Is the Resource Sector Finally Hotting Up?

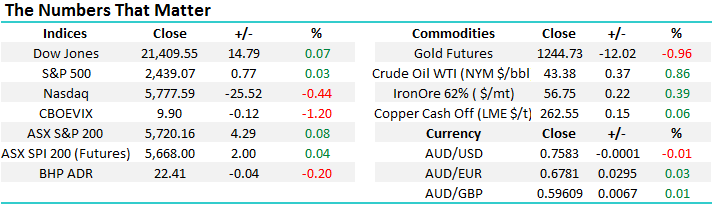

A weak session for the local market yesterday with early optimism fading throughout the day and the market limped into the close. A similar session played out in the US overnight with markets giving back early gains to close fairly flat for the DOW and S&P 500 while the Nasdaq ticked in the red. The DOW closed ~100pts from its high and we continue to think the US market remain vulnerable in the short term, although no sell signals are generated until the DOW breaks below 21000. Expect our market to open flat this morning with BHP up a few pts.

Dow Jones Daily Chart

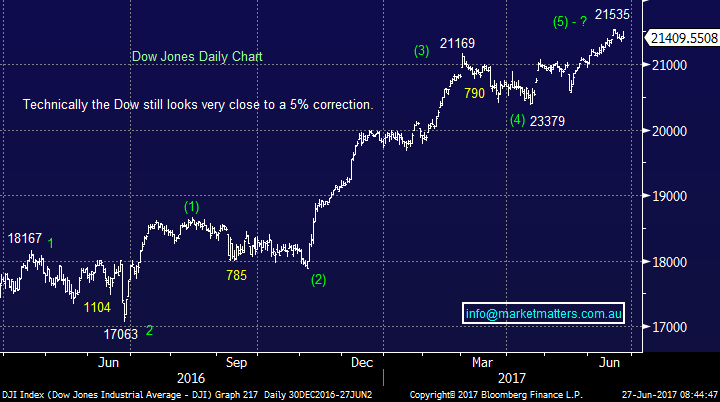

Locally the market continues to underperform with stocks down by 1.01% last week versus the US which was up by 0.30%, however we’re starting to see some interesting trends bubble away in terms of commodities, ahead of what’s a typically strong period for our miners. In early 2016 commodities started a strong bull run as optimism around global growth picked up, Trump won the election and that pushed commodity stocks up into a January 2017 high. Since then, commodity stocks have been under pressure around the globe and the Australian miners have felt the brunt of it, however this period of consolidation / weakness now look done and opportunities are popping up.

According to a number of different measures, commodities are now cheap, in fact they are the cheapest they have been relative to the S&P 500 in history.

Rio Tinto (RIO)

Rio Tinto (RIO) is orchestrating a bidding war for its Hunter valley coal mines, with both Glencore and China’s Yancoal desperate for the assets – so much for Coal being a dead duck! On Friday, Glencore upped its bid to more than $3.5bn trumping Yancoal’s current proposal by around ~$300m, however at the stage RIO is sticking with the Yancoal bid, one of its largest customers. It’s clearly an interesting predicament. Glencore’s bid is largely unconditional, they’ll pay a $225m none refundable deposit and the deal will likely complete, plus RIO would rather sell to a competitor than a customer, given the potential impact on future coal prices (if sold to a customer). Yancoal’s bid is conditional and they may have more difficulty getting regulatory approvals, however if RIO snub them, they’ll upset their biggest customer, not to mention the Chinese Govt.

Whatever the case, the deal will likely be done, the price for RIO will be good and this opens the door for further capital management for the miner. We own RIO and remain comfortable with our 5% holding

Rio Tinto (RIO) Weekly Chart

BHP Billiton (BHP)

A weak Oil price of late has been a drag on the BHP share price as the market has seemingly lost focus on Elliot’s proposal for the big Australian Miner. Elliot first made their views public with a release on the 10th April and the BHP share prices closed just below ~$26 that day. The proposal which included a number of aspects such as a single listing and spinning off some assets, detailed a valuation on BHP assets of around ~$US27, or in Australian Dollar terms around ~$38. Since then BHP has only tracked lower closing yesterday at $22.45. Elliot are a credible outfit and they put their money where their mouth is.

We hold BHP from ~$24, which in hind sight, was a tad early however we remain comfortable with our 7.5% holding.

BHP Billiton (BHP) Weekly Chart

Fortescue (FMG)

Clearly a more volatile proposition, however we’ve had good success with Fortescue over the past few years. The recent high above $7 was a shorting opportunity that we took advantage of and we now see Fortescue as a higher risk buy. Iron Ore prices have obviously been weak and we’ve now see brokers downgrade their earnings assumptions for FMG, however the share price is already down 40% from the highs – we think these downgrades have already been factored in.

We hold FMG from ~$4.66 and remain comfortable with our 5% holding.

Fortescue Metals (FMG) Weekly Chart

Summary

· We remain comfortable holders of BHP, RIO and Fortescue (FMG).

· For those looking for buying opportunities, these 3 stocks look good at current levels.

· July is typically a good time for the miners.

Overnight Market Matters Wrap

· A mixed yet sombre session in the US equity markets overnight, with the tech heavy, NASDAQ 100 the lone ranger to close in the red.

· Focus was clearly seen in the commodities market, particularly in the gold space, with a larger than average volume of contracts sold in only one minute of the session… many see this as a ‘fat finger’.

· The June SPI Futures is indicating the ASX 200 to open 10 points higher, towards the 5730 area this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 27/06/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here