Iron ore tumbles after Telstra!

Happy Easter! This will be the last MM report, apart from todays afternoon wrap, until Tuesday 18th.

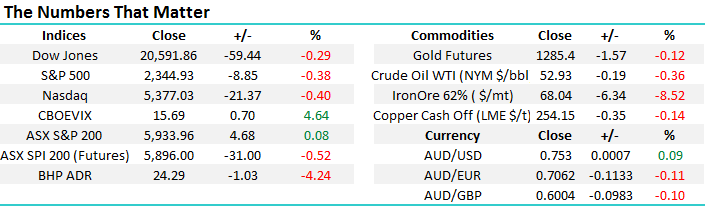

Markets have adopted a classic "risk off" attitude overnight as investors look unprepared to hold large positions over Easter with geopolitical risks continuing to dominate the news. Our overall position has not changed but the local market is definitely having the kitchen sink thrown at it, yesterday Telstra plummeted 7.5% taking ~14-points off the ASX200 and overnight iron ore has unfortunately beaten the Telco collapsing 8.5%! This morning the futures are guiding the ASX200 to fall ~25-points, this would be a pretty good effort considering BHP looks poised to open down $1 (4%).

Today we are going to briefly look at these topical issues plus illustrate how being flexible around sector rotation can lead to portfolio outperformance.

There is no change to our view that the ASX200 is bullish while it can hold over 5900 but this area is likely to be challenged today following mild weakness from US stocks and the above mentioned plunge in iron ore.

ASX200 Daily Chart

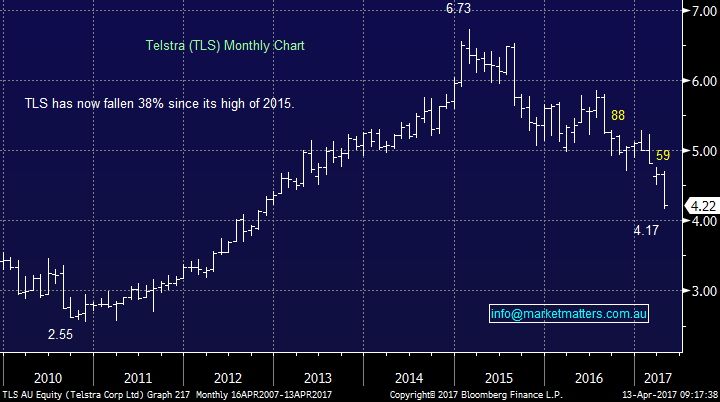

TLS was smacked 7.5% yesterday after David Teoh's TPG Telecom (TPM) paid a huge price for an 11-year licence to compete with Telstra, Vodafone and Optus on the mobile stage. TPM needed a fresh direction due to the massive pressure on its business from the NBN but there is no guarantee of success and creating a price war is normally only good for the consumer - you and I. One thing we do applaud from David Teoh is that he is committing ~$136m of his own fortune into the venture - very different to what the market has experienced recently from the directors of Vocus (VOC) and Bellamys.

Yesterday we stepped up and allocated 5% of the MM portfolio into TLS ~$4.28, the simple rationale is as follows:

1. Telstra has now fallen 38% from its 2015 high, a painful journey we have avoided - except for a successful foray in April 2016 when we picked up a nice "free" dividend.

2. We sold our disappointing position in VOC ~$3.80 on Monday. The stocks closed -11% lower yesterday.

3. Allocating ~65% of these funds into TLS yesterday as it collapsed is clear value add, but obviously time will tell if it importantly makes money.

4. Amazingly to us at MM broker analysts are suddenly scrambling to again downgrade the whole Telco sector after an event we were all confident would unfold! This was illustrated and discussed when we took a very small profit from our TPM trading position back in mid-March.

5. Today TLS is yielding 7.35% fully franked (10.45% grossed up) if they cut their dividend from 31c p.a. to 28c it will still be a 6.6% fully franked yield which remains compelling to many investors.

6. Technically TLS may "bounce around" between $3.80 and $4.40 over the next 6-months giving levels to add to the holding and / or cut if we are uncomfortable, or write calls for sophisticated subscribers.

Telstra (TLS) Monthly Chart

Iron ore has now corrected 28% since its high in February, no major surprise even the directors of FMG and RIO were forecasting its decline. Interestingly even after an anticipated $1 fall this morning BHP will be almost 4% above its low in mid-March, a classic example of stocks leading news, in this case the decline in commodity prices.

