Is the IVF space becoming interesting after its correction?

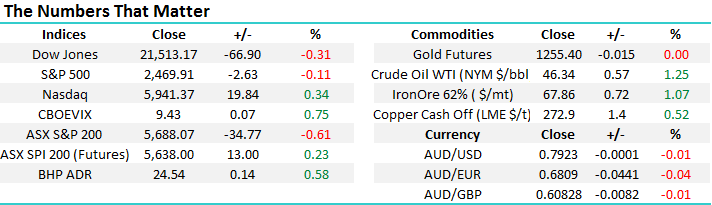

The ASX200 fell another 35 points / 0.6% yesterday, plumbing new lows not seen since the 9th of June. We have slowly been losing short-term confidence in the local ASX200 as it failed to rally with many of its global piers. Yesterday’s break to a fresh low for July by the Australian market is clearly concerning from a statistical perspective:

The DOT Theory – “80% of the time a market will make the high, or low, of any timeframe in the first 80% of that timeframe.”

The ASX200’s trading range for July is now 5792-5653, or 139-points. As we discussed in the Weekend Report the lowest monthly trading range for over 3-years is 160-points which strongly implies at least a test of the major 5629 support area over the next 5 trading days. However, when we combine the DOT Theory with yesterday’s fresh low for the quarter the next few months is clearly looking ominous. The first 2 quarters of 2017 have experienced very tight 319 and 327 trading ranges respectively, hence if 5792 remains the high of Q3, which the DOT Theory now implies, the ASX200 should test 5500 during August / September = our current view.

Yesterday MM took a negative position in the options market by buying the September 5575-5375 put spread. Our logic was simple:

1. We already hold 18.5% of the MM portfolio in cash and saw no obvious stocks we wanted to sell / lighten in the MM portfolio at current levels.

2. Hence the “Put Spread” is a trading position which hedges our portfolio.

MM still holds over 20% of our income portfolio in cash, not surprisingly we are looking to deploy some of this into any weakness over coming months.

ASX200 Weekly Chart

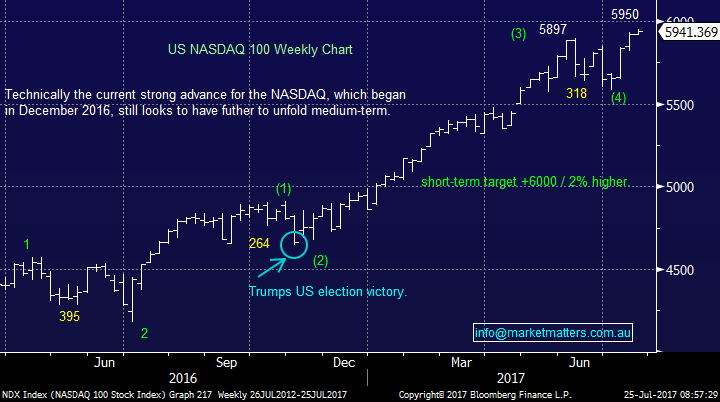

US Stocks

Last night US equities were again quiet still managing to hold around all-time highs. There remains no change to our current view, we are targeting potential further gains for the NASDAQ probably over 6000, now only ~ 1% higher, before a decent correction to test the early July lows.

This week we have ~40% of the major US stocks reporting which is likely to lead to some volatility, at least on the stock level. By the end of last week, we had seen ~20% of companies report with around 80% of stocks beating analyst’s estimations but the market only gained 0.5% implying to us that equities are “tired” at current levels.

Hence our view in terms of risk / reward is not compelling for buyers i.e. 1% upside v 7% downside.

However, importantly for local investors when the NASDAQ corrected sharply over 5% in June / July the ASX200 basically ignored the move, we are running our race at present.

US NASDAQ Weekly Chart

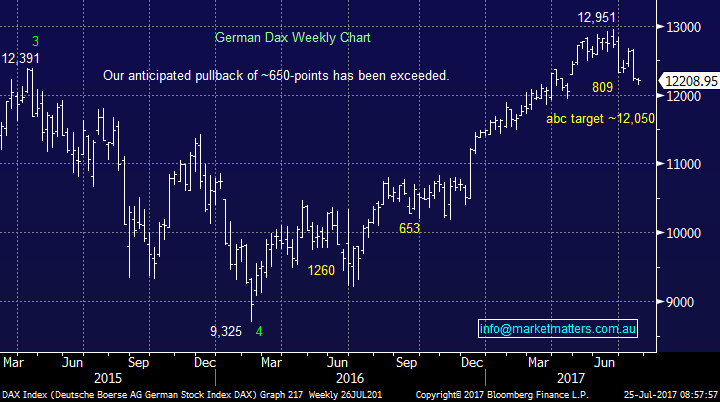

European Stocks

Europe has recently been tricky with the German DAX now approaching strong support in the 12,000-area following a 6.2% correction but the UK FTSE looks vulnerable to further declines, especially as investors get increasingly concerned around BREXIT.

