It’s not just Telstra coming back into favour (TLS, TPG, JHG)

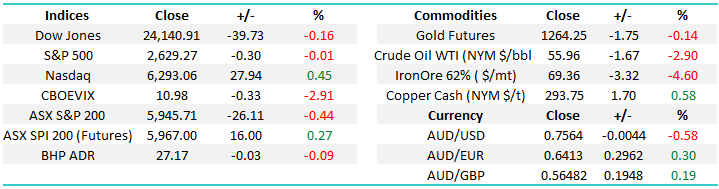

The ASX200 was weak yesterday led lower by the resources following a tough night for base metals – remember its seasonally common for the first half of December to be lacklustre for Australian stocks. The Christmas rally should get a helping hand from the 13th when investors receive their huge dividends from NAB, which is then followed by ANZ and Westpac over the following 8 days.

This morning local stocks are set to open up ~20-points, theoretically regaining most of yesterdays losses, with BHP unchanged in the US there is no obvious indication where the buying will be focused early on. We would have no interest if MM were traders selling a market which gains on average +2.5% in December the optimum buying remains under 5900 early next week, if the stars align.

Today we are going to focus on telco stocks which have come back into favour globally over recent weeks.

ASX200 Daily Chart

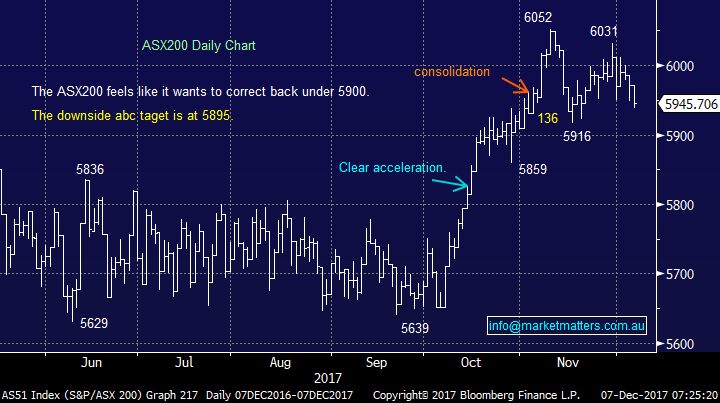

Over the last 24-hours the $A has slipped lower following disappointing local economic data:

- Last quarter the Australian economy only grew at 0.6% compared to the 0.7% forecasted by most economists.

- The country experienced its weakest household spending growth since 2008.

The combination of huge household debt and slack wage growth is leading to us Australians tightening the belt and restraining the economy – perhaps we need tax cuts like the US?

At MM we remain keen on stocks with overseas earnings.

The Australian Dollar $A Monthly Chart

Global telco’s playing catch-up

A number of us have both noticed and enjoyed watching Telstra (TLS) rally over 8% since last weeks fresh low for 2017 – TLS is now trading on a 6.1% fully franked yield that looks sustainable for at least a few years.

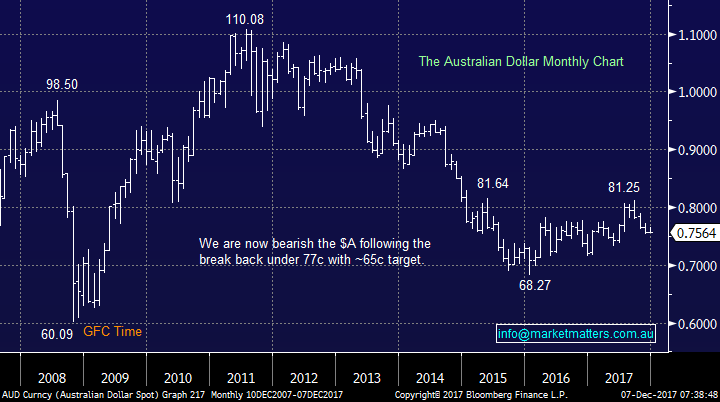

However the rally in TLS has more global overtones than just a relief rally following a clearing of the decks around the messy NBN saga. The story has been very similar with US Telcos and they have no NBN:

- US Telcos fell over 20% in 2017 while the broad S&P500 surged to fresh all-time highs.

- US Telcos have rallied around 14% from their 2017 lows in mid-November.

US S&P500 Telco Index Daily Chart

Recently we have witnessed some major reversals of the underlying trends during 2017 with retailers as well as the Telcos rallying strongly, probably hurting some slow short sellers. Also the high flying tech stocks have struggled as investors locked in profits before the festive season hence allowing the broad market to improve on a comparative basis.

At this stage we believe we are simply seeing some understandable book squaring ahead of Christmas which is potentially providing MM with the opportunity to rejig its Growth Portfolio.

