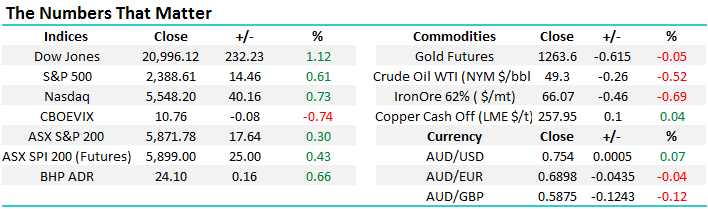

Hold on Tight, Markets are Getting Very Exciting!

The ASX200 had a subdued but positive day on Monday, ignoring global markets euphoria following the French elections. Basically we failed to pre-empt significant equity market gains across the world. The MSCI Global World Index that we touched on last week has made fresh all-time highs and is currently sitting only ~7% below our ultimate target for the bull market, which began back in March 2009 and has seen this developed world index appreciate by 273% over that time. When either individual stocks or stock markets are making fresh all-time highs it is undoubtedly a bullish sign.

Hence at MM, we continue to see 2 very different scenarios unfolding, depending on the timeframe being considered:

1. We remain bullish equities short / medium term, targeting further gains of ~7%.

2. We are bearish equities medium / longer term, eventually targeting a 25% decline back towards the 1450 area in the MSCI Global World Index.

Today we are going to keep our fingers very much on the pulse of the markets, which we believe hold the key(s) to obtain the best returns over the coming months / years, while also sleeping restfully. Importantly, we will again outline our current plans around our MM holdings and future planned investments, remember as the bull market matures we believe it is not the time to buy and hold stocks.

MSCI Global World Index Quarterly Chart

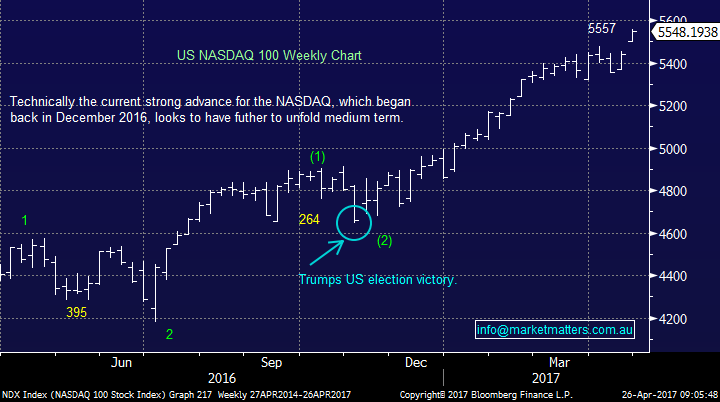

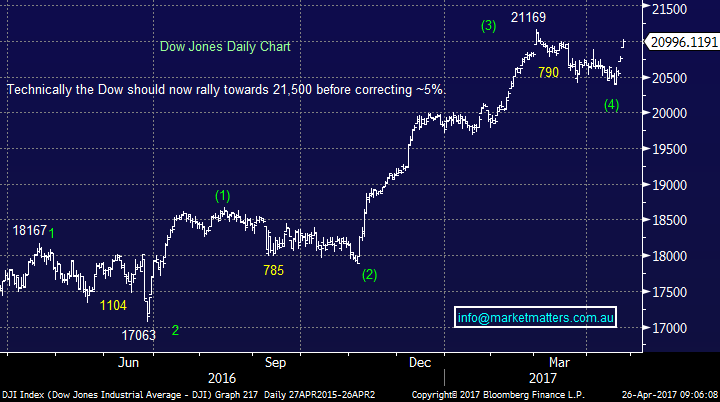

US stocks look solid for at least another 1-2 weeks, with our target for the Dow around the 21,500 area, or 2.5% higher. Interestingly while the NASDAQ and Dow are technically looking slightly different, the major interpretations are the same:

1. US stocks look poised to rally another 2-3% over next few days / weeks.

2. A 5% correction is now looming rapidly on the horizon, it now feels like we are heading towards a classic "sell in May and go away" scenario.

