Insider selling & buying is ignored at your peril (FB, EVN, NCM, KGN)

The ASX200 had very choppy Thursday giving little solace to either bulls or bears, with the index finally closed down less than -0.1%. Macquarie Bank (MQG) was the main story of the day with Nicholas Moore retiring as CEO to be replaced by highly regarded Shemara Wikramanayake but with the bank missing expectations by ~5% and shares falling accordingly people are understandably questioning whether Moore has left at the top.

We discussed MQG in Thursdays report identifying our preferred buy level initially at $118 but preferably below $115, this remains intact and we anticipate yesterday’s volatility will dissipate as fast as it arrived.

Macquarie Bank (MQG) Chart

Outside of the prevailing corporate activity between Nine & Fairfax, on a sector level the only stocks to catch our eye yesterday were the golds with Newcrest (NCM) and Northern Star (NST) both up well over 4%, with Newcrest delivering an exceptional set of production numbers. An interesting test will come today following the announcement that major shareholder La Mancha have been seeking buyers for 92M shares in Evolution Mining at a minimum price of A$2.79/share!

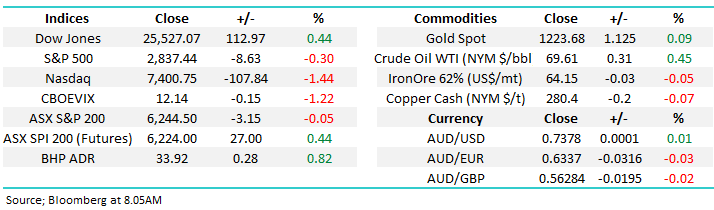

· MM is overall neutral the ASX200 with a close below 6140 required to seriously concern us but importantly we remain in “sell mode”.

Overseas stocks were again mixed with the broad-based S&P500 dragged down -0.3% by Facebook while the Dow rallied, Europe was fairly strong across the board – the SPI futures are calling the local market up 25-points with BHP closing up +0.8% in the US + they announced this morning the confirmed sale of their US Shale Assets for a cool $US10.8bn – sounds impressive but they did buy them for over $US16bn a few year ago. Payments will be in two tranches later this year and early next, and will ‘not touch the sides’t according to BHP, implying that it will be directed straight into shareholder pockets. The market was expecting this news and looked to have built in a ~$US10bn price target. Anything below = bad, anything above = good. Clearly it’s good, but not great!

Today’s report is going to focus on insider buying / selling following Facebooks initial 24% plunge after its latest report – You may recall in June we said “The insiders are selling FANG stocks at the highest rate in 6-years led by Mark Zuckerberg at Facebook!”.

ASX200 Chart

There was no change in the MM portfolio’s yesterday with SUN 33c below our $15.30 sell level and CIM well above our $47 buy area.

1 Facebook (FB) $US176.26

The social media giant FB has just become the largest collapse in US stock market history destroying over $US124bn of value last night – great timing of the recent selling by Zuckerberg.

Both sales and user growth disappointed investors with the understandable question of what comes next doing the rounds. At MM we have no attraction to FB at this point in time although we acknowledge the current estimated 2018 P/ E of 24.2x is not too scary but only if FB continues to grow.

· MM is technically negative FB targeting the $US150 area, around 15% lower.

Facebook (FB) Chart

2 Evolution (EVN) $3.04

Two large brokers have been given the job of placing $257m of EVN stock at an 8.2% discount to yesterday close, not a likely positive start to the day for EVN or the sector.

While this clearing of the La Mancha overhang can be taken positively we must ask whether this insider transaction is more meaningful as we consider human nature i.e. Human nature both on personal and corporate level is to try and buy low / sell high.

· MM is now neutral EVN and will opt to let the dust settle for at least a while.

Evolution Mining (EVN) Chart

Coincidentally following its report yesterday Newcrest Mining (NCM), the local heavyweight of the gold sector, finally kicked some solid goals leaving us positive for the first time in a long time. Their production report was strong, the best we’ve seen in a long time and although it benefitted from a period of very low maintenance outages, the run rate was impressive, particularly at their troublesome Lihir operation. Additionally, overnight we had Barrack Gold release a weak set of production numbers but importantly, their CEO was very clear in saying they need to address their depleting reserves – .i.e they need to buy more gold in the ground – a potentially bullish backdrop given NCM’s reserves are some of the cheapest out there.

· MM is bullish NCM at current levels with stops under $20.

Newcrest Mining (NCM) Chart

3 Kogan.com (KGN) Ltd $5.31

The KGN stock performance has been one from the playbook of insider selling with the stock halving since late 2017.

