Is the yield curve playing the tune of the ASX200?

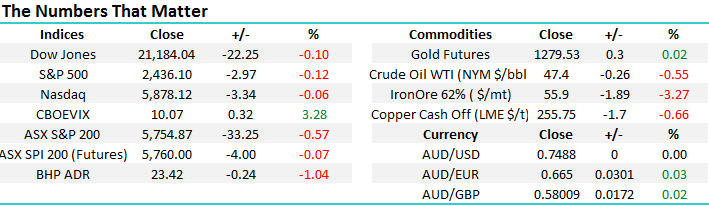

We are only 3 trading days into June and already we’ve experienced a decent sell-off, the ASX200 was actually down 50-points yesterday by mid-morning before fighting back to close down 33-points. Hence today is a logical time to start the morning report by considering the classic characteristics of June for local stocks. Most of us know that June is often referred to as the weakest month for local stocks but the question we ask is “what are the internals of June”? We are going to specifically consider the 8-years since the GFC so we are comparing apples with apples:

1. Even during the impressive 8-year bull market which commenced in March 2009 the ASX200 has only managed to close positive 25% of the time in June.

2. The average low-point in June has been in the last week and very often the last few days.

3. The average pullback during June since the GFC is a whopping 5.7% (pullback from high to low – not overall performance)

These are some pretty solid and negative statistics strongly implying investors should keep some ammunition for potential buying opportunities later in the month, especially as July is one of the best months for Australian stocks.

Seasonality Chart – ASX 200

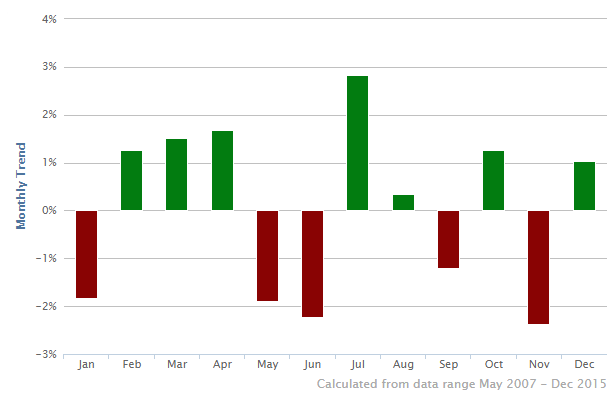

US stocks drifted marginally lower last night with the Dow closing only 15-points above its swing high on the 15th of March, over 3-months ago. A 4-5% pullback feels close at hand but no sell signals will be generated until the Dow closes back under 21,000.

US Dow Jones Daily Chart

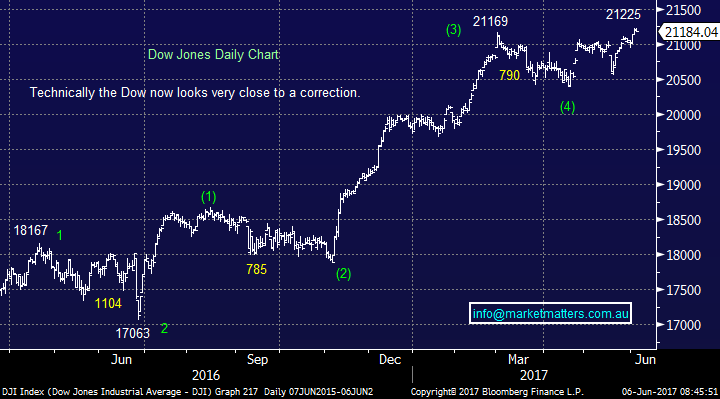

Around 60% of yesterday’s losses were courtesy of the banking sector which tumbled almost 2%, led by regional Bendigo (BEN) which was smacked 4.38%. This decline by our markets most influential sector is threatening to add to the already 13.2% pullback by the banks over the last 5-weeks.The banks have clearly been in sell corner since May with 5 negative factors hitting them all at once:

1. The new bank levy will likely knock a few % from the banks’ earnings.

2. Investors are becoming increasingly concerned with Australian property prices and the associated risks being carried by the banks.

3. The banks remain under political pressure in terms of capital adequacy

4. The 2-10 year yield curve has moved in the totally wrong direction for banks profitability over recent weeks. I.e, falling bond yields is a negative for banks

5. Three of the “big 4” banks have just traded ex-dividend.

Australian 2-10 year yield curve v Banking Index 240-mins Chart

It’s impossible to know exactly what is the main catalyst for the recent selling of our banks, but the combination of these 5 factors is certainly making it easier for investors to delay any aggressive buying. Interestingly the banking sector is usually ok in June with the selling more concentrated in the yield play stocks.

However on balance yesterday’s bank selling felt to MM that hedge funds were actually shorting the sector. They have done this before and been hammered but household debt is now substantially greater and any tick higher in bad debts for the banks is likely to lead to acceleration on the downside for their respective share prices. Recent weakness in the Canadian property market plus their banking sector, which has fallen over 10% since March, will unfortunately continue to bring our banks into the global hedge fund manager’s cross-hairs.

While our view is the majority of the local bank selling is likely to be behind us we see no reason to increase our exposure just yet.

ASX200 Banking Index Monthly Chart

BEN has been hit especially hard over recent weeks falling well over 10%, much of this weakness makes sense due to their high levels of Australian property exposure but yesterday’s 4.4% acceleration was a touch surprising. After years of positive revaluations BEN has announced it is moving to exclude unrealised gains from cash earnings on its Homesafe product. It seems to us that in doing so BEN have just called the top in Australian House prices, albeit with a lot less fan fair than some!!

We believe there is a lot of “bad news” now baked into the BEN share price with the stock trading on a valuation of ~12.3x and paying a 6.36% fully franked dividend. We are likely buyers under $10.50, or 2.5% lower but not if you believe Australian property is set to tumble!!

Bendigo and Adelaide Bank (BEN) Weekly Chart

Conclusion(s)

We are neutral the banking sector short-term especially as we move into the seasonally weak June.

We now like BEN into further weakness under $10.50 but this is likely to prove dangerous if Australian property prices tumble on the eastern seaboard.

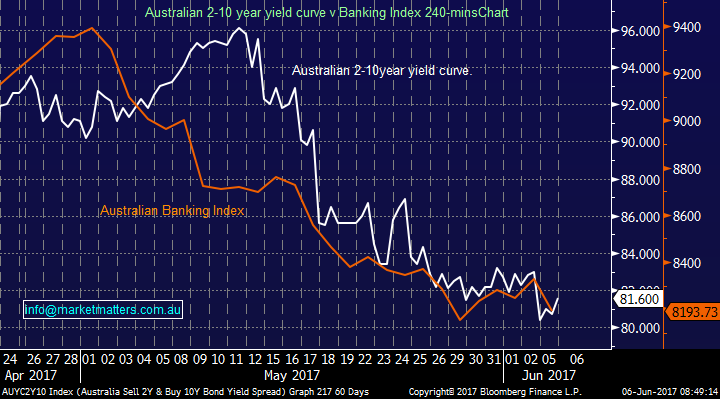

Overnight Market Matters Wrap

· The US indices all closed marginally lower, with investors taking a breather and reassessing their views and portfolio.

· On the commodities side, oil slid further on the news of the Gulf States rift with Qatar, with the benchmark Brent price dropping another 1%, having retraced nearly 10% from the pre-Opec meeting highs last month.

· Further weakness is expected with the major miners, with BHP ending its US session down an equivalent of -1.02% from Australia’s previous close.

· The June SPI Futures is indicating the ASX 200 to open 4 points higher, towards the 5,760 area this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 06/06/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here