Is a takeover tsunami unfolding?

Finally some volatility arrives in overseas markets with the Dow falling -237points led by the Financials -3% (banks fell the most since the BREXIT vote), the only areas that are looks likely to be positive today are the gold's and some "yield-play" stocks. US stocks have now corrected ~2.4% led by the financials who have now fallen ~8.4%, very close to the 10% correction for the sector we have been targeting over recent weeks. The catalyst for the weakness in stocks was crude oil falling under $US48 per barrel, US bond yields retreating and the $US breaking under the psychological 100 area on an index level as it endured its longest slide since November. All these movements are smack on with our outlook for the markets over March and support our logic of recently selling $US earners to increase our MM portfolio cash holding to 19%. With the bank heavy ASX200 looking to open down around 50-points (1%) this morning it's important this morning to share our thoughts with subscribers highlighting likely portfolio actions and logic:

1. We currently believe this market weakness is a short-term buying opportunity as April, the seasonally strongest month of the year for Australian stocks, is now only 7 trading days away.

2. Our ideal target for the US banks remains a further 2-3% lower but the majority of the anticipated correction has already unfolded. We will be looking to accumulate NAB or Westpac ahead of April and their large dividends looming in May.

However please note if we do get a strong rally, as usual, in our banking sector through April we are likely to take profit on our CBA position and maintain the ANZ + any new purchases for looming dividends.

3. While another pullback in resource stocks looks likely over coming days we are happy with our weightings in BHP and RIO and unlikely to increase exposure to the sector at this point in time.

4. We are happy with our gold exposure at present and have no plans to take early profits at this stage.

5. We are looking to increase our market exposure into April so watch for alerts!

6. If US stocks accelerate lower after today's sell off we will need to rethink our strategy but we believe this selling will run out of puff in a matter of days.

US S&P500 Banking Index Weekly Chart

Locally March continued to dawdle along yesterday with the ASX200 closing down a mere 4.3-points with no major moves on the sector front which saw volatility down sharply, but it will be a different story today. However, on the corporate front we did see a $1.2bn "hostile" takeover bid by Downer (DOW) for Spotless Group (SPO). At a glance today's 49% surge in SPO looks awesome but when we look back to early March 2015 the story is very different with SPO trading as high as $2.52, over 100% above the DOW takeover offer.

In fact looking at the SPO share price over 2016/7 its only aggressive investors who were brave enough to catch a falling knife over the last 8 weeks who will actually be showing a decent profit. Time will tell whether this is a good strategic move by DOW but it's certainly excellent timing from a price perspective and SPO is a business in need of redirection.

In yesterday's report we mentioned our thoughts that "We can imagine corporate America scrambling to buy their own stock over say the next 6-months as the market perception is clearly US interest rates have bottomed, this action will potentially leave a void of buying after one too many rate rises down the track".

Interestingly exactly the same theory applies to companies considering takeovers where they would potentially like to access funds at the current extremely low interest rates - we might not be surrounded by negative yields anymore but global interest rates are still only marginally above their lowest levels in history. Also, the Australian dollar trading ~30% below its 2011-12 highs adds to the attraction of Australian assets to overseas corporations.

Hence today's report is focused on Australian 5 companies where we can see a potential takeover unfolding in 2017 - we do believe more takeover activity is likely in 2017/8 while interest rates are low. Obviously there are a number of other companies that are likely to be in sights of hostile companies and we will continually update our thoughts in this theme over weeks / months ahead. At this stage some companies which are often mentioned in the press who we have not singled out are Mantra (MTR), Transurban (TCL), APA Group (APA), Aurizon (AZJ), Treasury Wines (TWE), Santos (ST), Asaleo Care (AHY), iSelect (ISU), Challenger (CGF), Qube Holdings (QUB), Graincorp (GNC) and even Woolworths (WOW)!

