How long in the “Sin Bin” ?

We certainly got our relief rally but interestingly courtesy of an FBI announcement on Sunday of all things! The local ASX200 rallied an impressive 70-points / 1.35% but as we are unfortunately accustomed to the US S&P500 outperformed gaining over 2.2%, with the Dow up 370-points. From our perspective it feels a touch premature to assume a Clinton victory tonight courtesy of the news that the FBI found no wrong doing by Mrs Clinton from her email saga. With over 20% of people having already voted and the email topic being very old news it feels unlikely to have made a material impact to voters, stocks just wanted an excuse to rally after 9-days of consecutive declines.

Here we are again with the similar quandary facing many investors:

1. US stocks are only 2.8% below their all-time highs.

2. US stocks are trading at historically rich valuations.

3. US stocks have rallied for the last 8-years, historically a decent correction is overdue.

4. US investors are sitting on the highest levels of cash for ~15 years.

5.Inflation is raising its head and interest rates are set to rise which is often damaging for stocks - we will cover the very important inflation topic in more detail shortly in a morning report.

Due to our medium term concern for US stocks, where we are targeting a correction of over 20% probably in 2017-18, stock selection is critical over the next quarter. In yesterday’s surge 2 of the best performing stocks were ones that have been hammered recently Mayne Pharma (MYX) +6.6% and Vocus (VOC) +4.1 %.

We remain committed to a more active approach in the months ahead with stocks / sectors that have been "oversold" often presenting excellent opportunities. Unlike you and I, fund managers take many days / weeks to exit or reduce exposure to a stock which can have a substantial impact on the share price if it follows negative news. Our flexibility should give us a nice advantage overtime as short term, stocks usually go too far up and too far down.

Today we are going to look at 2 sectors and a 3 stocks that have been sold off recently.

S&P500 Monthly Chart

The US banking index remains bullish after breaking the recent downtrend. The sector corrected ~30% over 8 months before finding a base. We remain positive this sector short-term which should benefit from rising long term rates with a target over 10% higher. Hence we currently remain comfortable with our 22% portfolio holding via CBA and Westpac – and would be open to increasing this again post the seasonally weak November trading period.

S&P500 Banking Index Monthly Chart

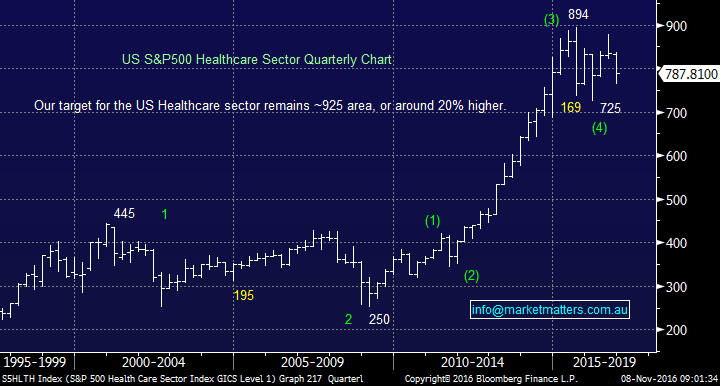

The US Healthcare Sector is one that fundamentally would prefer a Trump victory, however they’d also benefit if the Democrats took back the Senate while the Republicans retained the lower house plus of course a Clinton victory is what the overall market wants – Health stocks were up +2.2% overnight. The sector has corrected 13.2% over the last 4-months but medium term the sector looks positive.

We are bullish the local Healthcare Sector and already have 20% exposure via CSL, Ansell and Healthscope.

Note we are still considering adding to this Healthcare exposure.

S&P500 Healthcare Sector Quarterly Chart

As we mentioned earlier Vocus (VOC) rallied strongly yesterday, previously the stock had declined 45% prior to potentially finding a bottom last week after 23 weeks of declines, but the major move was over 14 weeks and 42%. This is significantly more than the common market phrase "buy the 3rd day down".

Today we are looking at 3 stocks that have been rerated recently by the market to consider if it's time to be brave.

1. Healthscope (HSO) $2.21

HSO has fallen 25% over 4-weeks. We bought the initial spike down ~$2.33 but have left ammunition to average this position as we are a fan of both the sector and stock medium term. We will only consider adding to our 5% holding towards the $2.10 area. It's likely to need a very strong market to rally after only 4-weeks of weakness.

Healthscope (HSO) Weekly Chart

2 TPG Telecom (TPM) $7.20

TPM had been slowly declining since late July but the acceleration after a poor report was ~40% over 7-weeks. We think TPM is a good aggressive trade around $7 but after only 7-weeks down, half of Vocus, we believe careful entry is important.

TPG Telecom (TPM) Weekly Chart

3 Start Entertainment (SGR) $4.91

SGR has declined 23% over 6-weeks since the news hit the market of Crown representatives being arrested in China which has similar negative ramifications for SGR. We like SGR for tourism exposure medium term but believe that more time is required to washout the major sellers of the stock / sector. We will consider the stock if over coming weeks we get a low momentum move under $4.70.

Start Entertainment (SGR) Weekly Chart

Summary

1. We like the banking and healthcare sectors over coming months. We note that November is usually weak for banks and strong for healthcare.

2. We want lower prices over coming weeks to justify buying more HSO and any TPM or SGR. When being aggressive it never hurts to miss an opportunity but it can be very painful to fire too early.

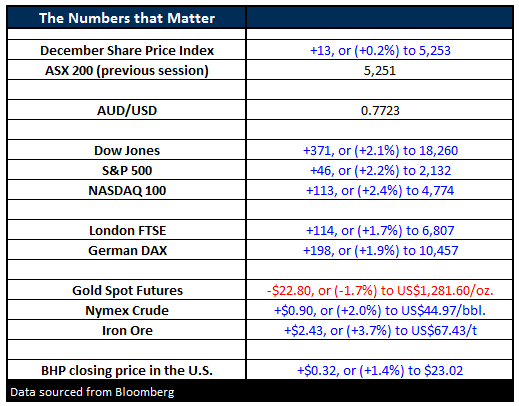

Overnight Market Matters Wrap

- The US markets put in complete reversal last night, after the FBI reported early yesterday our time that they were dropping the Hilary Clinton email saga. The Dow closed up 371 points (+2.08%) to 18,260. The broader market was marginally stronger, up 46 points to 2,132.

- The release of tension in the markets even helped the oil price, although it was slightly capped by doubts that OPEC will be able to cut production. Crude finished up 90c (+2%) to US$44.97/bbl.

- Gold came down for exactly the same reasons the share market rallied, especially a pick-up in the US$. Gold finished down US$22.80 (-1.7%) to US$1,281.60/oz.

- Iron Ore should help the material sector today after a strong pic-up in price last night. Iron Ore finished up US$2.43 (+3.7%) US$67.43. RIO finished up just shy of +4% last night in the US.

- The December SPI Futures is indicating the ASX 200 to open up 14 points higher this morning, testing the 5,267 area.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 8/11/2016. 8.20AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here