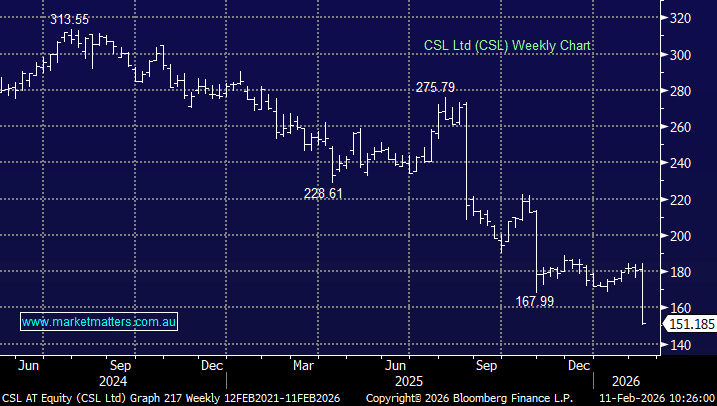

Is it time to switch some banks back to resources? (BHP, IGO, CYB, NAB, ANZ, WBC, BOQ, Apple)

All the ducks were aligning last night for a decent correction in equities as the papers were revelling in stories around the 30-year anniversary of the 1987 stock market crash, when the Australian market dropped an amazing 25% in just one single day. We had geo-political tensions on the rise with a surprise labour victory in the NZ election leading initially to a 2% drop in the Kiwi Dollar, Spain is causing major tensions within Europe, of course North Korean news continues to flow although with ever decreasing influence, Hong Kong had been smacked 552-points (1.9%) and for good measure we had the news that APPLE may be cutting orders for their iPhone 8 – plenty of reasons for a bad day in stocks and when I went to bed the US S&P futures were already down 0.7%.... but alas, when I turned on my Bloomberg this morning expecting to see some red on the screen US markets had recovered their losses and were essentially unchanged, holding around all-time highs.

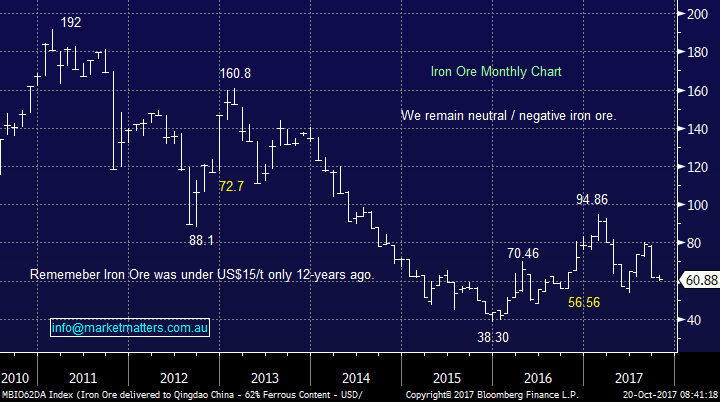

Simply until further notice the main game in town remains stock / sector rotation as the currently fickle market continues to shuffle money around the optimum place to be invested, primarily driven by the markets current feelings towards interest rates e.g. over the last month the Australian banking sector has gained +4% with some attractive dividends looming in November while iron ore stocks have been under pressure, with Fortescue falling -9%. At MM we may be more active investors than Warren Buffett but we do agree with his saying around “Portfolio Theory” hence we have held no iron ore stocks for a while as we were simply bearish the bulk commodity. We hold longer term core investments like Suncorp (SUN) which is been in our portfolio for 2-years and then tweak around the edges looking to increase our returns, an approach we especially like / choose in this mature bull market where simply buying and holding is fraught with danger - just consider that over the last 10-years Woolworths is the best performer out of BHP, Woolworths and Woodside taking the mantle after dropping ‘only’ 20%!

"Diversification is a protection against ignorance." - Warren Buffett.

