Health check on local mining stocks (BHP, RIO, FMG, ORE, WSA)

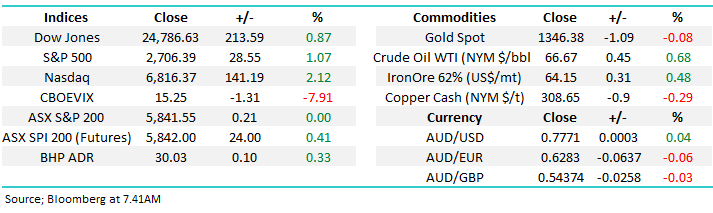

The ASX200 closed flat yesterday however for the second straight session the local bourse closed a long way below session highs. Two straight days saw the market close down 27pts and 30pts below the daily peak which highlights some underlying weakness, although the market looks poised to regain these losses early this morning courtesy of the Dow’s +213-point overnight rally - the futures locally are pointing +24pts higher with BHP likely to open up around 0.30%.

Most weakness on the local market lately can be put down to our heavy weight banks and more recently, local fund managers have been under significant pressure, largely offset by buying amongst the mining stocks.

For the ASX 200, the 5800 - 5900 range is holding and we still need a break above 5900 to confirm our more bullish short term stance.

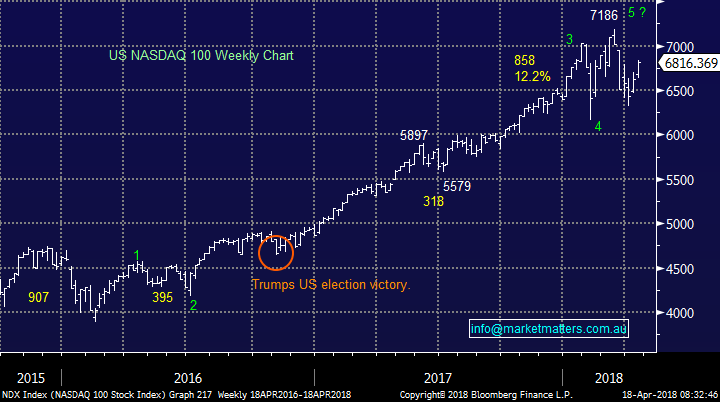

Overnight US stocks appear to have broken out of their recent funk led by the technology stocks, Netflix up ~9% after their quarterly update the prior day while we also saw a good result from Goldman Sachs which beat on most metrics The S&P 500 was up +1.07% however the tech laden Nasdaq was up by an impressive 2.12%.

Interestingly enough, in the MM Weekend Report on Sunday we said… Looking at the flow of buying in the US last week, it was clearly targeted mostly towards the technology stocks while locally the market was keen to buy Resource stocks. It’s interesting to think that the two respective ‘growth’ sectors or areas that usually do well when optimism is high saw most love last week. This provides a subtle indication that risk appetite is returning, and the tilt back up towards all-time highs for key US indices is still well and truly on the cards.

US NASDAQ

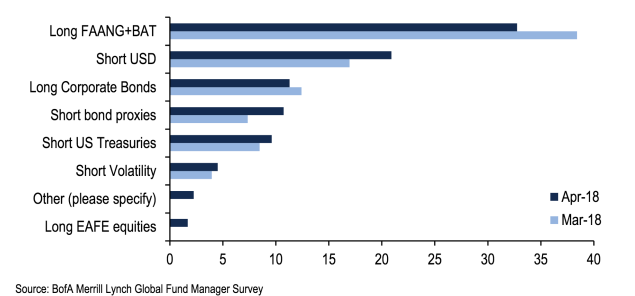

Sentiment is a strange beast and markets are heavily influenced by the perception of risk versus the potential rewards reaped from investing in stocks. We keep a close eye on the Bank of America Merrill Lynch global fund manager survey to see how ‘the market’ is positioned overall and towards specific themes. Cash levels are a strong indicator of how bullish or bearish the market is, but more importantly it gives a guide on whether or not the big end of town has the capacity to buy weakness (or not). Right now the survey found that cash balances sit at an average or 5% , which is above the 10 year average of 4.5%. In terms of positioning ‘net long’ in equities, managers are now at an 18 month low. High cash and a cautious stance tells us the direction of most pain is up, and markets often move in the direction of most pain.

