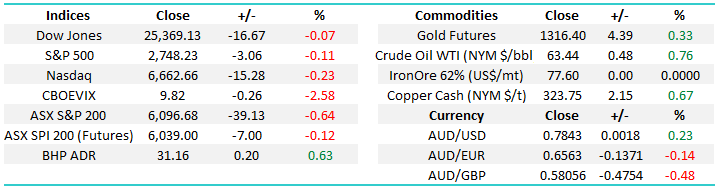

Interest rates / bonds are creating a double edged sword for equities (SYD, TCL)

Yesterday the ASX200 experienced a degree of weakness not felt since mid-November with a reversal down of over 50-points. The selling was focused in the bond proxies / yield play stocks with for example the real estate sector -1.8%, Transurban -2.7% and Sydney Airports -2.1% - today we will update our view on these stocks as we look at the likely / potential influence of bonds / interest rates on equities.

Overnight US stocks fell hard early but the Dow rallied over 100-points from its lows to close only marginally in the red but again the bond proxies fell with real estate down -1.5% and utilities -1.1%, making it -3.25% and -8.2% respectively over the last month - while the market has rallied close to +4%.

We are sitting on a healthy 26.5% cash position in the MM Growth Portfolio so while we are expecting to bring out the buyers hat into weakness patience feels the best option for now.

ASX200 Daily Chart

Bond markets / interest rates

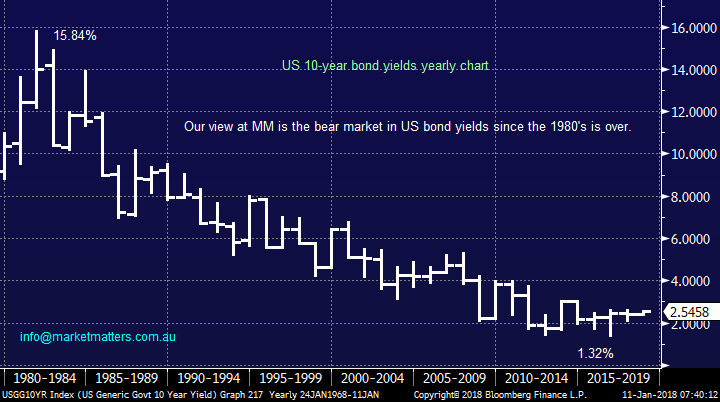

MM remains convinced that the bear market for interest rates is over with the main question remaining how fast will they rise?

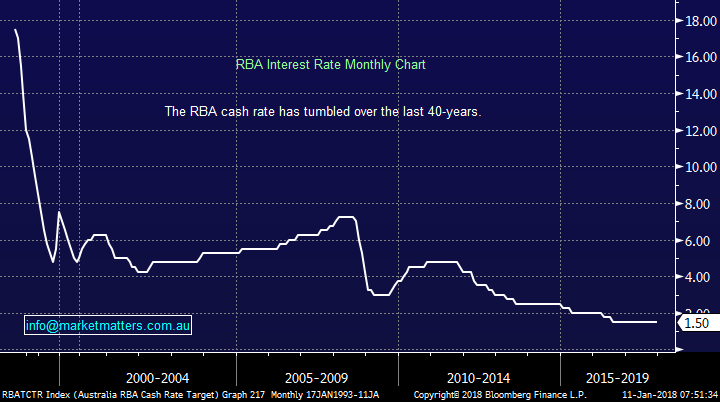

As most of you know the local RBA cash rate is at a record low of 1.5% although the majority of economists are now forecasting a rise this year – our best guess remains a 0.25% increase on Melbourne Cup day. Personally I think it’s ludicrous that interest rates are at such an accommodating / stimulatory level when the economy is chugging along reasonably well – it leaves the Reserve Bank with very few levers to pull if we do see an unexpected increase in unemployment! If you liken it to our investment approach we often have reasonable cash levels to aid in flexibility. Markets are fluid and things change quickly and having flexibility / room to move is key. Simply, we don’t feel the RBA have that luxury.

As has become abundantly clear in our reports, we think interest rates are headed higher, not to the heady days of the 1980’s with rates at ~17% but up none-the less.

2 points worth making in terms of home buyers:

- Rates are obviously very low compared to the last ~40-years but the obvious offset is higher prices. Naturally, and all things being equal, as rates go higher prices should come down

- A 2-3% increase in interest rates would historically just be a bump in the road as highlighted in the below chart

As we have said previously the key remains for many markets how fast interest rates rise and the key to this question is inflation, which has remained subdued to-date. Tomorrows US CPI data will provide the next piece of the puzzle but any surprise increase is likely to noticeably increase market volatility at least in the short-term.

