday tonight.

- The Dow ended its session up 59 points (+0.3%) at 19,083, the broader S&P500 up 2 points (+0.1%) to 2,205, while the NASDAQ 100 lost 20 points (-0.4%) to 4,854.

- Gold lost its lustre as investors continue to flock away from the ‘safe haven’ assets to more risk, losing 1.8% to US$1,189.20/oz.

- Iron Ore managed to climb further, rallying 1.3% higher to US$75.87/t, this led BHP in the US to close an equivalent of 1.2% higher to $26.22 from Australia’s previous close.

- The ASX 200 is expected to test the 5,500 level again, as indicated by the December SPI Futures this morning.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 24/11/2016. 9.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here