Below is a list of the markets most crowded trades…

Health check on local mining stocks

From an economic perspective, miners are meant to do well late in an economic cycle, the time when interest rates start to rise, economic growth has momentum, wages are growing and importantly, inflation is showing itself – we’re at that point now. As regular readers would appreciate MM has the clear view that markets are in the very mature stages of a long bull market and we expect a large correction later in the year, however for now it remains our view that stocks will make one final high before rolling over.

Across the MM Portfolios, we have BHP, Rio Tinto (RIO), Oz Minerals (OZL), Orocobre (ORE) & Fortescue Metals (FMG), while we’ve recently taken profits into strength in Alumina (AWC) & Woodside (WPL).

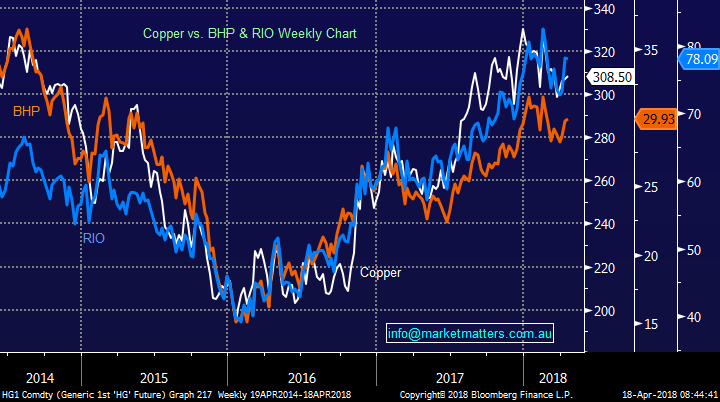

Copper; Dr Copper has been grinding higher since mid-2015 and is a typical late cycle commodity – a bell weather for global economic growth. The correlation between the Copper Price and diversified miners (BHP & RIO) is understandably high. While Copper holds above $275 we remain mildly bullish.

We are sellers of Rio Tinto (RIO) above $80, BHP above $32. We like OZL as a buy at current levels looking to sell new highs ~$10

Copper Monthly Chart

Copper v BHP v RIO Chart

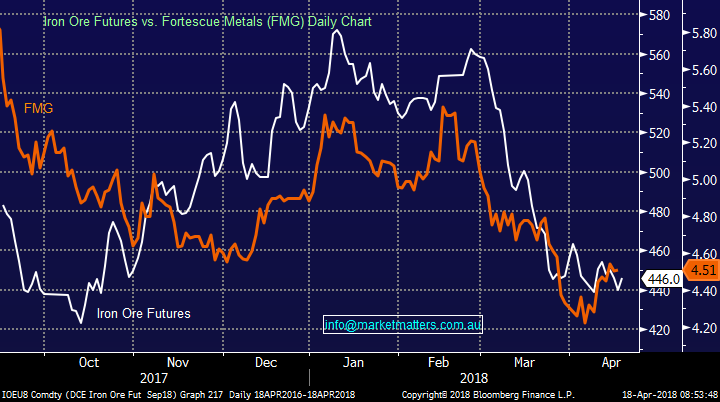

Iron Ore; has stabilised in the last month after a 25% correction in the first quarter of the year. We now expect a minimum 5% bounce in the Iron Ore price.

Fortescue is clearly the most pure exposure to Iron Ore prices and we remain mildly bullish here.

