Is the ASX200 headed for 6000 already? (CYB, MQG, RRL, BHP)

The ASX200 has finally broken out from its extended trading range, managing to achieve a 5-month high, leaving many technical analysts saying go / stay long unless the market falls back under 5800 - we certainly cannot argue with their logic. Like all jigsaws there are a number of pieces involved and when we consider them at this stage – we will outline some of our thoughts later in this report.

Hence at this stage MM will remain focused on stock and sector rotation to look for optimum returns into 2018 as opposed to chasing the market aggressively.

We are holding 14% cash within the Growth Portfolio and 18% in the Income Portfolio following our ~35% profit realised from the HFA Group yesterday.

ASX200 Weekly Chart

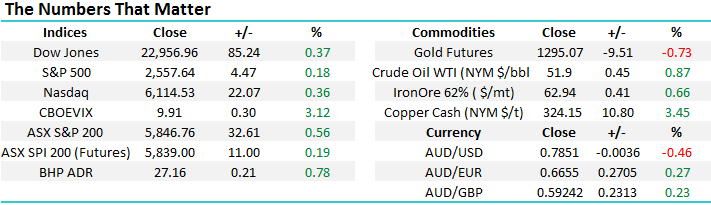

Global Indices

US Stocks

US equities were again higher last night, which is a phrase we feel that we’ve typed repeatedly of late. The NASDAQ continues to grind higher in the “rising wedge” we have illustrated below, this is a set-up which usually proceeds a fall but there remain no sell signals at present.

Overall there is no change to our short-term outlook for US stocks, where we would advocate patience ideally targeting a ~5% correction for the broad market to provide a decent risk / reward buying opportunity.

US NASDAQ Weekly Chart

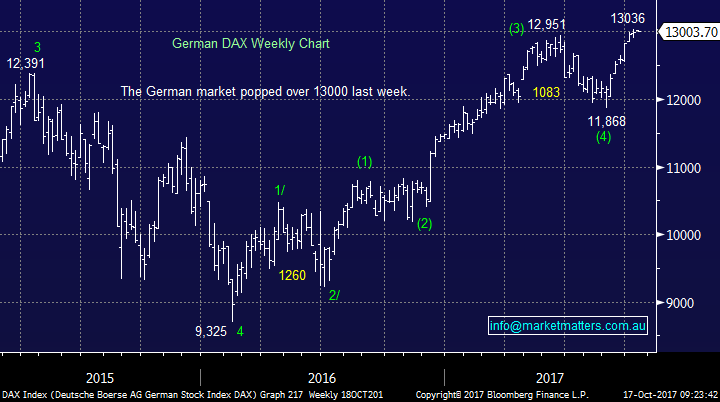

European Markets

No change, the German DAX made fresh 2017 highs last week but we can see this move failing and a decent correction again unfolding, potentially back under the psychological 12,000-area.

However overall on balance we have to remain neutral for now.

German DAX Weekly Chart

The pieces of the jigsaw.

We have put together 5-points that on balance leads us to believe it’s not time to “panic buy” stocks at current levels,besides the obvious fact that the Australian market is trading expensively on a historical basis i.e. over 16x forward earnings.

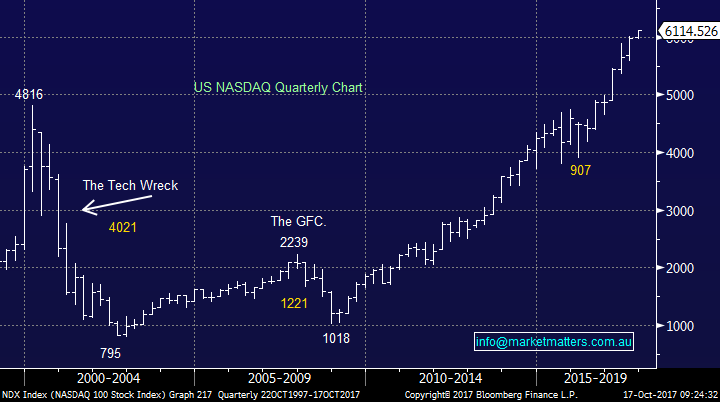

1. Talk of an equity melt up.

Over the last few weeks we have noticed one significant change to the stories covered by journalists looking to literally grab readers attention. They have migrated from “remember the October ’87 Crash and this market must be about to tumble” to “perhaps we are in for an equity melt-up, similar to that experienced by the NASDAQ in 1999-2000 just prior to the tech wreck.”