RBA Cash rate Monthly Chart

Most professional market pundits watch US bond yields (interest rates) very closely as they significantly influence stocks - although they don’t get anything like the same degree of media coverage. Global bond markets are significantly larger than the alternative investment option of stocks hence when fund managers decide to allocate some of their bond market investments to equities it usually has a noticeable impact on stocks.

The 2-edged sword for equities caused by bonds is fascinating:

Bullish – If markets continue to embrace our view that interest rates will rise, and hence bonds fall, we are likely to see a flow of money from bonds into stocks which is very bullish. However this positive influence is only likely to remain while the fall in bonds is in a measured manner but what if there’s a stampede for the exit and interest rates shoot up?

Bearish – While inflation may rise faster than expected and rattle bonds it’s not our major concern, although a sharp increase in inflation will send bonds down hard and stocks are likely to follow short-term.

- Our big worry is if the bear market becomes “obvious” and picks up momentum what happens if the investors who crazily, in our opinion, purchased long dated bonds in Japan, Germany, US etc yielding basically zero and amazingly negative decide to cut their losses and bail out, it could turn ugly quickly and lead to a decent pullback for stocks.

- Secondly we have China making noises about pulling back on their purchase of US bonds which could be another nail in the coffin of bonds and as a side note will make it harder for the US to fund their tax cuts – not good for stocks either.

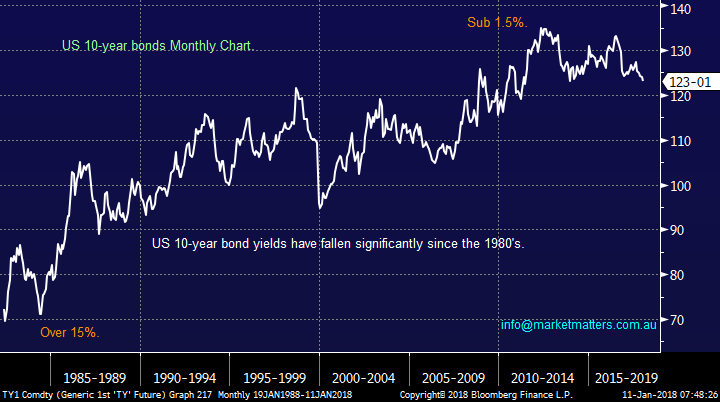

NB Bond prices and their underlying yield (interest rate) move in opposite directions, hopefully the below 2 charts clarify the picture.

US 10-year bond yields annual Chart

US 10-year bond prices Monthly Chart

Yield Play / Bond Proxy stocks

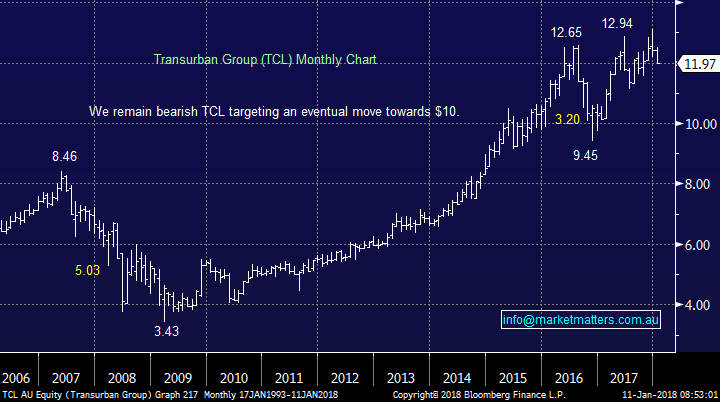

We’ve been bullish interest rates for over a year and subsequently bearish the likes of Transurban (TCL) and Sydney Airports (SYD). This call looked great in 2016/7 as they both fell well over 20% but they then rallied to fresh recent highs along with the strong year for stocks, plus reflecting that they are indeed solid companies.

However we continue to have no appetite for either of these, or other, interest rate sensitive stocks eventually looking for a retest of 2016 lows.