Iron Ore Futures Chart

Iron Ore Futures v Fortescue Metals Chart

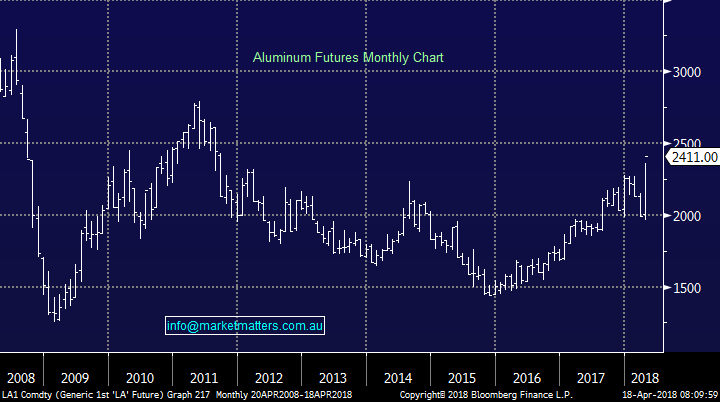

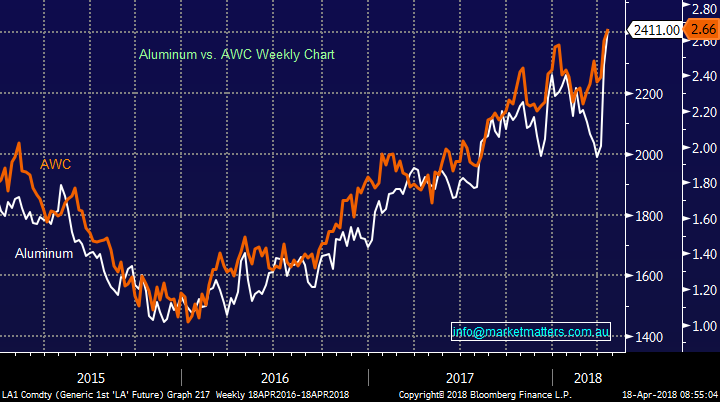

Aluminium / Alumina; In the last week or so, the Aluminium price has ripped higher after Mr Trump ‘tweeted’ about Russian sanctions. Alumina is an ingredient to make Aluminium and clearly supply disruptions are having a big impact on current prices. Russian company Rusal is the world’s second largest producer of both Alumina and Aluminium while we’re also seeing production issues in Brazil, which is crimping supply. AWC tracks the Aluminium price very closely – around a 92% correction. We were long AWC in the Growth Portfolio before taking a nice ~25% profit last week.