Our view is whatever is forecasted in the press very rarely comes to pass with bitcoin feeling like the more likely candidate for a melt-up / crash scenario. We definitely will not rule out anything but at this point in time it’s not our preferred outcome.

NASDAQ Quarterly Chart

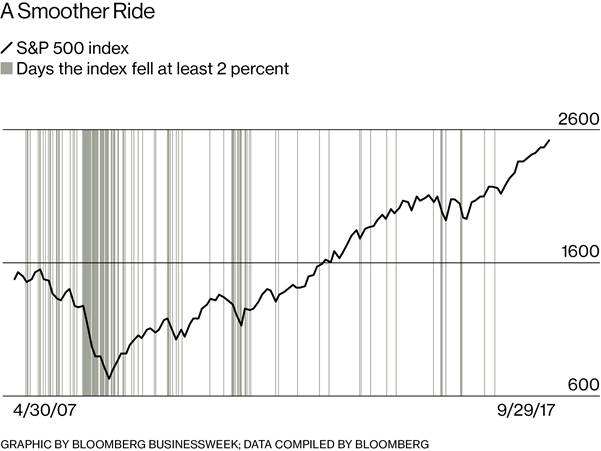

2. Complacency continues to rise

Complacency is increasing week by week, the chart below shown on Bloomberg illustrates just how long it’s been since the US S&P500 experienced a 2% fall, it’s a brave bullish investor who doesn’t recognize that some degree of pullback is extremely overdue, although we do acknowledge that many investors are looking for a pullback to buy stocks.

S&P500 Daily Chart

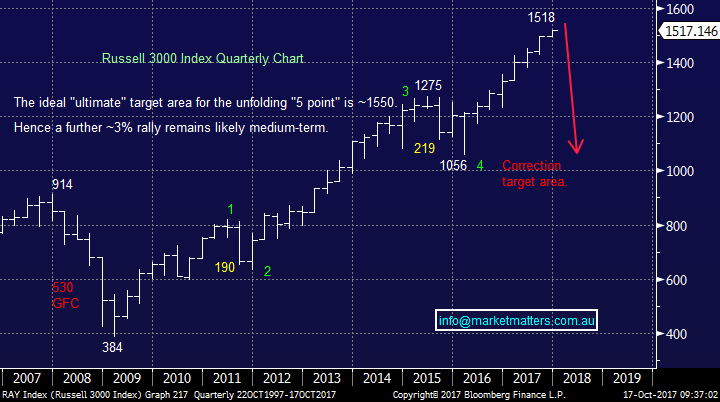

3. MM’s long-term outlook for stocks.

For the last few years MM has been bullish stocks using the large US indices as our big picture roadmap – not always ideal when investing in Australia but still solid for the major trends. Our target is ~3% higher for the broad US market so further gains are still expected.

Russell 3000 Quarterly Chart

4. Local resource stocks.

The major resource stocks like BHP and RIO are very influential within the ASX200, especially from a sentiment perspective. Although BHP has bounced ~6% over recent weeks it’s still over 2% below where we took profit in September. Our view remains that the resources sector looks good moving forward but is at a huge resistance level and better buying opportunities are likely at lower levels in the future.