Spotless Group (SPO) Weekly Chart

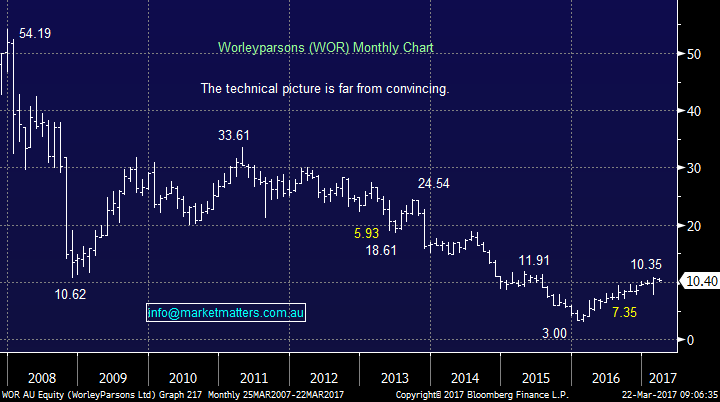

1. Worley Parsons (WOR) $10.40

Dubai's Dar Group bought a 13% stake in engineering group Worley Parsons (WOR) in February, clearly showing some intent which leads us to believe that some further corporate activity feels highly likely, probably from the Middle East where WOR remains fairly active (but also have accrued a large amount of unpaid invoices!). Technically, the chart pattern of WOR is not inspiring but that is fairly typical of companies that are likely takeover targets.

Worley Parsons (WOR) Monthly Chart

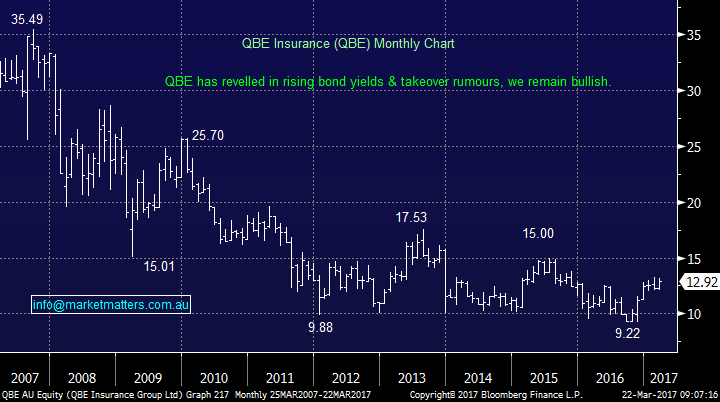

2. QBE Insurance (QBE) $12.92

The media has been full of a potential $20bn bid by Allianz for QBE Insurance - a stock we hold. While we think the acquisition would be attractive for Allianz they must expect the QBE board to fight for the company and any takeover would need to be at a large premium. QBE have engaged a defence team so they clearly believe it's a very real threat. We like QBE as a standalone investment as US interest rates rise over time eventually targeting the $15 area. Any potential takeover is cream on the cake for us.

QBE Insurance (QBE) Monthly Chart

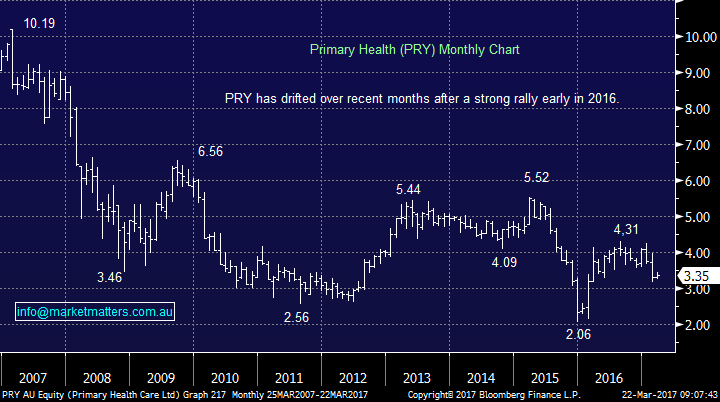

3. Primary Healthcare (PRY) $3.35

A question we ask ourselves is does Chinese group Jangho’s increase its interest in Primary Healthcare (PRY) above its current 14 per cent stake? The performance of the healthcare services provider looks very similar to that of Spotless over recent years However, from a technical standpoint the chart pattern looks a lot more constructive - we are now bullish PRY targeting the $5 area.