We continue to like AWC and would be buyers again under $2.40

Aluminium Futures Chart

Aluminium v Alumina (AWC) Chart

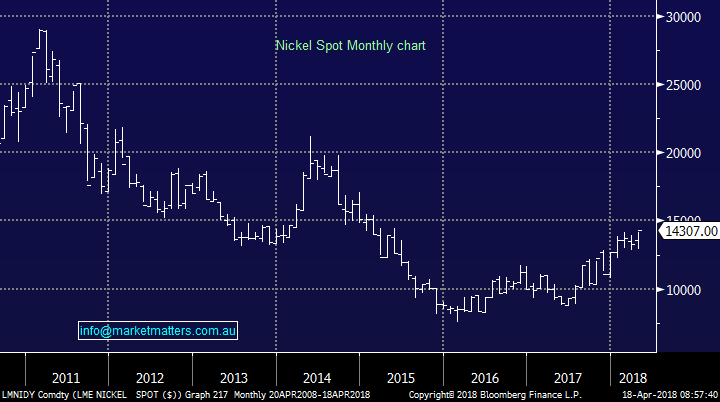

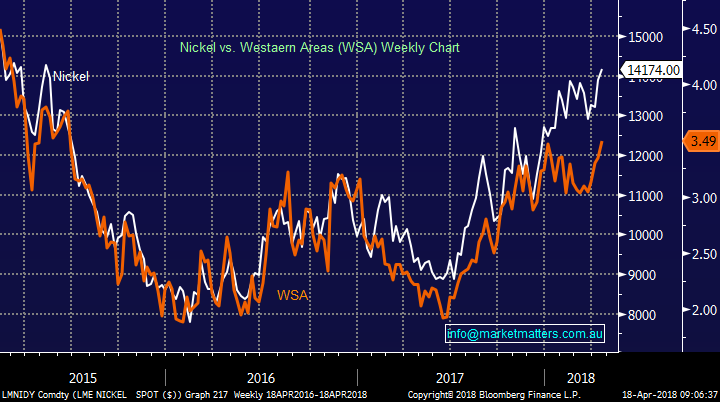

Nickel; Nickel has been somewhat of a laggard in terms of price momentum however we’re starting to see interest flow back into the sector. Another ‘late cycle’ commodity we have played profitably in the past through Independence Group (IGO). Western Areas has been included below to highlight the correlation with the Nickel price given it’s more a pure play Nickel miner (IGO has gold exposure). In the last pullback, we targeted a buy on WSA around $2.80 which it failed to reach.

We are keen on WSA under $3.40

Nickel Chart

Nickel v Western Areas Chart

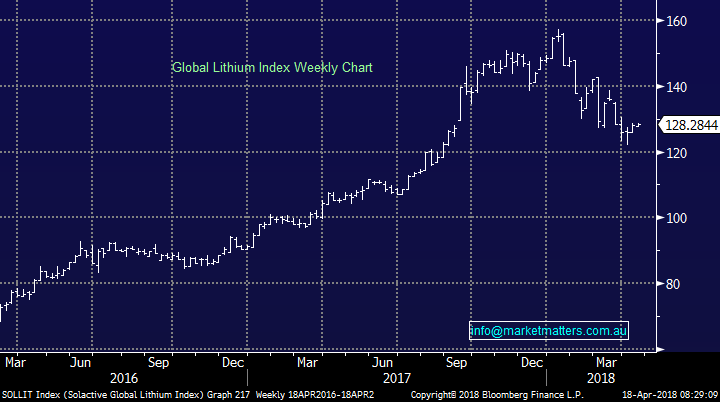

Lithium; The Global Lithium Index below tracks the world’s largest producers of lithium. After a very bullish 2016, Lithium peaked late in 2017 and has corrected ~30% from December highs. We remain bullish the lithium sector longer term and see recent weakness as a buying opportunity.

We hold Orocobre in the MM Growth Portfolio and remain buyers below $5.00

Global Lithium Index Chart

Global Lithium Index v Orocobe (ORE) Chart

Oil; We covered our specific view on Oil yesterday, and although we remain bullish Oil at current levels, the market has now moved towards that view. Simply, we think the easy money has been made on the oil trade and the risk/reward no longer stakes up. Click here to view Tuesday report

Conclusion (s)

· The US market is being led by the Tech stocks and last night was a bullish move – a test or previous highs now looks likely

· While we see commodity stocks higher in the short term, an eventual bottoming in the $US will provide a medium term headwind

· We remain short term bullish, medium term cautious

Overnight Market Matters Wrap

· The US earnings continue to lift its major indices overnight, with the Dow up 0.87% and the broader S&P 500 1.07%, while the tech heavy, Nasdaq 100 outperformed rallying 2.12%.

· On the commodities side, ‘safe haven’ gold and copper retreated, while iron ore gained. Locally, BHP is expected to open higher after ending its US session up an equivalent of 0.33% from Australia’s previous close.

· Locally last night, Link Group announced a $300m fully underwritten institutional placement, along with a ~$40m share purchase plan to eligible holders at $8.50 a share (2.47% discount from last close of $8.71).

· The June SPI Futures is indicating the ASX 200 to open 19 points higher towards the 5860 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 18/04/2018. 8.26AM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here