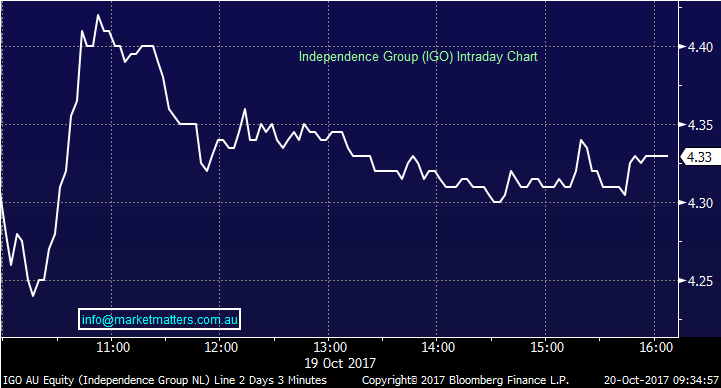

Yesterday we took a healthy profit 12% on our final 5% holding in CYBG Plc (CYB) and switched the funds to Independence Group (IGO) a move we flagged in recent reports. We wanted to trim our banking exposure following recent strong gains and CYB is yet to start paying a dividend so it was an easy choice - ANZ, NAB and WBC all go ex-dividend in November. Remember we are still overweight the local banking sector and hence the focus of today’s report.

The MM Growth Portfolio is now sitting on a fairly hefty 17% cash position but volatility feels to be on the rise so we remain confident of finding some good buying opportunities in the weeks ahead.

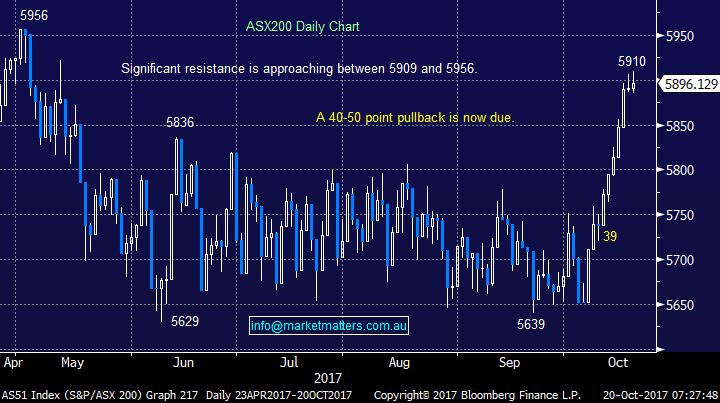

ASX200 Daily Chart

The Banks

We are currently long Bank of Queensland (BOQ), Commonwealth Bank (CBA), National Australian Bank (NAB) and Westpac (WBC) comprising a major 32.5% of the MM Growth Portfolio with all except CBA going ex-dividend in November. We feel the important points to consider:

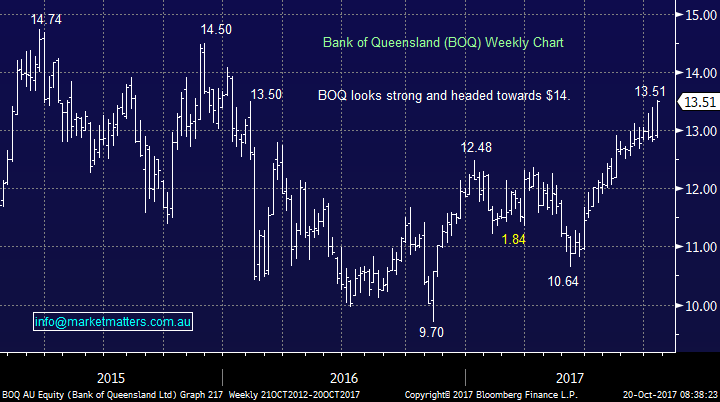

- Bank of Queensland recently reported very well and after an initial sell-off the stock is up 5% for the month and looking strong.