Primary Healthcare (PRY) Monthly Chart

4. ASX Ltd (ASX) $50.15

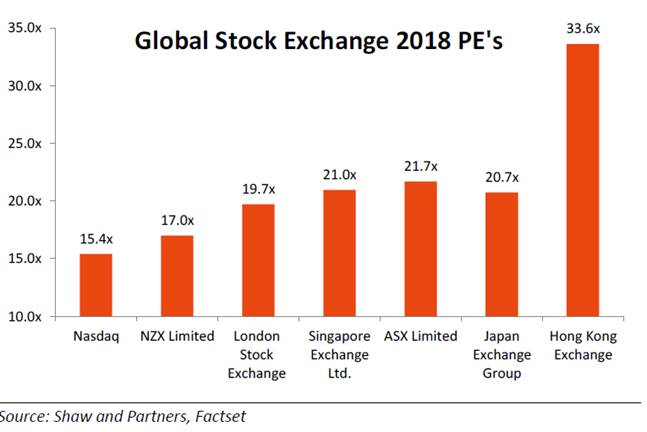

Although an earlier proposed merger of the ASX and the Singapore bourse was knocked back by Julia Gillard back in 2011 we still believe the concept makes sense as does a more Asia aligned Australian economy. The deal simply needs to be more of a merger and less of a takeover and the current Liberal government would potentially look at the deal very differently this time around. That said, we think current valuation may be an impediment with the ASX trading at a premium to other exchanges in the region (bar Hong Kong which is high growth).

ASX Ltd (ASX) Weekly Chart

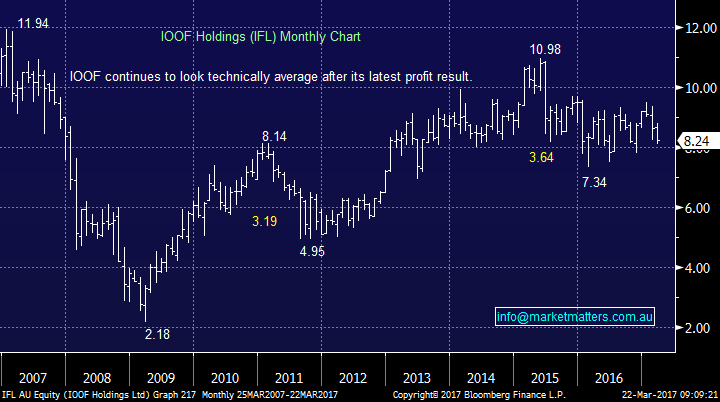

5. IOOF Holdings (IFL) $8.24

The press has often mulled the idea of Perpetual (PPT) buying / merging with IFL, the idea potentially makes sense with both companies struggling to grow and their share prices under distinct pressure i.e. PPT is trading 38% below its GFC high and 11% below its 2015 high while IFL is 31% and 25% below the equivalent times. We see good risk / reward in IFL ~$8, however the swing factor this year is around whether or not they will make a large acquisition (buying one of the Banks wealth management divisions, and would therefore need to raise equity)

Similar to Platinum (PTM) that we already own IFL is paying an excellent dividend, around 6.3% fully franked yield

IOOF Holdings (IFL) Monthly Chart

Conclusion

1. We do believe that corporate activity will remain strong in 2017 as companies scramble to benefit from low interest rates before they vanish.

2. Of the 5 potential takeover targets mentioned we own QBE and like IFL ~$8 and PRY around $3.30. The main criteria here is would we buy at these levels if no takeover materialised.

3. If / when the market does correct in 2017/8 potential takeover targets may outperform the ASX200 assuming they are not trading on inflated valuations as investors look for a takeover.

Overnight Market Matters Wrap

- The US major indices experienced its biggest fall in a day so far this year, with no real motive, but a healthy retracement from the Trump rally as investors reduced risk ahead of their health care vote this week.

- The Volatility index (VIX) jumped 10% overnight, however it still sits in the complacent level.

- In the Commodities front, base metals were lower, while Gold was the shining star overnight, as investors flock to “safe have” assets. BHP is expected to underperform the broader market after its weak US session ending an equivalent -2.48% from Australia’s previous close.

- A weak open is expected in the ASX 200 this morning, with the June SPI Futures is indicating the ASX 200 to open 48 points lower, towards the 5,725 area this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 22/03/2017. 9.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here