However Fortescue Metals (FMG) which is totally dependant on iron ore is likely to make fresh 2017 lows today. Aggressive traders might want to consider buying FMG ~$5.55 if we see panic today, however we are already long BHP and RIO so will refrain from increasing this exposure from a simple money management perspective,

Fortescue Metals (FMG) Weekly Chart

Sector rotation has shown some great returns over recent months, assuming you were on the "right foot" as fund managers have changed their economic growth viewpoint on a number of occasions. Two classic examples are below:

1. We purchased the gold sector into weakness a few weeks ago which has paid a nice ~20% profit with Regis Resources (RRL) while we still hold Evolution Mining (EVN). The sector pullback was courtesy of markets becoming too optimistic on the US economy subsequently sending bond yields surging, and hence gold falling.

2. We missed the resurgence of the "yield play" with the likes of SYD rallying ~17% over the last few weeks. We did flag its potential at the time but decided gold was the better option to invest for a pull back in US bond yields. In hindsight they have both performed equally well.

Over the last month from a sector point of view the winners have been Oil's up 10.9%, Real Estate +8.2% and Consumer Services +6.7% with losers Retail -7.2% and Telco's -8.5% (not including TPM's likely gap lower). Unfortunately we did catch some of this decline in Telco's courtesy of VOC but we have dodged the retail bullet. This is a great example that holding exposure to all sectors is not the ideal way for optimal returns.

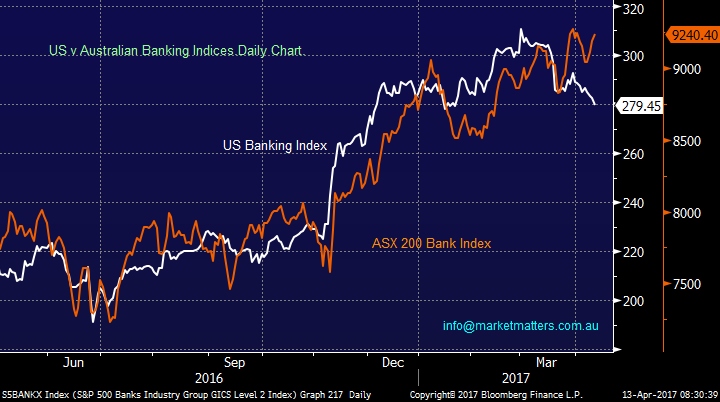

Importantly we are currently watching the local banking sector very closely as it defies weakness in its US equivalent, assisted by looming healthy dividends in May. History shows us the differential between the two indices will eventually close, our preferred scenario is US Banks recover and ours consolidate gains but caution is warranted.

Australian v US Banks Daily Chart

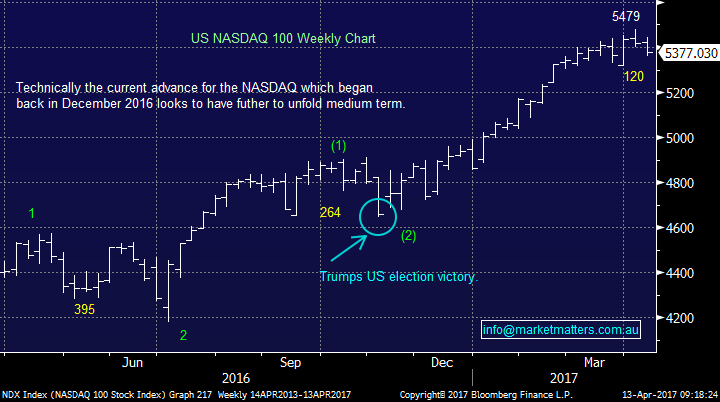

The picture is certainly cloudy in the US short-term as investors become slowly nervous. Importantly the NASADAQ has now corrected almost half of our targeted ideal buy scenario, we are buyers of the NASDAQ in the 5200 area, or another 3.3% lower.

US NASDAQ Weekly Chart

Conclusions

No change although short-term support is likely to be tested today. A clear break under 5900 is likely to test major support ~5830 quickly.

We now remain short-term bullish local equities in April, unless the ASX200 breaks back under the 5900 level.

*Watch for alerts.

Overnight Market Matters Wrap

·Another weak day with all major US indices lower as risk continues to be taken off investors’ table, due to geopolitical concerns and winding down ahead of the Easter break.

·The commodities were the highlight of the day, with Iron Ore plumbing down 8.52% overnight to US$68.04/t. BHP is expected to underperform, after ending its US session down an equivalent -4.24% to $24.29 from Australia’s previous close.

·The volatility (fear) index is starting to gain some ground from complacency levels, up 4.64% overnight.

·The June SPI Futures is indicating the ASX 200 to open 17 points lower, back towards the 5920 area this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 13/04/2017. 8.46AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here