BHP Billiton (BHP) Weekly Chart

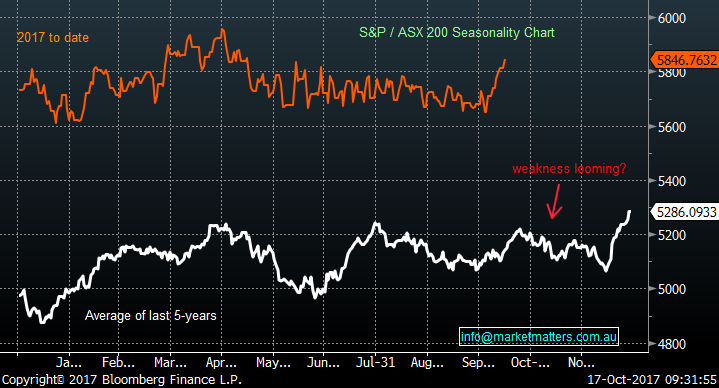

5. Seasonality says be patient.

From a seasonal perspective the ASX200 usually struggles from next week into mid-December which strongly suggests that maintaining a reasonable cash position makes 100% sense.

ASX200 Seasonality Chart

A Portfolio switch that we are considering.

It feels like recently every time we give subscribers the notice of a likely / pending alert the opportunity does not quite materialise e.g. yesterday selling Regis Resources (RRL) for our MM Growth Portfolio over $4 – the stock only reaching $3.95.

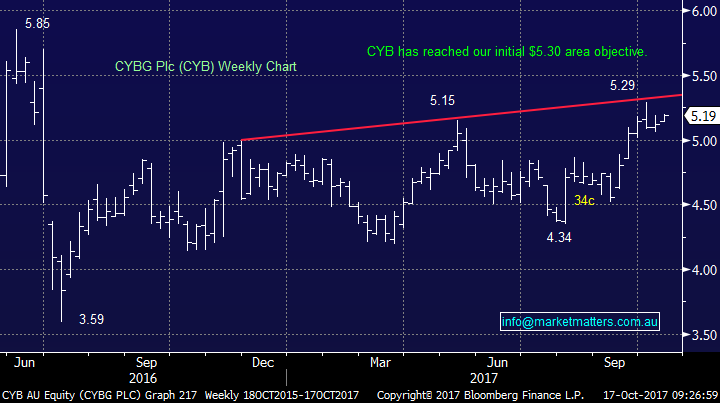

However, that’s the market we operate in and the best laid plans require continual adjustment! A potential switch we are watching at present is from CYBG Plc (CYB) to Macquarie Group (MQG):

1. CYBG – we are showing a reasonable 10.7% profit on our 5% holding and given recent consolidation around current levels, our sell target once again becomes the $5.30 area for our remaining 5% holding – which is only 2% above current levels.

2. MQG – we have been targeting the sub-$92 area to start accumulating MQG i.e. only 0.6% lower. MQG reports later in the month and we have noticed previously that it often drifts into its report before kicking higher, probably as the market worries that MQG must eventually miss on expectations. Note we may also just buy MQG outright as previously discussed with the potential for some weakness today given 1. IOOF (IFL) is bidding for ANZ’s wealth business, and therefore raising capital, therefore MQG could be used as a funding vehicle & 2. Challenger Group Financial (CGF) have this morning announced very strong Q1 annuity sales, above expectations and that stock should see buying, potentially at the expense of MQG – Watch for alerts.

CYBG Plc (CYB) Weekly Chart

Macquarie Bank (MQG) Monthly Chart

Conclusion (s)

No major change, remain flexible and be prepared to “tweak” portfolios when appropriate and this may well become one of the most exciting periods from investing we’ve ever witnessed.

On balance the ASX200 feels like its headed into a fresh 5800-5950 trading range.

Overnight Market Matters Wrap

· US bonds weakened, while the equity markets rallied in reaction to Fed Chair Yellen’s comments around rising interest rates despite low inflation.

· Recent weakness in financial stocks reversed overnight in the US and Apple rose on the back of a broker recommendation change to overweight.

· Copper surged nearly 4%, while oil and iron ore were slightly better, however gold fell back below US$1300/oz.

· The December SPI Futures are indicating the ASX 200 to open 10 points higher, testing the 5860 level this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 17/10/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here