Transurban (TCL) Monthly Chart

Sydney Airports (SYD) Monthly Chart

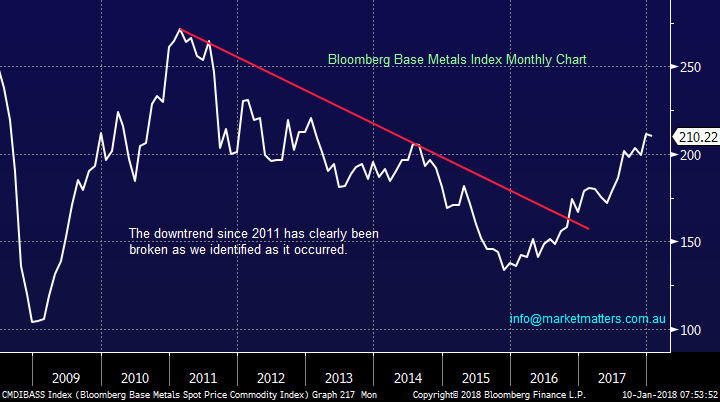

A side note is that during periods of rising interest rates growth assets usually perform well i.e. shares and resources are likely to be at the head of the pack hence this is one sector we anticipate being active buyers during any reasonable correction.

Bloomberg Base Metals Index Monthly Chart

Conclusion

We remain bullish interest rates and hence have no appetite for bond proxies / yield play stocks. Volatility within bond markets look likely to create opportunities within stock markets over the coming 1-2 years.

Global markets

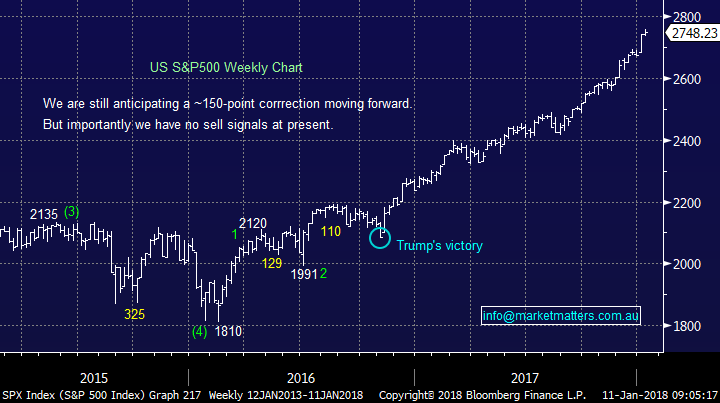

US Stocks

US stocks continue to remain strong on optimism around the economy with no sell signals being generated. For our interpretation that stocks are in the final phase of the bull market since the GFC the current upside acceleration / momentum needs to slow down pretty soon.

The current strong rally since Donald Trump’s election adds to our confidence with buying the first decent ~5% pullback.

US S&P500 Weekly Chart

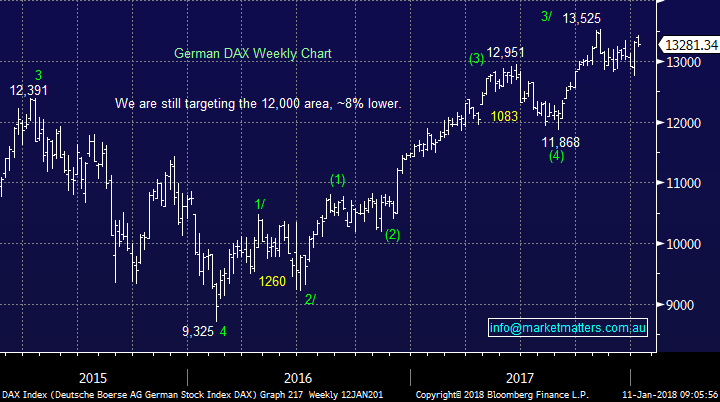

European Stocks

European stocks look set to make fresh recent highs the big question is will they fail or kick on. At this stage we are sitting on the fail side but only just!

German DAX Weekly Chart

Conclusion(s)

Global bond markets have a significant influence on equities – and that influence will have more moving parts in 2018 than it did in 2017

We have no interest in stocks that are negatively influenced by higher interest rates i.e – those with high debt levels

Inflation remains key to the pace of interest rate hikes

Overnight Market Matters Wrap

· The US equity markets had a breather after recently hitting fresh highs, ending its session marginally lower.

· Crude oil continues to climb, alongside with gold futures, while Iron ore was subdued and unchanged.

· The March SPI Futures is indicating the ASX 200 to open marginally lower, testing the 6090 level this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 11/01/2018. 4.00 PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here