German DAX Weekly Chart

As an investor, it always pays to remain open minded on potential investment sectors as the banks / resources will not always be the optimum place to be as the last few years have illustrated i.e. household debt is at record levels, wage growth is low plus banks are pushing up interest rates out of RBA cycle.

Today we have taken an initial look at the fairly new IVF sector whose stocks have only really been trading on the ASX for the last 3-4 years. This tends to be a defensive area of the market, albeit a more competitive one in recent years. Financial pressures, record housing prices, expensive ‘smashed avocado’ are combining to see couples start families later that in times gone by. This often leads to more complications / difficulties having a family which improves the demand for IVF services. These trends make us positive the IVF space as a sector but what stocks and of course at what levels?

The two leading companies MVF and VRT have seen their stock fall below their initial listing levels following a discounted offering by Primary Healthcare (PRY) which has stolen market share away from its two rivals.

1 Monash IVF Group (MVF) $1.595

MVF shares have corrected well over 30% from their 2016 high, at current levels the stock is becoming interesting yielding 5.5% fully franked and trading on a P/E of only 12.36x est. 2017 earnings.

However, the momentum clearly remains poor for the stock and we would currently only consider accumulating MVF under $1.50.

Monash IVF Group (MVF) Weekly Chart

2 Virtus Health (VRT) $5.55

VRT has corrected in a similar manner to MVF, falling around 40% from its 2016 high. The stock is now trading on a est. 2017 P/E of 14.6x while paying a dividend of 5% fully franked.

For both VRT or MVF to look attractive at current levels we need to see clear signs they have stemmed the flow of customers to cheaper offerings.

Virtus Health (VRT) Weekly Chart

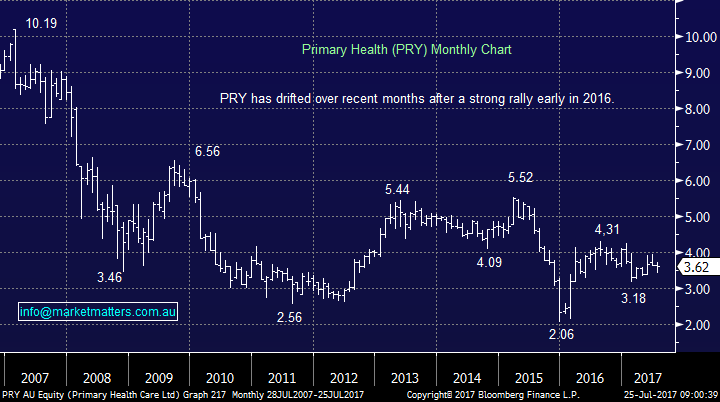

3 Primary Health (PRY) $3.62

We have liked PRY for a while and technically its bounce from the $3.20 support area is encouraging. PRY is trading on a P/E of 20.3x est. 2017 earnings while paying a 3.1% fully franked dividend. If local discretionary spending does deteriorate a discounted IVF offering is likely to remain very well received.

We could buy around here but only half size hence leaving room to average ~5% lower.

Primary Health (PRY) Monthly Chart

Conclusion (s)

We like the IVF space but the hardest question is how to play it, especially as we believe Australia is going to face some tough economic times in the years ahead from a discretionary spending point of view.

We like MVF around $1.50 and VRT around $5 – both lower levels. Conversely, we like PRY at todays $3.60 area but would only consider a 50% investment leaving room to average ~55 lower.

Overnight Market Matters Wrap

· The US share markets closed with little change, trading at a lower volume than the average 20 days as investors wait for important economic data and further corporate earnings, while the NASDAQ 100 closed at another record high.

· In Europe, particularly in German, weakness was seen in the auto industry after the European antitrust authorities allege collusion between the German carmakers.

· Iron Ore bounced overnight, up 1.07% with BHP in the US ending its session 0.58% higher from Australia’s previous close.

· The June SPI Futures is indicating the ASX 200 to open marginally higher towards the 5695 level this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 25/07/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here