US S&P500 v NASDAQ Daily Chart

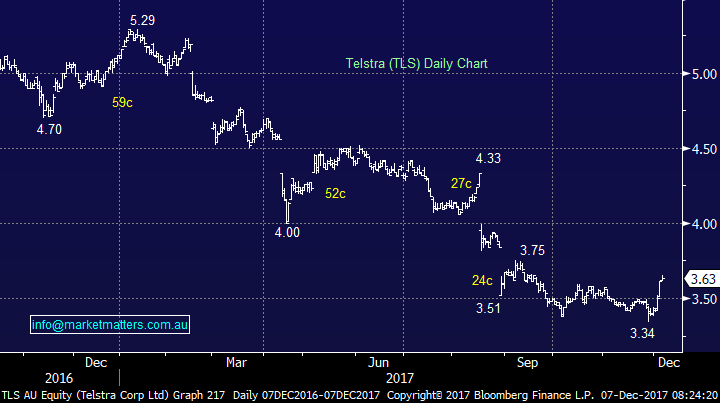

Telstra (TLS) $3.63

We are comfortable holding TLS but still feel our 10% waiting is too high in the Growth Portfolio and hence plan to look at our holdings in 2 halves:

- We are looking to take a small profit on half of our holding around $3.65.

- We are looking to take a larger profit on the balance of our holding around the $3.80 area

Watch for alerts.

Telstra (TLS) Daily Chart

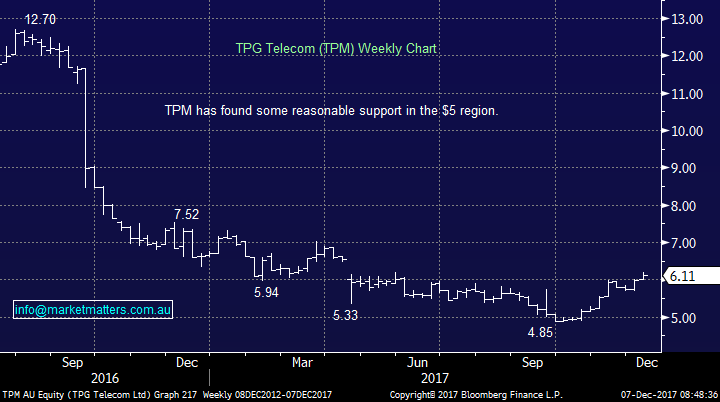

TPG Telecom (TPM) $6.11

Almost 30% of votes cast went against TPM’s executive pay structure in yesterdays AGM, probably no great surprise with the shares down ~50% since 2016. We see TPM as basically too hard at current levels with the impact of the NBN extremely hard to unravel.

TPG Telecom (TPM) Weekly Chart

A potential buy today for the MM Growth Portfolio

Janus Henderson (JHG) $47.35

We have been watching JHG for a few weeks liking both their sector and offshore earnings. The current uncertainty around BREXIT is potentially providing an opportunity to enter following a ~6% correction.

- We are potentially buyers of JHG around the $47 area.

- We are likely to be conservative with our weighting in case BREXIT talks do ultimately fail.

Watch for alerts.

Janus Henderson (JHG) Weekly Chart

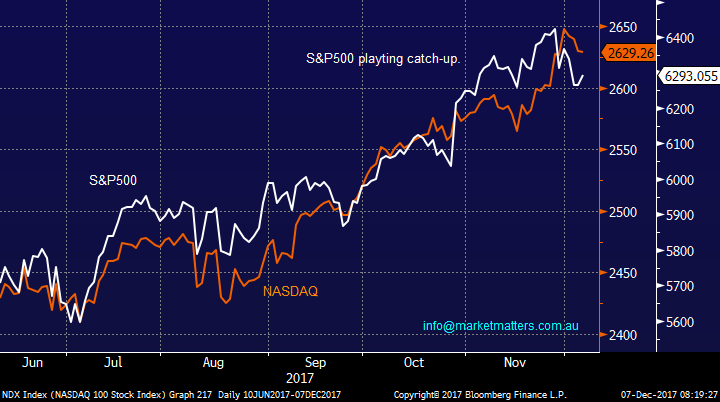

Global markets

US Stocks

No change, we still need a ~5% correction to provide a decent risk / reward buying opportunity, no sell signals have been generated to-date but it’s clearly struggling above 2600.

The current strong rally since Donald Trump’s election adds to our confidence with buying a decent ~5% pullback.

US S&P500 Weekly Chart

European Stocks

European stocks look to be failing after their recent break out to fresh 2017 highs, we are now neutral / negative Europe over the next few weeks.

German DAX Weekly Chart

Conclusion (s)

1 - We are considering selling half of our TLS holding around $3.65.

2 – We are considering buying JHG around $47.

*watch for alerts.

Overnight Market Matters Wrap

· Wall St has fluctuated overnight between gains and losses with all 3 major indices heading into the closing Bell in slight positive territory, as investors await further developments on the timing and size of the proposed tax cuts.

· US private payrolls rose 190,000 in November, with the biggest increase in manufacturing jobs this year. The numbers highlighted the difficulty of retaining skilled workers with labour market tightening and wages increasing.

· Among the individual stock highlights Home Depot announced a US$15bn share buyback, of which they plan to buy US$7bn in 2018.

· Commodities were generally weaker again with oil and iron ore under pressure - Brent oil price -2.5% at us$61.60/bbl and iron ore -3.4% at US$69.40/t - but copper holding onto slight gains after the previous day’s 4% selloff. The A$ is 0.5% lower at US75.6c and, despite weaker commodities, the futures are pointing to a slightly firmer opening on the ASX this morning of around 0.3%.

· The December SPI Futures is indicating the ASX 200 to open 20 points higher towards the 5965 area this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 7/12/2017. 9.00 AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here