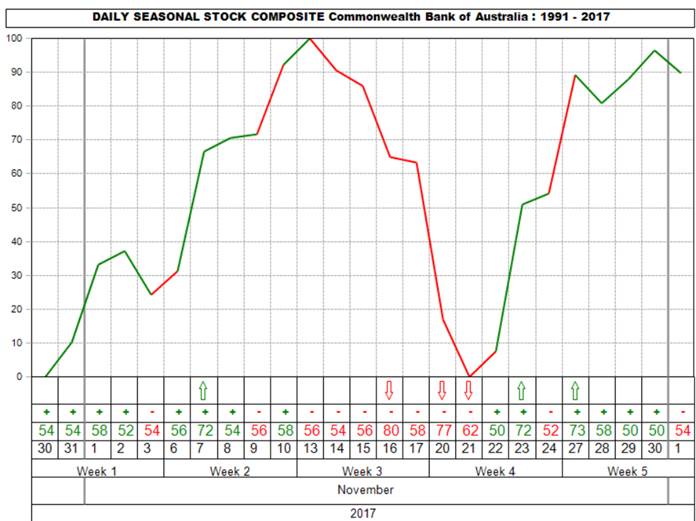

- Local banks usually struggle in November following their dividend payouts prior to rallying strongly into Christmas.

- We still feel local fund managers are underweight our banks and overseas hedge funds may well be caught “short” looking for a housing market crash.

- From a historical basis, local banks are no longer cheap but their dividends remain compelling e.g. NAB is yielding 6.1% fully franked.

- Banks is Australia, particularly CBA are positioned strongly to benefit from cost savings derived from better technology.

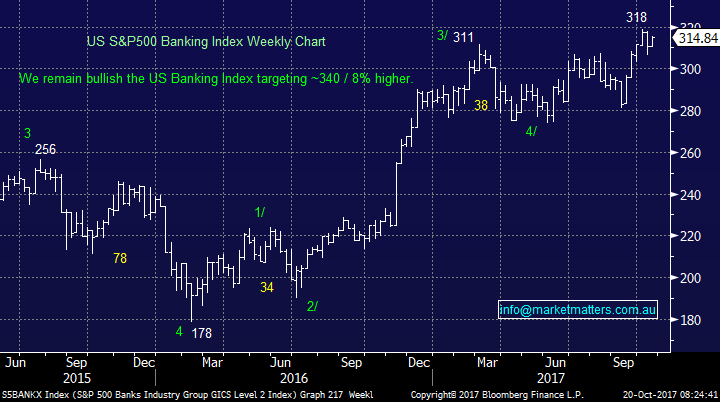

- Although US banks have reached our initial target ideally we still see a further ~8% upside from this mornings close.

- Overall we certainly see no reason to bail out of our banks but we may trim slightly in the coming weeks.

US S&P 500 Banking Index Weekly Chart

Seasonal Chart – CBA the clearest example here given it does not go ex-dividend during the period.

Bank of Queensland (BOQ) Weekly Chart

The Resources

No real change here as iron ore continues to fall rapidly, its currently down ~25% in just a few weeks. We have no interest in pure iron plays at this stage but do continue to like the large diversified players / the base metal stocks. What we are watching at present:

- BHP is due to open under $26.40 this morning, almost 4% below where we recently took profit but still over 5% above our targeted level to re-enter, closer to $25.

- Similarly RIO has dropped over 4% from this week’s high but remains way above our targeted buy zone.

- We continue to watch the likes of Oz Minerals (OZL) but again are targeting lower levels.

- Overall we remain keen to buy weakness, like yesterday’s purchase of Independence Group (IGO), but are likely to remain patient on other purchases for now at least.