3. Assuming we get a 5% correction over May and June, similar to last year, we will be keen buyers into this weakness targeting further gains in 2017.

US NASDAQ Weekly Chart

US Dow Jones Daily Chart

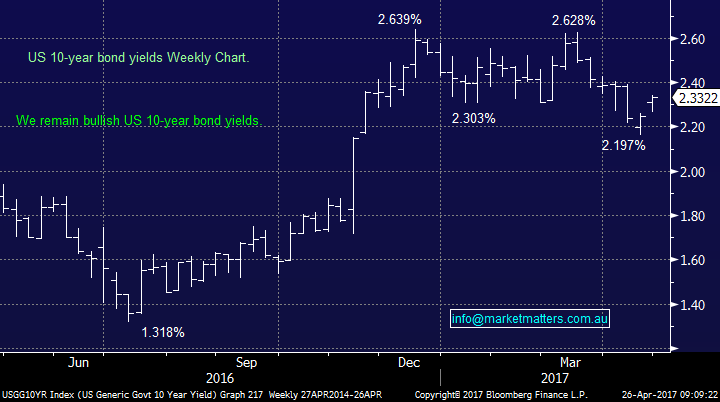

Not surprisingly, we believe bond yields remain the key to which sectors are likely to generate the best returns during 2017/18. In our opinion, the break back above 2.3% for the US 10-year bond yield technically confirms the recent correction is complete and we are set to advance to fresh 2017 highs for bond yields i.e. towards 2.8%. From a macro point of view this higher interest rate scenario should be very bullish for financials and bearish for gold / the defensive yield play.

Hence over the short term, we prefer the financials and commodity related sectors to outperform. The resources have certainly been a tough sector over the last ~10 weeks, following corrections in both BHP and RIO of well over 15%. Noticeably overnight some stock / sector moves caught our eye:

1. The Market Vectors Gold Miners ETF fell 4.2% - we remain buyers of weakness in both RRL around $3 and NCM close to $21, but we are definitely not chasing at present.

2. Following strong earnings reports, Alcoa (US) was up a huge 9.5% and Caterpillar (US) +7.9%. These very strong gains from both the mentioned mining related companies bode well for our resources sector moving forward.

US 10-year bond yields Weekly Chart

US S&P500 Banking Index Weekly Chart

Lastly and most importantly, moving onto the ASX200 which unfortunately has clearly been lagging against its global counterparts over recent weeks, primarily because of our Resources and Telco's sectors -

We are targeting fresh 2017 highs in coming weeks, towards the 6000 level, but we believe from an overall market perspective this will be an opportune time to reduce market exposure i.e. be nett sellers.

ASX200 Daily Chart

The following is some potential stock rotation by MM over coming weeks, remembering we currently hold 15.5% in cash:

Sellers

Commonwealth Bank (CBA) into fresh highs for ASX200 / US Banks / US bond yields, Ansell (ANN) over $24, ideally ~$26 and Platinum (PTM) "hopefully" over $5.

Buyers

Regis Resources (RRL) ~$3, Newcrest Mining (NCM) ~$21, OZ Minerals (OZL) under $7.50, Transurban (TCL) ~$11.00 and Telstra (TLS) ~$3.80.

Basically we will look to switch from stocks that benefit from higher yields to those that prefer lower ones, when / if US bond yields make fresh 2017 highs.

Conclusion

Two stand out conclusions today:

1. We are bullish US bond yields over coming weeks, looking for outperformance from financials / resources over gold and the "yield play".

2. We are looking for a short-term blow off top style rally into May prior to a classic "sell in May and go away" correction.

Overnight Market Matters Wrap

·The US rallied overnight, as global investors took on risk post the French election, with the safe haven assets given a breather.

·Iron ore and gold were down a touch, oil and most metals on the LME were better.

·The June SPI Futures is indicating a strong open in the ASX 200, up 51 points from the previous close, towards the 5,925 area this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 26/04/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here