Has Trump slain the Bull Market? (DMP, MFG, RHC)

The ASX200 looks set to open down ~1% around 5930, close to its mid-February support. At around 2.30am this morning the Dow was up over 150-points and it felt like the correction of the last few days was behind us, then up steps Donald Trump and in an hour stocks have plunged almost 750-points from their intraday high.

Donald Trump announced 25% tariffs on steel plus 10% on alumina causing stocks to plunge on concerns of a potential trade war with China – if you listened to the Don’s delivery it was certainly pretty confrontational. However, there is a lot of water to go under the bridge before a full-scale trade war erupts and yet again President Trump is only implementing what he promised on the campaign trail – that certainly does not sound like a politician!

At this point in time we are sticking with our short-term bullish outlook for global stocks while remaining very mindful of our medium-term view which is for a +20% correction commencing this year. We would not be surprised to see todays “Trump tantrum” create a decent swing low for March / April, remember over the last 20-years:

· Following a decline of -2.5%, or more, by US stocks in February the average return over March / April is an impressive to +4.7% - The S&P500 close down -3.9% in February.

Today’s report focuses on 3 stocks who have endured a very tough few weeks to see if we can find a quick recovery style opportunity – MM is currently holding a 9% cash weighting in our Growth Portfolio.

ASX200 Chart

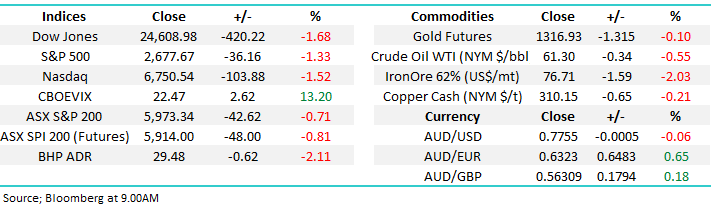

Interestingly during this morning’s plunge by US stocks, the Fear Index / VIX only reached 25, half of the panic during Februarys initial sell-off, implying market players are not too concerned at this point in time – not always a good sign.

Volatility “Fear” Index (VIX) Chart

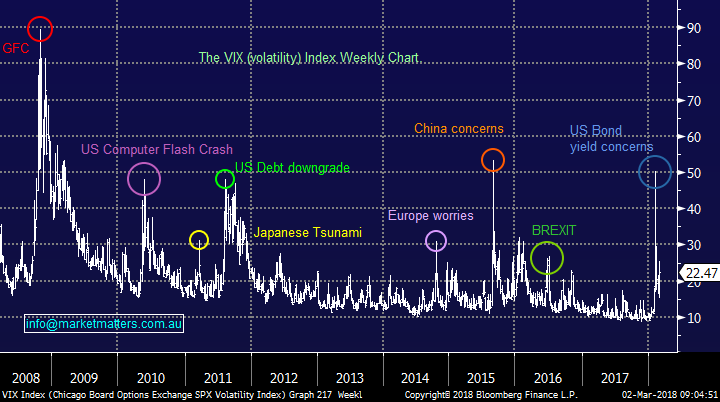

1 Domino’s Pizza (DMP) $38.98

DMP was a standout market favourite back in 2016 but since the heady days around $80 the stock has tumbled over 50%, including an 18% decline over the last month.

DMP shares declined aggressively in February after the company revised profit forecasts lower. Plus, there have been strong market rumours that the company have been supporting its share via margin loans and at the same time the CEO was selling his holding – doesn’t sound great.

We do not believe a company trading on 24.8x estimated 2018 earnings is cheap enough considering the current news flowi.e. there is not enough potential further bad news built into the price to feel attractive on a risk / reward basis.

Domino’s Pizza (DMP) Chart

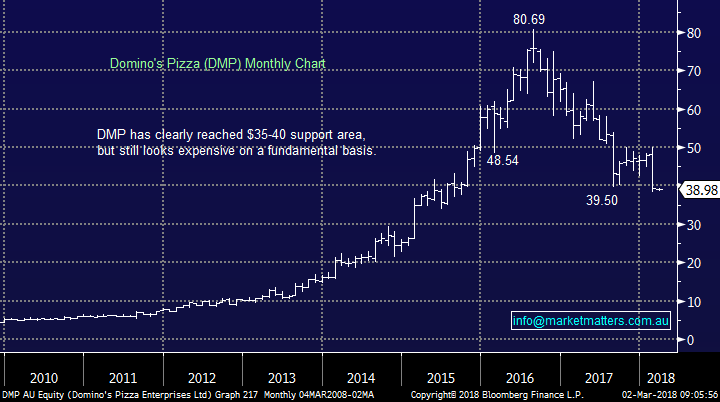

2 Magellan Financial Group (MFG) $25.18

MFG has fallen over 10% during the last month, a performance 4x worse than the ASX200. The stock fell ~7% in early February following the announcement of their half-yearly figures including revenue up +28% to $195.8m and a dividend up 16% to 44.5c.

Overall their performance was positive apart from the costs of setting up the Magellan Global Trust. The company also announced 2 acquisitions one in North America and one domestically.

At MM we like the way the company is evolving but the share price is highly correlated to the US.

Considering our medium-term outlook for stocks we think MFG is best left alone just here.

Magellan Financial Group (MFG) Chart

3 Ramsay Healthcare (RHC) $63.03

RHC is down over -8.4% over the last month including a $6 tumble this week following the private hospital operators latest profit report including a major restructure of its significant French business.