The founders appeared to be almost scrambling to sell down their shares last month to the tune of ~$100m. They finally and “apparently reluctantly” sold $49m worth of stock at $7 while the stock was closer to $8, looks a bad deal at a glance but what came next tells the tale.

Only 6-weeks later the stock is 24% below their exit price following a disappointing trading update – coincidence?

· There will be a time to buy KGN, but not yet given the overhang of stocks still out there

Kogan.com (KGN) Chart

Other local companies who have witnessed insider selling during 2018:

1. NIB Holdings (NHF) – the MD sold almost $500k parcel in March and the stock has since tumbled over 20%, technically still looks bearish.

2. Netcomm Wireless (NTC) – the founder sold 340k shares but still holds 21m so no big deal, technically we are neutral NTC.

3. Ramsay Healthcare (RHC) – small sales earlier in the year before the stock plunged ~15%, after which we bought.

4. Others include SAR, BGA, NST and SEK with all 4 stocks feeling stretched on a risk / reward basis.

Conversely there’re has been buying of the following stocks in 2018:

1. Aurizon holdings (AZJ) $4.44 – we like the risk / reward here with stops below $4.10.

2. Beach Energy (BPT) $1.84 – BPT has enjoyed a huge rally since 2016, we like it ~$1.60.

3. Harvey Norman (HVN) $3.50 - Gerry Harvey regularly buys when his stock gets sold off – MM is neutral HVN.

4. Plus, small top ups by “insiders" in ORE, HLO, MYO and Z1P.

While we typically use Bloomberg to track this, subscribers may find the free site below useful as it tracks the 100 most recent insider transactions, always useful to keep a handle on who is doing what. MM will also regularly keep you in the loop as we watch insider activity closely:

https://www.marketindex.com.au/directors-transactions

Conclusion (s)

We are always extremely cautious buying stocks against insiders, it very often ends in tears.

A simple filter of selling / buying with insiders and not against them is a great way of avoiding some market hand grenades i.e. let human emotions of Fear & Greed work for you.

NB, We like NCM at today’s levels and are looking to buy today

Global markets

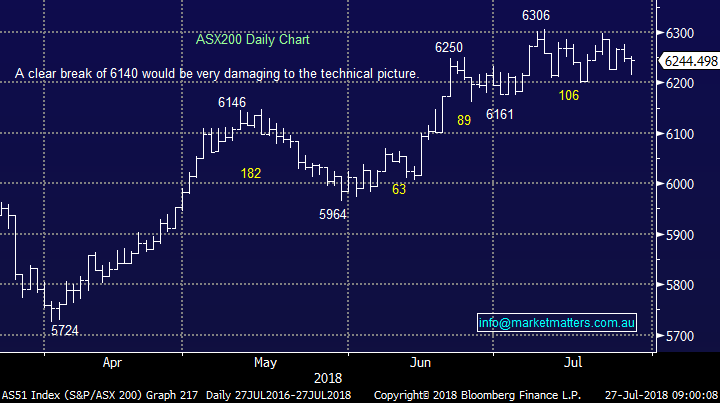

The US market held reasonably firm last night only punishing FB for its miss and not letting the fears spread across the NASDAQ as a whole.

US S&P500 Chart

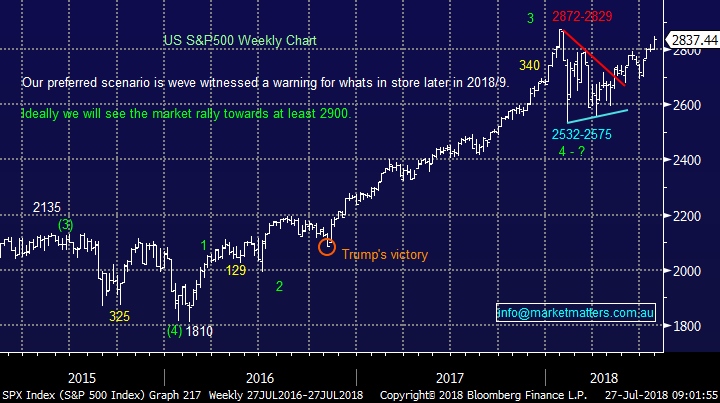

European stocks are slowly regaining their “mojo” and technically look ok.

Euro Stoxx 50 Chart

Overnight Market Matters Wrap

· A mixed session was witnessed in the US equity markets overnight, with the Nasdaq 100 underperforming, down 1.44% following Facebook’s disappointing numbers.

· Amazon however reported better than expected and the tech heavy index, Nasdaq 100 is expected to trade higher tonight following Amazon ending its after-market session up 3.5%

· The September SPI Futures is indicating the ASX 200 to open 41 points higher towards the 6285 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 27/07/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here