Initial capitulation in the “yield play” feels complete

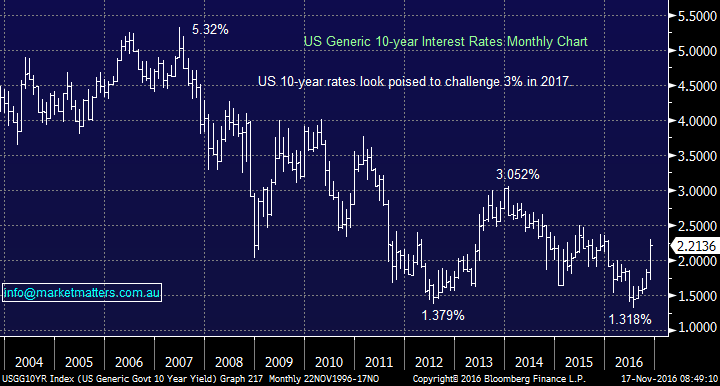

We have been discussing rising US interest rates at length over recent weeks but now feel the initial sharp increase has probably run its course. US 10-year bonds have been hammered sending their interest rate up from 1.32% to touch 2.3%, with over half of these gains unfolding in a frenzy since Donald Trump's surprise victory. The press is now full of rising interest rate stories and while we feel US 10-year bond rates do eventually head to 3% and probably beyond, a rest is now due - similar to our view on resources this week. Rising interest rates has also occurred locally with our 10-year bonds increasing from 1.8% to 2.7%, the RBA will probably remain on hold well into 2017 but the futures markets are now factoring in more chance of a hike than a cut for next year for Australia. Outside of the main banks mortgage rates have been ticking up as the lenders funding costs rise.

US 10-year Bond Interest Rates Monthly Chart

The increase in interest rates has led globally to both the "yield play" and defensive stocks being hammered. However what's interesting is the stocks have been falling sharply for the last 4/5 months while the declines since the US election have been relatively small compared to those experienced between September and October - another classic example of stocks leading the fundamentals.

Recently we purchased Westfield (WFD) for 3 reasons:

1. WFD had reached our medium term retracement target ~$8.50 . We went long around $8.40 with an initial target of $9.30.

2. WFD generates 75% of its revenue in $US and we are short-medium term bullish the $US.

3.We feel both the "yield play" and bonds are oversold short-term.

While this was a fairly aggressive play it feels correct at present as the stock has been strengthening over recent days.

Westfield Corp. (WFD) Monthly Chart

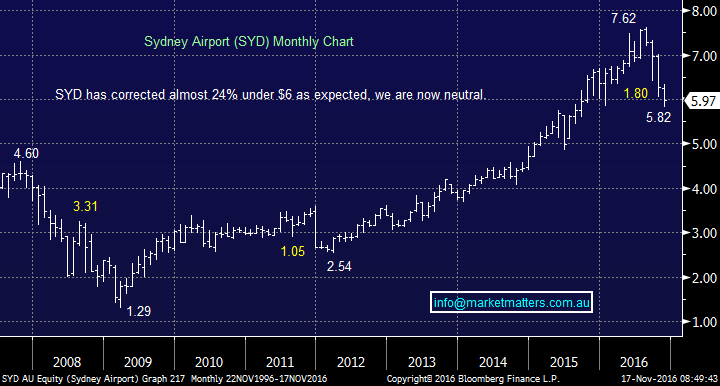

The local classic yield play stock we have discussed recently is Sydney Airports (SYD) which has fallen well over 20% since we initially turned negative the stock. Short-term we are no longer bearish SYD and could easily imagine a bounce back towards $7. However we are more comfortable buying WFD due to its $US earnings and overal debt levels plus we are not comfortable SYD being the most expensive airport globally, along with its Auckland counterpart.

Sydney Airports (SYD) Monthly Chart

A stock we prefer to SYD is TCL which has fallen into perfect long term technical support. The recent 25% decline has increased TCL's guided yield to 5.16% - which is up +11% on the same period last year. The stock goes ex-dividend at the end of December and that dividend will be partially franked (around 15%) however from then on zero franking is expected.

We believe investors can buy TCL at today's level and they will receive some capital gain plus a dividend before 2017.

Transurban (TCL) Monthly Chart

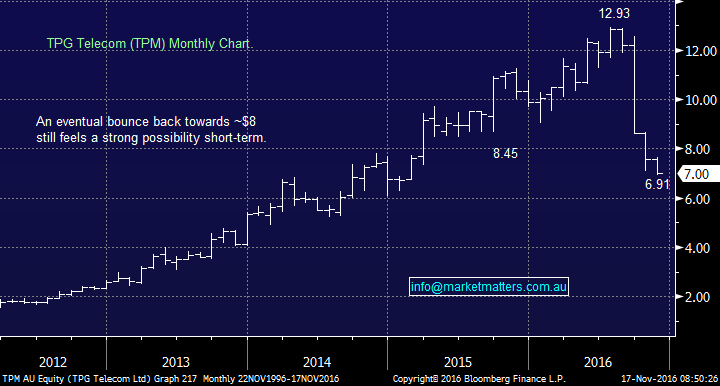

Lastly the perceived defensive stocks have gone from hero to villains as the fickle market has turned its back on them aggressively. The Telco sector has arguably been the mainstay of the defensives locally and while they have a number of fundamental issues, led by the NBN roll out and increased competition, a 30% sector decline feels oversold. The majority of the falls have been over the last 4-months courtesy of concerns of Vocus' integration of M2 Communications and a profit downgrade by old market darling TPG Telecom.

After a 46% decline over the last few months we feel TPM is poised to bounce back towards the $8 region. Similarly we can see Vocus (VOC) that we unfortunately own bouncing back over $6 and ideally towards $6.50.

We are not buyers of this sector at present but are being patient selling our poor position in VOC.

TPG Telecom (TPM) Monthly Chart

Summary.

- We are looking for a bounce in the "yield play" into Christmas.

- We are already long WFD and are considering reducing our banking exposure (if further strength prevails) into TCL later this year / early next.

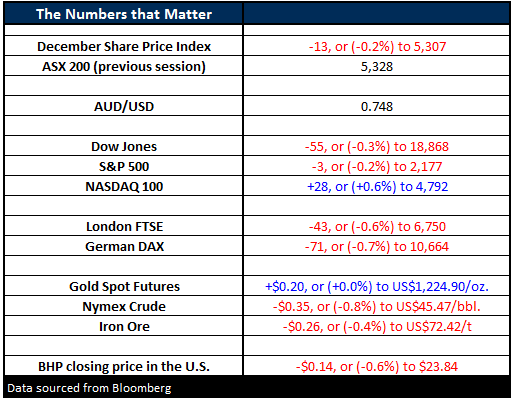

Overnight Market Matters Wrap

- Another breather was seen in the US share markets overnight, with the Dow ending its day down 55 points (-0.3%) at 18,868 and the broader S&P 500 off slightly, down 3 points (-0.2%) to 2,177.

- Better activity was seen in the currencies with the US Dollar Index hitting a 13-year high, leading the Aussie Battler down 1.1% overnight to US74.74c.

- Domestically, unemployment data is due at 11.30am with expectations for a rate of 5.7%.

- The ASX 200 is expected to test the 5,300 level this morning as indicated by the December SPI Futures, with a volatile morning expected due to November Index Options expiry.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 17/11/2016. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here