The company announced a 7.5% increase in NPAT (net profit after tax) to $288m which was a slight miss on expectations with European operations dragging the chain.

When a company is trading on valuation of 22.1x 2018 earnings, compared to say BHP on 13.8x and CBA on 13.5x, hence performance misses are generally not tolerated by the market.

We remain bearish RHC with an ultimate target ~$55, over 10% lower.

Ramsay Healthcare (RHC) Chart

Conclusion(s)

Considering our bearish medium-term outlook for stocks we need some enticing risk / reward to take on new short-term longs at this point in time – all 3 stocks we looked at today failed to make the grade i.e. DMP, MFG and RHC.

*Watch for alerts.

Global Indices

US Stocks

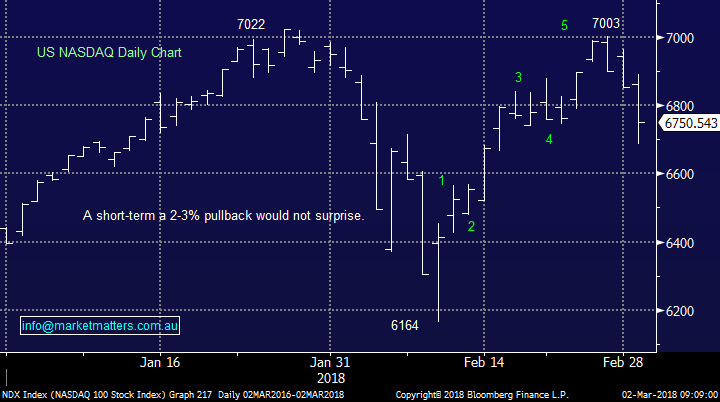

Our target area for the current pullback by the US tech NASDAQ was reached during last night’s panic, if our short-term bullish view is correct the market should turn around shortly.

US NASDAQ Chart

US S&P500 Chart

European Stocks

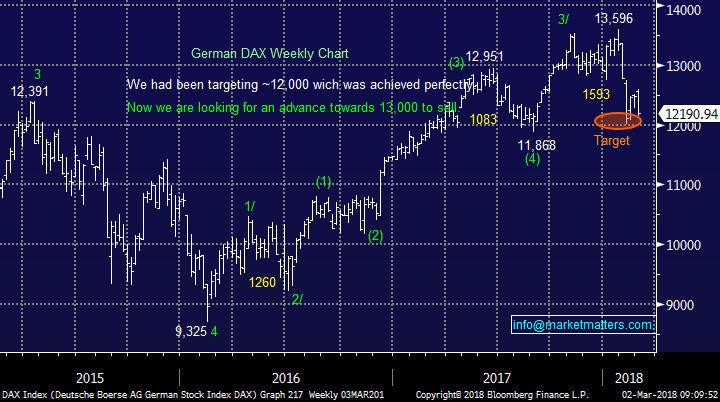

No major change we are now targeting around the 14,000-area for the German DAX before we will turn bearish i.e. a rally from here of over 10%! However, at this stage European equities have not embraced the global “bounce” by stocks but we believe they will, moving forward.

German DAX Chart

Asian Stocks

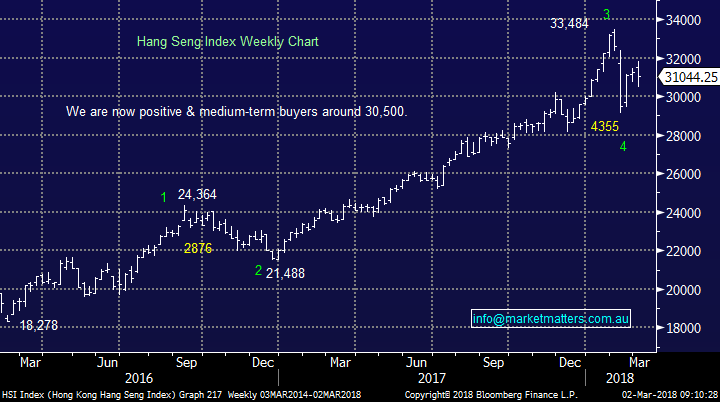

Similarly to western global indices, the Hang Seng corrected over 10% and looks good from a risk / reward perspective under 30,500.

The more time the market can spend around 31,000 the stronger it will look technically.

Hang Seng Chart

Overnight Market Matters Wrap

· US equities plunged overnight in a volatile session, while bonds rallied after President Trump caught investors offside, announcing plans to introduce tariffs on steel and aluminium imports, sparking fears of a global trade war erupting.

· The proposal, which could come into effect as soon as next week, would see a 25% tariff on steel and 10% tariff on aluminium imports, a move which is almost certain to see retaliatory moves from China in particular, the world’s biggest producer of both metals. US steel stocks rallied strongly on the news, and manufacturers, like the auto industry stocks, sold off.

· Markets hit an air pocket following the announcement, with the Dow losing over 500 pts (1.8%) at one stage, and closing off its lows. Treasuries rallied with 10year bonds back towards 2.8% while the volatility index (VIX) jumped more than 20% to around 25.

· Commodities were slightly weaker, with oil another 1% lower, leading to both BHP and RIO under pressure once again in US trading. Commodity stocks expected to weigh on our own market, which at this stage is heading for about a 1% fall. The A$ is also once again lower at around US77.5c, having touched US77.2c in overnight trading.

· The March SPI Futures indicating the ASX 200 to open 43 points lower towards 5930 this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 02/03/2018. 8.13AM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here