Iron Ore Monthly Chart

BHP Billiton (BHP) Weekly Chart

***Independence Group (IGO) purchase yesterday; We appreciate that the window to buy below $4.30 was a short one however the stock did come back to $4.30 by later afternoon. For those that may not have been set we remain comfortable buyers of IGO anywhere below the $4.40***

Independence Group (IGO) Intra-Day Chart

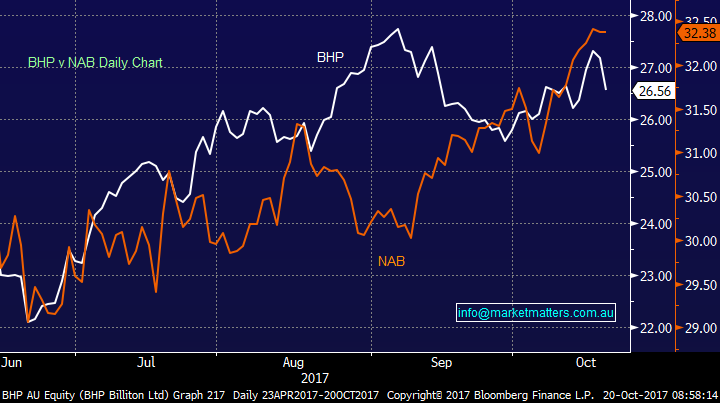

The “Bank – Resources” Spread

When we sold BHP around $27.50, to consolidate our overweight banking exposure, the differential between NAB over BHP was down to ~$2.50, today it sits closer to $6, an increase of well over 100% on the spread. However we feel this has a little further to go and would not be switching from banks to resources in general at this stage – stay patient for now is the main message.

BHP v NAB Daily Chart

Global Markets

US Stocks

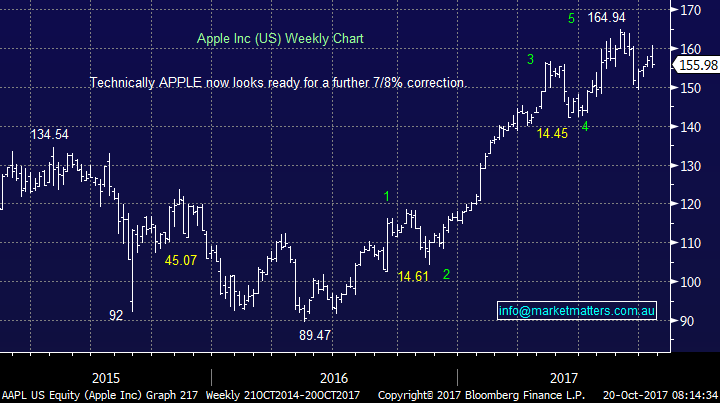

Last night the broad based S&P500 again closed up unchanged continuing to hover around its all-time high, but importantly recovering from an early sell-off. We are still looking for ~7% correction by the tech NASDAQ which coincides with our view on APPLE.

There is no change to our short-term outlook for US stocks, ideally we are targeting / need a ~5% correction before the risk / reward will again favour buying this market.

US NASDAQ Weekly Chart

US APPLE Weekly Chart

European Stocks

Yet again no change, European stocks have now made the fresh highs as anticipated but we would not be surprised to see this rally fail and another pullback towards 12,000 unfold for the German DAX.

German DAX Weekly Chart

Asian Stocks

The Hang Seng remains strong, especially after enjoying the ~5% advance over the last 4-weeks but we continue to believe this 28,000 area will be a magnet for the market over coming few weeks / months at least

Hong Kong’s Hang Seng Weekly Chart

Conclusion (s)

The time to switch some banks is approaching but we believe a little more patience is required – this suits the MM Growth Portfolio.

We remain comfortable buyers of the Independence Group (IGO) below $4.40

Overnight Market Matters Wrap

· The SPI is down 19 points as the DJIA and S&P 500 closed virtually flat, while the NASDAQ fell 0.3%.

· Apple fell the most in two months, down 2.8% on weak iPhone 8 sales. United Continental fell more than 10% after a disappointing profit outlook.

· US jobless claims fell to 220,000, a 44 year low and below consensus while the Philadelphia Fed’s business outlook was above analyst’s forecasts.

· Aluminium and nickel were better on the LME, oil and iron ore fell and gold is trading higher.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 20/10/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here